Biodegradable Polyesters: Packaging Goes Green

The U.S. is catching up with Europe and Asia in exploring the potential of biodegradable polyesters in flexible and rigid packaging. Because of their cost, these resins often find use in blends with other degradable materials.

In the past five years, a broad range of synthetic biodegradable resins based on aliphatic polyesters and aliphatic-aromatic copolyesters have been commercialized by global suppliers. Demand for biodegradable polyesters is said to be growing by about 30%/yr, though from a relatively small base, and North America is belatedly catching up with other regions in finding packaging applications for these materials.

Synthetic biodegradable polyesters are made in modified PET polymerization facilities from petrochemical feedstocks. Unlike other petrochemical-based polymers that take centuries to degrade after disposal, these polyesters break down rapidly to CO2 and water in appropriate conditions where they are exposed to the combined attack of water and microbes. These products meet U.S., European, and Japanese composting standards, typically breaking down in 12 weeks under aerobic conditions.

Synthetic biodegradable polyesters fall into two broad categories. One is highly amorphous, imparting flexibility and clarity comparable to a conventional LDPE copolymer. A second group of semicrystalline polyesters is more rigid, with properties similar to PET, PP, or PS.

There are also biodegradable polymers that fall loosely within the definition of polyesters. However, these resins—Cargill Dow’s polylactic acid (see PT, March ’02, p. 50) and Novamont’s thermoplastic starch-based polymer—are true biopolymers obtained from renewable (plant-derived) resources.

Cost is a stumbling block for synthetic biodegradable polyesters, whose densities are in the range of 1.22 to 1.35 g/cc and prices run $1.50 to $2.00/lb. That puts them at a disadvantage relative to paper, LDPE, PP, PS, and PET. Initially, suppliers hoped that degradable polyesters would gain value from the rise of composting, avoidance of disposal taxes, and the marketability of “green” packaging. The benefit of low-cost disposal has paid off in some film markets. But in North America, the infrastructure for sorting and composting organic waste is developing far more slowly than had been anticipated, and the value of being “green” is often trumped by higher cost.

Julian Jensen, Eastman Chemical’s business market manager, says the emphasis is now on using biodegradable polyesters as specialty materials for paper coating, fibers, and garbage bags. They are also showing up in thermoformed packaging as functional adjuncts to lower-cost biodegradable materials (e.g., as moisture-barrier films). Biodegradable polyesters also generally work well in blends with PLA, starch, organic wastes, and natural-fiber reinforcements like flax.

Who sells what

Eastman’s Eastar Bio and BASF’s Ecoflex are aromatic-aliphatic copolyesters based on butanediol, adipic acid, and terephthalic acid. Eastman’s version is highly linear in structure; BASF’s products contain long-chain branching.

Eastman supplies general-purpose and blown-film grades of Eastar Bio from a 33-million-lb/yr plant in Hartlepool, U.K. “We plan to stay ahead of fast-rising demand,” says Jensen, noting that an existing PET polymerization unit can be converted within a year and at low cost. Eastman’s 1.21-g/cc copolyesters have a melting point of 108 C (226 F) and offer good contact clarity, adhesion, and elongation (up to 800%). They have high moisture and grease resistance, and process much like LDPE. Eastar Bio is used in lawn-and-garden bags, agricultural films, netting, and paper coatings.

BASF’s Ecoflex copolyesters have just arrived in the U.S., reports Dirk Staerke, sales and marketing manager. They are made in an 18-million-lb/yr unit in Germany, and the company plans to retrofit a 70-million-lb PET facility at an undecided location in the next few years. Ecoflex reportedly processes easily and has a melting point (110-115 C, or 230-239 F) and other properties equal or close to those of LDPE. The F (film) version imparts high elongation and dart impact and yields clear films that weld and print easily, BASF says. Masterbatches can fine-tune the feel of Ecoflex films from soft to HDPE-like stiffness.

