Commodity Prices Fall; More Dips Coming?

Falling prices for the four main commodity thermoplastics was the trend by mid-July.

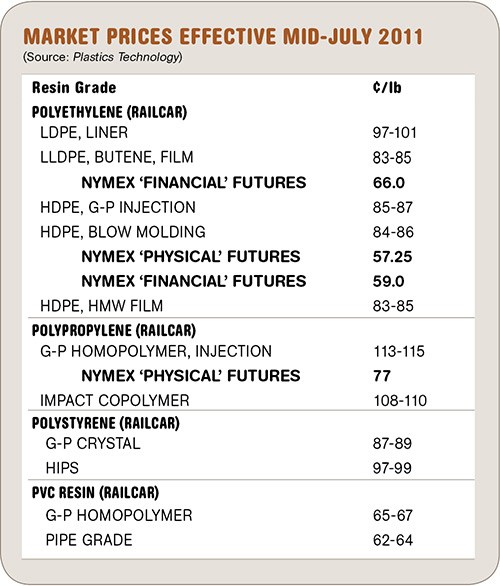

Falling prices for the four main commodity thermoplastics was the trend by mid-July. This was driven by stagnant domestic and export demand, along with rising resin-supplier inventories and falling feedstock prices. Further price relief is in the offing, barring unplanned feedstock or resin plant outages, according to resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas (resinpros.com). Here’s more on RTi’s outlook.

PE PRICES DOWN

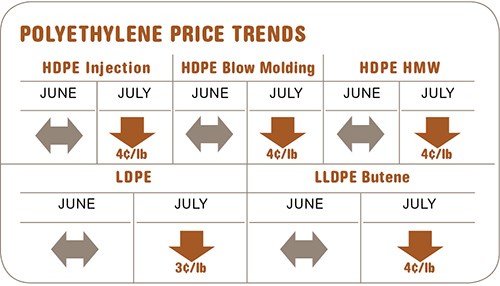

Polyethylene prices dropped in June by 4¢/lb for LLDPE and HDPE and 3¢ for LDPE. Further erosion was expected last month, especially for LLDPE and HDPE. Availability has improved for all resin grades. (Domestic PE production rose 3% in June while sales dropped almost 9%.)

In secondary markets, sellers were seeking out buyers in June and July with offers significantly lower than May prices. Some generic prime grades were offered for as little as 10¢ to 13¢/lb.

Spot ethylene monomer prices dropped 5¢/lb in June, rebounded by 3¢ by July 1 to about 58¢/lb, and then declined slightly in early July. Improved availability and minimal supply disruptions have contributed to flat-to-downward pricing.

Outlook & Suggested Action Strategies

30-60 Days: Continue to buy as needed while pursuing price concessions. Manage your inventory. If exports improve or a hurricane develops, suppliers may attempt a price increase.

PP PRICES PLUMMET

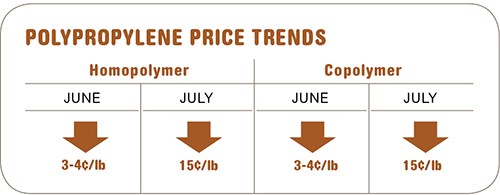

Polypropylene prices dropped a whopping 15¢/lb in June, following the price drop in propylene monomer penny for penny. Suppliers faced with soft demand and rising inventories made no attempt to issue new price hikes for either June or July. Supplier inventories grew to 41.2 days by the end of June, from 33.1 and 32.5 days in April and May, respectively. (Suppliers are expected to throttle back production in order to get inventories back in balance.)

The secondary market was particularly active in June. Prices varied widely but with a definite downward trend. Opportunities for large discounts attracted a lot of interest. By July it appeared that a lot of product had moved and the secondary market was beginning to firm.

Polymer grade propylene monomer dropped to 82¢/lb. It looked last month like July contracts would shave off another 3-5¢/lb. Spot monomer prices were as low as 77.5¢/lb by late June.

Outlook & Suggested Action Strategies

30-60 Days: PP prices may be bottoming out, though modest decreases (3-5¢/lb) are possible in the July/August time frame.

PS PRICES DROP

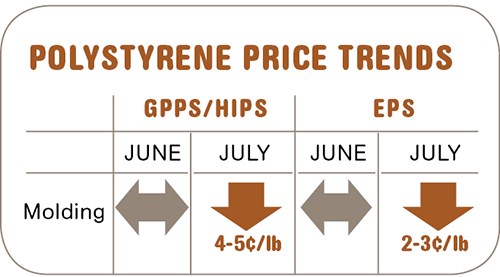

Polystyrene prices rolled over from May into June and then started a downward slide. Spot prices for GPPS dropped 2-3¢/lb while prices for HIPS, which continue to command an 11-12¢ premium, remained flat.

By mid-July prices had dropped 4-5¢ across the board. The June 4¢ hike on EPS saw partial implementation but was losing traction last month due to lower import prices and weakening demand.

Resin prices closely followed the drop in styrene monomer spot prices, which lost 4-5¢ by the end of June, down to 63¢/lb, while June styrene contracts dropped to 69-70¢, after discounts, from May’s 74-75¢/lb. Further softening in monomer contract prices was expected for July and August.

Spot prices of both benzene and ethylene precursors dropped in June, but butadiene continued to skyrocket, with June contracts settling 10-15¢ higher at about $1.50-$1.55/lb. July contracts were looking at a further 10¢ hike. Spot butadiene can run over $2/lb. (For perspective, average butadiene prices were 45¢ in 2009 and 84¢/lb in 2010.)

Meanwhile, PS operating rates in June dropped to 60% from 79% in May, and the downtrend was expected to continue in July/August, following a drop in domestic demand since the end of May.

Outlook & Suggested Action Strategies

30-60 Days: Weakening feedstock prices a

nd growing inventories are expected to result in further price declines this month. But HIPS prices will remain at a premium and reductions will be harder to achieve before the fourth quarter of this year.

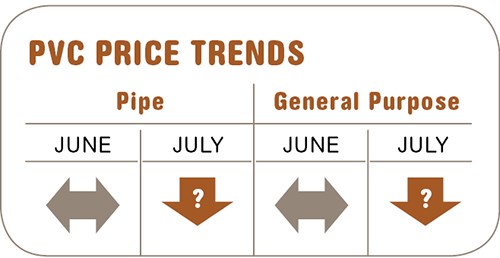

PVC PRICES MOVING DOWNWARD

PVC prices from the end of May and into June/July were flat-to-down as export demand continued to slide and there was only modest improvement in domestic demand.

Pushed to July, the 5¢/lb June price hike did not appear to have any chance of implementation. Spot-market availability at discounted prices was on the rise, despite Georgia Gulf’s force majeure that lasted through the end of June.

Supplies were ample and PVC supplier inventories rose dramatically in June and continued rising last month. Meanwhile, PVC feedstock costs were flat or on the way down.

Outlook & Suggested Action Strategies

30-60 Days: Look for opportunities as prices continue to decline through the third quarter, before the next round of planned domestic planned cracker maintenance outages in the fourth quarter. Ethylene production reliability is key. Buy as needed.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More

.png;maxWidth=300;quality=90)