The World Cup…of plastics

Echoing the continent’s thus far lackluster performance in the World Cup, Europe’s plastics machinery manufacturers are slogging through 2014, and while China’s not playing in the quadrennial tournament, key plastics players Germany, Italy, the U.S., Japan, England, Russia and Brazil are, with performances on the pitch mixed against their respective plastics sectors.

Germany's plastics and rubber machinery manufacturers have revised their expectations for 2014 downward, technically cutting them in half from 6 to 3 percent growth. That said, the sector, which remains the world’s largest still expects business to top Euro 7 billion, breaking that barrier for the first time ever. Further growth is anticipated in 2015, with sales forecast to rise 4 percent to just below Euro 7.3 billion.

Germany’s Plastics and Rubber Machinery Association (VDMA) announced the revision in mid June, noting that the sector is coming off record growth and exports in 2013. Russia, and its political difficulties, remain a drag, with performance hard to predict for what had been the third largest sales market for VDMA members, trailing only China and the U.S. (more on their equipment sector performances here and here). Those countries remain a bright spot, and an important one, with business in Brazil, Turkey, India, as well as Russia described as “markedly negative” by VDMA.

Germany’s exports of plastics and rubber machinery posted a small gain in their share of global exports. According to the data, almost 25 percent of all machines exported (24.5) were manufactured in Germany. China ranks second at 12.3 percent, followed by Japan (9.9 percent) and Italy (9.1 percent).

Italy’s plastics machinery and molds association, Assocomaplast, captured the sector’s struggles in its March summary of 2013, entitled “The Sector Is Holding, In Spite of Everything”. In 2013, production, exports, imports, and the domestic market were all down. There was, however, a slight positive trade balance, as overall production slipped from Euro 4 billion to Euro 3.9 billion.

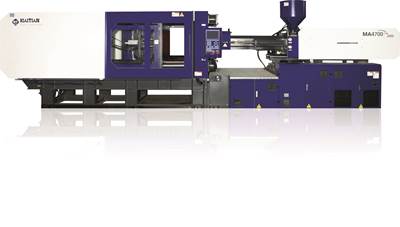

Overall, imports fell 5.6% from Euro 625 million to Euro 590 million, while domestic demand fell 5.4% from Euro 2.050 billion to Euro 1.940 billion. Exports were fueled by injection molding machine demand, where sales jumped 32% to more than Euro 126 million, while exports of extrusion and blow molding machines shrank. Tooling, which accounts for the largest portion of exports with a 25% share, held steady.

The top five export markets remained unchanged from 2012, led by Germany (Euro 365 million), France (Euro 145 million), U.S. (Euro 143 million), Poland (Euro 125 million), and China (Euro 121 million).

In an survey, one third of Assocomaplast members expected business to increase in 2014, while 46% anticipated “stability”. At least in January, order levels were “virtually identical” to month- and year-prior levels.

The British Plastics Federation (BPF) also surveyed its member companies regarding expectations for 2014. The respondents, comprised 66 percent by processors, were largely optimistic. Nearly three quarters (73 percent) anticipated an increase in U.K. sales in 2014, up from 67 percent in June 2013, and 55 percent at the start of last year.

Of the respondents, 21 percent thought 2014 would be flat compared to 2013, with only 6 percent forecasting a decrease. Nearly half (49 percent) believed profitability would be up in 2014, with the greatest optimism coming from injection molders, rotational molders, recyclers, and masterbatch and machinery suppliers.

Machinery markets were mixed for Japan in 2013, according to the Association of Japan Plastics Machinery (JPM). Production of injection molding machines fell to a three-year low in 2013, dropping 6.5% to 10,765. Extruders rose 9% to 464 units, while blow molding machines had their best result in more than 8 years, rising 8.2% to 645 units.

Germany’s VDMA called out Brazil as an area of lackluster growth, but for what it’s worth, the host of the 2014 World Cup was bullish on plastics in 2014. Jose Ricardo Roriz Coelho, president of the country’s plastics association, ABIPLAST, forecast growth in plastics production (+8 percent), jobs (+2 percent), and consumption (+9 percent), with imports, exports, and the trade deficit in transformed plastics all expected to expand.

Read Next

Chinese plastics machinery industry makes gains

What happens when China’s 1.3 billion people offer more to the global economy via their consumption as customers than their production as low-cost laborers?

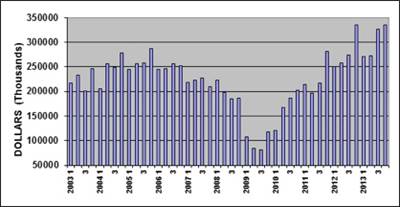

Read More2013 was good for N.A. equipment suppliers; Can 2014 Overcome a Slow Start?

The North American plastics equipment market saved its best for last in 2013, delivering shipments valued at $335.1 million in the fourth quarter—the best three-month stretch of the year and up 3% from the previous quarter. Will that momentum hold in 2014, however?

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More