Moving On Up

Prices of polyolefins were moving up last month and more increases were on the way.

Prices of polyolefins were moving up last month and more increases were on the way. Rising feedstock costs and a generally robust export market are the underlying causes. PET prices also headed upward, as did styrenics, PVC, nylon, PC, thermoset polyesters, and urethane isocyanates.

PE prices on the upswing

Polyethylene prices rose last month as suppliers pushed through increases of 4¢/lb for LDPE, HDPE, and butene LLDPE, and 7¢/lb for hexene and octene LLDPE. Meanwhile, a new 5¢ across-the-board hike was brewing for June 1. The London Metal Exchange (LME) short-term futures contract for June in blown film butene LLDPE sold at 54¢/lb, up from May’s 53.1¢.

Contributing factors: Strong exports, higher monomer prices, and tighter supplier inventories are fueling the increases. Ethylene contract prices were expected to settle at 42.5¢/lb for April—2¢/lb over March contracts, which rose 1.5¢. Domestic PE demand rose modestly from March to May, following a slump in January and February, which left total sales up 2% for the year so far. But exports to Europe, Latin America, and especially Asia were very strong. Exports to Asia are up an estimated 20% since October. The U.S. is the lowest-cost PE producer, with resin prices nearly 10¢/lb lower than in China, for example. The 4¢/7¢ increases would significantly close that gap, notes Mike Burns, managing partner at resin-purchasing consultant Resin Technology, Inc. (RTI) in Fort Worth, Texas.

PP prices rising

Polypropylene prices moved up 4¢/lb between April and May. That fell between the original 3¢ and the revised 5¢ hike that suppliers were asking for. Meanwhile, LME’s June futures contract for g-p injection-grade homopolymer sold at 58.1¢/lb, just below May’s 58.4¢.

Contributing factors: Suppliers point to increases in feedstock, transportation, and other energy-related costs. PP prices have closely tracked monomer prices, for which April and May contracts each rose 4¢/lb. “Monomer prices are at all-time high—53.5¢/lb in May,” says RTI managing partner Scott Newell, who attributes this to planned and unplanned refinery shutdowns in the last few months.

Although domestic PP demand was up only about 1% through April, strong export demand has left the market in balance. Supplier inventories are 10 days below normal.

PET prices up

PET prices generally rose 2¢/lb in May, reflecting partial implementation of a 3¢ announced increase. Suppliers followed that up with a new 4¢/lb hike for June 1.

Contributing factors: Suppliers say they need to recover several months of increased feedstock costs. They also note strong demand in North and South America. Says one major producer, “This is one of the busiest seasons, and resin plants are running at over 90% utilization.” This source also says the anticipated oversupply from new capacity is not likely to materialize until July or August.

PVC’s rise continues

Some resin producers and processors say the 3¢ hike set for April was trimmed back to 2¢—the size of Westlake’s hike. A further 2¢ increase was slated for May, and OxyChem and Georgia Gulf announced another 2¢ for June. Pipe demand was still good in mid-May, but weaker than before. Other construction markets were weak.

Polystyrene up 5¢

PS producers say they got a 5¢ hike in May without protest. Producers’ costs rose 6.4¢/lb in May on higher ethylene and benzene prices. Contract benzene went from $3.64/gal to $4.20. In a move to reduce PS overcapacity, Dow is expected to convert a 300- to 400-million-lb PS plant in Midland, Mich., to ABS production later this year.

Other thermoplastics

- Nylon 6: BASF, DSM, and Nycoa hiked nylon 6 resins 8¢/lb between May 1 and June 1.

- Polycarbonate: Dow lifted PC and PC/ABS tabs 12¢/lb June 1.

- Styrenics: Dow hiked ABS, SAN, and ABS 8¢/lb June 1. Lanxess Corp. raised Lustran ABS and SAN, Triax ABS/nylon, and Centrex ASA, AES, and ASA/PC 8¢/lb May 15. BASF hiked Styrolux and Styroclear SBC 4¢/lb May 1.

Thermosets & PUR:

Unsaturated polyesters, vinyl esters, and gel coats rose 5¢/lb at all major suppliers between May 25 and June 1. Dow, BASF, and Huntsman hiked MDI 5¢/lb and TDI 10¢/lb on June 1.

| Market Prices Effective Mid-May A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

The Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

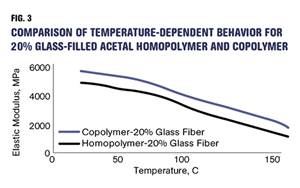

Read MoreHow Do You Like Your Acetal: Homopolymer or Copolymer?

Acetal materials have been a commercial option for more than 50 years.

Read MoreTracing the History of Polymeric Materials: Acetal

The road from discovery in the lab to commercial viability can be long, and this was certainly the case for acetal polymers.

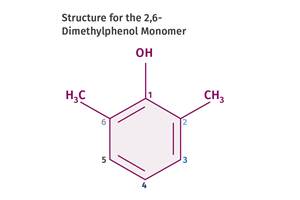

Read MoreTracing the History of Polymeric Materials: Polyphenylene Oxide

Behind the scenes of the discovery of PPO.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)