Polyurethane Foams Get Ready for HCFC Phase-out

With a critical deadline fast approaching, PUR foam formulators are mastering the art of using ‘cleaner' blowing agents. The latest PUR conference revealed new successes with these agents in a broad spectrum of rigid, flexible, and integral-skin foams.

The polyurethane industry is gearing up to meet fast-approaching deadlines for phasing out HCFC blowing agents in favor of "cleaner" alternatives for rigid insulation foams. Current R&D is focused on optimizing foam performance while reducing the cost of formulating with substitute blowing agents. This was a major theme of the recent Polyurethanes 2001 Conference and Expo in Columbus, Ohio, sponsored by the Alliance for the Polyurethanes Industry.

Notable among the technical presentations were reports on the latest efforts to achieve cost-effective formulations for construction, appliances, and automotive integral-skin foams based on liquid HFC-245fa, the leading contender in the U.S. Other papers discussed optimizing the performance of gaseous HFC-134a and CO2 (water) formulations.

Also newsworthy were pentane-soluble polyols for pour-in-place foams used in discontinuous metal-faced panels, as well new foam formulations for continuously laminated metal panels. Rounding out the news were new polyols and catalysts for HFC-blown appliance foams.

News in flexible foams included a novel PUR seat-trim cover, low-fogging surfactants for auto seating, and non-fugitive surfactants and catalysts for flexible foams. There were also developments in SRIM and RRIM composites.

'Clean' candidates

Production of HCFC-141b, the leading blowing agent in North America for PUR insulation, will be phased out Jan. 1, 2003, in accordance with the Montreal Protocol. The phase-out date for production of HCFC-22 and HCFC-142b, which have lower ozone-depletion potential, is Jan. 1, 2007. The latter two have had limited use in rigid PUR foam, mostly as blends with HCFC-141b.

In North America, appliance makers and flexible-faced laminators have moved faster than others to make the transition to alternative blowing agents. The leading candidates for refrigeration foams are HFC-245fa and HFC-134a. The latter is already used here and in Europe. But it appears that most appliance makers favor the non-flammable HFC-245fa, since it has been shown to yield the lowest cabinet energy consumption.

Meanwhile, most flexible-faced laminators are converting to pentane. Currently favored is a blend of cyclopentane and isopentane, although n-pentane is now being evaluated because it offers the best economics. The biggest hurdle for users of hydrocarbons is the need to convert plants to non-flammable facilities. Industry sources say conversion costs can vary from a few hundred thousand dollars up to $1 million. Payback still can be realized in as little as a year because the operating economics are very favorable.

In other rigid-foam construction applications—including pour-in-place foams for continuous and discontinuous metal-faced panels, spray roofing foams, and insulation for residential water heaters—blowing-agent conversion is more complicated. The choices now under consideration are HFC-245fa, HFC-134a, water, pentanes, and combinations of these.

In automotive integral-skin foams, HFC-134a and water are already used, since HCFCs were banned from this application in the U.S. five years ago. However, HFC-245fa alone and in blends with water looks attractive for balancing cost and performance.

None of the alternatives alone can offer both the physical properties and the cost of HCFC-141b, which sells for $1.20 lb. HFCs cost about one-and-a-half to four times more, while hydrocarbons cost from 20¢/lb for pure n-pentane to 75¢/lb for cyclopentane/isopentane blends. However, pentanes are limited by large upfront conversion costs.

HFC-134a sells for around $2/lb. HFC-245fa, currently produced only by Honeywell in pilot-plant quantities, will be initially priced at around $4.50/lb. HFC-365mfc, a low-flammability liquid that is the leading candidate in Europe, is available in semi-commercial quantities from Belgium's Solvay and is expected to sell in the same price range as 245fa. Full commercial production of HFC-365mfc is scheduled for the latter half of 2002, but Solvay will not supply it here.

Meanwhile, start-up of Honeywell's commercial HFC-245fa plant in Geismar, La., is on schedule for mid-2002. The company has licensed exclusive North American patent rights for both HFC-245fa and HFC-365mfc from Bayer AG in Germany. Honeywell does not rule out making HFC-365mfc in the future.