Ecoflex is said to have high toughness and good cling properties. That makes it possible for 10-micron cling films to replace vinyl in vegetable, fruit, and meat wraps. BASF claims its materials also make films with 50% lower MVTR than other biodegradables.

Japan’s Showa Highpolymer, part of the Showa Denko group, and Korea’s SK Chemicals both have small plants producing aliphatic (polybutylene succinate) and aliphatic-aromatic (polybutyrate adipate terephthalate) polyesters. Both firms also offer their resins here in the U.S. Showa’s Bionelle products are used in commodity bags, agricultural films, traffic cones, and industrial trays. Some Bionolle grades are modified with diisocyanate chain extenders to improve stiffness and thermal properties.

SK Chemicals’ Sky Green BDP products offer LDPE-like properties. They are used in films, disposable cutlery, food trays, hairbrush handles, and paper coatings. Aliphatic versions biodegrade more rapidly and offer better processing and tensile properties than the aromatic-aliphatic grades, which cost less.

In the semicrystalline category, Du Pont offers a modified PET incorporating three proprietary aliphatic monomers. Biomax 6962 has 1.35 g/cc density and 195 C (383 F) melting point—versus 250 C/482 F for PET—resulting in higher service-temperature capability and faster processing rates than for other biodegradables. Mechanical properties include high stiffness and 40% to 500% elongation. DuPont has targeted fast-food disposable packaging, as well as yard-waste bags, diaper backing, agricultural film, flower pots, and bottles.

Japan’s Mitsubishi Gas Chemical (MGC) offers a biodegradable version of polycarbonate termed “polyester carbonate” (PEC). It has a melting point of 110 C (230 F) and stiffness-toughness balance comparable to PP homopolymer. MGC’s PEC reportedly is used in a new portable tape-cassette player introduced by Sony Corp.

In 1995, Bayer AG introduced the “BAK” polyester amide family of biodegradable resins for film and molding. But last year Bayer quit the business, saying the regulatory climate provided “no sound economic justification” for continuing its costly effort.

Blending beckons

Partly because of their cost, biodegradable polyesters are finding much of their market in blends. Synthetic biodegradable polyesters tend to complement one another’s properties, as well as those of PLA, thermoplastic starch, and other organic materials.

Eastar Bio, for instance, is flexible and tough, with good contact clarity and adhesion properties. Its deficits are relatively low stiffness, poor melt strength, and a tendency to stick in injection molds. In contrast, Cargill Dow’s PLA tends to be brittle and has poor adhesion. Blends of the two are a logical way to increase the performance envelope of both materials, Eastman’s Jensen concludes. Officials at Cargill Dow agree.

Japan’s Dainippon Ink and Chemicals (DIC) has pursued the alternate approach of combining polyester and PLA properties into one polymer. DIC developed a biodegradable copolymer called CPLA based on a copolyester plus lactic acid. A higher ratio of copolyester increases flexibility, while more lactic acid adds stiffness. One version of CPLA is reported to combine PS-like clarity with PP-like physical properties.

Polycaprolactone aliphatic polyesters have long been available from firms like Union Carbide (now Dow Performance Chemicals), Solvay Interox, and DIC for use in adhesives, compatibilizers, modifiers, and films. These materials are miscible with numerous other polymers and are inherently biodegradable, though they have low melting points and high prices. Polycaprolactone is included in Novamont’s Mater-Bi Z, a film/sheet grade of thermoplastic starch. Caprolactone limits moisture sensitivity, boosts melt strength, and helps plasticize the starch.

Eastman is test marketing a binder fiber made of Eastar Bio for use with PLA, starch, natural fibers, and other biodegradable matrices. The low-melting, crimped staple fiber is said to forge mechanical and chemical bonds between blend components, optimizing their properties. Potential exists in medical products, disposable wipes, seed mats, and erosion-control uses.

Ramani Narayan, a chemistry professor at Michigan State University in East Lansing, says a search is on for films that combine the biodegradability of paper with the performance of PE. He recently founded Bioplastics Polymers & Composites to lead that effort in films for lawn-and-garden and shopping bags. His firm uses Eastman copolyesters as base materials but tailors their properties and rates of biodegradation through blending and reactive extrusion with thermoplastic starch, natural fibers, and polycaprolactones.

