What's Ahead for 'Green' Plastics: Look for More Supply, More Varieties, Better Properties

Major chemical companies are investing big bucks in new plants and technologies to produce plastics from annually renewable sources, not from petrochemicals.

Major chemical companies are investing big bucks in new plants and technologies to produce plastics from annually renewable sources, not from petrochemicals. Some suppliers aim to produce today’s conventional plastics from unconventional feedstocks like ethanol fermented from sugar cane. Others will make new monomers using other fermentation chemistries borrowed from life sciences and biochemistry.

“The market is exploding, not only because compostable applications are growing, but because it’s going from a narrow definition to a broad definition of sustainability,” says Frederic Scheer, president of Cereplast, a maker of starch-based compounds. Cereplast’s changing product mix reflects this philosophy. Initially it supplied all-renewable, all-compostable compounds, but its latest compounds are 50/50 renewable starch and conventional PP.

Biopolymers are being redefined by where their carbon comes from, not where it goes at end of product life. “Over the past year and a half, emphasis has shifted from biodegradability to bio-renewability,” notes Jan Ravenstijn, technology director at DSM’s New Business Development Performance Materials group, recently set up to invest in new carbon technologies. “The people developing these new building blocks aren’t materials people. They’re microbiologists. So you see entirely new disciplines stringing together in the value chain. That’s very new.”

Dow Chemical offers this view on its website: “We are on the threshold of a step-change movement in the way chemistry transforms future economic, environmental, and social sustainability.”

Many recent moves into biotechnology by resin companies were announced around the time of the K 2007 show in Germany last October. Some firms are investing to seed promising R&D. DSM Venturing, for example, participated in a $6.6-million investment in Novomer, an R&D spinoff from Cornell University that has developed low-temperature catalysts to polymerize carbon monoxide and CO2. DSM’s Novomer investment is part of up to $300 million DSM has earmarked for alternative sustainable chemistry over the next five years.

However, Michael Stumpp, head of global specialty polymers and foams at BASF, cautions that “sustainability” goes well beyond renewability. Sustainability encompasses the whole energy cost of production and transportation. For a plastic derived from corn, for example, that means accounting for all the energy and other environmental effects of producing the fertilizer, cultivating and harvesting the corn, transporting it, and all the steps in converting it to plastic.

Why are so many chemical companies rushing to invest in sustainable plastic technologies? “We think petroleum raw materials will become scarce and very expensive,” says Jean Lampe, assistant to the direction at Solvay in Brussels. “Bio-sourcing will make oil reserves last longer.”

The increasing number of biopolymers gives more choices for blending. “Having other biobased materials to combine will lead to more innovation,” predicts NatureWorks’ president Dennis McGrew. Blending is the preferred route to improve biopolymer properties because fermentation by living creatures doesn’t lend itself readily to making grade changes the way petrochemical synthesis does. In fermentation, if you change the feedstock of sugar or starch, you often need to change the fermenting bacteria as well, which means costly downtime to clean out the system completely.

Sweet Ethanol

Brazilian ethanol is a major ingredient in some of the new biopolymer investments. Thanks to its unique combination of climate and available land, Brazil has some 350 ethanol production units making 20 million m3/yr of ethanol from sugar cane. Within the last half year, Braskem, Solvay, and Dow Chemical all announced plans to produce ethylene from ethanol in Brazil to make renewable polyethylene and PVC. Ethylene from ethanol is identical to ethylene from naphtha or natural gas, and plastics made from bio-ethylene are indistinguishable from petro-derived resins.

Chemical plants in Brazil first made plastics from ethanol in the 1980s. The Brazilian government subsidized a half-dozen small ethylene plants, including some now belonging to Braskem, Solvay, and Dow. Together they produced 330 million lb/yr of ethylene from ethanol, which was made into PVC and PE. Braskem made bio-PVC from ethanol from 1981 to ’91. When oil prices fell, the subsidies and bioplastic production stopped.

