Commodity and Engineering Resin Prices Softening

As we enter the fourth quarter, price relief has already been felt in the four major commodity thermoplastics and four large-volume engineering resins.

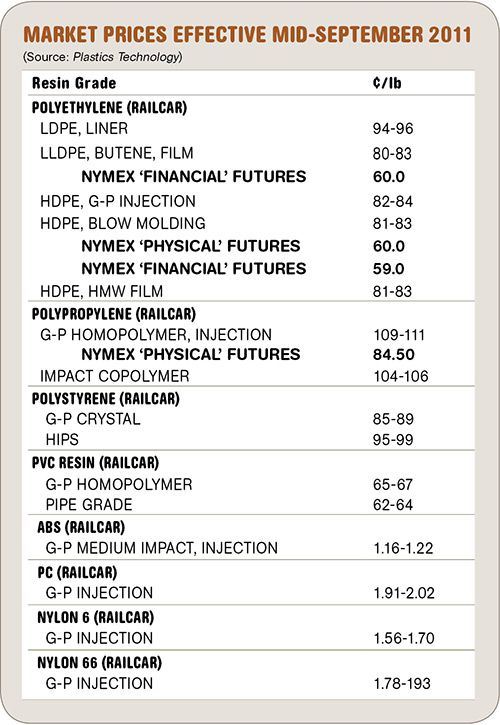

As we enter the fourth quarter, price relief has already been felt in the four major commodity thermoplastics and four large-volume engineering resins. Flat or lower prices can be expected for nearly all of these for the remainder of the year. That’s the view of resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas, who cite lackluster domestic and export demand, a slowed economic recovery, and global economic uncertainty as the overall drivers behind this trend. Feedstock costs dropping to more typical levels is also a key factor in the lower price outlook—barring any major unplanned outages of resin or feedstock production plants, of course.

PE PRICES FLAT TO DOWN

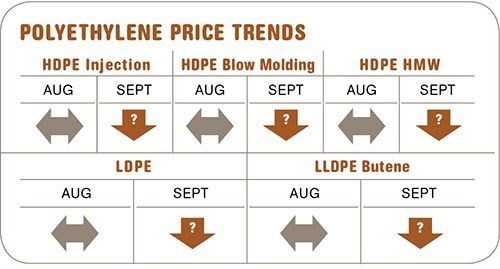

Polyethylene prices remained flat last month. PE suppliers have had a total of 11¢ of increases on the table since May, but RTi believes current market dynamics do not support higher prices. In fact, several market indicators point to softer prices ahead. Among them are an increase in suppliers’ resin inventory levels due to a 10% increase in production with only a 6% rise in sales. That has led to growth in attractive offers to the broker market, but these have met with little interest from processors. Despite pre-buying in the last couple of months due to hurricane-season concerns and planned shutdowns of five PE plants in September and October, average domestic demand improved by only 5% and exports by only 2%. International PE resin prices are also now lower and opportunities for exports appear to be flat.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Keep an eye on secondary market activity, a leading indicator for contract price direction. Weather-related events will be price drivers, particularly during the planned shutdowns of the five PE plants and six ethylene crackers.

PP PRICES FLAT FOR NOW

Polypropylene prices remained flat, as did propylene monomer, in August and September. Prices of the resin and monomer were originally poised to move up by 2-3¢/lb in August but global economic concerns squelched that possibility.

Planned cracker shutdowns last month and into this one may cause a spike in monomer prices. Overall, however, the propylene market appears to be well balanced. PP resin suppliers have throttled back production, with average operating rates this year no higher than 84%. The market has been tight although there is speculation that suppliers may be holding onto resin stocks in anticipation of planned and unplanned outages.

Total PP demand through the third quarter was down by 6.3% from 2010. Exports this year are down by nearly 17%. The outlook for demand is not strong, as most processors last month reported slow order patterns and general uncertainty on the short-term forecast. The secondary market was quiet due to limited availability. Spot PP prices have been even with or slightly above contract prices.

Outlook & Suggested Strategies

30-60 Days: Buy as needed; this market is still looking for direction. The balance between material availability, subject to scheduled or unscheduled plant outages, and demand levels will dictate the direction from here on. Weak demand will limit the impact of any supply constraints.

PS PRICE UPTICK NOT A TREND

Polystyrene contract prices moved up in August by 4¢/lb for GPPS and 5¢ for HIPS, although some buyers with strong competitive leverage or significant generic/spot purchases were able to limit their increase to 2-3¢. Spot GPPS increased 3¢ in August to 80¢/lb, while spot HIPS gained 4¢ to reach 91¢/lb. No further price hikes were issued, as feedstock cost reductions were expected to exert downward pressure.

The premium for HIPS over GPPS widened by an additional penny to 11-12¢/lb. However, butadiene spot and contract pricing appeared to have peaked in August and is now declining. If this downtrend continues, it will eventually allow buyers to negotiate lower HIPS premiums. At first, RTi expects to see suppliers reduce premiums to gain or defend business with specific customers, rather than market-wide reductions.

