Extruding Biopolymers: Packaging Reaps Cost Benefit of Going 'Green'

Plastics made from renewable carbon chains, not fossil carbon from oil or gas, are suddenly a solid commercial reality. The draw isn’t just “green” marketing, but the “green” of stable prices not linked to petrochemicals.

After years of hype and exaggeration, market demand for bioplastics made from renewable resources like corn or potatoes is no longer just an ecologist’s dream. Most of the action is in film and sheet extrusion for disposable packaging. Three simultaneous conferences last December attest to the heightened interest.

Data presented at Plastics Technology’s “Bioplastics Processing Conference” in Charlotte, N.C., (cosponsored by Polymer Process Communications); “Commercializing Bioresins” in San Antonio, Texas, (sponsored by Intertech-Pira); and “Biopolymers” in Frankfurt, Germany, (sponsored by European Plastics News) pegged the global market at 185 million to 206 million lb/yr.

More specifically, BCC Research sees global biopolymer demand at about 206 million lb/yr in 2005, comprising 95 million lb for compost bags, 55 million lb for loose-fill “peanuts,” 28 million lb for packaging film and sheet, and 28 million lb for miscellaneous uses.

Biopolymer producers don’t divulge their production volumes, but the stated plant capacities for the two most widely used biomaterials—starch-based Mater-Bi from Novamont in Italy and polylactic acid (PLA) from NatureWorks—far exceed those numbers. Nameplate capacity for PLA is 300 million lb/yr, while Novamont’s combined in-house and outside-contracted Mater-Bi compounding capacity totals 77 million lb/yr.

Both are expanding. Novamont is building a 125-million-lb/yr compounding plant in Italy, expected to start up this year. NatureWorks recently announced debottlenecking to boost output by 2008.

Shades of green

One obvious selling point for biopolymers is that they are good for the environment because they’re made from renewable plant starch, not petrochemicals. In the U.S., a bigger selling point is a chance to get off the petro-price rollercoaster.

It takes 68% less oil to make PLA from corn than to make plastic from oil, according to NatureWorks. But there’s a catch: The Earth Policy Institute in Washington, D.C., recently revised its estimates for corn demand to make ethanol fuel and concluded that corn prices will rise sharply. Its new study concludes that ethanol fuel plants could consume as much as half the U.S. corn crop next year.

Definitions of “bio” plastics can get muddled. Some products combine bio-based and petro-based materials. BASF, for example, blends its petro-based Ecoflex biodegradable resin with bio-based PLA to make its Ecovio material. Novamont makes most Mater-Bi compounds with starch plus a thermoplastic binder. Some are 100% biopolymer while others may be up to 60% petro-based.

Newly commercialized bio-based monomers are also used together with petro-based monomers to make some resins. PTT (polytrimethylene terephthalate) polyester from DuPont, used to make Sorona fiber, is made from corn-based PDO (propanediol) and petroleum-based terephthalic acid.

Environmental claims can be confusing for other reasons. Bio-derived and biodegradable aren’t the same thing, though they are often lumped together. Some bio-based resins can biodegrade back to CO2 and water. Some can’t, like bio-based thermosets made from vegetable oils. Some biodegradables will break down in the backyard; some require the heat of industrial composting. Some resins are biodegradable or even water soluble but nonetheless petro-based, like PVOH (polyvinyl alcohol) based resins compounded by Stanelco plc in the U.K.

In Europe, where biodegradability is a big selling point, some countries, like Holland, have extensive industrial composting infrastructure. Some, like England, have no industrial composting but lots of the backyard kind. So PLA, which needs industrial composting to break down, “has no desirable disposal route” in the U.K., notes Andrew Osborne, managing director of Anson Packaging, a British maker of thermoformed trays. Anson offers PLA for those who want it, but recommends RPET to customers.

Biodegradable plastic bags for compost collection–by far the biggest bioresin market in the world–are a successful application because of labor savings. The bags don’t have to be opened, but go directly into the compost.

Biodegradable rigid trays and bottles, however, require a collection and industrial composting infrastructure. Wild Oats Markets in Boulder, Colo., a health-food chain with over 100 stores, adopted biodegradable PLA containers for deli and fruit packaging.

Wild Oats created a drop-off program at half its stores to compost PLA packaging. (This helped boost sales because of repeat customer visits).

Petro-based additives for bioresins are another issue. For example, DuPont’s new Biomax Strong ethylene acrylate modifier is designed to be used at 1% to 20% levels in PLA applications to fix PLA’s problem of brittle cracking. Biomax also improves the quality of trimmed edges for thermoformed parts. But European Union rules allow no more than 10% of a non-biodegradable ingredient or else the whole composition is classed as non-biodegradable.

