Prices Hit Scarey Levels

The athletes in Beijing aren’t the only ones taking record leaps this summer.

The athletes in Beijing aren’t the only ones taking record leaps this summer. PVC producers asked for a startling 8¢/lb increase; PS prices ticked upward at two-week intervals; PP soared by double digits, as did several engineering resins; and LCPs scored a triple-digit climb. In nearly all cases, the cause was not supply or demand, but underlying costs of feedstocks, energy, transportation, and even packaging.

PE PRICES UP SHARPLY

Polyethylene prices moved up 5¢/lb in June, bringing to 11¢ the total increases implemented since January. Last month, suppliers were also intent on getting a 7¢ hike dated July 1 and they posted an 8¢ increase for Aug. 1. The London Metal Exchange (LME) North American short-term futures contract in blown film butene LLDPE also jumped from July’s 73¢ to 79.5¢/lb for August.

Contributing factors: The 7¢ July hike is likely to be implemented in full, as was the June increase, according to Mike Burns, global business director for PE at resin purchasing consultant Resin Technology, Inc. (RTI), Fort Worth, Texas. He notes that June contracts for ethylene monomer rose 5¢ to 70¢/lb. That adds up to 9¢ since January. But bids for July monomer contracts rose another 7¢ to 13¢/lb.

Domestic demand continues to be soft, and industry estimates predict a 2% to 6% decline for the first half of this year. Exports are still taking up much of the slack, but most industry experts look for exports to soften soon.

PP ROCKET UPWARD

Polypropylene prices moved up 6¢ to 7¢/lb in June, a partial implementation of that month’s 8¢ hike. For July 1, PP suppliers issued unprecedented price hikes totaling 17¢/lb, 2¢ of which is a surcharge for transportation and utility costs. LME’s August North American short-term futures contract for g-p injection-grade homopolymer soared to 91.2¢ from July’s 78.9¢/lb.

Contributing factors: PP resin tabs have closely tracked rising monomer costs. June propylene contracts moved up 6¢/lb and July contract bids ranged 8¢ to 15¢ higher. “Monomer inventories are low and the market is tight. This will continue until propylene prices are high enough to justify more monomer production,” ventures Scott Newell, director of client services at RTI.

Domestic demand for PP continues to be in a slump, with industry statistics showing a 5% drop through May. While PP export demand started the year above historical highs, it has dropped drastically in the last few months due to the cost of monomer, according to RTI’s Newell. PP plant utilization rates are said to be around 85% or perhaps lower. Suppliers have shuttered older capacity and throttled back production, thereby trimming inventories to 30 to 35 days, from the usual 38 to 40 days.

PET PRICES UP

PET prices moved up 8¢ to 10¢/lb by the end of June, reflecting partial implementation of price hikes for April, May, and June totaling 12¢/lb. Meanwhile, suppliers were aiming to implement a 7¢ increase for July 1.

Contributing factors: Feedstocks were up 13¢ between March and April alone, and energy and transportation costs for PET producers rose 1.5¢ to 3¢, according to one leading supplier. Price of paraxylene precursor, at 58.25¢/lb in March, was headed to 71.5¢ for June. Projections for July contracts were around 78¢/lb. Said one supplier, “We are trying to explain to our customers that these are unprecedented times and that this surge in feedstock, energy, and transportation costs is here for the long run.”

RECORD PVC HIKE POSTED

All PVC resin producers added 4¢ to previously announced 4¢ hikes for July 1, adding up to a record-high 8¢/lb price increase, at least half of which is expected to stick. Spot prices are already up 8¢. This follows a 4¢ increase in May and June.

Contributing factors: Ethylene monomer contract prices for June still had not settled in mid-July, but producers said there would be an increase of 5¢ to 15¢/lb. PVC demand through May was down 12.7%; pipe resin dropped 20.7%; and consumption in windows was off 6.5%.

TWICE-A-MONTH PS HIKES

The three big PS producers, Total, Ineos, and Americas Styrenics, announced staggered price increases of 12¢ to 14¢/lb for crystal and HIPS between mid-June and Aug. 1. Although their schedules varied, all three suppliers ended up raising prices at two-week intervals. What’s more, the spread between crystal widened to an unaccustomed gap of 4¢/lb.

Contributing factors: PS demand is fairly good, especially in packaging. But HIPS supply will stay very tight for at least the next two months because the rubber ingredient is on allocation.

OTHER RESIN INCREASES

BASF’s Styrolux and Styroclear SBC resins went up 6¢/lb on July 7 after rising a similar amount in June.

Bayer MaterialScience lifted tabs on PC and PC/ABS grades by around 10¢ to 15¢/lb in mid-June.

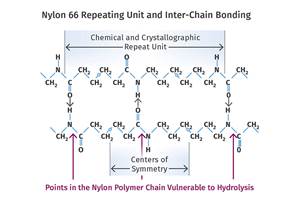

DSM raised injection molding and specialty grades of nylon 6 and 66 by 20¢/lb last month, while extrusion grades rose only 12¢.

Lubrizol hiked Estane and other aromatic TPUs by 21¢/lb July 15, but Tecoflex aliphatics went up 15¢.

Ticona’s Vectra A LCPs cost $1.60/lb more on Aug. 1. All other Vectra grades rose $1.15/lb.

Unsaturated polyesters, vinyl esters, and gel coats from Reichhold, CCP, and AOC cost 8¢/lb more this month. AOC added 2¢ and CCP 4¢ more to drum shipments because of the rising cost of steel.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

What is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

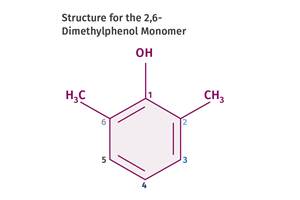

Read MoreTracing the History of Polymeric Materials: Polyphenylene Oxide

Behind the scenes of the discovery of PPO.

Read MoreTracing the History of Polymeric Materials: Acetal

The road from discovery in the lab to commercial viability can be long, and this was certainly the case for acetal polymers.

Read MoreResins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=300;quality=90)