Commodity & Engineering Resin Prices Heading Lower

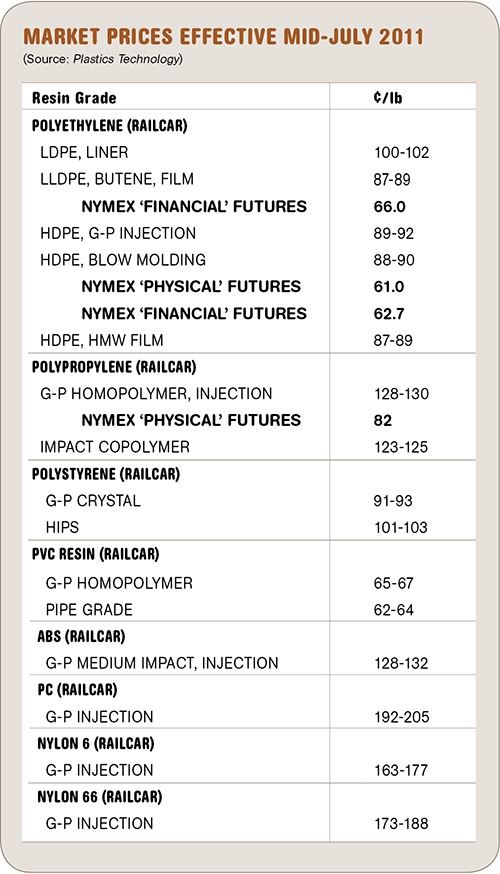

Entering the third quarter, prices of the four commodity thermoplastics are expected to be flat or lower. The outlook is similar for “commodity” engineering resins—ABS, PC, and nylon 6 and 66. Reasons include lower feedstock costs, slowed demand, improved supply, and low exports.

On entering the third quarter, prices of the four commodity thermoplastics are expected to be flat or lower by resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Tex. Their view is supported by lower feedstock costs, slowed demand, improved supply, and low exports. The outlook is similar for “commodity” engineering resins—ABS, PC, and nylon 6 and 66—and for similar reasons. Here’s more of RTi’s analysis.

PE PRICES FLAT TO LOWER

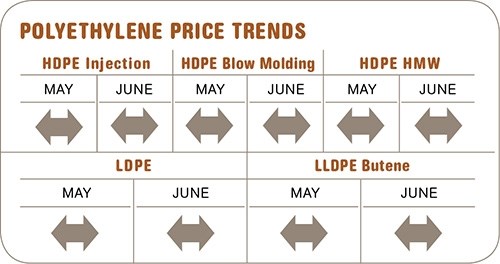

Polyethylene prices remained flat through May and into June. This was despite a 5¢ increase announced for May and 6¢ (LL/LDPE) or 8¢ (HDPE) pending for June. Prices appear to have peaked and are likely to fall as early as this month, barring any production disruptions.

With easing tightness of ethylene monomer supply, spot monomer prices were trading lower at around 65¢/lb last month. Supply loosened a bit as some some ethylene crackers came back on line. But there are still nine crackers with maintenance outages scheduled between now and November.

Meanwhile, PE resin inventories grew through May and into June, the result of a wait-and-see attitude among U.S. processors and lower prices and weak demand in Asia and Latin America, which diminished U.S. export opportunities (now down about 19% from last year). PE producer inventories rose across the board, even in HDPE, which had been on allocation at several suppliers.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. RTi expects June and July potentially to offer the best opportunities to pursue price concessions. Market demand tends to slow during the summer, and weak exports should help keep prices soft.

PP PRICES ON DOWNWARD TRACK

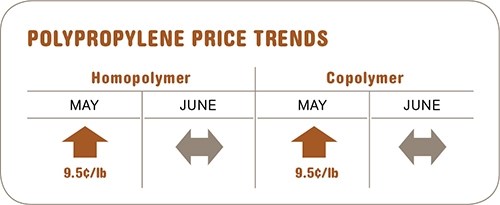

Polypropylene prices moved up 9.5¢/lb by the end of May in concert with the increase in propylene monomer cost. With prices in April and May at an all-time high, demand began to slow. Reports from all market segments indicate that sales fell off significantly, nearly approaching the February lows following January’s 17¢ price surge. By the end of May, spot resin prices in the secondary market had dropped by 8¢/lb. With monomer prices peaking and demand waning, PP prices were heavily discounted from contract prices. By the end of June, spot prices were expected to move back to normal ranges as suppliers began limiting production.

Due to dismal PP demand and high feedstock costs, several suppliers started planning to shut down operations for a limited time to avoid building expensive inventory. If demand were to come back strongly, certain grades would be on the tight side. The question is how much PP demand has been driven away permanently by all the price volatility this year.

Propylene monomer production finally began looking up in May, with improved operating rates and limited outages. The overall supply/demand balance has been improving steadily and June propylene contracts were expected to drop as much as 10-15¢/lb.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. The market has peaked and prices are coming down for the next couple of months. The next few months are projected to be good for propylene monomer supply. That doesn’t necessarily mean a full retreat from the 36¢ worth of increases so far this year, but it is possible. The third quarter will see a new round of planned cracker outages; this could be the time for the next market bottom and potential price run-up.

PS PRICES UP, BUT NOT FOR LONG

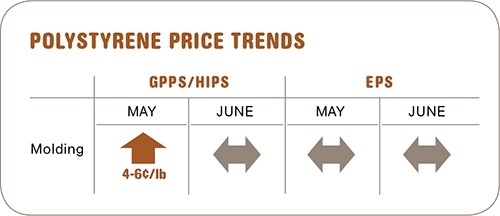

Polystyrene prices moved up in May as had been expected: 4¢/lb for GPPS and 6¢/lb for HIPS. After a soft first quarter, demand has improved for GPPS, HIPS, and EPS. April and May weather disruptions resulted in tight supply for all three resins. But better weather and lower feedstock prices should help reverse the upward price trend.

