Construction Market Boomed in 2015

End-Market Analysys

Next year is shaping up strong, too, though growth could peak around summertime.

In June, housing permits were seeing month-over-month growth, and the annual rate of growth looked like it was going to bottom out and start accelerating. Total construction spending was growing at the fastest rate since May 2012 and the second-fastest rate since February 2002. And non-residential construction spending was growing at a faster rate than residential spending.

Since then, housing permits grew at an accelerating rate. The annual rate of growth increased to 10.4% in August 2015 from 4.7% (since revised) for March 2015. In June, housing permits increased 40.1% compared with one year ago. Other than in June, the month-over-month rate of change has been much more modest. The annual rate of growth appears to have peaked in August, as it slowed to 9.7% in September. Based on the trend in interest rates (see chart), it is likely that housing permits have seen their peak rate of growth and will grow more slowly in 2016.

While housing permits seem to have peaked, total construction spending is on an absolute tear. In February and March 2015, the one-month rate of change in total construction spending was more than 12%. But, from April to August, the one-month rate of change has been above 20% each month. In August, the month-over-month rate of change was 22.5%. This was the fastest rate of growth in the history of this data set. In fact, the period from April to August is the only time ever when the one-month rate of change has been above 20%.

Residential construction spending is growing at an extremely rapid pace too. In fact, it grew even faster than total construction spending from May to August.

The annual rates of growth for both total and residential construction spending should accelerate in the first half of 2016. But at some point next year, the annual rate of growth in construction spending will peak. That’s because interest rates are already moving in a negative direction for future construction spending.

The real 10-yr Treasury Bond rate was 1.86% in September 2015—15 basis points higher than it was in August. This was the highest the real 10-yr Treasury rate has been since February 2011. Moreover, this was the fifth month in a row that the year-over-year change in the real rate was positive and the eight month in a row that it has increased from the previous month.

The nominal rate is still only about a third of its historical average. However, inflation is historically low. The current annual average inflation dipped back into negative territory (-0.04%) in September. That’s the fifth time in eight months the annual inflation rate has been negative. Therefore, the real rate is about two-thirds of its historical average. Low inflation is keeping real rates relatively high relative to the trend in nominal rates (remember, the real rate is the nominal rate minus inflation).

For processors serving this market, expect business to grow faster through much of 2016. But the leading indicators for the construction market are pointing toward a peak around the summer of 2016.

ABOUT THE AUTHOR: STEVE KLINE JR.

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800 email: skline2@gardnerweb.com; blog: gardnerweb.com/economics/blog

Related Content

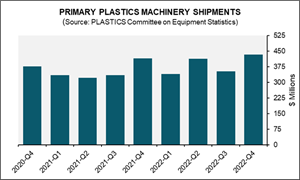

Plastics Machinery Shipments Rose in 2022’s Final Quarter

The Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES) reported that injection molding and extrusion machinery shipments totaled $432.7 million in Q4.

Read MorePackaging Waste Will Become Composite Decking

New partnership will incorporate process waste into wood-alternative decking.

Read MoreIneos Nitriles Launches Biobased Acrylonitrile

The company’s Invireo is said to deliver a 90% lower carbon footprint compared to conventionally produced acrylonitrile.

Read MoreChemical Recycling Process for Crosslinked PE

Borealis announces capability to produce recycled PE for use in wire & cable, infrastructure industries.

Read MoreRead Next

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.JPG;width=70;height=70;mode=crop)