Commodity Resin Prices Generally Flat

The exceptions are PS and PET, though they may have bottomed out last month.

Both PE and PP suppliers were attempting to raise prices in July and August, but industry pros characterized these efforts as being on “shaky legs,” owing to lower feed- stock prices, despite some unplanned production interruptions. Sagging PS and PET prices may have hit bottom last month—or possibly will this month—while PVC prices still have potential to fall farther, driven by a significant reduction in ethylene costs.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The in Chicago, and Houston-based PetroChemWire (PCW).

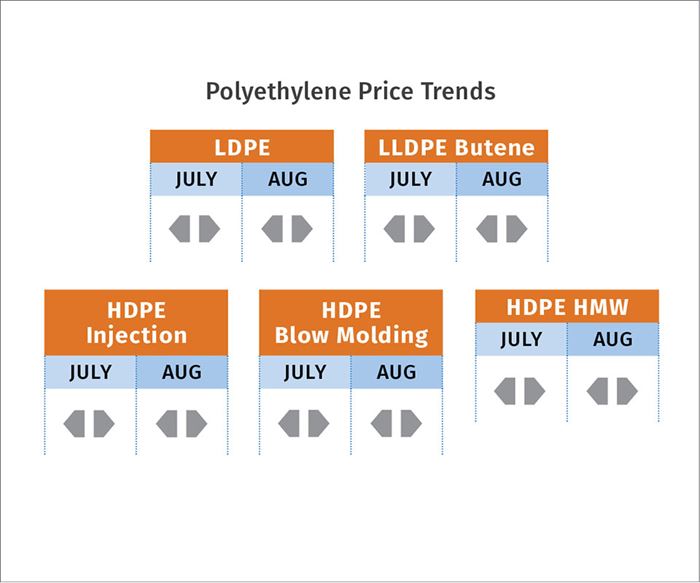

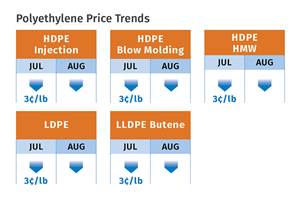

PE PRICES FLAT

Polyethylene prices in July remained mostly flat, despite some suppliers’ con- tinued attempts to implement a 3¢/lb increase scheduled for that month. Among them were Chevron Phillips, ExxonMobil, and LBI (LyondellBasell). Nova Chemicals and Westlake instead delayed the hike until August, while Dow Chemical reaffirmed it would pursue the July hike for HDPE while delaying the increase for L/LLDPE to August. Mike Burns, RTi’s v.p. of client services for PE, said there was a good chance that PE prices would stay put in July and August and possibly beyond.

Meanwhile, PCW reported firm prices in the spot market in the midst of snug supply. HDPE injection grades remained tight, commanding a 2-3¢ premium over HDPE blow molding grades, but a significant reversal was expected by early fourth quarter.

The Plastics Exchange’s Greenberg reported that spot PE sales were well distributed amongst the commodity grades, except for HDPE injection grades. In the third week of July, Greenberg reported, “Some offers emerged, but were priced out of reach of even those buyers in seemingly desperate need. Despite a shortage of HD injection resin, resellers are only seeking back-to-back transactions at this time, for fear of the huge premiums one day evaporating. We have seen strong spot buying for LDPE film resins, where premiums continue to erode.”

Burns maintained that there are no key factors that would drive an increase, outside of a major disruption. He ventured that if supplier inventories continue to recover, it would be reasonable to expect a 3¢/lb decrease as we approach the fourth quarter. Meanwhile, Dow started up new LLDPE production in June, and CPChem was scheduled to start up new HDPE and LLDPE capacity before the end of the third quarter. Burns also noted that Nova Chemicals’ scheduled September-October turn-around will only limit availability of incremental pounds for offgrade and export markets.

