Temporary Lull in Price Hikes

For the most part, commodity resin prices were stable last month, though rising feedstock prices, some upticks in demand, and revival of exports indicate pressure building for higher prices.

For the most part, commodity resin prices were stable last month, though rising feedstock prices, some upticks in demand, and revival of exports indicate pressure building for higher prices.

PE PRICES FLAT FOR NOW

Polyethylene prices were relatively stable though March, as suppliers pushed back their 5¢/lb price hikes from March to April. Meanwhile, the London Metal Exchange (LME) North American short-term futures contract in blown-film butene LLDPE for May was 38¢/lb, up slightly from April’s 37¢.

Contributing factors: Domestic demand is still down, but exports appear to be coming back to life. Also, ethylene monomer spot prices moved up to 23.25¢/lb early in April, having dropped to as low as 21.5¢ in mid- to late March. If spot monomer prices move as high as 27¢/lb, a PE price hike could result, says Mike Burns, global business director for PE at Resin Technology Inc., resin purchasing consultants, in Fort Worth, Texas.

PP PRICES TO MOVE UP?

Polypropylene prices were flat through March, and suppliers’ planned increases of 5¢ to 6¢/lb fell by the wayside. However, new hikes of 2¢ to 3¢ were issued for April. LME’s North American short-term futures contract in g-p injection-grade homopolymer was up to 37.2¢ for May from April’s 36.1¢/lb. Secondary market prices for PP resin dropped 2¢ to 4¢ and even more for wide-spec.

Contributing factors: April monomer spot prices appeared to be on the rebound, although April contract prices could remain flat or even soften a bit.

According to Scott Newell, RTI’s director of client services for PP, resin suppliers have been able to export a lot of their excess material, which has tightened up domestic supplies. “Polypropylene supply has tightened in the Far East and Europe and their prices have been going up. As a result, China and some European countries have been buying from North America.” Resin exports have also tightened domestic monomer supply. Demand for PP in the first quarter appears to have dropped at least 2-3%.

PVC APPEARS FLAT

PVC producers have gotten 2.5¢ to 3¢ out of 8¢/lb in price increases they have posted so far this spring. The announced 3¢ increase for April 1 does not appear to be in effect. OxyChem in mid-April told customers that April prices would be flat, but PVC in May would go up a whopping 5¢/lb. Flat ethylene monomer prices appears to be keeping PVC prices level. Window and siding demand in April picked up slightly.

PS PRODUCERS WANT 4¢ MORE

PS resin producers say they got their 3¢/lb increase in March, but in mid-April it was too soon to say whether they would get a 2¢ deferred increase as well. Americas Styrenics and Ineos both announced an additional 4¢ hike for Apr. 15, but Total made that date unlikely by posting its 4¢ hike for May 1.

Contributing factors: Rising benzene prices are behind the PS increases. Contract benzene for April was $1.69/gal, up from $1.29 in March. Every 10¢ increase in benzene translates into 1¢ higher cost for styrene monomer. Export demand for styrene is picking up in China. PS demand in packaging also grew slightly (5% to 10%) in April, though total PS sales through February were down 16.3%.

PET PRICES UP?

PET prices moved up 2¢ to 3¢/lb in March, a partial implementation of March increases of 5¢ to 7¢. This followed implementation of a 4¢ hike in February.

Contributing factors: Suppliers’ partial success in raising prices was spurred by hikes in paraxylene and ethylene glycol feedstocks and by improved resin demand—however slight—which is typical in the second quarter. Mike Dewsbury, global business director for RTI, says demand is up 2% to 3%, a far cry from the 6% to 7% gains of the last couple of years and the consistent annual double-digit demand growth of just a few years back. If StarPet starts its new 800- to 900-million-lb PET production line in June, rather than later in the year, overcapacity will put downward pressure on prices. In the fourth quarter, Indorama Polymers is scheduled to start up a 1-billion-lb plant in Decatur, Ala.

DOW HIKES POLYCARBONATE

Dow Chemical Co. said all polycarbonate resins, compounds, and blends would go up 7¢/lb on May 1. Dow sought counteract to six months of declining prices for PC and a 60% rise in benzene and 35% increase in propylene raw materials since January.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

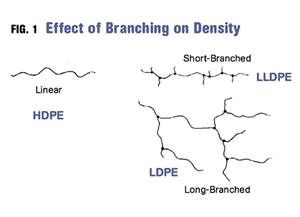

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More