There is also concern in Europe over biopolymers based on genetically modified (GM) U.S. corn, even though no genetic material remains in the polymer. PLA packaging is often used for high-priced organic produce, so the packagers want “non-GM” materials. Sainsbury, a big U.K. retailer, uses lots of biodegradable packaging, but shuns PLA trays until there is a European source for PLA from unaltered corn. (NatureWorks offers to supply “non-GM” PLA for a premium price.)

Emerging bioplastics

Bioplastics are either starch blends or fermented polyester, or both. Novamont’s Mater-Bi starch blends come in 20 commercial grades and more than 20 custom versions. Most are blown film grades for compost bags, lamination to nonwovens, and antistatic films. Custom Mater-Bi formulations are tailored for permeability to moisture and barrier to gases, oils, fats, and alcohol. Mater-Bi has a milky appearance, so products are typically pigmented. A new Mater-Bi material, expected later this year, will be clear and starch-free, based instead on Eastar Bio polyester (acquired from Eastman Chemical in 2004).

Big processors of Mater-Bi include BioBag in Norway, the world’s biggest producer of blown biopolymer film; Huhtamaki in Finland; and Wentus in Germany. Other compounders of starch-based biopolymers include Cere-plast, which compounds PLA with starch and other ingredients. Cereplast recently announced a capacity boost of 40 million lb/yr.

Plantic in Australia makes a water-soluble starch/PVOH compound with silicate nanoclay added. It is used captively to make thermoformed candy trays. Recently Plantic developed grades for blown film.

PLA is a high-clarity bio-polyester derived from fermented corn starch. NatureWorks makes 19 grades. Pilot-plant quantities are also made by Mitsui Chemical and Shimadzu Chemical in Japan and Tate & Lyle Biopolymers bv in the Netherlands. Another small producer, Galactic SA in Belgium, works with a Chinese partner.

Purac in the Netherlands (U.S. office near Chicago) is a lactic acid producer that blends different isomers of PLA to produce specialty grades such as Purasorb medical resins and high-heat grades for microwave or hot-fill packaging.

PGA (polyglycolic acid) homopolymer is a bio-polyester that has been made for years for absorbable sutures and medical implants.

PHA (polyhydroxyalkanoate) is a bio-polyester produced by bacterial fermentation. It has properties similar to polyolefins from PP to LDPE. It is made in a pilot plant by Metabolix, which recently formed a joint venture with major grain processor Archer Daniels Midland Co., Decatur, Ill. ADM plans to have a 110-million-lb/yr PHA plant running in Clinton, Iowa, by 2008.

Kaneka in Japan is working on a type of PHA called PHBH (polyhydroxybutyrate-hexanoate).

Growing bio applications

PLA’s big initial obstacle was cost. In 1995, Cargill made 10 million lb/yr in a semi-works plant. It sold for $3/lb, and no one took it seriously. Then, Cargill (in a since-terminated joint venture with Dow Chemical) built a first-of-its kind production plant for 300 million lb/yr of PLA. In 2002, Cargill's wholly owned NatureWorks unit started up the first of two polymer trains with capacity of 150 million lb/yr, and the price of PLA dropped to $1.30/lb.

In 2004, lactic acid fermentation was integrated with PLA polymerization, increasing efficiency so that PLA could compete in price with APET trays for big buyers. Then oil prices soared, and suddenly PLA could compete with PS trays, too. Its high clarity (2% haze) and stable pricing made it attractive. In 2005 Wal-Mart announced its intention to replace all PET produce containers in its stores with PLA. Though that strained NatureWorks’ capacity, PLA today sells for about 85¢/lb

The next stage of cost reduction for PLA (and also PHA) could someday be to use less expensive biomass as a feedstock. One potential source is corn stover, using the entire corn plant including stalks and cobs, not just kernels. SRI Consulting in Menlo Park, Calif., estimates that operating a PLA plant on corn stover could yield lactic acid (PLA’s precursor) for 35¢/lb.

Metabolix is also researching and developing a means of extracting PHA directly from genetically modified switchgrass. If successful, this plastic someday could be harvested like a crop.

PLA’s handicap is its low glass-transition temperature (Tg). Thermoformed packages reportedly will deform after just a few hours’ exposure to temperatures above 120 F. Anson Packaging reported at the Frankfurt conference that one customer had a problem of clamshell sandwich packages popping open on automated filling lines, so the customer switched to RPET.

Competitors once joked that PLA boxes would have to be shipped in refrigerated trucks—and they weren’t far wrong. PLA found a niche in thermoformed trays for fresh berries and high-end organic produce. Such produce is stored and shipped under refrigeration, so there’s no distortion of PLA boxes.