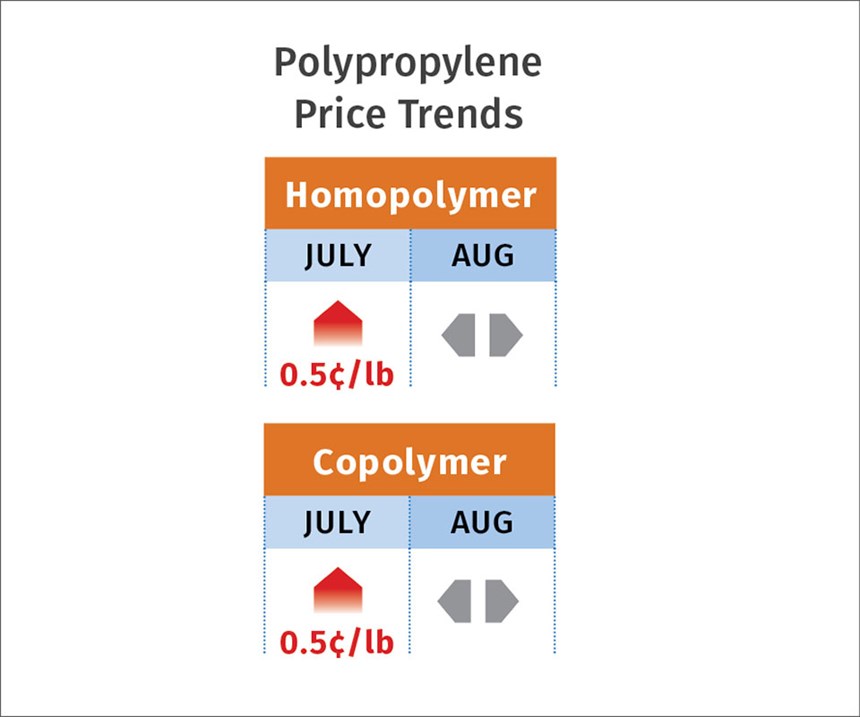

PP PRICES UP A BIT; MORE SOUGHT

Polypropylene prices in July moved up by 0.5¢/lb in step with the July propylene monomer contact. However, most major suppliers had issued a 3¢/lb hike for profit-margin expansion on Aug. 1, above what the monomer contract price might settle at in August. An important exception was ExxonMobil, which had made no move by July’s end, noted Scott Newell, RTi’s v.p. of PP markets.

Newell sees the return of profit- margin expansion moves as “on shaky legs.” He explained, “June was one of the strongest demand months—perhaps a record one—for PP. It was mostly attributed to restocking after the price volatility of the first quarter. Suppliers’ inventories saw a drawdown of 125 million lb, resulting in a tight market.” But he noted that demand is now slowing, as indicated by material returning to the spot market.

Newell thought August monomer contracts were likely to end up flat-to-down. So, if propylene loses the 0.5¢ gained in July, PP suppliers would aim to implement a 2.5¢/lb margin expansion. His assessment was based on the fact that by the end of July, two downed propylene units, which had caused monomer tightness, had been restarted. Greenberg’s take on what was setting up to be the first margin-enhancing PP price increase in more than a year is that monomer supply would be the wildcard. “If all units can remain up and running, monomer might go another leg lower and resin prices might just fall less. Otherwise, we see a good chance that a stable or firming monomer market would help push PP prices higher in August and September.”

PCW reported that PP spot prices were flat to a penny lower, amid some signs of improving homopolymer availability. Spot impact and random copolymers were still balanced-to-tight, with suppliers enjoying two months of strong domestic sales in May-June and several suppliers recovering from recent production issues.

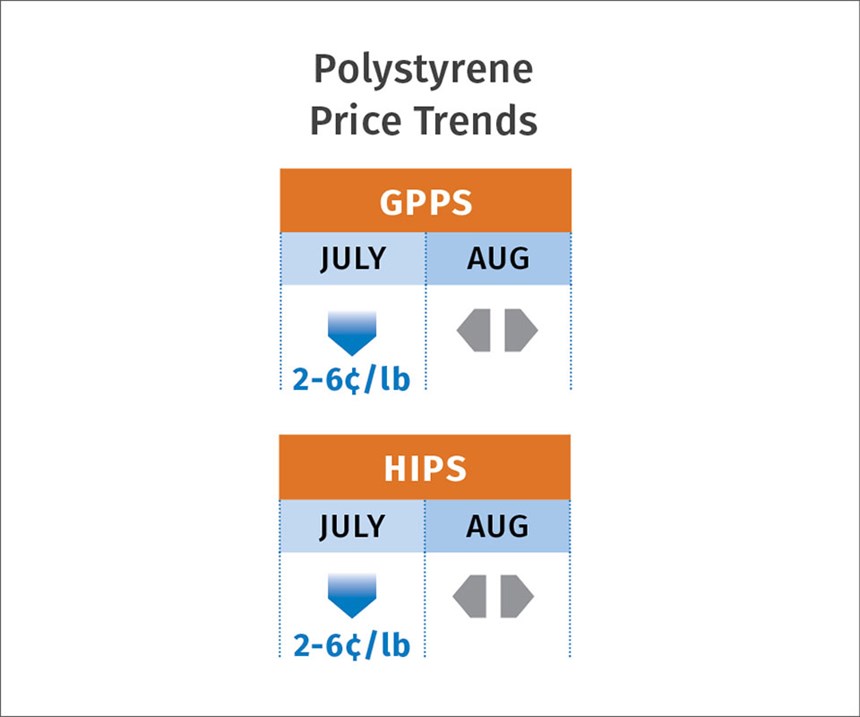

PS PRICES DOWN

Polystyrene prices in July dropped 2-6¢/lb, according to both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. This was on top of a cumulative 7¢/lb drop in April and May. One supplier had issued a 2¢/lb increase for August, a move that went unsupported by the rest of the industry.

