Flat to Lower Pricing for Volume Resins— Except Nylons

Improved supply/demand balance in key feedstocks and resins is steering prices flat to lower, but not for nylons.

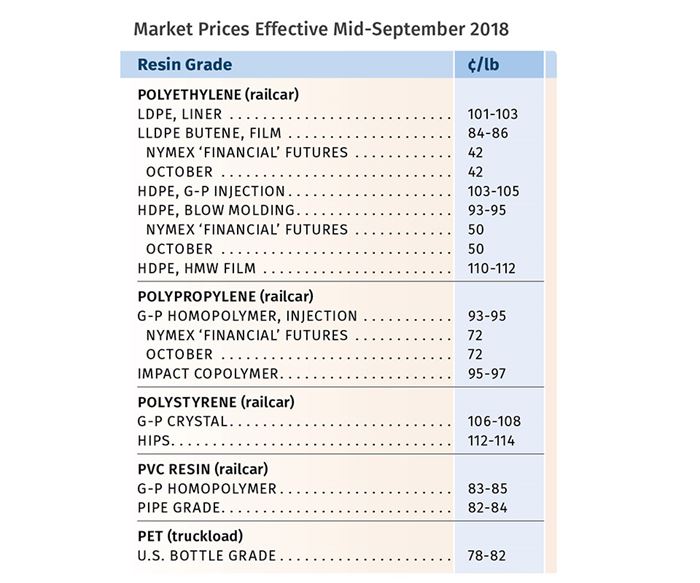

Heading into the fourth quarter, a combination of lower prices for some key feedstocks and improvements in both feedstock and resin availability heralded a flat-to-lower pricing trend for PE, PP, PS, PVC, PET, ABS and PC. In contrast, tight feedstock and resin availability has been pushing prices upward for nylons 6 and 66.

Those were the views last month of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of the Plastics Exchange in Chicago; and Houston-based PetroChemWire (PCW).

PE PRICES FLAT TO DOWN

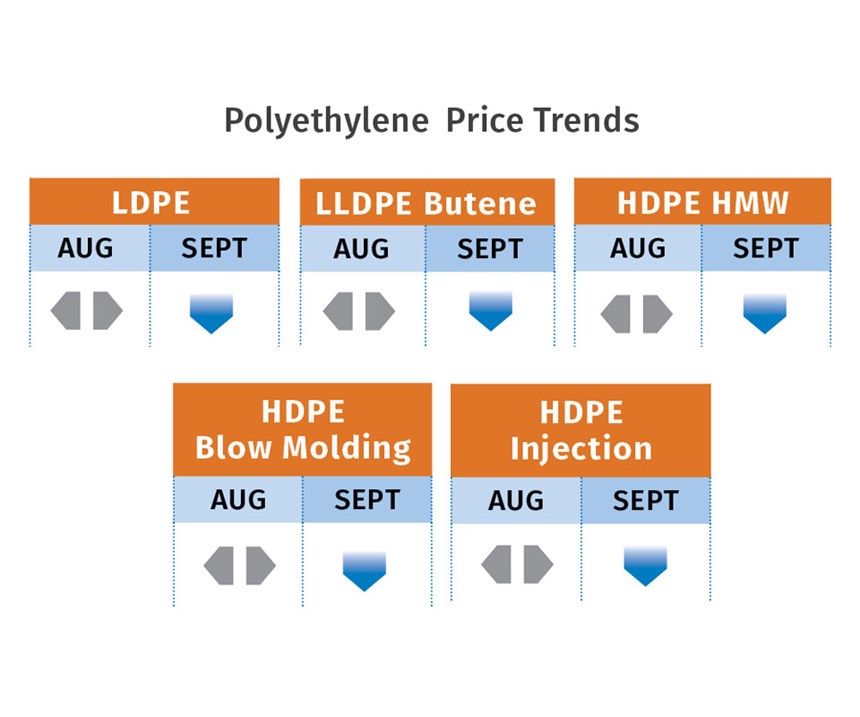

Polyethylene prices were a mixed bag in August, with suppliers offering decreases of 3¢/lb for all PE resins to select processors. Meanwhile, Dow delayed once again a 3¢/lb increase to September and added on a new 2¢ hike. No other supplier took similar action. Mike Burns, RTi’s v.p. of PE markets, ventured that the 3¢/lb decrease would likely be realized by the rest of the industry. “We’re now 3-5¢/lb from the bottom, so there is potential to see a total drop of 5¢/lb before year’s end.” The Plastic Exchange’s Greenberg and PCW both reported soft spot PE prices, with discounts ranging from 1¢ to 2.5¢/lb.

