Engineering Thermoplastics Are Going ‘Green’

As high-performance materials follow the path taken by some commodity resins, farming could replace drilling as suppliers rely more on plants than oil or gas for feedstocks.

Commodity resins like polyolefins and PET have been in the forefront of biobased and recycled-content news over the last five to 10 years, but some engineering thermoplastics have been catching up. To ensure that such sustainable plastics are widely adopted, suppliers have been aiming to make them comparable to conventional resins in performance and cost-effectiveness.

Driven by markets such as packaging, automotive, electronics, consumer goods, and medical devices, there has been increasing activity among suppliers of engineering resins to develop biosourced feedstocks from plant oils, sugars, or starches to synthesize new monomers for some of their key materials. The emphasis by several companies has been on developing sugar sources from crop waste or other renewable chemicals from non-food biomass. Most of the commercial activity has been focused on nylons and polyesters, though some has been directed toward higher-end TPEs and TPUs.

Attesting to these trends were presentations at the “Re-Invention of Plastics via renewable Chemicals” conference by Innoplast Solutions, Inc., held in Miami this past January. Presenters included such leaders in this arena as DuPont, Wilmington, Del., Arkema, King of Prussia, Pa., DSM Engineering Plastics, Birmingham, Mich., and China’s Cathay Industrial Biotech (U.S. office in Powell, Ohio), each of which

addressed its newest activities and future aims.

Other companies active in biobased engineering-resin development include BASF, Florham Park, N.J., Evonik, Parsippany, N.J., Solvay Specialty Polymers, Alpharetta, Ga., Invista, Wichita, Kan., and Lanxess, Pittsburgh. Still others are Lubrizol Engineered Polymers, Cleveland, Elevance Renewable Sciences,

Woodbridge, Ill., and Rennovia, Santa Clara, Calif.

Most of these developments entail partnerships with, or acquisitions of, agricultural business concerns. An early example is DuPont, which divested Conoco in 1999 and purchased Pioneer Seed, becoming a world leader in agri-business. The company reported that this sector accounted for 32% of sales in 2013, with performance chemicals representing 19%. (The latter is being spun off this year.)

NYLONS: THE OLD AND THE NEW

The oldest 100% biobased engineering thermoplastic is nylon 11. Made exclusively by Arkema and sold under the Rilsan brand name, the 40+-yr old material is based entirely on castor oil, and has long been used in such applications as truck air brakes. In recent years it has gained acceptance in diesel fuel lines and camera lens caps.

Nylon 610 is another “green” resin (60-64% from castor oil) with a long pedigree—over 50 years—and has gained entry in automotive radiator end tanks and fuel lines. It’s available from several suppliers, including Arkema, DuPont, BASF, Solvay, and Ems Chemie (U.S. office in Sumter, S.C.).

In 2009, Arkema launched the first transparent biobased nylon, Rilsan Clear G830, a highly transparent amorphous nylon with 54% biobased content. It has found use in applications ranging from sport or designer optical frames to breathing masks and hearing aids. It boasts 10-20% lighter weight than ABS, PC, PMMA, or nylon 6. Rilsan HT followed soon after; it’s a high-temperature polyphthalamide (PPA) extrusion resin with unusual flexibility for a PPA. It has made its mark in metal-to-plastic conversion of engine-compartment tubing.

Biobased Rilsan T nylon 1010, launched in 2013, is a unique long-chain nylon. In addition to the chemical resistance and mechanical properties of long-chain nylons, it is said to afford an excellent degree of rigidity, thermal stability, impermeability to fuels, and processability. This 100% biobased material further expanded Arkema’s range and was boosted by the firm’s 2012 acquisition of Chinese companies Casda, a global leader in sebacic acid derived from castor oil; and Hipro Polymers, which makes Hiprolon 610, 612, 1010, 102. Arkema also purchased a stake in India’s Ihsedu Agrochem, which

produces castor oil.

There are now several nylon suppliers with materials whose monomers are sourced partly or entirely from castor oil, with a minimal biobased content of 20%. A common denominator of these newer nylons is nylon 10, which like nylon 11 is 100% castor-based. They include: BASF (Ultramid Balance nylon 610); DSM (EcoPaXX nylon 410; DuPont (Zytel RS nylon 610 and 1010), Evonik (Vestamid Terra nylon 610, 1010, and

1012); Solvay Engineering Polymers (Technyl eXten nylon 610, through its Rhodia acquisition); and Ems Chemie, whose Green Line includes nylons 610 and 1010 and a PPA.

Several companies are sourcing their current and developing biobased materials from other renewable plant sources. At DuPont, for example, that includes sugar cane, corn, soybeans, and wheat. In 2013, the company revealed that it had a major R&D campaign underway aimed at replacing over half of its current plastics portfolio with biobased versions as drop-in replacements within a 15-year time span. The company also aims to make these renewable polymers less expensive and/or higher performing than their petro-based counterparts to further bolster the interest of OEM end users.

