Plastics Processors Planning Equipment Spending Spree

CLOSE-UP: CAPITAL EQUIPMENT FORECAST

Gardner’s latest survey indicates a robust 17% increase in capital equipment purchases planned for in 2015. What does this mean to you?

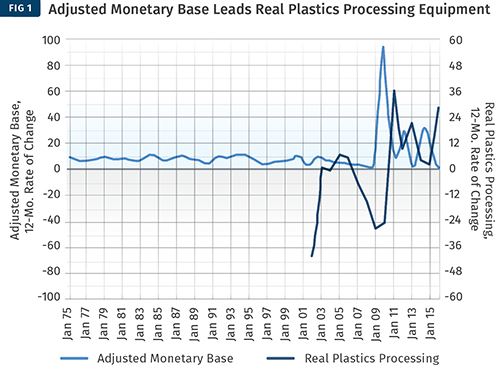

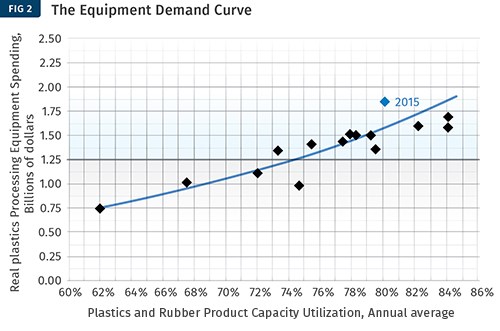

U.S. plastics processors plan to invest heavily—very heavily—in primary machinery, auxiliary equipment, and molds this year, according to an exclusive survey conducted by Gardner Business Media, the Cincinnati-based parent of Plastics Technology. The annual Capital Equipment Spending Survey, conducted last August of subscribers to this magazine and sister publication MoldMaking Technology, indicated an increase of 17% in spending over last year’s levels, reaching about $5.4 billion. While some may view the projections as far-fetched, indicators tracked by Gardner suggest they are realistic (see sidebar below).

The survey projects primary processing equipment spending to reach more than $1.84 billion in 2015, an increase of 28% from 2014. Roughly 67%, or about $1.28 billion, of this total will be spent on injection molding machines. Nearly 80% of injection machine spending will be on horizontal-type presses. However, spending on vertical machines will more than double in 2015 compared with last year, while horizontal machines will increase by about 25%.

Regardless of the machine’s orientation, spending on hybrid machines will be relatively flat to slightly down in 2015. This means that all of the growth will be in electric or hydraulic presses. In 2014, the survey indicated that within horizontal injection machines, spending was fairly equal across electric, hydraulic, and hybrid machines. But, in 2015 spending will return to its more typical pattern of noticeably higher spending on electric and hydraulic machines compared with hybrids. The same pattern can be seen in vertical machines.

Historically, the survey is fairly accurate when it comes to forecasting spending on injection machines. However, it is more difficult to forecast other primary equipment types because they are typically more expensive and purchased less frequently. That said, the survey does suggest a significant increase in extrusion equipment spending in 2015, topping $200 million, a mark that hasn’t been hit since 2008. Spending on blow molding and thermoforming machines is expected to be relatively flat, while investment on compounding machines will decrease sharply compared with 2014.

Within auxiliary equipment, the most obvious trend is the dramatic increase in spending on robots. In 2014, Gardner estimates that investment in robotics topped $300 million for the first time since at least 2008. The 2015 survey indicates that robot spending will increase by nearly one-third to almost $400 million in 2015. Screws/barrels also should see a significant increase in spending in 2015, reaching $229 million, suggesting processors will be refurbishing existing lines or perhaps recommissioning lines that had been shut down. In fact, this would be the first time that spending on screws/barrels was more than $100 million since at least 2008. Finally, auxiliary equipment for extrusion processes, including downstream equipment and dies, should increase nearly 100% in 2015.

Spending on complete molds (as opposed to mold components) will be more than $1.26 billion in 2015. This would be the second year in a row that complete mold spending has been above $1 billion. And, this is nearly double the spending on molds in any single year from 2009 to 2013. Of the $1.26 billion projected spending for molds, about 67% will be on molds equipped with hot runners. Spending on hot-runner molds will increase at slightly faster rate than spending on cold-runner molds.

THE 'HOT' INDUSTRIES

Across all equipment categories, custom processors will account for nearly 38%, or about $2.02 billion, of the roughly $5.4 billion in spending. According to the survey, custom processors will spend $568 million on injection machines, $625 million on auxiliary equipment (with more than 33% of that on robots and screws/barrels), and almost $500 million on complete molds.

Based on demographic data collected by Gardner, 69% of custom processors make parts for the automotive industry, 57% for the medical/pharmaceutical industry, 41% for electronics/computers/telecommunications, and 39% for aerospace/aviation. So, while the plants dedicated to the automotive industry look to be spending less in 2015, this is because automotive work is being pushed down the supply chain to custom processors.

