Prices of Commodity Resins Are Lower and Headed Down

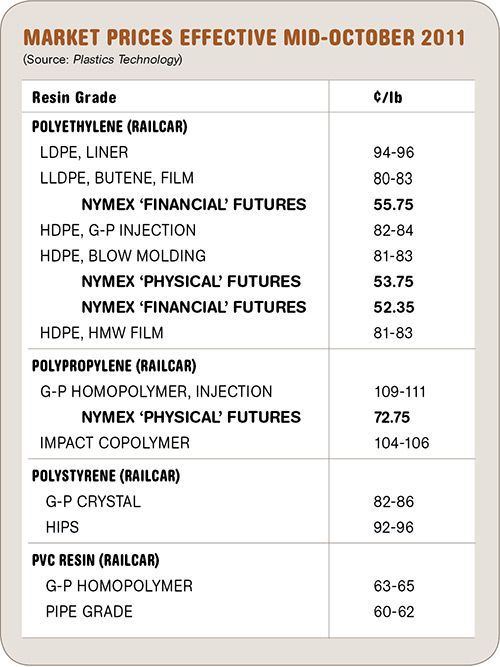

Prices of PE, PP, PS, and PVC were on the way down last month after remaining flat or slipping slightly in September.

Prices of PE, PP, PS, and PVC were on the way down last month after remaining flat or slipping slightly in September. Demand is dismal, except for PE, where the market is only lackluster. Moreover, downward pressure is coming from price erosion of key feedstocks and growing inventories at resin suppliers. Barring unexpected world events, this softer resin pricing trend is expected to continue for the remainder of the year, according to resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Tex..

PE HIKES TABLED

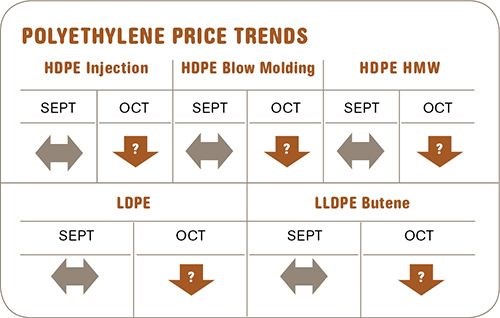

Polyethylene prices remained flat through September, as suppliers failed to implement their 5¢ price hikes. Suppliers did not rescind any of their increases, which for October totaled 11¢/lb. Prices were not expected to increase, in any case.

Although demand for PE is slow but not bleak, it is no longer vibrant as was the case earlier in the year, and the outlook is for more of the same. Strong exports to Asia in July/August were halted by economic uncertainty; buyers retreated, leaving behind extra material with no place to go. Resin availability in the secondary market is quite good and pricing was flat but very little material was moving. Domestic production is down 5%, operating rates are down by 6%, though sales were

up by 3%.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. December pricing is likely to be the market low.

PP DISCOUNTS SPREADING

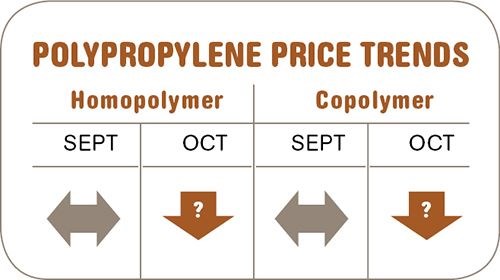

Polypropylene prices remained flat in September, following the trend of propylene monomer contracts, which held at 78¢/lb. Propylene cracker turnarounds had no effect in tightening the market due to poor demand.

Despite PP suppliers throttling down production, supply remained quite ample. Resin plant operating rates dropped to the low 80s from the high 80s in August. Total sales were down by roughly 40 million lb and production was down by 130 million lb. Resin inventories actually shrank.

In the second half of September and through last month, spot PP prices were being discounted and propylene monomer prices were expected to settle lower. Despite more attractive secondary market prices, not much material was being moved. Many buyers have taken a more careful approach; uncertain demand and the potential for future price erosion is on everyone’s mind. The fourth quarter could end up being the slowest of the year.

Outlook & Suggested Action Strategies

30-60 Days: RTi anticipates October monomer contracts will drop as much as 10¢/lb. Buy as needed in anticipation of lower prices in October/November, with even lower prices next month.

PS PRICES DOWN, HEADED LOWER

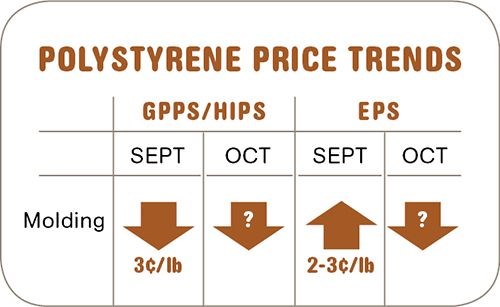

Polystyrene prices dropped an average of 3¢/lb across the board by the end of September, and further price erosion was expected in October and over the rest of the year. Spot GPPS prices were up to 8¢ lower by last month.

Prices of key feedstocks (benzene, ethylene, and butadiene) declined significantly in the last couple of months, lowering the average cash cost to make GPPS by 5.5¢ and HIPS by 7.5¢/lb. As a result, the premium for HIPS has begun to narrow. Last month, it remained at 11¢ to 12¢/lb in North America, but was down 9-10¢ in Asia and Europe, driven by the large drop in butadiene prices. Having peaked at $2.20/lb, butadiene has been falling, with spot prices as low as $1.30/lb and September contracts settling downward at $1.70-1.75/lb. Styrene monomer spot prices dropped by as much as 7.5¢/lb by the end of September, and September contracts were 3¢ lower.

Outlook & Suggested Action Strategies

30-60 Days: Expect plenty of resin availability and prices to soften further. Suppliers will attempt to shed inventory in the face of lower demand. RTi suggests that HIPS buyers negotiate lower premiums over GPPS, which RTi expected to shrink by 3¢/lb in October.

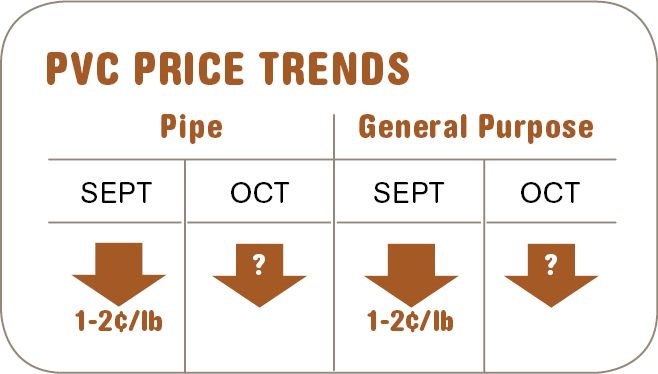

PVC PRICES SLIDE

PVC prices dropped at least a penny across the board in September, and spot prices kept sinking through mid-October. PVC feedstock costs were 1¢/lb lower in September, and a slightly larger decrease was expected last month, based primarily on anticipated lower ethylene contact prices.

PVC domestic demand grew 12% in August due to restocking and to some improvement in construction. Exports grew 17% to a new record above 565 million lb, accounting for 43% of total demand. Then economic uncertainty here and abroad slowed everything down. The domestic demand outlook is for a continued slowdown, and ditto abroad, causing falling export prices.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed and look for lower prices. RTi expects softer global demand through the year’s end to help push PVC resin prices still lower.

Related Content

The Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More