PCW Adds PS to its Weeklies Just as a Reverse Trajectory Emerges

Price hikes possible for PS; no relief for PVC or PP, while PE up in air.

Moving into the third week of August, PetroChemWire (PCW) added polystyrene (PS) to its weekly reports just as August contracts appeared to have rolled over and one supplier issued a 2¢/lb hike, effective Sept. 1. This driven by higher spot benzene and styrene monomer prices and relatively balanced supply, according to Senior Editor Dave Barry.

Meanwhile, the PCW weekly reports on PP and PVC indicate any price relief is unlikely in the near term, while PE prices may possibly roll over and not move up despite suppliers’ intentions. Here are key takeways from these weeklies and from the Aug. 18 market update of The Plastics Exchange.

PP: PCW’s Barry for one, does not see any price relief for PP from falling monomer prices in the near term as there’s industry talk of tighter monomer supply, along with indications that the month of August would show healthy domestic demand—amid relatively snug supply. PP spot prices were flat-to-higher. Plastics Exchange CEO Michael Greenberg noted that spot PP prices moved up 1¢/lb as spot monomer prices continued to firm up to a level that he noted supports a 2¢/lb cost-push price increase. As previously reported, PP suppliers have called for a 3¢/lb price increase for August, in addition to any change in the August monomer contract price, yet to be settled.

When some resin buyers look at industry numbers showing an increase in PVC demand this year, they can’t figure out where the resin is going.

PVC: PCW’s senior editor Donna Todd did not see much potential for any PVC price relief next month, just as the 1¢/lb decrease that was hoped for by converters in July/August did not materialize following consecutive ethylene price decreases. Now, spot ethylene prices are climbing and the outage at Formosa’s VCM plant at Point Comfort, Texas appears to be playing a bigger role—industry talk has it that the plant will not be back on line until the end of September, and not fully up and running till sometime in October.

Todd described the PVC market as being “deep in the dog days of summer.” She noted that pipe converters characterized orders and shipments as good one day and bad the next. Some reported a slower month than July while others characterized demand as subdued throughout the summer. Overall, PVC buyers appear to be less optimistic that things will pick up in the fall, as they had expected better demand by now. “When some resin buyers look at industry numbers showing an increase in PVC demand this year, they can’t figure out where the resin is going,” Todd noted.

The big “if” is how quickly will full output be achieved by the new production units slated for startup next month.

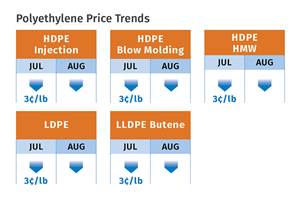

PE: Suppliers continued to be intent on implementing a 3¢/lb increase this month for PE, though supply/demand fundamentals do not support an increase, according to both PCW’s Barry and Plastics Exchange’s Greenberg. Barry reported no new support for the 4¢/lb increase, effective Sept. 1 announced by two suppliers. Both described the PE spot market demand as lackluster amidst flat-to-higher price offers.

The big “if” is how quickly will full output be achieved by the new production units slated for startup next month. Noted Barry,“There was talk that the new capacity might not have much effect on the prime market until late October or November.” Similar reporting came from Greenberg, “Although over-reaching supply/demand dynamics do not necessarily support a price increase, there are also whispers indicating possible delays in the aforementioned new production, and stranger things have happened. We are generally a little early on market timing and we remain neutral at best, with thoughts of some softness ahead.”

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

.png;maxWidth=300;quality=90)