Falling Resin Tabs May Rebound

The downtrend in prices for commodity thermoplastics continued through last month due to lower feedstock prices and poor domestic and export demand.

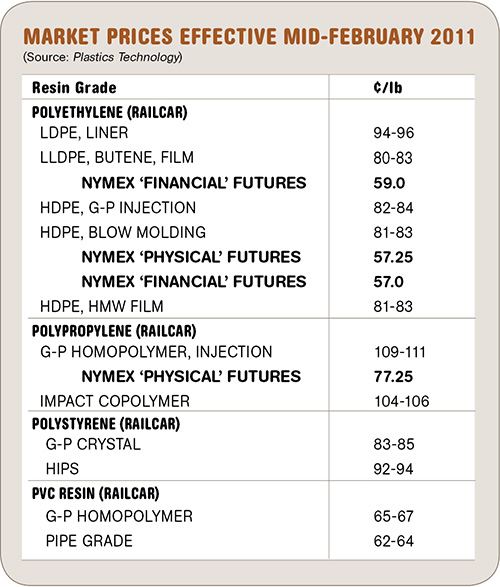

The downtrend in prices for commodity thermoplastics continued through last month due to lower feedstock prices and poor domestic and export demand. But there are signs of a reversal ahead—except for PVC. A key driver is a spike in feedstock costs due to planned cracker shutdowns and, in the case of PE, a rebound in export demand, according to resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas (resinpros.com). Here’s more of RTi’s outlook:

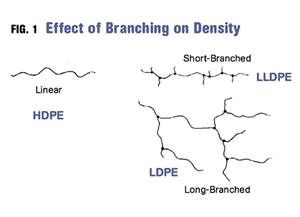

PE PRICES BOTTOM OUT

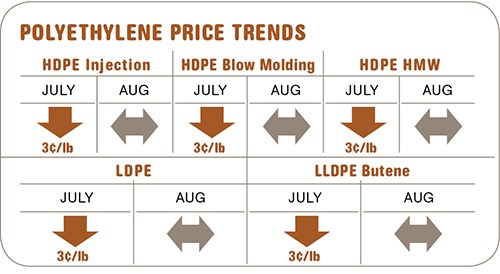

Polyethylene prices dropped another 3¢/lb across the board in July, following June’s decreases of 4¢ for LLDPE and HDPE and 3¢ for LDPE. Through Aug. 1, year-to-date prices were up a net 2¢ to 4¢/lb. The delayed May price hike of 5¢ was pushed up to August; but by mid-month there was no indication that market dynamics would support it. However, market prices appeared to have bottomed out by the end of July, and a new 6¢ increase emerged for Sept. 1.

Since June, market indicators that signaled a likely reversal in the price decline included a drop in operating rates to below 90% and drawdown of suppliers’ inventories, particularly for LDPE/LLDPE, due to increased domestic and export demand. Domestic demand appeared to be largely prebuying ahead of an anticipated price increase. Domestic production decreased by 6% but total sales increased by 4%. Although ethylene inventories were at average levels, six planned cracker shutdowns starting this month are expected to diminish those stocks. Cash cost to produce ethylene is now 35.7¢/lb, up from June’s 30.9¢/lb. Add 15¢ to get the cash cost of 1 lb of PE, according to RTi’s calculus.

Outlook & Syggested Action Strategies

30-60 Days: Upward pricing pressure could continue into next month as a result of supply tightness and higher feedstock costs. Suppliers may reduce inventories as a result of rising exports and five planned PE unit shutdowns through November.

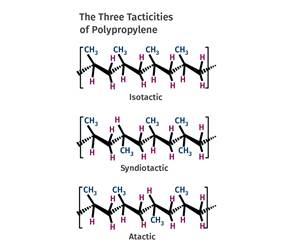

PP PRICES FLAT FOR NOW

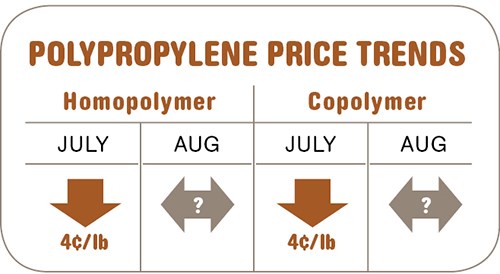

Polypropylene prices dropped another 4¢/lb in July, in concert with propylene monomer prices, which fell to 78¢/lb. Despite an attempted price increase, monomer contract prices for August remained flat. However, PP suppliers issued Aug. 1 price hikes of 3¢/lb in anticipation of a monomer hike, and they still plan to push for higher tabs, but RTi doubts the market will support it.