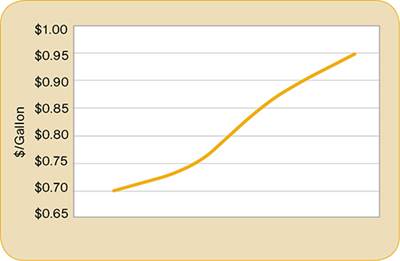

Benzene feedstock prices have been very volatile. August benzene contracts settled at $4.13/gal, down only 10¢ from May, but in between it varied in a range of 54¢/gal. Spot benzene prices were a little over $4/gal but had been as low as around $3.95. As a result, a drop in September benzene contract prices was expected. Spot ethylene monomer was relatively stable at around 60¢/lb. Based on changes in benzene and ethylene pricing, RTi estimates the cash cost to make styrene monomer as having risen 2-5¢/lb in August vs. July, depending on whether you use feedstock spot or contract prices in the calculation.

Spot styrene monomer prices in early August averaged 3¢/lb higher than in July but declined later that month. August styrene contracts settled 5¢ higher and then also dropped in September. Butadiene prices peaked at $2.20/lb and began to decline, though they are still quite high. Spot prices were about $1.90 in August, while September contract price nominations are for flat to down by 6¢/lb, which would bring the contract price down to $1.75-1.80/lb.

Outlook & Suggested Action Strategies

30-60 Days: Based on the projected softening of feedstock prices, we foresee resin prices trending downward in the fourth quarter. The spread between GPPS and HIPS should begin to shrink.

PVC PRICES DOWN

PVC resin contract prices dropped a penny in July and remained flat through August despite suppliers’ attempts to raise prices. By the end of August, PVC resin spot prices were flat as domestic demand slowed and exports pulled back due to global economic uncertainty. September and October hikes totaling 5¢/lb are still on the table as suppliers’ hedge against a potentially tighter ethylene market resulting from maintenance shutdowns during these two months, during the peak of the hurricane season. PVC feedstock costs were generally flat or lower from June to early September. Domestic PVC production was up 3% from July to August, after falling 9% in June. PVC exports rebounded 41%, though domestic demand fell by 15%.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. We see ethylene monomer as the wild card if there are significant disruptions from hurricanes. Otherwise, the markets will be flat or lower as economic concern keeps everyone in wait-and-see-mode. Restarted global PVC capacity and reduced Asian demand will translate into more favorable domestic PVC pricing.

ABS PRICES DROP

ABS prices have been on a downslide in the last couple of months and were expected to fall at least 4¢ to 6¢/lb by the end of September. Driving this trend is strong competitive activity, with distributors fighting for volume and resin makers battling it out in specific market segments. Moreover, ABS imports have been abundant, forcing domestic suppliers to react to lower overseas prices. Overall ABS supply is reportedly very long as global demand is off significantly and domestic demand remains slower than expected. North American ABS plant operating rates are said to be in the high 50s to low 60s, and many Asian plants are reportedly off-line or have slowed to minimal production rates.

Meanwhile, feedstock costs are generally sliding downwards. Acrylonitrile contract prices are flat-to-down. Butadiene spot and contract prices have dropped after a long uptrend, and further decreases are expected in this quarter. Styrene monomer prices are also on the decline following the trend of lower benzene and ethylene prices.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Expect prices to continue trending downward for the remainder of the year. Know where your price is compared with your competition, and consider import options as part of your buying strategy.

NYLON PRICES LOWER

Nylon 66 prices in July moved up 5-10¢/lb while nylon 6 prices were flat to down by as much as 5¢. Prices were flat for both in August and prices were on the way down by September. In the case of nylon 66, decreases of 1¢ to 2¢/lb were under way at press time last month, driven by lower propylene and butadiene feedstock costs. For nylon 6, decreases of 1¢ to 3¢/lb were occurring due to decreased benzene costs.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Lower feedstock costs and softer demand (both domestic and export) could halt any further price increases. High nylon costs have created demand destruction in both domestic and export markets, to the advantage of lower cost resins, which will become more apparent as economic growth slows.

PC PRICES CONTINUE TO DROP

Polycarbonate prices are moving down by varying amounts in different markets, depending on the degree of competitiveness, demand, and economic uncertainty. Lower pricing is particularly evident in larger volume categories and in minimally compounded products.

Supplies of polycarbonate and its intermediates are ample, while export demand has continued to decline. Costs of key feedstocks benzene and propylene peaked in May, dropping by a total of 10¢/lb in June and July. Feedstock prices then moved up 5¢ in August but were dropping again last month. Phenol production has improved globally, despite a recent force majeure event in Europe. Polycarbonate exports are said to have declined more than 25% since their peak in January.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Polycarbonate inventories will continue to improve globally, as production in Japan is back at full rates and SABIC’s polycarbonate production in Saudi Arabia is gaining momentum. A slowed economic recovery will determine whether prices will drift lower or will flatten out. Improved production of intermediates will loosen supply before the year’s end.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

Experts Advise on How to Get Smart About Resin Purchasing

Resin markets are not fair!

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More