Articles

Innovator in Polymer Science and Education: Dr. Joseph A. Biesenberger

Dr. Joseph A. Biesenberger, a pioneer in polymer science and education, was inducted into the Plastics Hall of Fame in 2024. From founding the Polymer Processing Institute to seminal works in reactive polymer processing, his impact continues to shape the plastics industry.

Read MoreDr. Walter Kaminsky: Pioneer of Catalysts Revolutionizing Polymer Production and Recycling

Dr. Walter Kaminsky’s pioneering research on metallocene catalysts at the University of Hamburg sparked a global revolution in plastics production. Inducted into the Plastics Hall of Fame in 2024, Kaminsky’s legacy continues to shape the polyolefin industry and plastic recycling technologies.

Read MoreGeorge Victor Sammet Sr.: Pioneer of the Plastics Industry

The remarkable journey of George Victor Sammet Sr., a leader in the early days of the plastics industry, includes groundbreaking inventions and the establishment of key industry organizations such as the Society of the Plastics Industry (SPI).

Read MoreH. Joseph Gerber: Pioneer of Plastics Innovation for Various Industries

The remarkable legacy of H. Joseph Gerber in plastics revolutionized multiple industries. Inducted into the Plastics Hall of Fame in 2024, Gerber's inventions — including computer-controlled fabric cutting and CAD/CAM systems — continue to shape manufacturing processes worldwide.

Read MoreInnovator and Architect of INSITE Technology: Kurt Swogger

The pioneering legacy of Kurt Swogger at Dow Chemical Co. revolutionized the plastics industry with INSITE Technology. Inducted into the Plastics Hall of Fame in 2024, Swogger’s innovations in high-performance polyolefins have shaped industries worldwide.

Read MoreJacques Edwin Brandenberger: From Patented Viscose to Cellophane Innovation

Get to know the story of Swiss chemist and textile engineer Jacques Edwin Brandenberger, whose invention of cellophane in 1908 revolutionized the packaging industry. He was inducted into the Plastics Hall of Fame in 2024.

Read MoreLuigi Bandera: Pioneer of Plastic Extrusion With Vision

Get to know the life and legacy of Luigi Bandera, the visionary behind Costruzioni Meccaniche Luigi Bandera, who revolutionized plastic extrusion technology and earned a place in the Plastics Hall of Fame in 2024.

Read MorePLASTICS Names McGwire Winner of 2024 William R. Carteaux Leadership Award

Member of PLASTICS for more than 40 years served on several committees and boards since 2005, including a stint as chairman.

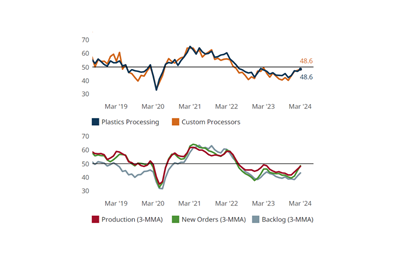

Read MoreProcessing Making Slow, Steady Progress

Plastics processing activity didn’t make its way into expansion territory in March, but seems headed in that direction.

Read MoreIn the Zone: Packaging Part 2

Check out the Packaging Zone at NPE2024 and explore the latest in both flexible and rigid packaging.

Read More8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE 2024.

Read MoreBASF Chair to Keynote on Firm's Sustainability Path

Chair, CEO Heinz to discuss materials giant's sustainability journey.

Read More

.png;maxWidth=300;quality=90)

.png;maxWidth=970;quality=90)