Now Braskem plans to invest $150 million to build a 450-million-lb/yr bio-PE plant, expected to start up in 2009. Braskem plans to make around a dozen grades of LDPE, LLDPE, and HDPE from bio-ethylene. It’s now producing HDPE samples for film, injection, and blow molding. It will produce LLDPE samples in the second quarter.

Dow has a joint venture with Crystalsev in Brazil to build an ethanol-based ethylene plant for 770 million lb/yr of Dowlex bio-LLDPE, to start up in 2011. Solvay is investing $135 million to add 130 million lb/yr of ethanol-based ethylene by 2010 to an existing Brazilian plant in order to make bio-PVC.

Will consumers perceive an advantage in plastic sourced from sugar in Brazil just because it has a lower fossil-carbon “footprint”? Many of the new materials won’t be identifiable by the consumer the way some earlier degradable biopolymers were.

“Unfortunately many biomaterials are more expensive. If a renewable package sits side by side with an old-style package, and the customer doesn’t see an advantage, they typically won’t pay more for it,” says Michael Drozek, thermoforming division president of Clear Lam Packaging in Elk Grove Village, Ill., a large extruder of sheet from polylactic acid (PLA) biopolymer. “But if the message is properly communicated, consumers have shown they’re willing to pay more.”

Renewable Mandates

Governments and large end-users of plastics are rapidly formulating policies on renewability. The Japanese government set a “Biomass Nippon Strategy” back in 2002 with a goal that 20% of all plastics consumed in Japan would be renewably sourced by 2020. The Japanese Bioplastics Association says that 20% represents about 6.6 billion lb/yr of plastics.

Toyota set the same goal of having 20% of all plastic in its vehicles not come from oil by 2020, an estimated requirement for about 800 million lb/yr of renewable plastics, most of which don’t exist today. So Toyota has a development plan for using up to 200 million lb/yr of PLA to create interior trim parts, says one automotive resin supplier. Japanese electronics supplier NEC also wants 10% of its plastic to come from renewable sources by 2010.

This demand for renewable materials in durables is accelerating R&D to meet higher property requirements. That is resulting in hybrid resins that combine biomaterials with conventional resins. Cereplast’s Scheer notes high interest in the firm’s new 50% sustainable Biopropylene compound of polypropylene and starch. Cereplast is building a new plant in Seymour, Ind., to start by 2010 with capacity for 500 million lb/yr.

Laws also encourage degradability for short-lived products like thin-gauge shopping bags. As of Jan. 1, the Belgian government put a 300% tax on nondegradable bags, making degradable ones more economical. The Italian government mandated that by 2010 all two-handle bags in Italy must biodegrade.

The U.S. is the world’s largest ethanol producer—24.6 million m3/yr, based on corn—but it is heavily subsidized for fuel use, so little if any of that goes into plastics. Ethanol from corn raises other sustainability issues because corn requires large amounts of fertilizer, which is energy-intensive to make (it comes from natural gas). “It’s important to look at the whole environmental impact of what you’re doing. Ethanol from corn has a greater carbon footprint than ethanol from sugar,” says Helmuth Leitner, environmental manager for Solvay. He calls that “green-washing” the true carbon footprint.

Agricultural bio-carbon sources for fuel and chemicals compete with food for land use. China, a net importer of carbohyd-rates, is seeking to limit which crops can be used to make chemical intermediates in order not to compete with food production. A lot of government-funded university research in the U.S., Europe, China, and Japan is looking at enzymatic degradation of waste plant matter, or “biomass.” The idea is to extract lignin and mixed sugars from cellulose. But commercial enzymatic conversion of biomass is probably still years away. The recent U.S. energy bill sets a goal of making 21 billion gal/yr of ethanol from biomass, not corn, by 2022.

Using Mineral Carbon

Novomer’s room temperature, low-pressure polymerization of carbon monoxide and dioxide is unconventional but not biologically derived. Novomer intends to get its carbon from the relatively pure CO2 emitted as a byproduct from commercial cement production. “It’s all synthetic chemistry, which will allow us to scale up more rapidly,” predicts Novomer president Charles Hamilton. “We don’t have to figure out how to get bacteria to produce plastic.” The chemistry of CO and CO2 copolymers with epoxides like propylene oxide or ethylene oxide has been known for years.