HFC-245fa's chemical and physical properties are very similar to CFC-11 and HCFC-141b in terms of boiling point, molecular weight, non-flammability, and resulting foam properties. However, it has chemical characteristics more analogous to CFC-11 than to HCFC-141b and physical properties bordering on a low-boiling-point liquid. Due to these differences, Honeywell will release this month a conversion handbook to aid in efficient adoption of 245fa. The book contains recommendations on storage, handling, and processing. For information on Honeywell's Enovate 3000 (HFC-245fa) and on how to obtain the handbook, visit www.enovate3000.com.

HFCs in construction foam

At the Columbus meeting, Honeywell reported on field evaluations of rigid foams blown with HFC-245fa alone and in blends using standard equipment in a variety of construction applications. Overall, HFC-245fa was shown to produce foam with equivalent k-factors and superior k-factor aging relative to current HCFC-141b systems. HFC-245fa foams meet critical insulation requirements while HFC-245fa blends can provide the answer for the more cost-driven markets.

Without any significant modification to equipment or shipping containers, two recent spray-foam roofing trials by Resin Technologies and BASF showed HFC-245fa/water-blown foams to be equivalent or superior in quality to HCFC-141b foam. The 245fa foams reportedly had core densities of 2.99 to 3.00 pcf, compressive strengths of 48.6 to more than 50 psi, and excellent surface quality. The applicator also praised the 245fa formulation's processing characteristics.

Similarly, a pour-in-place trial by Resin Technologies showed an HFC-245fa cavity-fill foam had comparable k-factor to HCFC-141b foam but superior physical properties. The 245fa foam had 2.2- to 2.6-pcf core density and compressive strength (parallel) of 41.8 psi and perpendicular compressive strength of 22.8 psi.

Atofina Chemicals discussed production of PIR foams with HFC-134a used as a co-blowing agent with pentanes. HFC-134a was shown to improve k factors relative to pure pentane-blown foams. Measured at 0° C, the improvement ranged from 4% to 12%, depending on the type of pentanes compared.

Atofina also reported on use of two gaseous blowing agents, HFC-134a and HCFC-22/142b mixture, at both high and low levels in spray-applied PUR foam. At higher levels, similar to those used with HCFC-141b (9% to 13% of the B-side), they require pressurized containers because of their high vapor pressures. However, such spray PUR formulations can be processed through standard equipment with no modifications. The cost/lb of foam made with HFC-22/142b is similar to that with HCFC-141b at these levels, while the cost/lb of foam with HFC-134a is 3¢ to 5¢/lb higher.

At lower levels of the gaseous blowing agents, partial pressures are less than 12 psig at 110 F. Thus, PIR formulations can be shipped in standard drums, which drops the cost of foam 3¢ to 5¢/lb lower than foams with HCFC-141b. The alternative foams also show improved compressive strength and dimensional stability, indicating the possibility of further reducing foam cost by lowering the density.

Pentane-soluble polyols

A report on European pour-in-place, discontinuous metal-faced panels made with pentanes was presented by Oxid, Inc. The company developed new polyester polyols whose backbone has been modified with pentane-soluble ingredients. The polyols are said to maintain high aromatic content and yield good foam physical properties. One product, Terol 588, is being used commercially in continuous flexible-faced lamination. Newer Terol 681 was developed for pour-in-place systems.

According to Oxid, pentane-blown PIR systems can be formulated for discontinuous metal-faced panels that meet a UL723/ASTM E-84 Class I tunnel-test rating. Recent trials show this can be accomplished with Terol 681 and a combination of a liquid non-reactive fire-retardant additive package (a tetrabromophthalic anhydride polyether and tris-chloroethyl phosphate). Increasing the loading of polyester polyol and reducing the level of polyether resulted in foams with the lowest smoke ratings.

PIR for metal panels

New PIR foam formulations for the core of continuous-laminate metal panels were discussed by Dow Polyurethanes. The company developed an HCFC-22 froth system as a transitional solution that meets E-84 Class I requirements. Also new is a PIR system for cyclopentane/isopentane blends that can meet E-84 requirements. It reportedly shows thermal conductivity similar to HCFC-141b foams, as well as easy processing.

