Your Business Outlook - March 2003

Trash Bags & Liners Grow at Rate of GDP

Growth will continue to be slow for industrial liners, consumer trash bags, and institutional trash bags.

Growth will continue to be slow for industrial liners, consumer trash bags, and institutional trash bags. These markets appear to be mature, although the products are an everyday necessity and consumption reached over 4 billion lb in 2001. This market represents approximately 24% of total PE film resin consumed, according to Mastio and Company’s latest PE Film Market Study. With an average annual growth rate similar to GDP (3.3%), consumption of trash bags and liners is expected to surpass 4.7 billion lb by 2006.

Consumer trash bags represented approximately 1.563 billion lb, or 39% of this market in 2001. It is both the biggest and the fastest-growing sector at 3.4% average annual growth. Next in both size and growth rate is institutional trash bags or can liners. They consumed around 1.408 billion lb, or 35% of the market, and are growing at 3.2%/yr. Industrial liners used about 1.034 billion lb (26% of the total) and are growing at 3%/yr.

Struggle against imports

U.S. producers of trash bags and liners face stiff competition from Asia. Imports have grown at a startling rate—tripling in the last five years, according to some manufacturers. Asian resin prices that are 15% to 20% lower than here, as well as plentiful, low-cost labor, put domestic producers at a disadvantage. However, the vast majority of trash bags and liners consumed here are still produced domestically.

The sluggish economy has also contributed to processors’ difficulties. Consumers haven’t stopped purchasing trash bags, but they may purchase lower-cost generic brands to save money. Consumers aren’t as willing to pay more for additional features like colors, scents, or special handles and draw strings.

Many institutional trash-bag extruders have suffered a year-long decline in demand for their products, and prices have slid. One industry executive describes the institutional trash-bag market as having hit bottom. Industrial liners are slowing in growth, and consumption may even have declined in some applications. Industrial liners are typically used for boxes, cans, bins, drums, totes, and truck beds. They are also used to protect electronics, carpets, mattresses, TVs, textiles, and other products. But some businesses have switched from industrial liners to shrink wrap and stretch film for these applications. Several film extrusion companies say they produce industrial liners on an as-needed basis in order to fill capacity while waiting for demand to recover in more profitable film products.

Although growth is expected to remain slow, one area of new potential is using trash bags to hold something other than garbage. For example, they can be used for laundry, sports equipment, and toys. Other possibilities are storing holiday decorations or lining the cat litter box.

During 2002, Minneapolis-based Tyco Plastics, a company of Tyco International, Ltd., was the largest trash-bag and liner producer, holding a market share of approximately 19%. Glad Manufacturing, part of Clorox Co., Oakland, Calif., was the second largest contributor with a market share around 8%. Other companies in the top five producers are Pactiv Corp., Lake Forest, Ill.; Bemis Co., Inc., Polyethylene Packaging Div., Minneapolis; and AEP Industries, Inc., S. Hackensack, N.J. Collectively, these five companies comprised a market share of about 45%.

Metallocene LLDPE gains

LLDPE represents 66% of PE consumption in this market. Metallocene LLDPE is growing in usage because of its high clarity and increased strength.

LDPE is also used due to its ease of processing, high clarity, and compatibility in blends or multilayer coextrusion. HMW-HDPE is a higher-performing resin for trash bags and liners. It makes consumer trash bags three times stronger and more durable than LLDPE or LDPE bags of the same thickness.

Mastio & Company, based in St. Joseph, Mo., is a well-known consulting firm specializing in industrial-consumer opinion research and market trends in the plastics industry. For more information, call (816) 364-6200 or visit www.mastio.com/pt/outlook.html.

Read Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

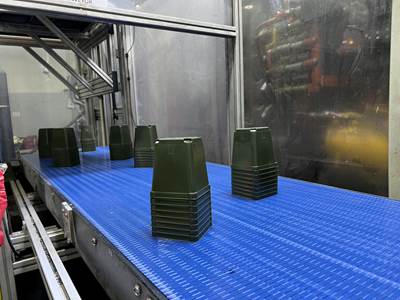

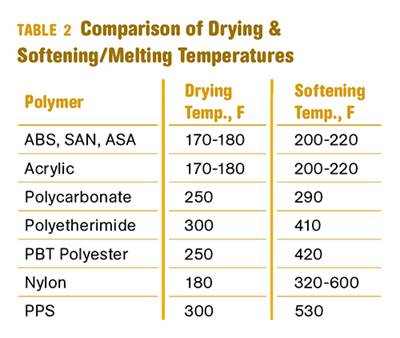

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More