Novomer is developing two materials: aliphatic polyethylene carbonate (PEC) and polyhydroxyalkanoate (PHA). PEC is a barrier resin potentially useful for packaging. It’s made of 50/50 CO2 and ethylene oxide. Novomer is already selling high-purity PEC toll-produced and shipped in solvent as a binder for capacitor production. Its PHA will be similar to bacterially produced PHA (from sources like the Telles joint venture of Metabolix and Archer Daniels Midland), but is based on mineral CO and epoxides. Novomer is considering building its pilot plant nearby a producer of sugar-based epoxide in order to make 100% sustainable resins.

Over the past 15 years, Procter & Gamble Co. in Cincinnati developed chemistry to overcome the brittleness of PHA, which it trademarked Nodax. P&G’s technology adds three or more carbon side chains to the PHA molecule, giving it more flexibility. Side branches suppress crystallinity, so film gets softer and less hazy. Melt temperature also drops to 266 F from 320 to 338 F.

P&G sold its PHA technology late last year to a new company, Meredian, set up by Danimer Scientific, which makes PLA compounds. Meredian plans to start with a 30-million-lb/yr pilot plant and be in commercial production by 2009. P&G had already evaluated the material in truckload quantities, using toll fermentation facilities. Kaneka Corp. in Japan licenses the Nodax technology to supplement its own patented PHA material technology.

‘White’ Biotech

A term being applied to new materials coming out of biotechnology and life sciences using fermentation is “white” biotech. Biotechnology, it seems, comes in colors. “White” biotech means biotechnology used to make industrial chemicals like ethanol and plastics. “Green” biotech is applied to plants, such as genetically modifying corn. “Red” biotechnology is applied to medical products that are absorbed into the body.

Bacterial fermentation used to make PHA and variants PHB and PHBV (polyhydroxybutyrate and polyhydroxybutyrate valerate copolymer) is being developed by at least a dozen companies around the world. It was originally developed by ICI, transferred to Zeneca, sold to Monsanto, and then to Metabolix. Zeneca actually commercialized PHBV shampoo bottles in Germany in the early 1990s, but they suffered from stress cracking.

Metabolix came up with genetically modified “designer” bacteria that are more efficient in making plastics. Its joint-venture plant in Clinton, Iowa, is expected to start up this year with capacity for 110 million lb/yr of PHA (see table of properties below).

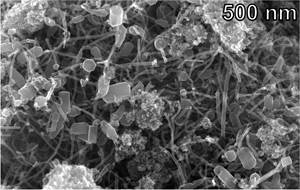

Many other producers use natural bacteria and unmodified feedstocks. The world’s first commercial producer of PHBV is Tianan Biologic Material Co. in Ningbo, China. It has a semi-works plant, which late last year doubled in capacity to 2 million lb/yr, and the company plans to start up a 20-million-lb plant in 2009. Tianan’s commercial PHBV contains about 5% valerate, though developmental grades have up to 15% valerate, and even higher valerate content is being tested. Valerate adds flexibility to the polymer.

Tianan’s PHBV sells for about $2/lb (FOB Ningbo for <50-ton quantities). It’s being evaluated for injection molding packages for personal-care and cosmetic products, and also for thermoforming and blown film. Some grades are being blended with BASF’s EcoFlex biodegradable (but not renewably derived) polyester to make flexible blown film, which is already used commercially for electronics packaging. The price should come down to around $1.80 lb when the larger plant starts up.

Meanwhile, researchers at the Technical University of Delft in the Netherlands report developing a process to make PHA using “a volatile fatty-acid-containing waste stream” as feedstock. “It uses an open, mixed microbial culture that does not require sterilization and a very specific substrate composition,” says Dr. Robbert Kleerebezem of TU Delft. Delft researchers report high yields of PHA, but haven’t yet made a detailed cost analysis.

There’s also a PHB resin made via fermentation by Biomer in Germany. It’s being used in injection molded medical products. The firm also makes PLA (see Learn More).

