Outlook - March 2009

Film & Sheet Will Start To Recover in ’09

The U.S. economy remains mired in the worst downturn since the Great Depression, but recent indicators suggest that demand for many manufacturing products at least started to stabilize in the first quarter.

The U.S. economy remains mired in the worst downturn since the Great Depression, but recent indicators suggest that demand for many manufacturing products at least started to stabilize in the first quarter. For most plastics processors, this means that business levels will flatten out at the current low levels for the next few months. Now that the economic trends have started to establish firm bottoms, expectations about the future will become more optimistic, and both businesses and consumers will respond with increased buying activity.

MODEST GROWTH IN 2009

The uncertainty that gripped consumers at the end of last year was clearly evident in the charts of both our Film Business Index and Sheet Business Index (both available at www.ptonline.com). These indicators are designed to measure total North American output of these products. The severity of the downturn during the second half of 2008 (the steepness of the down slope) was the most pronounced in the history of our data. By year’s end, the Film Business Index had posted an annual decline of 12% and the Sheet Business Index was down 8%. In 2009, production of plastics film and sheet will grow moderately, followed by more robust growth in 2010.

As was the case in many manufacturing segments, declines in film and sheet at the end of last year overstated the actual decline in the underlying supply/demand fundamentals that would normally describe these markets. Recessions are self-fulfilling prophecies in which the collective perception of economic conditions becomes far more powerful than reality. So once a bottom is finally established, there will likely be a short burst of demand for most types of film and sheet as expectations are brought back into line with actual activity levels.

This will likely be the scenario during the second half of 2009. After that, increases in demand will be steady but gradual for a few quarters as employment levels ramp up and painful memories of the past recession begin to fade. This represents the start of the period in an economic recovery when the pending expansion becomes the self-fulfilling prophecy. This will not occur until 2010.

In the meantime, we have interest rates at a very accommodating level and the anticipated benefits of an enormous stimulus package. History shows that the trend for changes in film demand turns very early in the business cycle. Most film is used in packaging and other low-cost, non-durable products. Demand for these products is less volatile than those in the durable goods sector.

Film and sheet manufacturers who want to anticipate the start of the next recovery phase must closely monitor the changes in the market’s momentum (i.e. the slope of the chart). A recovery naturally follows a bottoming-out, but because the actual economic activity levels are still quite low by historical standards, managers who ignore the trend of the graph will wait too long before they acknowledge that the recovery has started.

PP PRODUCTS HELD UP BEST

The market for polypropylene films performed much better than other film segments in 2008, and this trend will continue for the foreseeable future. Output of oriented PP film fell by only 3% last year, much less than the average for the film sector. For makers of polyethylene film, demand for food-packaging films held up much better than did non-food packaging and non-packaging products. All of the PP and PE film sectors will enjoy lower average materials prices in 2009 and 2010 than they did in 2008.

Plastics sheet had grown faster than most other plastics industry segments before 2008, and last year the sheet data declined at a slower rate than the overall average. This was mostly due to the performance of polypropylene sheet. In 2008, PP sheet output contracted by 5% while PVC and PE sheet were off by more than 10%.

About the Author

Bill Wood, an independent economist specializing in the plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. He can be contacted by e-mail at BillWood@PlasticsEconomics.com. His monthly Injection Molding and Extrusion Business Indexes are available at www.ptonline.com.

Related Content

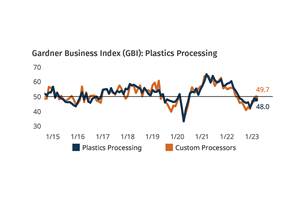

Plastics Processing Contracted Again in March

Processing activity contracted for the ninth straight month, and at a faster rate.

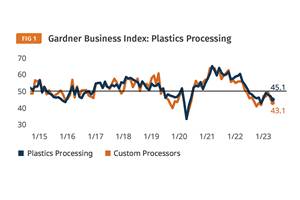

Read MorePlastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

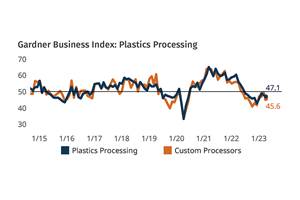

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

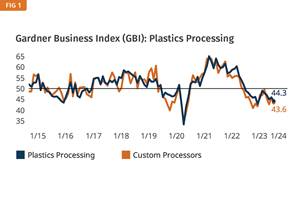

Read MorePlastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More (2).jpg;maxWidth=970;quality=90)

(2).jpg;maxWidth=300;quality=90)

(1).jpg;maxWidth=970;quality=90)