Mid November Commodity Resin Prices Flat to Soft

Prices of the four major commodity thermoplastics are projected to be a bit lower or remain flat (especially in the case of PE) as the year comes to an end.

Prices of the four major commodity thermoplastics are projected to be a bit lower or remain flat (especially in the case of PE) as the year comes to an end. Slowed seasonal demand, relatively tight to balanced supplier inventories, and lower feedstock costs are key driving factors. That’s the view of resin purchasing consultants at Resin Technology, Inc. (RTi) Fort Worth, Texas, and Michael Greenberg of The Plastics Exchange, Chicago.

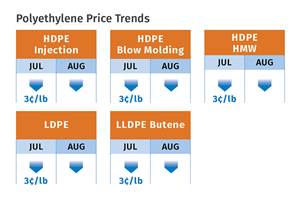

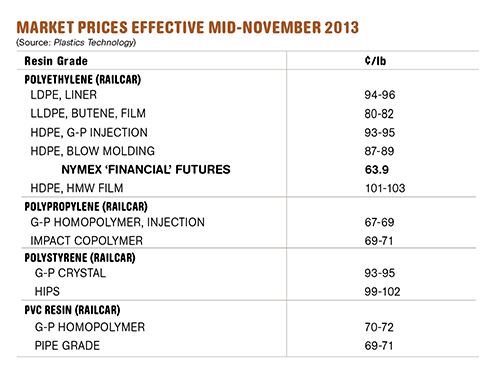

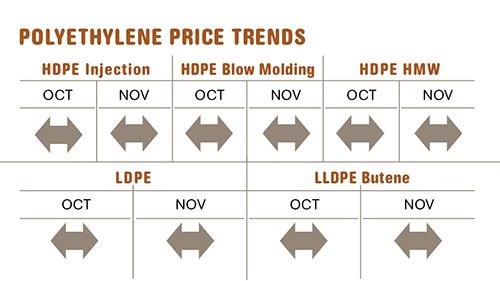

PE PRICES FLAT

Polyethylene prices were flat through October and into November. This was the first such period this year that no industrywide price hikes were on the table, according to Mike Burns, RTi’s v.p. for PE. In early November, The Plastics Exchange’s Greenberg speculated that a little relief was possible for November PE contracts, noting that “there is plenty of margin to be shared on both a spot and contract basis.” He noted that processors were seeking a price decrease and were drawing down their resin supplies for year-end inventory accounting. RTi’s Burns noted that resin availability, the driving factor behind PE resin price hikes this year, “appears to be improving,” with no product allocations over the last few months and the emergence of some export activity after a lengthy hiatus. “Off-grade resin prices have come down a bit, and there is more inventory and less panic about getting material,” he observed.

Still, Burns does not see PE contract resin prices dropping, noting that PE processors have been able to pass along this year’s resin price hikes to their end-use customers, and resin suppliers are quite cognizant of that. Processors will buy as needed through this month, regardless of any end-of-year price-increase announcements. Burns expects an increase to emerge in the first quarter of 2014.

PP PRICES FLAT OR LOWER

Polypropylene prices in November were likely to roll over or drop by 0.5 ¢ to 1¢/lb, depending on propylene monomer contract settlements. For this month, prices were projected to remain flat. Although there has been some scheduled downtime for propylene production facilities in the last couple of months, generally soft demand means that these temporary phenomena were not expected to result in higher monomer or polymer prices.

Having been tight for most of this year, PP supplies began to loosen up little by little as we entered the fourth quarter. Supplier inventories are reported to be building up, and plant operating rates dropped from the low-to-mid 90s to the mid-to-high 80s percentile by last month. After several months of premium prices, spot PP material dropped below prime resin cost. Says Scott Newell, RTI’s director of client services for PP, “Sellers initially held firm on price and there was no movement. As they started to lower prices a bit to generate some demand, there was little response until they lowered prices by 2-4¢/lb.” Greenberg reported spot prices dropping by up to 7¢/lb within the six weeks leading up to Nov. 1, a period in which there was a steady flow of well-priced off-grade material.

Demand for PP in the fourth quarter was expected to register an increase. Newell explains that this does not represent “real demand,” but indicates year-end railcar deals that producers offered to move product and which were snapped up by processors. “Historically, processors have seen price increases announced for the first part of a new year. But this is not necessarily going to be the case this time,” Newell notes.

PS PRICE ROLLBACK LIKELY

Polystyrene prices moved up 3¢/lb across the board in October, owing largely to planned and unplanned monomer and polymer production disruptions. By early November, however, a price drop of 2-3¢/lb looked very likely, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC. Prospects of price relief before year’s end are bolstered by a drop of 27¢/gal in November benzene contract prices, along with the possibility of a 1¢/lb drop in ethylene prices for October contracts.

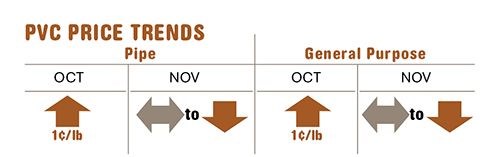

PVC PRICES FLAT TO DOWN

Vinyl resin prices dropped by 1¢/lb in October and were expected to be flat or down another penny last month. Two major planned PVC plant shutdowns were completed by last month and had no impact on the market due to the domestic seasonal slowdown, according to RTi's Kallman. Lower ethylene monomer contract prices would also point to slightly lower resin prices. However, there has been increased interest from export markets, which could tighten up domestic supply a bit.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

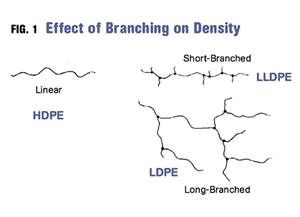

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

.png;maxWidth=300;quality=90)