Expectations for Electronics Defy Headlines

The electronics industry seems expected track with the overall economy’s growth for 2019, though firms with greater exposure to China may have to be more cautious during the year.

The electronics industry entered 2019 overshadowed by concerns over shrinking demand for electronics goods in China, joined with tepid demand in the U.S. This was capped by Apple’s January 2 announcement of weaker-than-expected fourth-quarter 2018 sales of its core electronics products. Such headwinds at the start of the year, combined with an extended U.S. government shutdown and prolonged tariff negotiations with China, have been generating concerns among many businesses.

These events have complicated matters for those looking for insights into what 2019 may hold and how to respond in the face of potentially greater near-term volatility. These early announcements sent the Dow Jones Industrial Average into a frenzy during which it fell more than 10% in the course of just a few weeks in December. This was in part because Apple’s shares constitute a nearly 5% stake in the Dow Jones Industrials and more than a 10% stake in the Nasdaq 100, according to Factset.

The electronics industry—less Apple’s share—is expected to see inflation-adjusted revenue growth of 3.5% in 2019, combined with even stronger earnings growth. This is based on the actual and forecasted financial results of nearly 60 electronics industry firms generating $658 billion in revenues in the 12-month period ending with the third quarter of 2018. Including Apple’s third-quarter 2018 projections pushes the industry’s overall revenue growth up to 8.5% by year-end 2019. From a domestic perspective, the sector seems expected to follow in line with the overall economy’s growth; however, firms with greater exposure to China may have to be more cautious during the year.

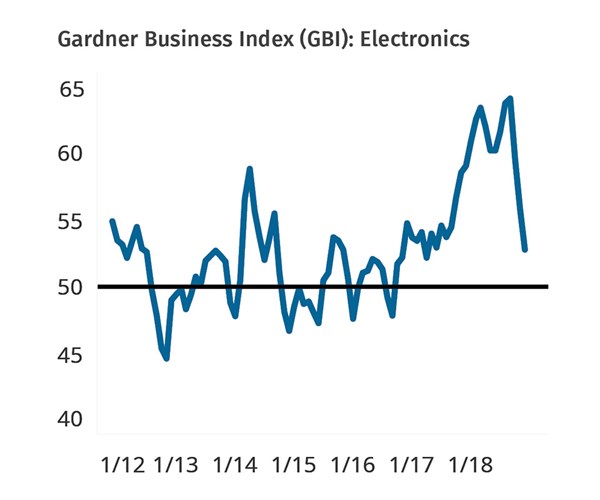

Gardner’s proprietary data from U.S. manufacturers serving the electronics industry largely mirrors Wall Street’s tepid 2019 outlook. The latest Gardner employment readings are above long-run averages, which suggests that firms are still optimistic about making investments in people and thus are optimistic for the longer-run. Simultaneously, production, new orders, backlogs and supplier deliveries at year-end 2018 were flat to slightly growing after a two-year period in which many of these measures set record highs. Despite a toughening trade environment in 2018, Gardner’s export data did not contract during the second half of 2018, although the data indicated generally slowing export growth through December.

Lastly, Gardner’s data indicated that smaller firms (20 employees or fewer) experienced disproportionally more challenging economic conditions during the fourth quarter of 2018 than their larger peers with more than 100 employees. This reinforces the common understanding that smaller firms often have fewer options when maneuvering through more challenging business conditions and thus are more sensitive to economic change.

ABOUT THE AUTHOR: Michael Guckes is the chief economist for Gardner Business Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling and forecasting work for nearly 20 years among a wide range of industries. Michael received his BA in political science and economics from Kenyon College and his MBA from The Ohio State University. mguckes@gardnerweb.com.

Related Content

-

Plastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

-

Plastics Processing Contracts Again

October’s reading marks four straight months of contraction.

-

Plastics Processing Contracted Again in March

Processing activity contracted for the ninth straight month, and at a faster rate.

.jpg;width=70;height=70;mode=crop)