DuPont has several renewable polymers in development, including developmental PTT (polytrimethylene terephthalate) film and injection molding grades using its Sorona chemistry. Sorona PPT, introduced previously for fiber, has properties similar to PBT. It’s made with 20% to 37% bio-sourced PDO (1,3 propane diol), obtained through bacterial fermentation of corn sugar. DuPont says making bio-PDO takes 40% less energy than does petrochemically derived PDO. DuPont also can make Hytrel copolyester TPE with up to 60% polyols derived from bio-PDO. DuPont plans to introduce renewably sourced Hytrel RS grades this year for automotive uses.

Last year, DuPont opened a 100-million-lb plant for making bio-PDO from corn. For the long term, DuPont is exploring use of plentiful agricultural waste products like corn stover, which contains around 60% easily fermentable sugars. Use of stover would more than double bio-PDO production per acre cultivated. DuPont plans to create a pilot cellulosic “biorefinery” this year to make ethanol from corn stover.

Making A Better PLA

Another exciting new green chemistry will make the first commercially available lactide, the lactic-acid-based monomer for production of PLA. Purac in the Netherlands, the world’s largest supplier of lactic acid, has built a plant in Thailand to produce 220 million lb/yr of lactic acid from sugar or tapioca starch. The plant went into operation in November.

Purac has also built a pilot lactide plant in Spain and plans to build a full-scale plant in Thailand to start in 2009 and produce 150 to 200 million lb/yr. Purac says a number of companies that now buy PLA as feedstock for other compounds will make their own PLA once lactide is available. “Using lactide directly will allow these companies to fine-tune PLA and make more exotic copolymers, which opens up a whole new suite of properties,” says Ruud Reichert, market manager of Purac. This should rapidly increase the availability of PLA.

Synthesizing PLA from lactide is relatively simple and doesn’t generate any costly byproducts, Purac says. Making lactic acid and lactide efficiently was Cargill’s big breakthrough, which led to the formation of NatureWorks in 1998, and the building of the world’s first and still only large commercial PLA plant. NatureWorks expects to fill out the full 300-million-lb plant capacity by 2009.

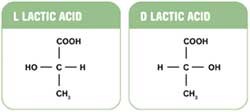

Lactide is a cyclic dimer composed of two units of lactic acid. Lactic acid is a molecule that comes in what organic chemists call “right-handed” and “left-handed” forms. Left-handed (L) lactic acid is the naturally occurring kind found in sour milk. Right-handed (D from the Latin dexter) lactic acid is less commonly available because no bacterium produces the pure “D” form. D-lactic acid is made on a small scale for specialty medical grades of PLA. Combining L-PLA with D-PLA creates a stereo complex with much higher heat resistance. D and L lactides can be used to make PLA block copolymers by stringing left- and right-handed monomers in specific sequences.

347-356Mirel PHA Grades from Metabolix/Tellesa PROPERTIES SPECIF. GRAV. MOLD SHRINK, IN./IN. WATER ABSORP., 24 HR, % TENS. STR. @ YIELD, PSI ULTIMATE ELONGATION, % FLEXURAL MODULUS, PSI FLEXURAL STRENGTH, PSI NOTCHED IZOD IMPACT,

FT-LB/IN.HDT, F @ 66 PSI @ 264 PSI VICAT, F DRYING (DESICCANT) MELT TEMPERATURE, F BARREL TEMP., F REAR MIDDLE FRONT MOLD/DIE TEMP., F aProperties measured after 21-day aging.

Purac announced commercial production of D lactide late last year and plans to produce it at its plant in Spain. Purac reports that PLA made with a 50/50 blend of homopolymers of L and D lactides (PLLA and PDLA) makes a semicrystalline resin with a melting point of 215 to 230 C. That’s 50° to 80° higher than unmodified PLA. The PDLA acts like a nucleating agent, causing faster crystallization and higher ultimate crystallinity, opening new applications for PLA.