Burns noted that August was the highest production month for PE ever, while at the same time, tariffs newly imposed by China (which accounts for 8% of U.S. PE exports) caused PE exports to drop by about 100 million lb per month, creating an oversupply situation. However, with very good domestic demand, as well as export demand from countries other than China, Burns expects the oversupply to wane.

“What’s good for suppliers is that oil prices are up 2% and expected to keep moving up through the rest of the year, creating more opportunity to export.”

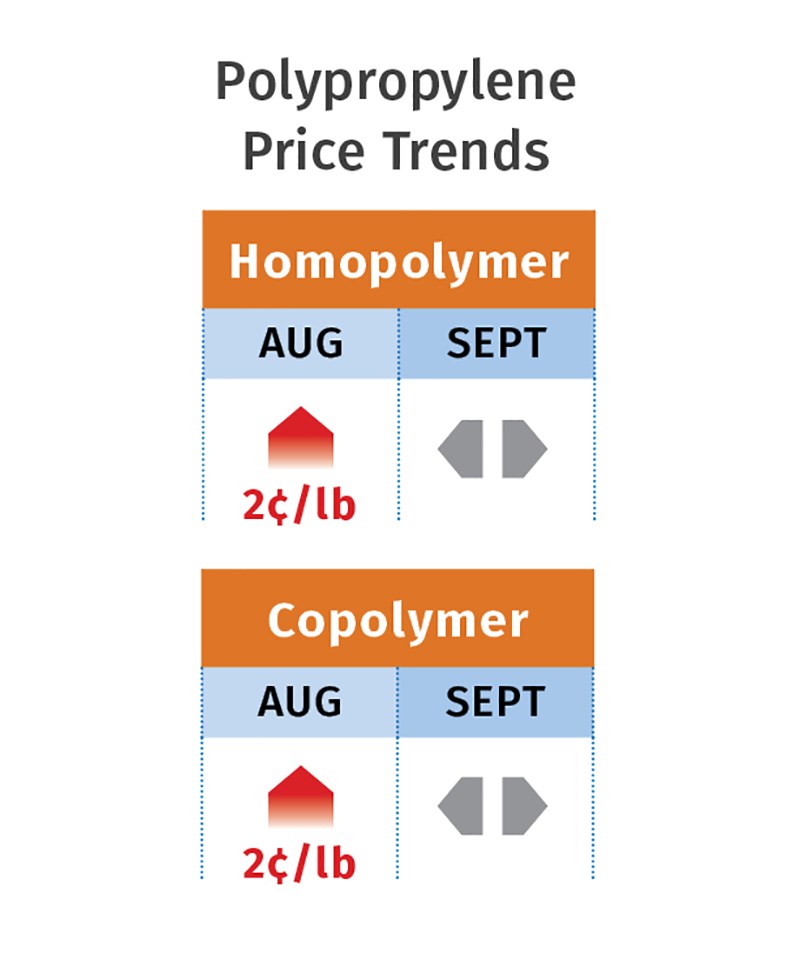

PP PRICES PEAK

Polypropylene prices moved up in step with propylene monomer by 2¢/lb in August. However, end-of-month monomer spot prices were moving down and September contract prices were expected to drop, according to Scott Newell, RTi’s v.p. of PP markets. He predicted that PP prices may have peaked. “The issues with propylene availability have not totally gone away, but we’re seeing some demand destruction for both the monomer and PP.” He also noted that on-purpose propylene plants are up and running again after unplanned outages.

Both Greenberg and PCW reported a very active spot PP market and better availability overall. Industry sources generally forecasted that PP prices could drop 2-4¢/lb in the near term. PCW and Newell both noted that the wide gap between domestic and international prices was attracting imports of resin and finished goods.

PS PRICES FLAT TO DOWN

Polystyrene prices were flat in August, following a 3¢/lb July drop. Price hikes of 4¢/lb for Sept. 1 were issued by both Americas Styrenics and Total. By August’s end, however, Ineos Styrolution had not taken similar action.

Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, anticipated that without the latter’s action, the increase would flounder. Moreover, Chesshier ventured that even if Ineos Styrolution issued a price hike, there would be only partial implementation. “It’s a weak market. Demand is slowing, styrene monomer prices have dropped, pressure from benzene prices is insufficient.” Barring a natural disaster, she expected prices this month to remain mostly flat and trend downwards through the fourth quarter as demand wanes and operating rates decrease further.

Chesshier attributed some of this trajectory to Chinese import tariffs on styrene monomer. PCW reported flat U.S. spot pricing through August and anticipated the same for September. PCW also noted that August PS demand appeared healthy, with adequate feedstock supply. Implied styrene monomer production cost based on a 30/70 formula of spot ethylene and benzene was flat at 32.9 ¢/lb by the end of August, compared with 31.6-31.7¢/lb in late July.

PVC PRICES FLAT TO DOWN

PVC prices continued flat through August and were expected to remain so through last month, with the potential for downward pressure from lower export prices this month, according to Mark Kallman, RTi’s v.p. of PVC and engineering-resin markets. Cost pressure from ethylene was insignificant. PCW noted that the 1.25¢/lb ethylene hike translates to about a half-cent increase in the cost of making PVC.

Kallman noted that production rates dropped along with export demand, but domestic demand was up through much of the third quarter, resulting in a fairly balanced market. PCW reported that some industry sources expected export prices to continue to soften, with a widening delta between export and domestic prices. However, others expected the erosion in export pricing to have hit bottom, and reasoned that export prices will not drop again because the loss of both China and Turkey (driven by tariffs) as destinations for U.S. resin had already been “baked into the market.” PCW also ventured that strengthened demand for PVC from September through November, as has been the case in some previous years, could resist any downward pull from lower export pricing.

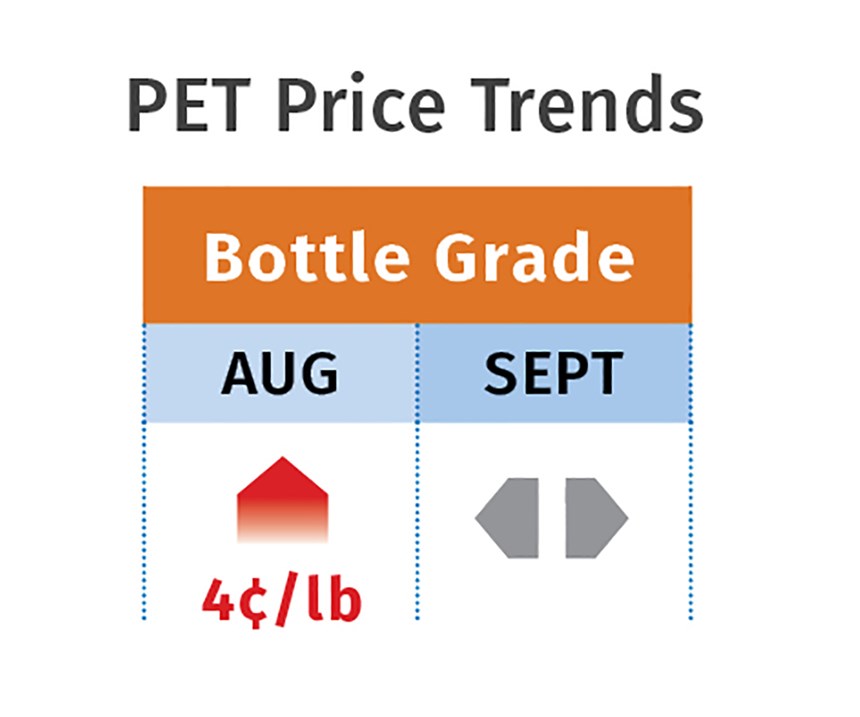

PET PRICES FLAT TO LOWER

Prices for domestic bottle-grade PET ended August at 78-82¢/lb delivered East Coast and West Coast, and at 81-83¢/lb delivered to Midwest locations for truckload business, according to PCW. This was up 4¢/lb from July. Higher prices were driven primarily by strong demand for PET bottles, packaging and fiber going into consumer products. At the same time, higher costs for PET feedstock in August saw PET prices rise for high-volume domestic PET customers with monthly contracts. PET supply from U.S. plants was actually steady from July to August. The first truckload shipments were delivered to domestic processors from the new Apple Grove plant in West Virginia, now owned by Taiwan’s Far Eastern.