Michael Saltzberg, DuPont’s business director for biomaterials, gives just one example: “We were the first to introduce nylon 610 in a radiator end tank application (Toyota). But the main driver for its use was not its biobased content, but the cost/performance balance it offered compared with nylon 12.” He notes that the nylon 12 shortage of 2012-13 resulted in lot of growth for nylons 610 and 1010, both of which boast better thermal properties than nylon 12, in addition to their biobased content.

In automotive, Jeff Sternberg, DuPont global automotive technology director, notes that the main focus is on reducing emissions through improved fuel economy. While renewably sourced materials and/or recycle content currently are not as high a priority for their own sake, market interest is definitely increasing. “DuPont is developing polymers based on biobased feedstocks that will offer improvements for underhood applications like fuel tanks, reservoirs, and engine and chassis components,” he says.

BASF introduced Ultramid nylon for flexible packaging films whereby the company replaces up to 100% of the fossil resources with certified biomass. Third-party certification confirms to customers that BASF has used the percentage of renewable raw

materials specified by the customer. Ultramid nylon produced by this so-called mass-balance approach is identical to conventional material in terms of formulation and quality, but with lower greenhouse gas emissions.

DSM’s EcoPaXX nylon 410 (70% biobased content) has shown its mettle in fuel-vapor separators produced for Ferrari and Maserati. Halogen-free flame-retardant grade Q-KGS6 combines flame retardancy (UL 94V-0 rating at 0.7 mm) with the high level of

chemical resistance needed for this application.

This material is also used to produce a multi-functional crankshaft cover for next-generation Volkswagen diesel engines. This cover replaces nylons 46 and 66 and boasts 40% lower weight and 25% lower cost than aluminum flanges of similar geometry. The

material is also being targeted for use in fuel-line connectors to replace incumbent grades of glass-reinforced PPA or nylon 12.

A newer EcoPaXX grade can replace insulating profiles currently made primarily of nylon 66 and assembled into aluminum frames. Its high melting point of 250 C enables it to pass through the powder coating process in a fully assembled aluminum frame. It

also offers significantly lower moisture absorption than nylon 66. Other new grades are debuting in high-performance sport shoes, eyeglass frames, and electronic wire-to-board connectors.

Meanwhile, DSM’s German development partner, MF-Folien has produced the first EcoPaxx films. They boast higher moisture barrier than nylon 6 films and a comparable oxygen barrier. They are targeted to applications in flexible food packaging, construction, medical, aviation, and shipping.

Solvay Specialty Polymers has been expanding its revamped line of biobased Kalix HPPA (high-performance polyamide) resins since the introduction of the 3000 and 2000 series at K 2013, which were aimed at mobile electronics. The 3000 series is based on an entirely new molecule and claims to be the first biobased amorphous PPA. It contains 16% renewably sourced sebacic acid and 50% glass fiber. The semi-crystalline 2000 series, with 27% renewable content, is based on nylon 610 but with better impact and flow properties.

Solvay has now added halogen-free flame-retardant grades of Kalix 2000, including Kalix 2930 HFFR and 2945 HFFR, which are candidates for laptop applications. The company has also developed opaque black laser-welding grades based on Kalix 2000 and 3000 as options for structural parts where laser welding is needed for better water resistance.

In addition, the company is making headway with both series in the medical-device arena, where these materials show significantly better chemical resistance than PC or PC/ABS for frames and covers for mobile healthcare devices.

CHALLENGING NYLON 66

Going after the “holy grail” of nylon 66, which together with nylon 6 are the largest-volume nylons, has also been a focus among suppliers. Cathay Industrial Biotech has been producing biobased nylons from renewable sources like sugars, palm oil, and castor oil. The company has unveiled a new line of nylons produced with a novel, proprietary technology that produces 1,5-pentane diamine monomer from sugar cane, making it 100% renewable. This novel 5-carbon diamine reportedly offers performance comparable to the currently used 6-carbon diamine—1,6-hexamethylene diamine (HMDA)—in many nylons, while also offering new properties in specialty applications. The Terryl line includes nylons 56, 510, 512, 514, and 612.

In his Innoplast conference presentation, Paul Caswell, Cathay’s president and cofounder, showed the properties of nylon 56 to be very similar to nylon 66, but with 47% sustainable content. Test products have included cable ties (pure nylon 56); a heated bug-repellent housing (pure nylon 56); and an electric part housing (30% glass-filled nylon 56). He noted that in its first facility Cathay will use corn sugar; the company is also working on non-food, biomass-based sugar derived from agricultural waste and plans a gradual conversion as the technology develops.