Dow researchers say use of CO2/water solutions for PIR foams is challenging but feasible. Trials show the need for preheated facers, conveyor temperatures higher than 120 F, and possibly a temperature-controlled storage area for newly produced panels. Resulting foams reportedly meet the most severe fire standards. Moreover, the addition of soluble quantities of HFC-134a to the high-water-containing polyol blend may allow foam density reduction.

Dow's lab trials with HFC-245fa PIR foams show them to have initial thermal conductivity similar to HCFC-141b foams plus improved flame resistance. To reduce cost, HFC-245fa can also be used as a co-blowing agent in high-water-content PIR systems. The combination is said to offer advantages in processing, flammability, and smoke development.

Water-heater insulation

At the conference, Bayer addressed the challenges of replacing HCFC-141b in PUR insulation for residential water heaters. Among those challenges are revised standards from the U.S. Dept. of Energy. Effective Jan. 20, 2004, the minimum required energy efficiency (EF) is increased by 4.43% to 5.18% for electric water heaters and 8.59% to 11.63% for gas heaters. The EF value for a given heater is determined by the DOE's 24-hr Simulated Use Test.

Bayer tested EF of 50-gal electric heaters insulated with foams produced with HCFC-141b, HFC-245fa, HFC-134a, and cyclopentane. The results showed the best foam insulation, in terms of Btu/hr and k-factor, to be HFC-245fa, followed by HCFC-141b, cyclopentane, and HFC-134a in that order.

Appliance foams

Dow reported on ways to improve the performance of HFC-134a appliance foams. This HFC provides moderate cost at a penalty in cabinet energy consumption. But Dow has a new polyol that is said to significantly improve the thermal insulation of foams using HFC-134a. This k-factor improvement could provide cabinet energy performance nearly equivalent to that of a hydrocarbon-based appliance foam but without the flammability issue. K-factor of these improved 134a foams is also within 8% of foams made with HFC-245fa.

Meanwhile, efforts to raise the CO2 content in HFC-134a systems have resulted in a system that reduces materials cost and density without hurting k-factor. This is said to reduce the overall cost of the system by more than 10%.

Japan's Tosoh Corp. has developed novel amine catalysts for use with next-generation HFCs. They are said to give foam properties identical to HCFC-141b. In HFC-245fa systems, new Toyocat NP and RX7 reportedly reduce foam thermal conductivity. RX7 showed the lowest expansion level due to its low pressure during foaming.

HFCs in integral skins

Honeywell's experiments with HFC-245fa in integral-skin foams show that improved performance is possible relative to currently used HFC-134a and water. Compared with the former industry standard, CFC-11, foams blown with HFC-134a or water both give poorer skin formation.

Foams of 16 and 32 pcf were molded with free-rise densities of 8 and 16 pcf and a pack factor of 2. At the same level of blowing agent, the free-rise density of HFC-245fa foams was about half that achieved with CFC-11. Given their similar molecular weight, this indicates 245fa's much higher blowing efficiency. Moreover, HFC-245fa gave skin thickness similar to that obtained with CFC-11 and showed very similar change in skin thickness as mold temperatures or packing levels were varied.

For cost-sensitive applications, HFC-245fa/water blends appear to be efficient options. Skin formation with the blends is less than with neat HFC-245fa. But even at 30% water, there is still an appreciable amount of skin formation. Addition of water to the system increased the in-mold pressure, which led to post-blowing in some cases (at 30% water level). This in-mold pressure is still lower than for 100% water-blown foams.

Auto seating news

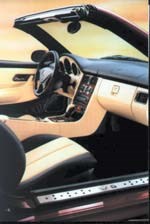

Dow Polyurethanes reported on a "fabric-free" approach to molding seat covers for vehicles and furniture. Dow developed a PUR composite of foam and a top-surface elastomer layer a few millimeters thick. This one-step process eliminates costly cut-and-sew operations for foam pads topped with fabric, vinyl, or leather. Dow's approach also substitutes for coverstock preforms for pour-in-place molded seat foams. Dow said it produced seats with a supple, durable outer layer; excellent touch and grain definition; molded-in color capability; and ability to tune comfort levels.

