Blow Molder on a Growth Path

On Site: Alpha Packaging

Being in the right place(s) counts in the bottle business—as do having the right product, the right customer service, and the right technology. Alpha Packaging has taken all those principles to heart.

In real estate, they say success is all about location, location, location. Being in the right place(s) also counts in the custom and stock bottle business—as do having the right product, the right customer service, and the right technology. Alpha Packaging has taken all those principles to heart, and they help explain why Alpha kept sales growing even in the depth of the recent recession, and why president and CEO Jeff Kellar says Alpha is one of the few North American packaging companies today that is reinvesting in new equipment and capacity.

Alpha has grown by leaps and bounds since its founding as Alpha Con Plastics in 1969 and its acquisition in 1985 by 25-year-old entrepreneur Dave Spence with the help of a Small Business Administration (SBA) loan. He changed the name to Alpha Plastics and expanded its range of processes from extrusion blow molding to include injection-blow and stretch-blow molding. He also moved the headquarters twice to larger buildings, built additional plants in Salt Lake City, Jacksonville, Fla., and the Netherlands, and made a series of acquisitions.

Two of the most significant purchases were Quality Container in Ypsilanti, Mich. (2007) and Progressive Plastics in Cleveland (2010), which gave Alpha a presence in the Midwest; and Technigraph Corp. in Winona, Minn. (2008), which added custom decorating capabilities.

Alpha is now owned by Irving Place Capital, N.Y.C., a $4-billion private-equity firm, whose other investments include Mold-Rite Plastics, an injection molder of caps and closures in Plattsburgh, N.Y., which last year acquired two other closure molders, Stull Technologies, Somerset, N.J.; and Weatherchem, Twinsburg, Ohio.

In 1985, Alpha was blow molding wheels for barbecue grills, gym rings for outdoor swing sets, and about 35,000 bottles per day. Today, its six blow molding plants across the U.S.—including the St. Louis headquarters and its Northeast plant in Bethlehem, Pa.—plus one in British Columbia and another in the Netherlands, produce over 2 million bottles a day, mostly of PET and HDPE, but also some PP and PVC. Sales were $18 million in 2000 and are approaching $250 million this year.

Alpha employs over 900 people and ships to every state in the U.S. and over 30 countries abroad. It operates over 190 blow molding machines—predominantly single-stage (all-in-one) stretch-blow machines, and the rest two-stage reheat stretch-blow (with in-house preform injection molding), extrusion-blow, and injection-blow.

GROWING IN HEALTHCARE

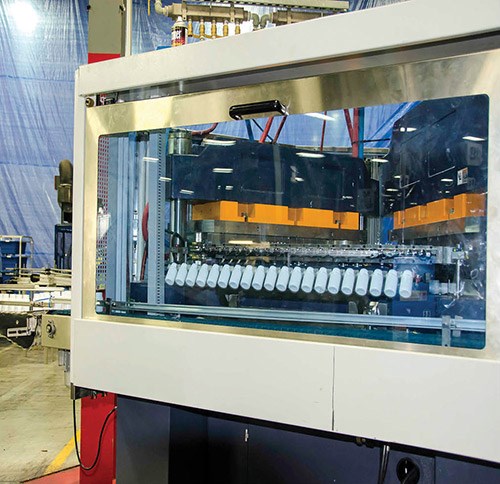

The scene of Alpha’s current expansion in capacity is its 125,000-ft2 Bethlehem plant, where an extrusion-blow and two injection-blow machines are being added to the existing lineup of 18 Aoki single-stage stretch-blow machines, two extrusion-blow lines, and two injection-blow presses. Brian McCarthy, Alpha’s senior v.p. of sales and business development, calls this “Stage 1” of expansion at Bethlehem and highly confident that additional machines will be added for HDPE containers in Stage 2 by mid-2014.