Suppliers whose price reductions were at the lower end of the 2-6¢ range are likely to be forced to meet the larger decreases in order to stay competitive—5¢ for GPPS and 6¢ for HIPS—noted Kallman. HIPS prices dropped even more as falling butadiene prices, down another 5-7¢/lb in August, were at the lowest level since early 2016. Kallman expected a further compression of the delta between GPPS and HIPS prices, already down to 8-9¢/lb, compared with double digits when butadiene prices were high.

Meanwhile, PCW reported that PS spot prices edged lower amid seasonally slow demand. PS imports continued to put pressure on domestic spot pricing.

PVC PRICES FLAT-TO-DOWN

PVC prices were flat in July, with some potential to drop 1-2¢/lb in August-September, according to Kallman and PCW. Both sources and PVC processors had expected a price decrease of that order in step with falling ethylene monomer prices. However, an outage at Formosa’s largest VCM plant at Point Comfort, Texas, brought the company’s overall VCM operating rate to 50% of capacity. This led to a force majeure action on some PVC grades, according to Kallman.

Based on a 2.75¢ reduction in June ethylene contract prices, and the expec- tation of another 1-2¢/lb drop in the July settlement, PVC processors thought that resin prices ought to fall by 2¢/lb, and some sought a 3¢ reduction. Meanwhile, spot ethylene prices were trading at lows of 18.5-19¢/lb.

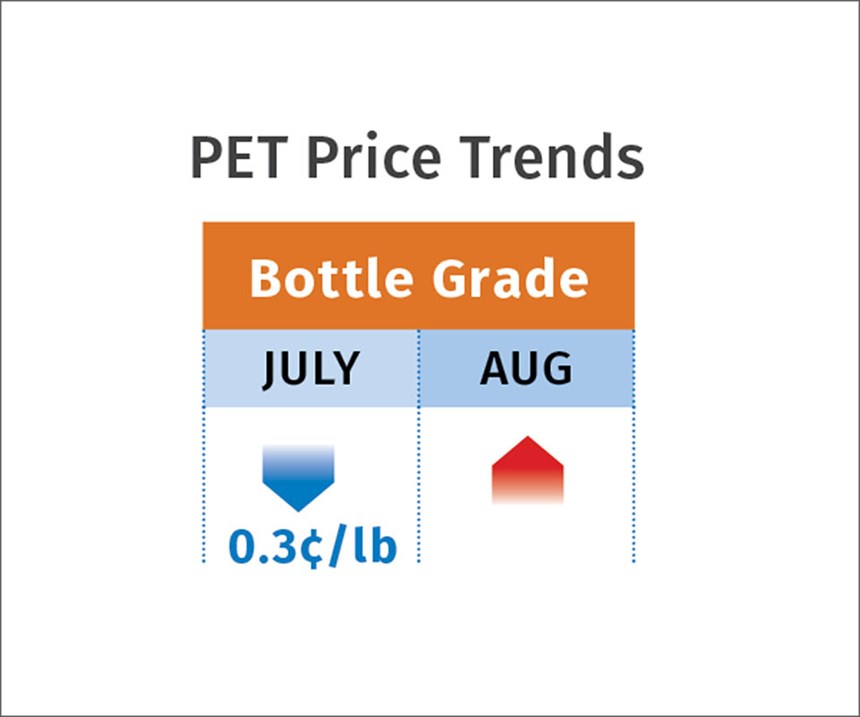

PET PRICES DOWN BUT FIRMING

Domestic bottle-grade prime PET prices in July averaged 55.2¢/lb, down 0.3¢/lb from June, based on PCW’s Daily PET Report. (That price represents PET business on a delivered Chicago basis.) On Aug. 2, the price was 55¢/lb, driven by lower costs and plentiful supply of feedstocks (PTA, MEG and PX) in June, despite strong demand from bottlers and packaging manufacturers. However, that trend may be reversing.

PET feedstock costs are on the rise. In July, they averaged 51.51¢/lb, up 0.62c/lb from June. August feedstock costs were estimated to be about 52.5¢/lb. So August PET prices were expected to flat or higher.

Meanwhile, prices of imported prime PET with an IV of 78 or higher in July averaged 53.5¢/lb, up 2.1¢ from June (on a delivered duty-paid U.S. port basis). The price on Aug. 2 was 53¢/lb.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=970;quality=90)