Is Diversification Right for Your Business?

NPE2012: The Big Picture

End-market strategies.

The so-called Great Recession of 2009-2010 pushed quite a few plastics processors out of the industry, and forced even more to re-evaluate their position in the market. Many processors tied to markets hit the hardest by the downturn—such as those who supplied the automotive and construction industries—started to look at altogether new markets.

But there is a lot more involved in diversification than, for example, simply investing in specialty equipment or a clean room, or buying market-specific materials. It’s a comprehensive process that involves top-down commitment.

Diversification is not a process that’s dictated by company size. Processors big and small have succeeded—and failed—in attempts to enter new markets. And there are various paths to take. Some have diversified organically, others through acquisition, and still others by adding new process capabilities.

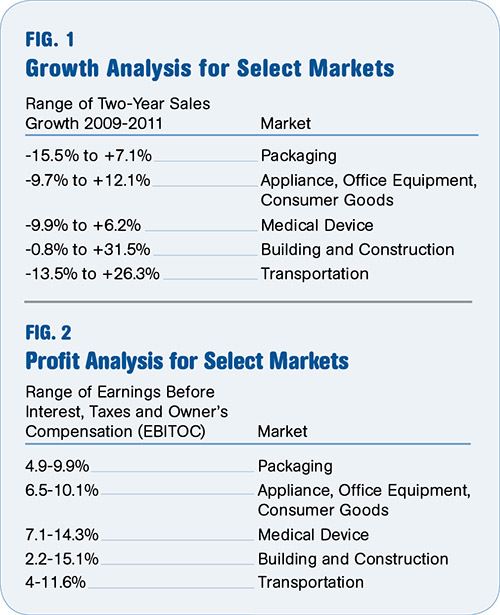

And, of course, diversification is not for everyone. If you’re a medical molder, for example, and your profit margin is 25%, why go anywhere else? So before you even consider reallocating machine time or realigning your sales and marketing efforts to penetrate a new industry, make sure it’s worth your while financially (see Figs. 1 and 2).

THE CHALLENGES

What are the traits of a processor who has successfully diversified? Corner-office commitment is critical. CEOs need to be involved throughout and be able to add or shift resources where needed.

Operational flexibility is also crucial. Different markets require different volumes and scheduling. This is a significant issue for manufacturing. If, for example, you’re a high-volume molder and you’re looking at a market that might have seasonal fluctuations or shorter runs, it’s best to learn how to do changeovers more expeditiously.

Your resin-buying patterns for that market might be different as well. If you are shifting from part to part and color to color—instead of running the same thing day in and out—your whole process of buying materials will change. To address these issues you’ll need the right people in place. You might have to go outside your organization to find them if there are no internal options.

Diversification might be a big issue for your logistics operation, too—suddenly they are dealing with smaller shipments, and more of them. It’s also best to get a clear understanding of each market’s cost structures and know the “rules of the game” for each market. These include finance/cost estimating, sales, and a clear understanding of what your new customers will need in the way of support. All of these factors differ from market to market.

Before you get into a new market, you’d better have a clear understanding of what that new customer defines as “quality.” Maybe you’re accustomed to molding Class A painted parts for automotive. Perhaps the standards of the market you’re looking at aren’t quite as stringent. Maybe you don’t have to do 100% part inspection before shipping. Understanding the quality expectations can mean the difference between making and losing money.

You should also have a clear understanding of expected support services. Engineering, for example, might have to execute a product pre-launch and do a lot of hand-holding during the entire process. And keep in mind that markets with big swings in production volumes not only require highly flexible manufacturing teams, but highly capable customer service professionals as well.

LAUNCHING A PLAN

Gathering market intelligence is a critical part of any plan to diversify. The top four most important elements to consider are:

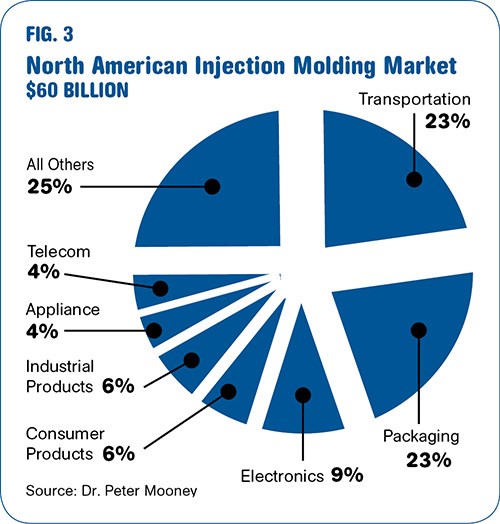

•Defining the market’s customers: Who are the potential buyers of your products? Where are they located? How are your potential customers’ products being brought to the end user? How will this impact your role as a supplier? This kind of insight will help you determine how to cover a market. For instance, in the residential and commercial HVAC market, just six companies control 70% of the spending on plastics products. The $8 billion electronics market, on the other hand, is quite fragmented, consisting of hundreds of potential customers.

•Defining the scope: What are the bundles of products and/or services you will offer to this market? What is the basic value proposition of a plastics supplier to this market ? Do you need to an integrated partner driving solutions, or just a build-to-print supplier that can compete against low-cost foreign manufacturers? What type of manufacturing processes need to be employed? Do you have the necessary tools in the toolbox? Are there unique characteristics to this market that will impact you?

Scheduling, for example, is all over the place: In HVAC it ebbs and flows throughout the year. For recreational products there is generally a six-month production year. In medical there is a lot of scheduling unpredictability.

•Defining how you’re different: How do you win business? If, for example, you are looking at the aerospace market, you must have the ability to handle short production runs; to introduce new technology, especially as it’s related to raw-material development; to add customer support, especially during the product-development phase; and to propose product applications with minimized tooling investment. This could be a huge challenge for molders more accustomed to high-volume production.

If you are looking at the electrical market for commercial/industrial/residential, you’ll have an entirely different set of challenges. Price is always a factor, but it’s really a critical matter here. You’ll need to be positioned to provide technology-driven solutions, especially regarding parts consolidation. Having a geographic footprint is critical, as is the ability to accommodate high-mix/low-volume releases. You’ll need to respond quickly to solve problems at the local manufacturing facility.

•Defining the value capture: Getting the order is one thing, making money once you’ve gotten it is another matter altogether. In aerospace, for example, you’ll need to fill machines with other programs during down times. Remember, parts are run in small quantities. You’ll have to balance raw-material purchases to match order quantities. You’ll need to be able to run in a highly efficient manner, including quick mold changeovers, fast purging procedures, and good mold maintenance. Your odds of success are not good without good production-management procedures.

KNOW THE TRENDS

It also helps to be familiar with the technology and market trends in any industry you are looking to penetrate. Let’s look at a few for illustrative purposes:

•Lawn and garden: Phase III regulations to reduce emissions by 35% took effect Jan. 1, 2012. Plastic fuel-vapor canisters will be required on most lawnmowers.

•Medical equipment: Tax law changes and healthcare reform are driving OEMs to reduce costs. Suppliers with cost-cutting solutions are badly needed.

•Recreational vehicles: The market is depressed and trending as though it will stay that way for awhile.

Other key issues involve the purchasing behaviors of your prospective customers and their rules of the game. Also, what are the tactics used by the purchasing group to award business:

–Do they source business to a small handful of suppliers?

–Do they use reverse auctions?

–Does the plant closest to their’s get the bid?

–Does the best expense account win?

–Will they let you pass along your resin cost increases?

–Are annual givebacks expected?

–Are setup charges allowed?

–Is it necessary to be have certain quality certifications? ISO 13485 is widely considered a must-have for medical, for instance, but it might not be for your specific project.

Diversifying can be a good way for a processor to insulate itself from tumultuous market fluctuations. Suppliers of materials and equipment have been developing products specifically for one market or another. Do your homework before proceeding.

Related Content

Plastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MorePackaging Waste Will Become Composite Decking

New partnership will incorporate process waste into wood-alternative decking.

Read MoreArchitectural Mesh Made from Covestro’s Bioattributed PC

Kaynemaile’s new RE8 Architectural Mesh will deliver an ISCC Plus certified sustainable share of up to 88% of its architectural product.

Read MoreInfrastructure May Prove Big Landing Spot for Recycled Plastics

As the government funds infrastructure improvements, a hot topic at NPE2024 – exploration of the role recycled plastics can play in upcoming projects, particularly road development.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More.png;maxWidth=970;quality=90)

(1).png;maxWidth=300;quality=90)