Will Rise of Benzene Prices Impact Those of Nylons, ABS & PC as They Have PS?

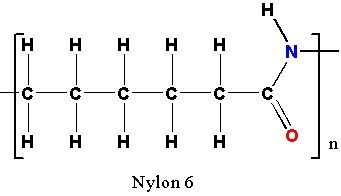

Rising benzene prices have already impacted prices of PS and nylon 6 appears to be next.

July benzene contract prices settled up by a whopping 80ȼ/gal to $3.05/gal, and polystyrene suppliers were quick to issue price hikes of 6-8ȼ/lb on PS resins, effective July 1. This was a reversal from June, when benzene contract prices dropped by 59ȼ/gal., and PS prices dropped by 5ȼ/lb.

This latest benzene price trajectory is due to snugger domestic supply which has resulted from a combination of improved downstream demand for benzene and a sharp drop in benzene imports. Mark Kallman, v.p. of client services for engineering resins, PS, and PVC at Resin Technology, Inc. (RTi), Fort Worth, Texas, ventures this supply tightness will last through August. He anticipates some relief from higher benzene prices with the potential return of imports.

In the meantime, it would not be surprising to see similar moves emerge on prices of some key commodity engineering resins, as was the case with nylon 6 earlier this week. BASF, DSM, and Honeywell have each issued price increases on their nylon 6 resins. Effective dates, respectively, are: July 15, July 24, July 20--or, as contracts allow, Nylon 6 suppliers had been out with a 5ȼ/lb increase for June, but that attempt lost its legs following the drop in June benzene contracts.

So far, there have been no official price nominations for nylon 66. Kallman had projected generally flat pricing to continue for nylon 66 from second quarter into the third; this before the July benzene contract increase.

Also, while the domestic nylon 66 supply/demand has been characterized as relatively balanced by Kallman, that balance includes nylon 66 materials imported to the North American market by BASF. As previously reported, BASF declared force majeure at its Seals Sands, UK facility on June 17. The company cited production problems and noted that it was not in a position to predict how long this would last. Affected products includes the company’s Ultramid A and Capron PA 66 resins and compounds.

Possible actions could be forthcoming from suppliers of ABS and PC. In the case of ABS, suppliers were out with a 4ȼ/lb increase, effective June 1, but that did not materialize due to the decline of the June benzene contract price.

In the case of PC, there were some price increase attempts during second quarter; this following a 2-8% decline through first quarter until benzene prices bottomed out. Those second quarter attempts ended up falling by the wayside. In June, Kallman explained it to me this way: the domestic market is a well-balanced one (including lower-priced imports due to a global PC overcapacity) with feedstock prices well below 2014. This, of course, did not include the reversal of benzene contract prices now taking place.

Want to find or compare materials data for different resins, grades, or suppliers? Check out Plastics Technology’s Plaspec Global materials database.

Related Content

-

Plastics Machinery Shipments Rose in 2022’s Final Quarter

The Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES) reported that injection molding and extrusion machinery shipments totaled $432.7 million in Q4.

-

IPEX Opens Injection Molding Facility in North Carolina

The pipe and fittings manufacturer’s new 200,000-square-foot facility represents a $200 million investment and will create 150 jobs.

-

Nexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.