Prototype seats were produced with a sprayed in-mold coating followed by a sprayed elastomer layer and then poured MDI flexible foam. Any typical seating foam (all-MDI, TDI/MDI, or all-TDI) can be used behind the sprayed elastomer layer. Overall, there was excellent compatibility between the in-mold coating, elastomer, and flexible foam layers. There was no cracking nor deterioration of the in-mold coating under any of the standard heat or humidity test conditions nor after fatigue testing. The foam/elastomer composite often exceeded typical foam specifications for tear strength, durability, compression set, flame resistance, and fogging.

Goldschmidt Chemicals reported on three new experimental silicone surfactants that are said to optimize North American-type, high-resilience TDI-80 foams for auto seating. Forty-three experimental silicone surfactants were evaluated in five different foam formulations. New EP-K-52, -53, and -54 products reportedly proved superior to competitive surfactants and to existing Goldschmidt products in processing latitude, flowability, bulk stability, and fogging/VOCs.

Additives for flexibles

Novel surfactants and catalysts for flexible foams also made a debut at the Columbus conference. Although liquid CO2 technology is now widely used, improvements are still needed in cell structure and uniformity of physical properties throughout the block, according to sources at Goldschmidt. Company spokesmen discussed newly developed silicone surfactants, Tegostab B 8059 and B 8250, that reportedly give better properties in liquid-CO2 foams than the company's established products, Tegostab BF 2370 and B 8240.

The new candidates were found to give optimal cell structure under industrial conditions using all three liquid-CO2 machine technologies currently in use (Novaflex, CarDio, and Beamech). Both new products exhibit an improved nucleation profile but differ in their stabilization characteristics. Tegostab B 8250 is non-hydrolyzable and highly efficient as a universal surfactant (even for FR foams) that allows higher foam yields. New B 8050 is hydrolyzable and gives a wide processing latitude that is said to minimize top-to-bottom block variations and allow fine-tuning of foam hardness.

Air Products & Chemicals has developed non-fugitive catalysts and surfactants for reduced VOC emissions in polyester PUR slabstock. The new additive package consists of Dabco NE400 catalyst and Dabco DC4020 silicone surfactant. NE400 is said to meet the latest auto-industry requirements for zero amine emissions and to minimize negative interactions with other plastic materials. Physical properties, humid aging, and processing performance are comparable to standard industry catalysts.

DC4020, a high-performance surfactant suitable for many polyester slabstock grades, provides excellent processing and reduced emissions, according to the company.

SRIM & RRIM materials

Bayer reported on a few developments in materials for reinforced RIM composites. One was a longer-flow PUR system used to mold the high-density SRIM cargo box for the General Motors' GMT800 Silverado pickup-truck box (currently in limited production as an option). The Baydur 425 IMR system reportedly allows longer shot times (10-12 sec) and improves initial wet-out of the glass preform.

Bayer also reported on an experimental HD-SRIM system developed to permit molding larger parts with chopped-fiber injection technologies like Hennecke's FipurTec, Krauss-Maffei's LFI (Long Fiber Injection), and Cannon's InterWet systems. Bayer's new formulation is said to allow longer pour time while maintaining fast cure.

Bayer also has new candidates for molding large RRIM parts for auto exterior panels. Bayflex 190 polyurea reportedly eliminates the need for post-cure by developing full properties in the mold. Another product with similar properties is Bayflex 180 PUR, developed for thinner walls. Both have higher flex moduli than earlier RRIM systems—87,000 psi unfilled. Bayflex 180 was recently reformulated to accept higher filler loadings to make it suitable for auto door skins. A 20% filler loading gives a flex modulus of 304,500 psi, adequate for door panels 1.5 to 2.5 mm thick or fenders 3 to 3.5 mm thick. When filled with 25% wollastonite, carbon fiber, or refractory fiber, its CLTE reportedly matches that of aluminum in the flow direction.

Related Content

GEON Performance Solutions Buys PolymaxTPE

Combined company aims to be global leader in thermoplastic elastomers.

Read MoreResins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreFoster Adds Specialty TPU and TPU Alloy Products to its Arsenal of Healthcare Materials

AdvanSource Biomaterials’ specialty TPU materials are used in application segments such as cardiology, orthopedics, drug delivery, endoscopy, wound care, urology, and neurology.

Read MoreMulti-Purpose TPV with Post-Industrial Recycled Content

Teknor Apex’s new Sarlink R2 3180B TPV offered with 25% PIR content.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)

.png;maxWidth=970;quality=90)