Some 70% to 80% of PLA consumption is for thermoformed trays and cups. Wilkinson Industries Inc., Omaha, Neb., is the biggest producer, making trays for Wal-Mart.

Other extrusion markets for PLA are coating paper (for coffee cups) and blown and bi-oriented film. Small amounts are also injection molded, stretch-blow molded, and used in blends to stiffen other biopolymers. From 6% to 30% PLA goes into some Mater-Bi applications and into Stanelco’s starch-based Starpol compound for blown film. PLA/starch compounds have advantages over plain PLA—they don’t need drying and can use regrind easily.

Biaxially oriented PLA sheet is commercial in applications like prepaid phone cards and gift cards and hotel key cards, where it replaces PVC. Sheet for such cards is made by Biax International Inc., Tiverton, Ont., and Treofan Group in Raunheim, Germany.

PLA is used by extruders like Plastic Suppliers Inc., Columbus, Ohio, to make blown film for lamination, hygienic films, and packaging. PLA sheet for thermoforming is extruded by merchant producers Spartech and Ex-Tech Plastics, as well as captive users Fabri-Kal in Kalamazoo, Mich., and Sabert Corp. in Sayreville, N.J.

PLA foam is made in Europe by Coop Box in Italy. Two U.S. processors are expected to launch foamed PLA meat trays early this year. PLA can be foamed to the same density as PS foam, and with comparable cell size and surface quality, NatureWorks says.

Processing PLA

Speakers at the recent biopolymer conferences focused more on processing of PLA than of Mater-Bi starch polymer. That may have been because PLA is newer on the market and is growing faster in the U.S. Also, PLA appears to have more processing quirks.

According to a conference presentation by Conair, most processing problems with PLA stem from inadequate drying. PLA picks up ambient moisture very rapidly. Because it is a condensation polymer, presence of even a very small amount of moisture during melt processing causes degradation of polymer chains and loss of molecular weight and mechanical properties.

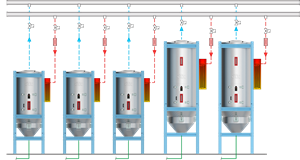

PLA needs different degrees of drying depending on the grade and how it will be used. Sheet grades have to be dried to below 250 ppm of moisture. Under 200 ppm is better because viscosity is more stable. PLA needs a dehumidifying (desiccant) dryer. With proper drying, the web sags less and the sheet is less brittle. Amorphous grades used for heat-seal layers in film are dried at 130 F for 4 hr. Crystallized grades used to extrude sheet and film are dried at 175 F for 4 hr. Processes with long residence times or higher temperatures—like fiber spinning at up to 450 F—need more drying, to less than 50 ppm of moisture. Like PET, PLA requires crystallization so it will not clump together in a dryer.

PLA film can be extruded with a general-purpose screw, though processors say output is better with a low-shear screw designed specifically for this resin. A processing consulant says some screws won’t run PLA—polyolefin screws are the worst—and polyolefin extruders typically don’t have enough drive power for PLA, either. Short, low-shear PVC screws reportedly are the best.

“Sheet and foam definitely require their own screw,” says Tim Womer, v.p. of engineering and technology at Xaloy, which sells a modified Fusion screw for PLA. Plastic Engineering Associates has developed a special Turbo Screw for extruding PLA foam. NatureWorks generally recommends a mixing section on the screw and a static mixer before the die for good melt uniformity. All temperatures in the extrusion system must be closely controlled, as excessive heat can be disastrous, notes a PLA sheet processor.

A significant processing cost for PLA film is scrap. Oriented film producers typically don't recycle scrap back into the process—they repelletize it for sale to less critical markets. But volumes of PLA film scrap are not large enough yet to develop an outlet for this waste material.

However, rigid sheet extrusion is a different story. Thermoformed sheet scrap is being granulated for reuse, but care must be taken to keep knife-to-screen gap constant, so the flake doesn’t overheat and degrade or melt. PLA also needs good fines separation.

Winding and roll handling equipment may need to be resized, and hoppers may need reinforcing to handle more weight. PLA has a density of 1.24 g/cc, lighter than PET (1.33), but a lot heavier than PP (0.90) or PS (1.04). That means the same size roll of PLA film weighs a lot more than one of OPP or PS.

Because PLA is more dense than OPP, chill rolls need to remove more heat from the same thickness of sheet. Cooling is hindered by the fact that the bio-resin conducts heat about 30% to 40% more slowly than PS or PP.