Bethlehem is an average-sized plant for Alpha, but it is getting this extra attention because its location positions it to take advantage of new market opportunities. “Our strongest market is nutritional supplements,” says McCarthy, “where we are the world’s market leader. It accounts for nearly half of our overall sales.” Personal care is its second-largest segment, and other core markets are pharmaceuticals as well as automotive, industrial, and household fluids and food packaging.

“The new machinery is a key component of Alpha’s pharmaceutical growth strategy, says McCarthy. “Our strength has traditionally been in PET, but not so broad-based in HDPE, and most of that capacity was in the Midwest. The pharma industry uses HDPE, which is why we’re adding that capacity here.” Bethlehem, he explains, is situated close to big pharma industry producers, both OEMs and “fillers” (outsourced contract manufacturers). Alpha is aiming for two of the fastest-growing sectors in pharma—generics and private-label over-the-counter drugs.

“Relatively few packaging companies can service the pharma industry effectively,” says McCarthy. “Our experience and understanding of the requirements—limited regrind, specified materials, and strict quality control —coupled with our development of the most commonly used containers in this segment positions us well for future growth. Our customers are pulling us into this marketplace.”

But in some respects, pharma markets are less challenging to serve than nutritional supplements: “Pharma is predominantly white HDPE, while supplements go for shelf appeal with colored PET—greens, and ambers,” notes McCarthy. “That means color changes and added complexity. Also, pharma uses a smaller range of sizes, while supplements range from 60 cc to 6250 cc.”

The pharma market is also attractive, he explains, because these customers tend to be what he calls “sticky.” The business carries a longer selling cycle and is highly regulated. Once a supplier and its packages are qualified, pharma customers are not eager to make a change.

Alpha Bethlehem has just qualified seven new injection-blow molded HDPE bottles as part of its new HDPE Pharma Line. When completed later this fall, that line will include at least 14 injection-blow and extrusion-blow molded bottles from 50 to 950 cc that replicate the HDPE round bottles most prevalent in the pharmaceutical industry.

These bottles are also well suited to Alpha’s customers in nutritional supplements, many of which are located in the vicinity. And the large extrusion-blow machine—which handles 12 cavities with 125-mm centers—will also help Alpha capture custom packaging projects for personal care, household chemicals, and automotive products, McCarthy anticipates.

Alpha is investing $3.5 million in new machines, molds, and downstream equipment for Phase 1 and is prepared to double or triple that investment for Phase 2 in 2014. So why aren’t its competitors investing and expanding as well?

McCarthy says one reason is that Alpha’s revenue growth is able to fund this capacity expansion. Some of its competitors reportedly are strapped for capital or are experiencing other business difficulties, in his view. But there are other reasons for Alpha’s success.

COMPETING ON SERVICE

“Our library of products is wider than competitors’, especially in PET. We have around 900 stock products. We have a huge library of preforms and tons of molds. Customers can build the blow cavities without having to buy the whole mold. And our locations are outstanding to serve customers from nearby locations.

“Alpha is distinguished by being able to make any size bottle for our markets—from 0.5-oz hotel amenity bottles to 6250-cc sports nutrition packages—and by our willingness to support run sizes from a pallet to a truckload. This flexibility is highly valued by our customers, particularly our distributor partners. Most of our competitors just won’t do it.”

David Smith, director of operations for Bethlehem and three other plants, adds that Alpha has customers that take up to 15 truckloads a week and others that take less than one pallet. “We’ll make a changeover for eight cases, if necessary,” he says.

In fact, the Bethlehem plant made 180 job changes in the month of September, and the whole company makes more than 1000 changes a month, Smith says. As a result, Alpha has become something of a quick-change artist. “We have cut changeover times in half, down to 10 minutes.” That requires a carefully organized process: getting things ready for the next run before the current run is finished, making sure the proper tools and jigs are available for the job, and using quick-disconnects on tooling.Looking ahead, McCarthy says Alpha hopes to cut down on job changes by increasing the proportion of make-to-stock vs. make-to-order product.

