Your Busines Outlook - November 2007

Large-Part Blow Molding: Stagnant in ’07, Moderate Rise in ’08

The predominant trend in U.S. production of large blow molded parts (not bottles) has been flat to downward in 2007, and this will not change much through the early part of 2008.

The predominant trend in U.S. production of large blow molded parts (not bottles) has been flat to downward in 2007, and this will not change much through the early part of 2008. However, as next year progresses, a combination of moderately declining resin prices and gradual growth in overall U.S. manufacturing will encourage demand for large blow molded products, especially in the second half. Overall growth for 2008 is expected to be 5% to 7%.

The pattern in the historical data for industrial blow molding output is similar to that of many injection molded and extruded products, but the blow molding data have been more volatile. During the second half of the 1990s, demand for large blow molded items increased rapidly. Production volume of these goods increased by an average of 6% to 8% per year, while the shipments’ value was rising by an average of nearly 15%/yr. But since 2001, the average annual growth rates for both the total volume and value of many types of large blow molded products have been flat or even down.

So far this decade, blow molders have been buffeted by three significant negative factors. The first was the cyclical downturn in demand that resulted from the recession in the U.S. economy in late 2000 and early 2001. The second blow was the emergence of countries like China as low-cost suppliers of many types of blow molded products. And though the last recession in the U.S. economy ended about six years ago, many sectors of domestic blow molding have yet to return to the levels seen during the ’90s. The toy industry is one of the largest and best-known examples of the demise of domestic blow molding. But there has also been significant consolidation in the auto parts sector, and much slower growth in demand for non-auto parts. The third factor that has weighed down blow molding production is the high price of resins in recent years.

Sectors to watch

A couple of segments of the blow molding business merit closer scrutiny, based on recent trends. The first is industrial drums. These products are made primarily of HDPE, and the sharp increase in the price of steel in recent years has made plastic drums an attractive substitute for many applications. As was the case for most other blow molded products, the output of plastic drums hit a cyclical peak in early 2000. Production fell sharply in 2001 and stayed down in 2002 and 2003. But this sector bucked the trend in 2004, when demand jumped sharply. After a small decline in 2005, output of industrial drums has grown by nearly 8% in both 2006 and so far in 2007. Growth is expected to decelerate to a still respectable 5% in 2008.

The second segment that bears notice is automotive fuel tanks. Unlike most other types of blow molded products, production of plastic gas tanks did not hit a cyclical peak in 2000. If anything, output levels accelerated during the recession and continued to grow rapidly through 2004. In the first four years of this decade, plastic fuel tank production grew at an average rate of more than 15% per year. The rate declined moderately in 2005 and 2006, but it has held steady so far in 2007.

As might be expected, demand for fuel tanks is affected by the overall cyclical trend in demand for cars and trucks. But progress in both chemical resistance and barrier properties of the plastic tank structures have been, and may continue to be, the more important factors in determining future production. The costs of substitute materials such as steel will also play a role. This sector may yet reinvent itself and rocket up rapidly. Even based only on the latest historical trends, 2008 will likely be a year of positive growth for blow molded gas tanks. Our current forecast calls for a gain of 5%.

Bill Wood, an independent economist specializing in the plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. He can be contacted by e-mail at BillWood@PlasticsEconomics.com. His monthly Injection Molding and Extrusion Business Indexes are available at www.ptonline.com.

Read Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

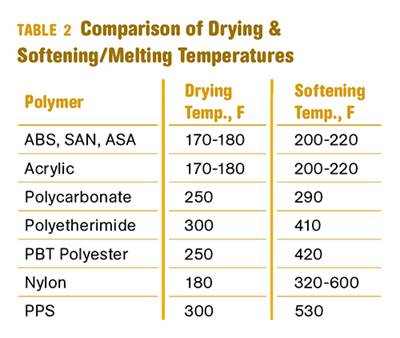

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

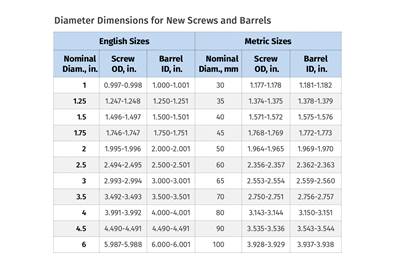

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.png;maxWidth=300;quality=90)