Rennovia has produced developmental quantities of its Rennlon 100% biobased nylon 66 and is working with a partner to make the world’s first commercial entry of such a product. It is made from Rennovia’s renewable monomers, adipic acid (AA) and hexamethylenediamine (HMD). The company projects that production costs of biobased AA and HMD will be 20-25% lower than petroleum-based versions. Rennovia has received a $25-million equity investment from Archer Daniels Midland.

Invista has a partnership with LanzaTech (U.S. office in Skokie, Ill.) to develop biobased butadiene as feedstock for making adiponitrile (ADN), an intermediate for nylon 66. LanzaTech is initially converting carbon monoxide (CO) to 2,3-butanediol and then subsequently converts it to 1,2-butadiene using gas fermentation. The companies plan to produce CO-based butadiene directly using a single-step process

via gas fermentation by 2016.

TPES & SPECIALTY COPOLYESTERS

In 2007, DuPont launched its Hytrel RS TPEs and its Sorona EP PTT polyester, both made from propanediol (PDO) derived from fermented cornstarch. Hytrel RS copolyetherester TPEs have PBT hard segments and renewable PTMEG soft segments. The renewable content varies according to the hardness required. These materials have been used for automotive and industrial hose and tubing, constant-velocity joint (CVJ) boots, airbag doors, energy dampers, air ducts, and coil cords. They have also been used in furniture, such as in the suspension webbing of the new Knoll “Generation Chair.” Softer versions have potential for cellphone covers and wire insulation.

Sorona EP PTT is a unique thermoplastic polyester with 37% bio-PDO content. It has been targeted to electrical and electronic components, appliance parts, power-tool applications, furniture, medical applications, and automotive components. The material has reportedly been used to make medical biopsy punches.

Its automotive debut was in the 2012 Toyota hybrid Prius alpha, where it was chosen for air-vent louvre vanes because of its heat resistance and durability. In addition to lower warpage and Class A surface appearance, the 45% glass-filled Sorona part eliminated the extra paint step needed with the 45% glass-filled PBT used in the past. DuPont is looking for additional similar applications.

In 2010, Arkema introduced its first engineering TPEs made from renewable resources. Pebax Rnew polyether block amide (PEBA) combines a rigid block of nylon 11 with a hydrophobic polyether soft block, yielding a resin with 20-95% bio content. These TPEs have found use in sports shoes and other sports equipment as well as in blends with other resins.

In her Innoplast presentation, “Biobased High Performance Polyamides: Solutions for Consumer Markets,” Arkema’s Min Zheng, business development engineer for the consumer market, concluded that by combining Rilsan nylon and Pebax Rnew, manufacturers can now design consumer goods made from 100% biobased resins ranging from mobile-phone cases and sports shoes to appliances, hygiene and beauty items, films, and packaging.

Two companies are making significant headway in biobased TPUs. At NPE2015, Lubrizol unveiled its new TPU line made with 30-80% renewably sourced material. Ranging in hardness from 82 Shore A to 55 D, it is targeted to sports, footwear, electronic, and automotive applications.

And Elevance Renewable Sciences recently announced that it has developed TPUs based on polyester polyol building blocks from a renewable, plant-based source—Elevance Inherent C18 Diacid. The result is a new semi-crystalline class of TPUs that have potential in applications such as automotive brake liners and sports equipment.

Meanwhile, Lanxess in Germany has made production runs of Pocan PBT using 20 metric tons of biobased BDO (1,4-butanediol) made with the process developed by San Diego-based Genomatica. The process converts sugars into BDO in a patented direct fermentation process. According to Lanxess, biobased PBT compounds are a drop-in replacement in established PBT automotive or electrical/electronic applications.

BASF recently announced it is now offering biobased Polytetrahydrofuran 1000 for the first time as an intermediate to selected partners for testing in various polymer synthesis applications.

PolyTHF1000 is a polymer made of linear diols with a backbone of repeating tetramethylene units connected by ether linkages. It can be used as a building block for soft-segment elastomers such as TPUs, copolyetheresters and copolyetheramides.

PolyTHF is derived from 1,4-butanediol (BDO). BASF is now producing BDO using Genomatica’s patented one-step sugar fermentation process. Applications range from ski boots and shoe soles to automotive instrument panel skins, hoses, films, and cable sheathing.

Related Content

50 Years...600 Issues...and Still Counting

Matt Naitove marks his first half-century in plastics reporting, with a few of his favorite headlines.

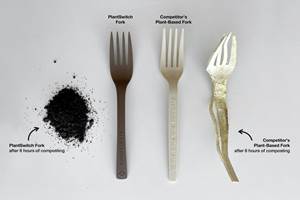

Read MoreAdvanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

Read MoreWhy Are They Blending Biopolymers?

A sit-down with bioplastic producer Danimer Scientific showed me there are more possible answers to that question than I had previously thought.

Read MoreResins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More