All this is part of what McCarthy calls a “customer-first” business model. “We try to be flexible and responsive and not encumbered by internally focused policies.” He adds that Alpha used to be an “opportunistic” company. “Now were are more market-driven. We have appointed a leader for each of our five core markets.”

Another aspect of customer service is being able to supply a “total package solution,” as McCarthy puts it. With the 2008 purchase of Technigraph (technigraph.net), Alpha is better positioned to service the “salon market” in personal care with silkscreen and pad printing, hot stamping, labeling, spray frosting, and clear coating.

Another arrow in Alpha’s quiver is its in-house moldmaking operation in St. Louis. The company builds 60% of its molds, mostly for PET, but it wants to beef up its HDPE extrusion-blow mold capabilities. “Tooling is not a profit center for us,” McCarthy notes. Rather, Alpha uses low tooling cost as an incentive to win business.

Service is an essential tool in staving off global competition. Says Marny Bielefeldt, director of marketing, “We do occasionally have overseas competition, especially for smaller pharmaceutical and personal-care bottles that are easier to ship in large quantities. We are usually able to compete with lower-cost overseas competitors based on quality and service.

Quality problems from an overseas supplier are substantially harder to resolve than a similar problem with a domestic supplier, and the time required to address even a minor quality issue—and get replacement bottles, if necessary—from an overseas supplier can take many weeks or months, whereas Alpha can resolve a quality issue in days, and provide replacement stock much faster.”

COMPETING WITH TECHNOLOGY

“We have a huge advantage in forging partnerships with our machine suppliers,” says David Smith. “Our Canadian plant worked closely with a supplier and actually helped them develop a new machine for our needs,” Smith notes. “In addition, we have probably the largest stable of Aoki machines—60 of them—outside of Asia, so we can work closely with them for spare parts and technical service.”

Another Alpha advantage, says Smith, is that “we have a ‘pit crew’ of specialists in St. Louis that are experts in refurbishing used machines.” This enables Alpha to reduce capital costs by acquiring, overhauling, and upgrading previously owned equipment.

Smith points to other technical initiatives that make Alpha more efficient and competitive:

•Lean manufacturing includesimproving flow through the plant. “We can move goods with less fork-truck traffic,” explains Smith.

•Tooling optimization is Smith’s term for a program of redesigning PET preforms to save material. “We used to design preforms to be able to make a variety of container sizes. Now we optimize the preform for a specific size. We expected to save 10-15% in preform weight, but we actually saved 25-30%.” New designs, he notes are longer and wider, providing more surface area to speed cooling and shorten cycles. A special application of this technology is ultra-thin-wall PET bottles for soaps and sanitizers. Produced on two-stage reheat stretch-blow machines, these rigid yet collapsible squeeze bottles are a distinguishing achievement for Alpha, in McCarthy’s view.

•Automation is essential for cost-competitiveness and for meeting customers’ strict quality demands. All production lines have inline leak detectors that check 100% of bottles coming out of the machine. A small but growing number of lines have vision systems to check for black specks, neck finish, and other parameters. As a result, Smith proudly reports, “From 2010 to 2013, we reduced defects from 0.30 ppm down to 0.091 ppm.”

Related Content

Solve Four Common Problems in PET Stretch-Blow Molding

Here’s a quick guide to fixing four nettlesome problems in processing PET bottles.

Read MoreModified Machines to Mold Unusual PET & PP Bottles at K 2022

K 2022 visitors looking for new ideas in stretch-blown containers will be treated to two novel collapsible concepts a the Nissei ASB booth.

Read More‘Ultrafast’ Machine for Large PET Bottles

Sidel’s new EvoBLOW XL stretch blow molder makes up to 10 L PET bottles at up to 18,000 bph.

Read MoreAll-rPET Bottles with Glued-in Handles Save Material

At K 2022, KHS is showing a 2.3 L PET bottle with glued-in handle that offers 10% material savings and other advantages over clip-in handles. Bottle and handle are both 100% rPET.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More