PP demand through June was lower than expected, boosting suppliers’ inventories by 50 million/lb, adding eight days’ worth to the April level. But suppliers managed production to bring inventories into balance with demand. So far this year, overall demand is down 7.5% and export demand is down 15% compared with 2010. And the secondary market changed abruptly in July when suppliers stopped offering discounts. In July, the market was portrayed as tight even as the industry inventory numbers indicated the opposite.

Outlook & Suggested Strategies

30-60 Days: Prebuy at July prices, as the market appears to have bottomed. Prices are expected to increase due mainly to monomer tightness that will result from planned cracker shutdowns in the next couple of months.

PS PRICES COULD REBOUND

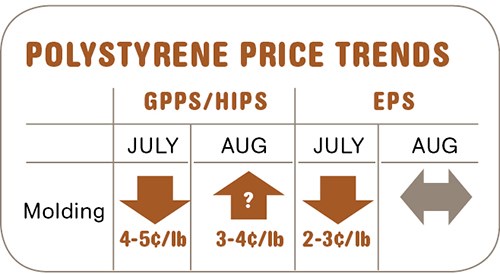

Polystyrene prices dropped by 4¢ to 5¢/lb in July, but suppliers were seeking hikes of 3¢ to 4¢ last month, reflecting rising feedstock costs driven by benzene prices and the continuation of near-record prices for butadiene (for impact grades). This would boost the premium for HIPS over GPPS by a penny to between 12¢ and 13¢/lb. Spot GPPS prices dropped 1¢ in June and 3¢ in July to about 77¢/lb. Spot HIPS prices dropped 3¢ in this period to 87¢/lb. Suppliers’ inventories are very tight at 21 days, about 15% lower than normal.

Meanwhile, spot benzene prices rose 21¢/gal in July, rebounding to over $4.10, and a hefty increase was expected in August contract prices. Styrene monomer prices followed the roller-coaster ride of benzene. After dropping 7¢/lb in June, spot prices were flat in early July and up by month’s end. July styrene contracts settled 5¢ lower, but increases of 3¢ to 4¢ were expected for August.

Butadiene spot prices hit a high of over $2.20/lb in mid-July, and then eased to about $2.03/lb. To put this into perspective, butadiene averaged 46¢/lb in 2009, 92¢ in 2010, and $1.43/lb through the first half of this year. July butadiene contracts rose to between $1.70 and $1.75/lb. August contract price nominations ranged 5¢ to 15¢ higher. Prices are expected to rise further as supplies remain tight due to plant maintenance turnarounds and a move to lighter feedstock cracking.

Outlook & Suggested Action Strategies

30-60 Days: Buy as needed and use competition to limit price increases currently on the table. Prices for September and October are unpredictable due to the recent movement in feedstock prices and the start of the hurricane season. Watch the market for signs that a strategy change is needed.

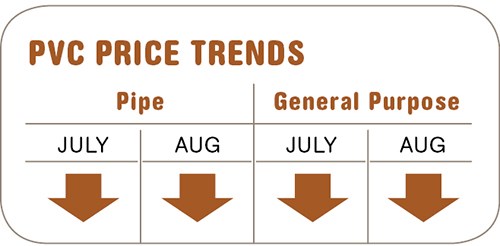

PVC PRICES LOWER

PVC prices have been flat or down since June. Suppliers’ efforts to keep a price increase on the table by splitting the original 5¢/lb June hike across July and August failed. The 5¢ May price increase established a peak in the market.

Total demand fell by 9% in June as domestic and export demand dropped. PVC spot prices continued to dip as ethylene monomer prices dropped and suppliers saw fewer overseas opportunities. Operating rates in July dropped to 80% from June’s 86%, while demand rates dropped to 77% from 84%. Suppliers will try to cut production over the next few months if export demand does not mop up excess resin. PVC feedstock costs through August were expected to be flat or down.

Outlook & Suggested Action Strategies

30-60 Days: Expect more favorable PVC prices due to restarted global capacity, reduced demand from Asia, and lower global feedstock costs, at least until the next round of planned cracker maintenance shutdowns later this year. Ethylene production reliability will be a key factor in domestic pricing trends.

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

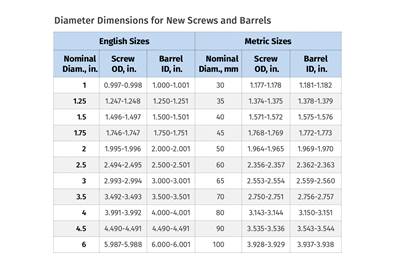

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More