Machinery and equipment manufacturers are the second largest end market when it comes to total spending. This industry segment will spend $430 million on primary machinery, auxiliary equipment, and molds, a 50% increase from 2014. About $180 million will be spent on complete molds in this sector. Total spending on primary and auxiliary equipment will be about equal to the spending on complete molds. The vast majority of primary processing equipment investment will be on injection molding machines, with a much smaller amount on extrusion machines.

Within auxiliary equipment, machinery and equipment manufacturers will spend nearly $30 million on welding/assembly equipment, which is by far the largest auxiliary equipment type for investment by this group. Specifically, there will be significant spending by power-driven hand-tool and packaging-equipment manufacturers.

Medical OEMs will spend more than $300 million on machinery, equipment, and molds in 2015. This is roughly a 20% increase from 2014, and by far the most spending since 2008. The medical market will spend about $70 million on primary processing equipment, almost of all of which will be injection machines. Medical OEMS will spend more than $30 million on robots and more than $10 million on welding/assembly and resin-handling equipment. But most of the spending will be on complete molds, suggesting new medical products are in the pipeline. Of the spending on complete molds, the majority will be on cold-runner molds, which makes the medical industry different from many other industries.

WHAT DOES IT ALL MEAN?

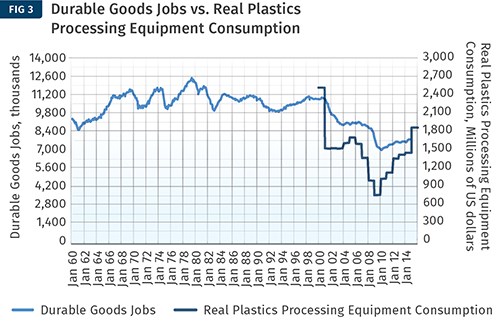

The results of the Gardner survey are a clear indicator that American manufacturing has made a dramatic recovery from the two recessions that have already occurred in this new century. For processors, the increased investment in capital equipment will result in new jobs. While that’s a positive, processors have had issues over the last several years in filling existing positions. Moreover, increased investment in capital equipment leads to higher productivity, which leads to greater profits, which leads to even more jobs.

The survey results should be meaningful to processors for three reasons. First, processors should expect longer delivery on equipment orders as the year progresses. Capital equipment takes a lengthy time to build, especially if customization and automation are required. Like all other manufacturers, suppliers of equipment and molds want to keep their inventory as low as possible. So, when demand increases rapidly, as the survey indicates it will, suppliers may have a hard time ramping up production fast enough. As orders build up in the pipeline, delivery times typically grow longer and longer. Because a significant amount of the processing equipment acquired in the U.S. is imported, shipping times from overseas can exacerbate the problem.

Second, equipment and mold prices are likely to rise during 2015. This is a supply-and-demand issue. When demand rises rapidly and builders cannot increase the supply as fast as demand is rising, the price of machines and molds tends to increase to balance things out. Historical market data supports this effect. Price increases are even more likely on equipment types that the survey indicates will be in higher demand next year.

Third, the longer processors wait before pulling the trigger on an order next year, the more unlikely it is that they will be able to buy their first choice of equipment. If processors cannot accept the extended delivery time for their preferred machine because, for example, they have a new order that must be fulfilled right away, then they’ll have to settle for the next-best machine that will meet their time frame.

Moreover, if the type of machine is in high demand, then the price could rise to a level that makes return on investment hard to justify. Wise planners will include detailed contingencies that adjust for accepting that second- or third-best option.

If processors know they are going to buy a machine (or multiple machines) next year, then it may be better to buy sooner rather than later to avoid potentially longer delivery times and higher prices. It could be a good tactic for staying one step ahead of the competition.

Related Content

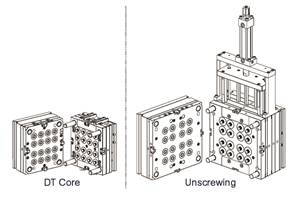

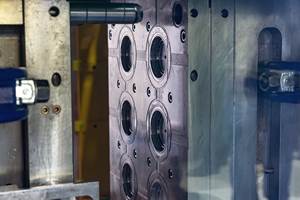

Best Methods of Molding Undercuts

Producing plastics parts with undercuts presents distinct challenges for molders.

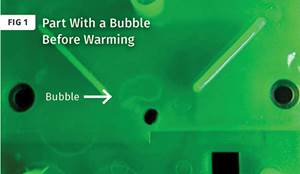

Read MoreHow to Get Rid of Bubbles in Injection Molding

First find out if they are the result of trapped gas or a vacuum void. Then follow these steps to get rid of them.

Read MoreA Simpler Way to Calculate Shot Size vs. Barrel Capacity

Let’s take another look at this seemingly dull but oh-so-crucial topic.

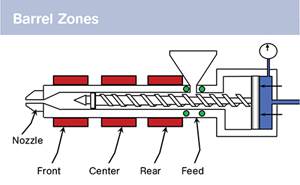

Read MoreHow to Set Barrel Zone Temps in Injection Molding

Start by picking a target melt temperature, and double-check data sheets for the resin supplier’s recommendations. Now for the rest...

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)