Cortec Corp., St. Paul, Minn., makes biodegradable compounds, films, and liners for protecting metals and other industrial goods. It recently launched the Eco Film family of compostable films containing Cortec’s proprietary Vapor-phase Corrosion Inhibitor (VpCI). The films are based on aliphatic-aromatic copolyesters.One Cortec product is an all-copolyester, multi-layer stretch film for protecting steel coils during shipment. It includes a strength layer, a VpCI-containing core layer, and a surface layer containing a biodegradable cling additive. The film offers cost savings by eliminating tariffs and disposal fees imposed on conventional non-degradable PE stretch film. Cortec has also developed biodegradable films for oversized bin liners used for animal feed and composting. The liners measure up to 21 x 19 x 54 in.

Thermoformed trays

Synthetic biodegradable polyesters also play a role in thermoformed trays for fresh produce and meat, as well as disposable plates, bowls, and cups. In these products, the polyester is a moisture-barrier film over a rigid substrate made of a low-cost natural composite supplied by Earthshell Corp., Santa Barbara, Calif., and Apack AG, Markt Erlbach, Germany. The Earthshell composite consists of cellulose from paper waste, starch from potato waste, ground limestone, and water. Apack dispenses with the limestone but adds a polymeric ingredient. Both composites are foamed and formed with special equipment in a process comparable to making waffles.

Thomas Koeblitz, managing director at Apack, says gaps in the performance of its composite are bridged by using Eastman copolyesters and PLA. Apack’s trays are being used for organic produce by two top U.K. supermarket chains as a replacement for EPS foam trays. A 2.5-mil-thick Eastar Bio film is laminated to the upper surface of the Apack tray. This breathable film provides moisture and grease resistance to protect the substrate from premature degradation, but lets in air to ensure biodegradation. The film also adds rigidity and printability.

For shipping, the trays are bundled in a 15-micron Eastar Bio cling film, which replaces 12-micron PVC film used with EPS trays. Apack trays are 300% more costly than EPS versions, but the concept of a “natural product in natural package” makes the switch worthwhile.

Apack meat trays have a base similar to that of the produce tray. It is mated to a clear, heat-sealable PLA lidstock. PLA has inherently poor oxygen barrier, but use of a proprietary post-extrusion step reportedly extends shelf life by 50% to 6-9 days. The package is being tested for poultry in the U.S.

An Apack subsidiary starting up in Canada is promoting use of its composite in hot- and cold-drink disposable cups to replace EPS. Apack Canada’s cups are foamed to 0.2 g/cc density, reportedly providing better insulation than paper cups. A copolyester coating prevents moisture penetration, permits quality printing, and provides enough insulation (in hot cups) to dispense with costly paper sleeves. The sprayed-on coating uses a blend of an Eastman copolyester and a second biodegradable resin to get a balanced viscosity.

Earthshell and DuPont have formed an alliance to serve the disposable food-service market, including plates, hinged clamshells, hot and cold cups, and more. DuPont is concentrating on a new flexible sandwich wrap for fast-food chains that will appear this month. Company spokesmen say that DuPont’s Biomax polyester is one of several ingredients in the Nature Partners sandwich wrap. The wrap provides moisture and grease resistance, paper-like feel, excellent deadfold, and good printability. It is made on standard cast-film equipment.

Bacterially grown polyesters

Biodegradable aliphatic copolyesters produced by bacterial fermentation will be launched in the next few years by two suppliers. Collectively termed polyhydroxyalkanoates or PHAs, these polymers are synthesized in the bodies of bacteria fed with glucose (e.g., from sugar cane) in a fermentation plant. A hundred PHA compositions have been reported, some made by genetically engineered bacterial strains.