PLA viscosity is also very sensitive to temperature and moisture, so PLA webs tend to stretch and sag unevenly if these aren’t controlled carefully.

PLA also shrinks 9% in the transition from melt to solid, going from a melt density of 1.13 g/cc to a solid density of 1.24 g/cc. This shrinkage builds up tension in a roll stack if all three chill rolls turn at the same speed. NatureWorks recommends a clutch and variable speed on the lowest chill roll to relieve tension.

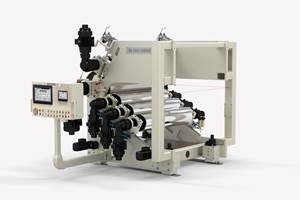

No biax film line has ever been built specifically for PLA, but the resin is being run on modified BOPET lines because their stretch ratios are similar (about 3.5:1 in both MD and TD). PET processors also have drying capabilities.

PLA can run on lines for BOPS film with typical stretch ratios of 2:1 MD and 4.5:1 TD. But PLA is too different from PP, which has a 5:1 MD and 10:1 TD ratio, to use most BOPP equipment, says Parkinson Technologies, maker of Marshall & Williams orientation equipment.

PLA has a low Tg (135 to 140 C) and high tensile modulus—an unusual pairing that requires special attention in sheet processing. Above its Tg, PLA stretches easily; below the Tg, not at all. “So failing to pay attention to web temperatures in biaxial orientation can pull idler rolls right out of the tenter frames and stall the line,” warns a biopolymer consultant.

PHA: the next big thing?

After PLA and Mater-Bi starch resins, PHA is due be the next biopolymer available in large volumes, once the joint venture of Metabolix and ADM gets the first commercial plant up and running next year. PHA is a family of bio-polyesters produced by fermentation, but unlike PLA, the polymer is formed and stored inside a living bacterial cell, similar to starch in a plant or fat in an animal.

Metabolix makes about 20,000 lb/month of PHA for market development. Its Natural Plastic is aimed at opaque sheet, paper coatings, and semi-transparent film (which has good contact clarity)

The first two commercial PHA products for extrusion coating and cast film are expected this year. Potential applications are stretch film, bags, soluble detergent sachets, and mulch films. Injection molding grades are also being tested.

PHA is hydrophobic and resists both water and oils, even when hot, so it can be used in applications up to 230 to 240 F. HDT is above 212 F, so it can coat hot-drink cups. PHA has a narrow molecular-weight distribution (which can be fine-tuned) and good printability.

PHA is semicrystalline (up to 60%) with density of 1.20 to 1.25 g/cc, melting points of about 50 to 180 C, and Tg from -20 to +5 C. Melt temperatures are from 176 F to 320 F, not far from its thermal degradation temperature of 338 F. So extruder barrel temperatures are reversed, starting at 365 F and dropping to 329 F at the die.

Cast film and downstream handling use heated rather than cooled rolls at 140 to 149 F, so the plastic has time to crystallize before cooling. Pellets of PHA should contain less than 0.1% moisture, which requires drying at 176 F for about 1 hr.

Unoriented cast film has tensile strength of 1600 psi at less than 1 mil thick, up to 3600 psi at 15 mils. Tensile modulus ranges from 58,000 to 145,000 psi over that thickness range, and elongation at break is 100% to 1000%.

Related Content

Davis-Standard to be Systems Integrator for Novel EDI Flat Die

Die uses motorized lip-adjustment, said to be three to five times faster than heated-bolt adjustments.

Read MoreDie-Service Cart Upgraded to Handle Screws, Chill Rolls

Processing Technologies International LLC has released its next-generation flat die servicing system, the uCAMS (Universal Cleaning Assembly and Maintenance System) Plus.

Read MoreHow to Effectively Reduce Costs with Smart Auxiliaries Technology

As drying, blending and conveying technologies grow more sophisticated, they offer processors great opportunities to reduce cost through better energy efficiency, smaller equipment footprints, reduced scrap and quicker changeovers. Increased throughput and better utilization of primary processing equipment and manpower are the results.

Read MoreGreen’s the Theme in Extrusion/Compounding

The drive toward circular economy is requiring processors to make more use of PCR. Machine builders at K—across all extrusion processes—will be highlighting innovations to help them do just that.

Read MoreRead Next

Higher-Performing Biopolymers Seek New Market Opportunities

A new generation of biodegradable polymers is going beyond conventional applications like bags and disposable cutlery and packaging.

Read MoreBiodegradable Polyesters: Packaging Goes Green

The U.S. is catching up with Europe and Asia in exploring the potential of biodegradable polyesters in flexible and rigid packaging. Because of their cost, these resins often find use in blends with other degradable materials.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More