Articles

Sensing Instrumentation for More Sustainable and Automated Polymer Processing

NPE2024: Dynisco solutions support move to nontoxic materials and adds feedback control capability.

Read MoreKiefel Showcasing New Equipment and Sustainable Solutions

NPE2024: Kiefel is demonstrating its Speedformer KMD 90.1 Premium machine and cutting-edge technology for efficient polymer cups and fiber sip-lid production.

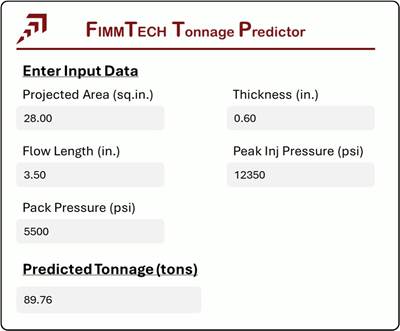

Read MoreThe Fundamentals of Artificial Intelligence and Machine Learning and Their Application to Injection Molding

As AI and ML continue to develop, they can eventually play a role in helping molders predict more accurately and, perhaps someday, model very close to the actual process results.

Read MoreBest of Fattori, Tooling Know How

In this collection of articles Jim Fattori offers his insights on a variety of molding-related topics that are bound to make your days on the production floor go a little bit better.

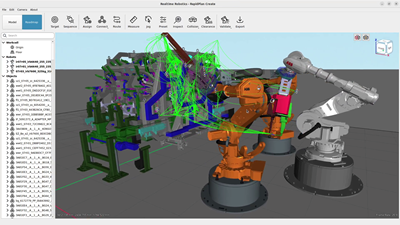

Read MoreDigital Twin Creates New, Virtual Paths for Robots with Real-World Cycle-Time Impacts

Realtime Robotics seeks to get more robots involved in manufacturing by addressing the biggest current barrier: programming costs.

Read MoreAddressing Supply Chain Leakage in Plastics

NPE2024: Ultratech offers spill containment solutions customized for handling plastic pellets.

Read MoreHow to Configure Your Twin-Screw Extruder for Mixing: Part 5

Understand the differences between distributive and dispersive mixing, and how you can promote one or the other in your screw design.

Read MoreIn the Zone: Materials Science Part 2

Explore the Materials Science Zone at NPE2024 and discover the chemistry behind the materials that best meet your needs.

Read MoreBASF Highlighting How They 'Make, Use and Recycle Future Solutions'

NPE 2024: On May 8, company chairman and CEO Michael Heinz gives keynote session, “Our Plastics Journey: The Road to a Sustainable Future.”

Read MoreThe Role Barrel Temperatures Play in Melting

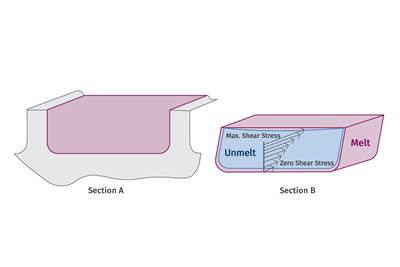

You need to understand the basics of how plastic melts in an extruder to properly set your process and troubleshoot any issues. Hint: it’s not about the barrel temperature settings.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreShaping Talent in Plastics: The Legacy of Professor Nick R. Schott

Delve into the career of Dr. Nick R. Schott, a figure in plastics technology, whose pursuit of excellence and commitment to innovation have left a legacy.

Read More