The commercial candidates are Biopol PHBV, being developed by Metabolix, and Nodax PHBH, marketed by Procter & Gamble. The crystallinity of PHAs can be manipulated to provide a broad range of mechanical and barrier properties, in some cases matching the performance of engineered thermoplastics.

Metabolix’s PHBV (polyhydroxybutyrate valerate) was initially developed by ICI. PHBV and related copolymers are made in a pilot plant using different bacteria to create compositions with up to 70% crystallinity. Properties range from elastomeric to resins as stiff and tough as nylon 6 or polycarbonate. Elongation can be manipulated from 5% to 1000%, and melting points range between 135 and 185 C (275-365 F). In late 2002, Metabolix plans to introduce products suitable for hot-melt adhesives, coatings, and coextrusion tie layers. Molding and film grades will arrive in subsequent years.

Metabolix recently produced PHBV for the first time in a commercial-scale fermentation plant. Much idle fermentation capacity exists in the U.S. for making animal feed (e.g., lysine) and food additives like MSG. The supplier plans to tap this on a toll basis or through a joint venture to cut the current high costs. To further reduce PHBV cost, plans call for exploring direct or plant-grown PHBV, in which polymer is made in the leaves or roots of a plant. Switchgrass is being investigated because it grows well on marginal land. It holds out hope of driving PHBV cost down to around $1/lb.

Norma McDonald, associate director of business development and licensing at Procter & Gamble, says the branched nature of Nodax PBHB copolymers makes them distinctive. Carbon side chains of C6 to C24 length are appended to the C4 backbone, and comonomer content can range from 2% to 20%. Analogous to a conventional LDPE copolymer, PBHB’s long-chain branching allows a considerable range for tailoring crystallinity, melting point, stiffness, and toughness.

PBHB comes in short-chain (C6), medium-chain (C8-10), and long-chain (C12-22) species, but current emphasis is on the C4/C6 class. P&G recently licensed rights to make these polymers to Kuraray in Tokyo, Japan, which plans to bring a plant on line by 2005.

Nodax C4/C6 is said to be “a natural fit” for injection molding and extrusion of sheet or film. McDonald says the polymer has mechanical properties similar to a polyolefin and surface properties much like a PET—including high receptivity to printing inks and dyes. Adhesion to LDPE and PP is good enough to avoid tie layers in multi-layer structures. Remarkably, Nodax’s oxygen barrier approaches that of EVOH.

PBHB biodegrades both aerobically and anaerobically (e.g., underwater) and is alkaline digestible and water soluble. These characteristics open potential for lower-cost handling and disposal of troublesome wastes. McDonald cites examples of biohazard or medical-waste containers and devices, which could be put in a “trash digester” (an industrial alkaline washing machine) for disposal. What’s more, industrial stretch-wrap films used to protect automobiles during shipment might be removed and disposed of by hot washing and flushing steps instead of labor-intensive film handling. In recycling, it might be feasible to alkaline digest low-value elements of a bottle recycling stream (labels and caps) while keeping the bottles intact for reclaim.

P&G is investigating the manufacture of Nodax by plant-grown methods. That could reduce Nodax prices to 45¢ to $1/lb. Nodax C4/C6 also blends well with PLA.

Related Content

Resins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreHonda Now Exploring UBQ’s Biobased Material Made from Unsorted Household Waste

UBQ is aiming to expand its reach for more sustainable automotive parts as well as non-automotive applications.

Read MoreCling Wrap Made from Potato Waste

Australia’s Great Wrap to expand into U.S. with home compostable cling wrap and its refillable dispenser made from recycled PET bottles.

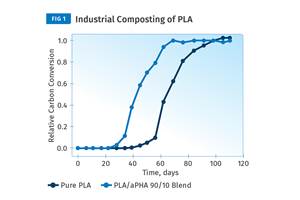

Read MoreBlend Amorphous PHA with PLA to Improve injection Molded Part Properties

Adding aPHA to PLA can boost a range of mechanical properties and expedite composting. Here are the details as well as processing guidelines for injection molding the blends.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=300;quality=90)