Meanwhile, prices of PET imports were at parity with U.S. prices. PCW says the U.S. remains awash in imported PET due to global PET oversupply, especially in South America and Asia, while the U.S. market remains one of the world’s most robust due to its heavy consumption of single-use plastic products.

PCW reported steady PET prices in early September, with expectation that demand would be strong throughout the month, keeping prices 1-2 ¢/lb higher as the summertime carbonated beverage and water-bottle season winds down. But PCW anticipated PET prices in October would taper off by 2-4¢/lb as a result of the typical seasonal drop in demand and robust PET imports. Ramping up production at Apple Grove should also add to a somewhat bloated supply picture as the fall season kicks in, PCW reported.

ABS PRICES FLAT

ABS prices remained fairly stable through most of the third quarter, as they had in the second quarter, following the 5¢/lb increases in January, according to RTi’s Kallman. He expected flat prices in September. Demand has been good, in step with GDP growth, driven by automotive and construction.

Feedstock prices did not increase sufficiently to allow suppliers to push through a new increase. Most importantly, despite a 4¢/gal hike to $2.88/gal in August, benzene has remained below the $3/ gal threshold. And small increases in acrylonitrile and butadiene had insignificant impact on prices. Kallman said some downward pressure could be coming this quarter from lower-cost ABS imports.

PC PRICES STEADY

Polycarbonate prices held flat through the second quarter, and no change was expected through the third quarter. This follows increases of up to 14¢/lb in the first quarter, according to RTi’s Kallman. Upward pressure from feedstocks, particularly benzene, were not an issue; and despite an unplanned outage, the market remains relatively well balanced.

Kallman also noted that despite planned outages this month and good domestic demand from automotive and construction, inventory buildup would ensure that a balanced market would continue. He saw potential for downward pressure in the fourth quarter from lower-cost Asian imports. “However, polycarbonate is on the list for the next round of tariffs, so this reduction may not materialize,” he noted.

NYLON 6 TABS RISING; NYLON 66 SPIKES

Nylon 6 prices were expected to move up 3-5¢ in August, following a 2¢/lb surcharge in July, attributed by suppliers to a shortage of trucks and drivers, according to RTi’s Chesshier, who noted that freight costs rose upwards of 40%. She anticipated upward pricing pressure through September and October, with both BASF and AdvanSix (the former Honeywell nylon 6 business), having issued 5¢/lb price hikes for Sept. 1. In addition to the freight costs, these suppliers attributed their move to tighter supply due to increased demand from processors aiming to switch from nylon 66, along with a tighter caprolactam supply due to unplanned shutdowns. However, because benzene prices have not risen sufficiently, there is potential for only partial implementation.

Nylon 66 prices jumped 10-20¢/lb in the third quarter, in addition to the 15-20¢/lb implemented in the first quarter, driven by a very tight global market, according to RTi’s Kallman. The seven force majeure actions on intermediates—mostly in Europe—through the first and second quarters, were nearly matched in number by more unplanned outages in the third quarter. “Tightness in intermediates is the key problem,” Kallman explained. He cited unplanned production disruptions at key intermediate plants—including precursor ADN (adiponitrile) and derivative HMD (hexamethylene diamine) in France and the U.K., along with other logistical problems such as transportation strikes. In addition, a July fire at Ascend Performance’s Pensacola facility led to a force majeure imposed on its nylon 66 resins, compounds and industrial fibers, further tightening this market. Industry sources reported that the Ascend plant appeared to have restarted in early August and was being brought gradually up to full production, though the force majeure remained in place. Said Kallman, “People are doing their best to qualify alternative materials.”

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

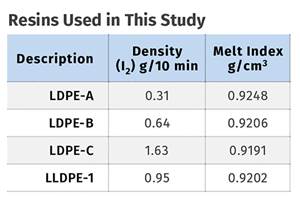

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

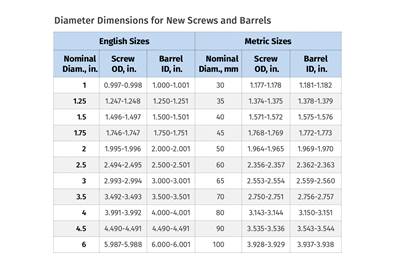

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More