PE, PS Prices Higher But Steady

Resin-Buying Strategies

But indications for the remainder of the year are for flat to slightly lower pricing for all four commodity resins

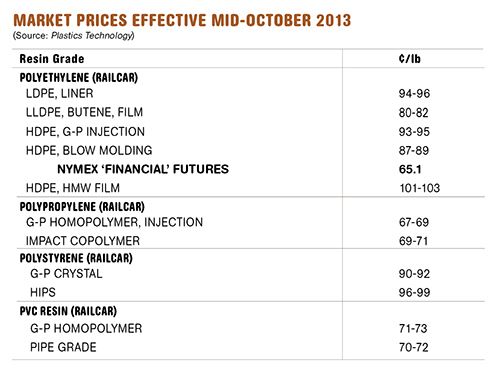

Alhough PE and PS prices moved up in September, all indications for the remainder of the year are for flat to slightly lower pricing for all four commodity resins, prompted by a drop in feedstock prices, slower demand, and some improvement in supply restraints. That’s the view of resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

PE PRICES UP

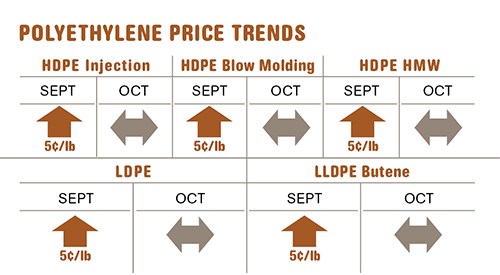

Polyethylene prices moved up 5¢/lb across the board by the third week in September. A new 5¢ increase for Nov. 1 was emerging at press time. Mike Burns, RTi’s v.p. for PE, noted that strong mid-month supplier support, along with PE production disruptions, bolstered implementation of the September hike. As for the follow-up November increase, he said, “I don’t see any of that increase being implemented, barring unplanned PE production disruptions.”

Burns sees the September move as most likely the last price hike of the year and ventures that the proposed November increase could be the first hike implemented early next year. Similarly, The Plastics Exchange’s Greenberg does not envision the November price increase “finding prompt implementation.”

Polyethylene plant utilization rates continue to be in the 90s percentage range and supplier inventories are healthy—over 30 days. Although exports are down, domestic demand has been consistently better than anyone had anticipated, and processors have been able to pass along price increases.

Spot PE markets have been tight due to earlier production issues, particularly for HDPE, where spot prices have seen the most strength, according to Greenberg. Meanwhile, spot ethylene monomer prices dropped to a low of 45¢/lb in the second week of October. In late September, Greenberg reported, “At 17¢/lb, spot HDPE margins are the best since the very beginning of 2011—add that to 40¢/lb ethane-to-ethylene margins and yes, it is good to be a petrochemical producer today.”

Greenberg continued: “It’s not so bad to be a processor, either. Sure, resin prices are high, but they’ve been here before, and generally better consumer demand, spread among a consolidated field of processors, has led some to record earnings as well.”

PP PRICES DOWN

Polypropylene prices dropped by 2.5¢/lb last month in step with October propylene monomer contract prices. Scott Newell, RTi’s director of client services for PP, noted that spot propylene monomer prices continued to drop last month to the mid-60¢/lb range, and he saw this as indicating another price drop for November monomer and PP contract prices.

Greenberg reported in late September that spot PP prices, which by early in the month had matched the peak February price, subsequently slid 2¢/lb over two weeks. “Spot PP buyers were happy to see some price relief, albeit small, but well-priced railcars still came and went in a snap,” he remarked. These sources report what appears to be a slight increase in PP supplier inventories—now at 31.5 days. Processors had built up their inventories a bit prior to the August price hike, and PP demand weakened accordingly over the last couple of months.

But a couple of factors could shift the scenario toward stronger prices. One is that Petrologistics, a large domestic propylene monomer producer, had a planned one-month shutdown slated to end Oct. 28. A delay in startup of the unit could cause some issues in the tightly balanced monomer market, according to Newell. And there are cracker maintenance shutdowns slated for November. Scheduled PP plant shutdowns were taking place last month and into this one by Phillips 66 and Formosa.

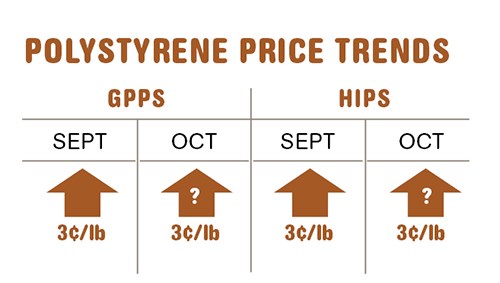

PS PRICES RISE

Polystyrene prices moved up 3¢/lb for GPPS and 1-3¢ for HIPS in September, driven by a spike in benzene prices. A new 3¢ across-the-board hike emerged for Oct. 1. Its likelihood of implementation was very doubtful, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC.

The upwards pricing pressure on PS from feedstocks is easing. October benzene contract prices dropped back 3¢/gal and another drop was anticipated for November. Spot ethylene prices have fallen to the mid-40s; and while September contract prices did not budge, lower October contract settlements are expected.

Yet Kallman does not see price relief for PS this month, owing to relatively tight supplies for both styrene monomer and PS, exacerbated by the planned maintenance shutdowns.

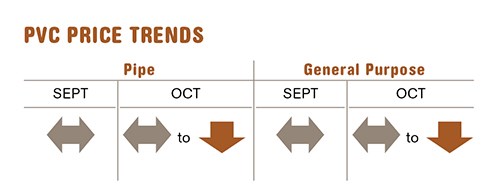

PVC PRICES FLAT

PVC prices remained motionless through September, though October contract prices were still under discussion at press time. Market factors would not support another attempt by suppliers to hike prices, according to RTi’s Kallman.

In fact, he projects PVC prices to be flat to slightly lower through the rest of the year, owing to both lower ethylene monomer prices and the seasonal demand slowdown. Two major planned PVC plant shutdowns, one last month and one this month, are not likely to have more than minimal impact on the market.

Related Content

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

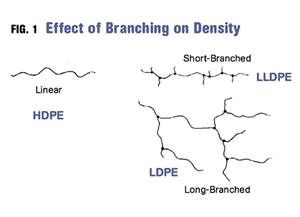

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreNew Entrant Heartland Polymers Stepping up as Reliable Supplier

Heartland Polymers’ new Alberta, Canada facility will produce 525 KTA propylene and 525 KTA polypropylene. It is expected to stabilize supply chains across the continent.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More