Softer Resin Prices Expected

Softer prices can be expected for all four commodity thermoplastics as the year ends, a trend that may continue in the first quarter of 2013, for some resins, at least.

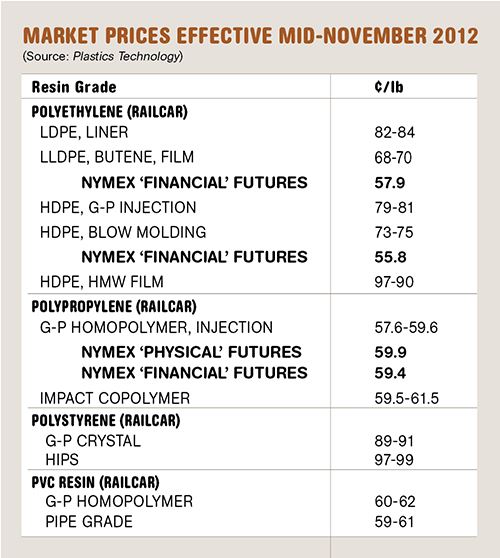

Softer prices can be expected for all four commodity thermoplastics as the year ends, a trend that may continue in the first quarter of 2013, for some resins, at least. Though higher feedstock prices helped push up prices for PP, PS, and PVC last month, supply/demand for all the key feedstocks is pretty well balanced. Lackuster domestic demand for the four resins and dwindling exports are other factors that point to price relief ahead.

Meanwhile, PP and PS suppliers are poised to shake things up a bit by changing how they set contract pricing so that it no longer is linked directly to monomer pricing. These and other observations were offered by CEO Michael Greenberg of Chicago-based The Plastics Exchange and by purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas.

PE PRICES FLAT TO DOWN

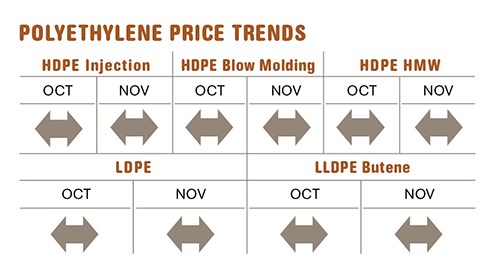

Polyethylene contract prices remained stable despite suppliers’ repeated attempts to push through a 5¢/lb increase. By most accounts, this increase has no chance at being implemented.

Mike Burns, v.p. of PE at RTi, says suppliers’ inventories grew in September and October by 400 million lb, which equaled the June/July inventory drawdown. So inventory levels have recovered to 38 days, the highest in three years, due to flat domestic demand and nearly vanished exports this year—except in June and July.

Meanwhile, processors are buying as needed. In mid-November, Greenberg reports, spot PE availability continued to improve. Generic prime railcars were available but priced to reflect suppliers’ third attempt to implement increases. Greenberg expects that processors will continue to resist paying more and said some were actually hoping for a bit of contract price relief. “Domestic resellers and exporters are generally eager to move uncommitted inventory and make room for opportunistic purchases if deals are presented closer to year-end,” he adds.

The ethylene monomer market was quiet last month. Barring an unexpected calamity, Burn says processors can expect price relief within the next 60 to 90 days. He forecasts overall 2012 demand for PE to be up by less than 5% over 2011. Greenberg, however, notes that cracker turnarounds planned for the first four months of 2013 could cause temporary supply constraints on PE and PP.

PP PRICES UP FOR NOW

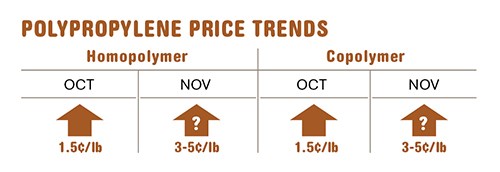

Polypropylene prices were expected to move up last month as suppliers sought hikes as high as 7¢/lb, based on monomer contract-price nominations. Scott Newell, director of client services for PP at RTi, thought prices would rise only 4-5¢. “Monomer prices went up due to planned outages, but most crackers were coming back on stream and monomer is expected to be well balanced.” Greenberg reported that while a 7¢/lb increase on contract propylene monomer was floated for November, spot monomer was trading less than 3¢ above October levels, but a 3-4¢ increase was likely.

Both PP demand and production in October were higher than the month before, and Newell expects 2012 demand to be up about 2% over 2011. But he predicted demand would be slow through the end of the year. He said PP suppliers’ inventories are on the tight side at 31.5 days. He and Greenberg both note that PP suppliers aim to change the basis for their 2013 contracts, essentially decoupling PP pricing from a direct tie to propylene monomer.

PS PRICES UP

Polystyrene price increases averaging 5¢/lb for Nov. 1 took effect for GPPS and HIPS. EPS price increases of 4¢/lb were also under way last month, so that imported beads looked very attractive for November and December deliveries, according to Stacy Shelly, director of business development at RTi.

October styrene monomer contract prices settled late and presumably higher. But even with higher benzene costs, October and November spot monomer prices stayed flat, reflecting very weak demand, says Shelly. Weak demand and high benzene costs in November made business unprofitable for monomer producers, leading some of them to sell their benzene back into the market and reduce operating rates. Ethylene spot pricing is up slightly but remained within the same 4¢/lb range for over a month. Butadiene is very balanced, with both spot and contract pricing flat for several months. Supplies are tight but demand is weak. Global prices are also down and spot prices are down roughly 62% from this year’s peak.

PS suppliers are attempting to decouple resin contracts from feedstock prices. Shelly ventures that these efforts will only speed up OEM efforts under way to convert applications from PS to other resins like PP and PET. Shelly foresees overall 2012 PS demand to be down again, and the same is forecasted for 2013.

PVC PRICES UP, THEN DOWN?

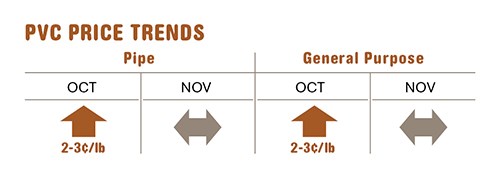

PVC prices were expected to move up last month, but closer to 2-3¢/lb instead of the 5¢ sought by suppliers for Oct. 5, according to Mark Kallman, director of client services for engineering resins and PVC at RTi.

Ethylene contracts settled 1¢/lb lower in October, raising hopes for further decreases in November, which will help keep PVC prices flat or lower through the year’s end. Kallman says October PVC production and overall demand held flat, though domestic demand increased 3%, reflecting improved construction numbers ahead of the winter season. In contrast, exports fell 6% and are expected to continue to decline due to both seasonal and economic factors into early next year.

Inventories rose another 4% in October, as operating rates still outstripped demand.

Related Content

In Sustainable Packaging, the Word is ‘Monomaterial’

In both flexible and rigid packaging, the trend is to replace multimaterial laminates, coextrusions and “composites” with single-material structures, usually based on PE or PP. Nonpackaging applications are following suit.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreNew Entrant Heartland Polymers Stepping up as Reliable Supplier

Heartland Polymers’ new Alberta, Canada facility will produce 525 KTA propylene and 525 KTA polypropylene. It is expected to stabilize supply chains across the continent.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=300;quality=90)