May styrene monomer contract prices rose to 74-75¢/lb, bringing the total monomer increases since January to 14-15¢/lb. May’s flooding on the Mississippi River tied up transport, which resulted in inventory build-up at resin suppliers. This led to some downward pressure when the river was reopened. June monomer contracts are expected to settle 3-4¢/lb lower. Both benzene and ethylene contract prices rose in May but were expected to fall back in June. Butadiene prices show no sign of easing, however. They average 87% higher than a year ago. The “butadiene effect” has helped raise tabs on standard HIPS by 11¢/lb this year. The delta between GPPS and HIPS is now greater than 10¢/lb.

Outlook & Suggested Action Strategies

30-60 Days: Weakening feedstock prices and growing inventories indicate lower prices through this month. But HIPS will continue to sell at a premium and reductions in prices will be hard to achieve until fourth quarter.

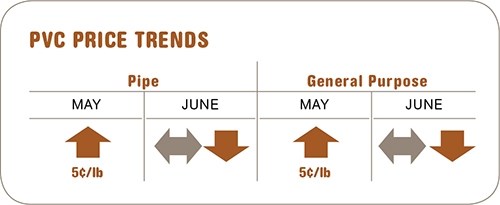

PVC PRICES UP & DOWN

PVC prices moved up in May by 5¢/lb but were on the way back down in June. At least one supplier was aiming for another 5¢ hike on June 1, but no such increase is likely to be realized anytime soon. RTi expected higher May prices to be offset by lower prices in June based on lower ethylene costs, improved supplies, and reduced exports.

Implementation of the May increase was bolstered by an ongoing PVC force majeure and two planned outages, along with short-term ethylene outages and concerns about Mississippi River barge traffic. Total demand fell by 8% as production problems and higher prices reduced exports by 15%.

Outlook & Suggested Action Strategies

30-60 Days: RTi expects a decline in PVC prices this month with opportunities for further reduction in August. Reliability of ethylene monomer production and the strength of the construction season are key factors to watch.

PC PRICES MODERATING

Polycarbonate prices moved up 22-25¢/lb from April to June. But the average trend is now flat to downward.

RTi notes that the earlier increases were out of line with suppliers’ feedstock costs, which were 3-4¢/lb lower in March-April and 6¢ lower in May. Average second-quarter polycarbonate production costs are only 3-4¢/lb higher than in the first quarter. Although PC feedstock (ethylene and benzene) costs rose a total of 18¢/lb from January through May, they are expected to drop at least 4¢ in June.

Meanwhile, the polycarbonate market has been tightly balanced, with strong demand and restricted supply from a force majeure in the late first quarter. However, the supply/demand balance has improved domestically as exports pulled back, as did domestic demand from Japanese auto transplants. By May, there were indications of offshore PC resin creeping into the North American market. Domestic polycarbonate suppliers have made modest concessions in price negotiations.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Projected lower benzene and propylene monomer prices and reduced demand were expected to stabilize polycarbonate prices. Previous hikes more than covered all feedstock cost increases so far this year and provided additional profit margin, RTi says. Expect the PC supply situation to continue improving as production gets restarted in Japan. Expect downward pressure on PC resin prices as the economic recovery slows.

ABS PRICES WEAKENING

ABS prices moved up again in May by 4-6¢/lb, bringing the total increases this year to 20¢/lb. Tight supplies prompted by strong demand, and higher costs of feedstocks, worked in suppliers’ favor through May. Their ABS profit margins jumped significantly in 2010 due to strong demand, and the 2011 price hikes have served to maintain those margins.

But prices were expected to peak by the end of May. While butadiene prices continue to skyrocket, acrylonitrile tabs peaked in May and were expected to fall.

Outlook & Suggested Action Strategies

30-60 Days: ABS prices should soften in this quarter in concert with decreases in feedstock costs and an easing of supply disruptions. Domestic ABS prices have reached a point that can adversely affect demand. ABS imports will also encourage lower pricing. The level of competition for your business is a key factor in establishing your best ABS price.

NYLON PRICES UP FOR NOW

Nylon 6 and 66 prices moved up another 5-10¢/lb in May. The historical delta between the two has disappeared, and in some cases nylon 6 prices are now higher than those of nylon 66—the reverse of the usual relationship. The run-up in prices since the start of the year amounts to 30-40¢/lb for both resins. Riding on high global demand, nylon suppliers are focused on maintaining their gain in margins since the recent recession ended.

A couple of nylon 66 suppliers made bids for June price increases of 10-15¢, while a 7¢ hike was announced for nylon 6. However, most nylon feedstock costs (except butadiene) are now receding. In the case of nylon 6, feedstock costs are down a net 4¢ since March. Slowed fiber and automotive demand in Asia is also a factor.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed. Downward pressure from lower propylene and benzene feedstock prices is countered by upward pressure from high-priced butadiene, making for different cost pressures at different suppliers, depending on their production method and feedstock position. Nylon producers see Japanese earthquake-related automotive demand interruptions as a relatively minor “bump in the road.” RTi expects the market to flatten for a while, barring any further production outages that would derail feedstock prices, or a return to higher oil prices, or stronger-than-expected demand growth.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreThe Importance of Melt & Mold Temperature

Molders should realize how significantly process conditions can influence the final properties of the part.

Read MoreLanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=300;quality=90)