Musashino Chemical Laboratory in Japan has announced plans for commercial production of D lactide in China. Musashino also has a biopolymer joint venture with Teijin, which developed Biofront, a heat-resistant stereo-complex PLA (50/50 L- and D-lactide blend) with 200 C to 230 C melt temperature. It is aimed at fibers, films, and molded parts. Teijin expects to produce several hundred tons by early next year. Teijin also recently bought 50% of NatureWorks from Cargill. NatureWorks has its own D lactide patents.

Total Petrochemicals and lactic-acid producer Galactic in Belgium (a unit of sugar producer Finasucre), also recently announced an R&D joint venture, called Futerro, to develop new and more economically competitive PLA production technology. The first step will be a pilot plant in Belgium for 3 million lb/yr of PLA, to come on stream by 2009. Galactic developed its own micro-organism to make D lactic acid and is now building a pilot plant for 2 million lb/yr of lactic acid, to start up in 2009. It will use D lactic acid to develop PLA resins for durable goods and performance fibers.

New Starch Developments

Though much of the renewable polymer activity is based on microbial fermentation, there is also a growing field of resins derived from plant oils, starches, and fatty acids. The K 2007 show saw an upsurge in activity from firms like BASF, Arkema, and Merquinsa in nylon 610 derived from castor oil, as well as new TPEs, TPUs, and copolyamides based on vegetable oils and acids. There are also a number of developments in polyurethanes and thermosets based on soybean and other vegetable oils.

Makers of compostable natural and grafted thermoplastic starches are also developing new products. Natural starch can’t be extruded because it degrades at around its melting temperature, so it’s typically blended with a polymer binder or chemically processed to make thermoplastic starch.

(Although it can’t be called a plastic, natural starch together with natural cellulosic fibers are made into compostable trays and cups by hot-pressing methods similar to molding paper pulp. Biosphere Industries LLC in Carpinteria, Calif., and New Ice Inc., Durango, Colo., are making such products to compete with cardboard and plastic foams.)

Two makers of starch-based thermoplastics are looking to make an impact in the U.S. market. Novamont is expanding its bio-refinery in Italy to 130 million lb/yr and is studying plans for a U.S. refinery, which would use a special nonfood crop as feedstock, says CEO Catia Bastioli. Novamont has patents pending on use of the crop to make a vegetable-oil monomer to use with thermoplastic starch.

Novamont also will commercialize this year “nano-starch” particles for use in new film grades of its Mater-Bi starch resin. Adding 25% to 40% nano-starch is said to allow making thinner, stronger, clearer starch films. Novamont will also soon launch Origo-Bi, a clear biodegradable polyester made from renewable nonfood crops. It is based partly on the Eastar Bio technology for biodegradable polyesters purchased from Eastman Chemical Co. in 2004.

Plantic in Australia announced last fall a joint venture with DuPont to develop new materials using Plantic’s high-amylose cornstarch materials for cosmetic and food packaging. And in November, Plantic announced an agreement with Bemis Co., Inc., Neenah, Wis., to develop blown film for dry-goods packaging with very high renewable content based on Plantic’s starch resin. DuPont will distribute both Plantic’s starch polymer pellets and thermoformable sheet.

Another starch-based polymer is Bioplast from Biotec GmbH in Germany. Biotec has 24 million lb/yr of capacity and offers six commercial formulations for injection, rigid and flexible extrusion, and foaming.

Related Content

Research Suggests Path From Waste Plastics to High Value Composites

Flash joule heating could enable upcycling of waste plastic to carbon nanomaterials.

Read MoreRead Next

Polyurethanes: Bio-Based Materials Capture Attention

The hot topic at this year’s PUR conference was rigid and flexible foams with increased biobased content. There was also news in one-component cast elastomers, surfactants, and TPUs.

Read MoreHigher-Performing Biopolymers Seek New Market Opportunities

A new generation of biodegradable polymers is going beyond conventional applications like bags and disposable cutlery and packaging.

Read MoreExtruding Biopolymers: Packaging Reaps Cost Benefit of Going 'Green'

Plastics made from renewable carbon chains, not fossil carbon from oil or gas, are suddenly a solid commercial reality. The draw isn’t just “green” marketing, but the “green” of stable prices not linked to petrochemicals.

Read More

.png;maxWidth=300;quality=90)