Five Straight Years of Plastics Equipment Shipments Growth

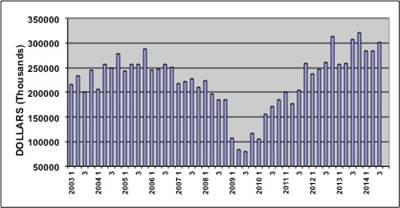

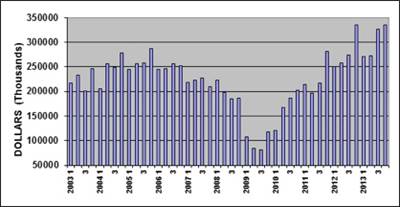

One week before the sector’s biggest show, the U.S. plastics industry reported a surge in equipment shipments for the full year and final quarter of 2014, with solid momentum maintained heading into 2015.

Annual shipments of plastics machinery increased for the fifth straight year in 2014, while shipments of primary plastics equipment jumped 9.8% in the fourth quarter of 2014 over the third quarter with an increase of 8% year over year, according to SPI: the Plastics Industry Trade Association’s Committee on Equipment Statistics (CES).

Shipments of primary plastics equipment, including injection molding, extrusion and blow molding machinery, totaled $346.1 million in the fourth quarter for CES reporting companies. That was nearly 10 percent higher than the revised shipments total of $315.1 million from the third quarter.

The total value of primary equipment shipments was up 7.6 percent for the full year compared with 2013. Apart from relative flatness in single-screw extruders, growth was evident across the board with healthy gains in injection molding and auxiliaries, as well as robust growth in twin-screw extruders and blow molding machines.

Highlights By Sector

Injection Molding: The shipment value of injection molding machinery rose 7.7 percent in the final quarter of 2014 when compared to the year-prior quarter. Shipments of injection molding machinery rose 5.3 percent in 2014 over 2013.

Extruders: The shipment value of single-screw extruders rose slightly (1.1 percent) in the fourth quarter compared to the final quarter of 2013. For 2014 as a whole, single-screw extruder shipments slipped 3.0 percent. The shipment value of twin-screw extruders, including co-rotating and counter-rotating machines, jumped 8.2 percent in the fourth quarter, and for 2014 as a whole, shipments of twin screw extruders jumped an impressive 26.3 percent.

Blow Molding: The shipments value of blow molding machines advanced 10.2 percent in the fourth quarter of 2014, and for the full year, shipments of blow molding machinery spiked 38.1 percent.

Auxiliary Equipment: New bookings of auxiliary equipment, including robotics, temperature controls, and materials handling systems, among other technologies, totaled $103.5 million in the fourth quarter for reporting companies. That was 2.2 percent higher than the year-prior quarter, and for 2014 as a whole, bookings of auxiliary equipment were up a solid 9.2 percent.

View from a Supplier

For auxiliary equipment supplier and CES reporting member Novatec Inc., Baltimore, 2014 was a banner year. Full-year 2014 sales were more than 40% higher than 2013 according to company president, Conrad M. Bessemer. “Novatec has continued to enjoy significant gains thanks to a robust industry as well as market share gains,” Bessemer told Plastics Technology.

That growth has carried over into 2015 as well, according to Bessemer. “We are continuing to see the same level of strength in Q1 2015 as well with additional year-over-year growth,” Bessemer said, noting that growth has been experienced in all sectors with “exceptional” gains for Novatec in the automotive and medical segments.

With the triennial NPE show just around the corner, Bessemer believes Novatec and the industry can maintain that momentum. “With the more vibrant economy, we are seeing more processors planning to attend the show this year,” Bessemer said, adding that Novatec reps in the Midwest and New England are reporting a significant increase in the number of customers planning to attend the show this year, whereas in 2012, processors in those regions didn’t attend the 2012 show in strong numbers.

Optimism Reigns

As strong as the numbers were, the sentiments for the market going forward might be stronger. The CES also conducts a quarterly survey of plastics machinery suppliers, and fourth quarter survey responses indicate that machinery suppliers are quite optimistic.

When asked about expectations for future market conditions, 92 percent of the respondents expect business to stay the same or even improve in the coming quarter, and 94 percent expect it to hold steady or get better during the next 12 months.

A healthy consensus of respondents believed North America holds the most promising market conditions for machinery suppliers in the coming year, with expectations for Mexico also quite high.

Expectations for Asia and Europe, which were mostly unchanged from the third quarter, call for demand to hold steady. Respondents expect automotive and medical to remain strong, with all other end-markets expected to see steady-to-better demand in 2015.

Read Next

Record-Breaking Auxiliary Orders Propel North American Plastics Equipment Shipments

Shipments of primary plastics equipment were up 6 percent for the quarter and the year, while new bookings of auxiliary equipment totaled a record-breaking $108.2 million dollars in the third quarter.

Read More2013 was good for N.A. equipment suppliers; Can 2014 Overcome a Slow Start?

The North American plastics equipment market saved its best for last in 2013, delivering shipments valued at $335.1 million in the fourth quarter—the best three-month stretch of the year and up 3% from the previous quarter. Will that momentum hold in 2014, however?

Read More2013 was good for N.A. equipment suppliers; Can 2014 Overcome a Slow Start?

The North American plastics equipment market saved its best for last in 2013, delivering shipments valued at $335.1 million in the fourth quarter—the best three-month stretch of the year and up 3% from the previous quarter. Will that momentum hold in 2014, however?

Read More