Commodity Prices Up Sharply

Resin makers have taken the gloves off on price increases for many commodity materials.

Recession or no recession, resin makers have taken the gloves off on price increases for many commodity materials. Rising feedstock prices are taking the blame.

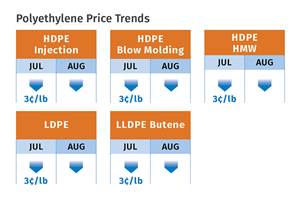

PE PRICES UP

Polyethylene prices rose 3¢/lb in May and were expected to gain another 3¢/lb in June. The London Metal Exchange (LME) North American short-term futures contract in blown-film butene LLDPE traded at 41¢/lb for July, up from 38¢ for June.

Contributing factors: One factor in rising prices was low inventories for ethylene monomer, as producers throttled down production. Spot monomer prices rose from 21¢/lb in May to 25¢ in June. May contract prices were flat, but June prices were likely to rise. Thus, PE suppliers are likely to push hard for the 3¢ June hike.

Domestic PE demand showed some improvement from May into June. Says Mike Burns, global business director for PE at purchasing consultant Resin Technology Inc. (RTI), Fort Worth, Texas, "We are not talking about robust orders, but better than in the first quarter. However, surging export activity halted in June."

PP PRICES RISE

Polypropylene prices moved up 2.5¢ to 3¢/lb in May, and suppliers issued hikes averaging 10¢/lb for June 1. Meanwhile, the LME short-term futures contract in g-p injection-grade homopolymer rose to 40¢/lb for July from 37¢ for June.

Contributing factors: Rising propylene monomer prices ended three to four months of relative stability in the PP market. May monomer contract prices moved up 2.5¢/lb. June contracts were poised to jump 8.5¢ to 40¢/lb. "You can expect PP resin prices to move up at least 8.5¢ by the end of June," says Scott Newell, RTI's director of client services for PP. Newell foresees prices of both monomer and resin moving up a bit in July, based on very tight supplies for both, particularly monomer. Higher PP prices have already curtailed previous export activity, while domestic PP demand is still off by 15%, according to Newell.

3¢ MORE FOR PVC

Some PVC buyers saw a 1.5¢ increase in May, which was half of what resin producers were seeking initially. Suppliers then posted a 3¢ hike for June and announced a further 3¢/lb hike for July 1. CDI, however, estimated only 1.5¢ for the June hike.

Contributing factors: Processors and resin producers see an uptick in demand, but they all view it as restocking by large buyers who had exhausted their inventories, not as reflecting real demand.

MORE PS HIKES ANNOUNCED

Polystyrene producers tried for 4¢ in May, but appear to have gotten only 2¢, after some suppliers told customers they would defer half the hike to June. PS makers had already posted a 3¢ increase for June 1 but are considered unlikely to get 5¢ total. Resin producers have all announced a further 5¢ increase for July 1.

Contributing factors: Benzene contract prices shot up in June to $2.34/gal from $1.90 in May. Some seasonal uptick was expected for summer gasoline production, but benzene rose higher and faster than expected, leading PS producers to announce the July hikes. PS producers expect benzene to rise again in July.

PET GOES UP, TOO

Bottle-grade PET prices moved up 2¢ to 3¢/lb in June, in partial implementation of the May 1 hikes of 5¢ to 6¢. July prices are expected to be flat.

Contributing factors: Resin prices got a push from feedstocks. Paraxylene rose 5.5¢/lb in the second quarter and peaked at 49.5¢ in May. June contract prices were expected to move up to around 50.5¢. Ethylene glycol tabs in June increased to 28.1¢/lb from May's 26.3¢, but no change was expected for July. Says a source at a major PET producer, "We got the 2¢ to 3¢ increase because of the uptick in feedstock prices. Also, we are in the summer 'beverage season,' and we are seeing some increase in demand. We expect prices for feedstocks and resin to be flat."

Last year was the first year that PET showed negative growth in demand—a 3.8% decline from 2007. Until then, PET had grown 6% to 7%/yr. For 2009, industry sources project demand to hold even or decline slightly.

NYLON & THERMOSETS UP

After Honeywell Resins and Chemicals announced a 10¢/lb hike in nylon for May 11, Rhodia came out with a 12% increase at the end of May, and DSM raised nylon 6 tabs 10¢ on June 15.

After AOC hiked unsaturated polyesters and gel coats by 5¢ on June 1, CCP and Interplastic followed with 5¢ higher tabs for July.

| Market Prices Effective Mid-June A | |||

| RESIN GRADEb | ¢/LB | ¢/CU INc | |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

.png;maxWidth=300;quality=90)