Helping Multi-Shot Molding Taxi for Takeoff

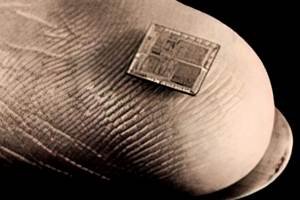

Multi-component molding remains a niche market in North America, yet one with explosive growth potential.

Multi-component molding remains a niche market in North America, yet one with explosive growth potential. Jack Elder is in a unique position to both promote and profit from that growth potential. Elder, an advocate of multi-component molding for about two decades, has founded two companies that approach the technology from different angles.

Multi-component molding caught Elder’s attention in the 1980s when he was an engineer and designer for General Motors, where he evaluated advanced polymers and processing techniques. He discovered multi-component molding on a European trip. “Fickenscher GmbH in Selb, Germany, had developed a new process they called In-Mold-Assembly,” he recalls. “Using multi-material machines and dissimilar polymers, they were molding parts such as toys and automotive HVAC registers, yielding fully assembled components right out of the molding machine. The quality and cost advantages of this process were obvious.” At the time, multi-component molding was on the rise in Europe but was nearly non-existent in North America.

Elder says one reason for that lag has been the added capital investment and tooling costs required for multi-component molding. Traditional multi-component machines were often rigid in their configuration and programming, not ideal for custom molders that need the flexibility to manufacture many different types of products. “That meant higher costs that are difficult to pass on the customer and concerns about utilizing such a specialized machine after a job is completed,” Elder explains. Even today, mold and machinery makers say that no more than 10% of their U.S. sales are for multi-component work.

However, Elder points out that producing fully assembled parts of multiple colors or materials in one mold is reaching critical mass. “This is a tremendous competitive advantage, Elder says. “Traditional injection molding is generally the domain of low margins, so progressive molders are looking to go upscale and establish niche capabilities that set them apart.”

Going out on his own

In 1995, Elder left GM and took an exclusive license for the Fickenscher technology in North America. Together with his brothers, Elder established a molding business named Fickenscher America in Richmond, Ind. Its sole purpose was to produce multi-component parts, specifically movable components made of incompatible materials that don’t bond when overmolded.

His firm focused initially on the automotive sector. “A typical part would be a moveable vent with louvers in PBT, a connecting rod of ABS, and a housing that could be PP,” Elder says. “Although we made a large investment for a multi-component molding cell, we were able to eliminate secondary assembly and deliver high-quality, tight-tolerance products. The margins tend to be better in multi-component molding compared with single-shot, because you are competing only with high-capability firms.”

In 2000, the company name was changed to Innatech. Its multi-component business had grown to include consumer products, packaging, and industrial products. It acquired custom molder Lebanon Plastics in Lebanon, Ohio; expanded into a new molding plant in Richmond; and added a tooling and technical center in Rochester, Mich.

Elder’s newest endeavor is to lower the cost barriers to entering multi-component molding. Two years ago, he founded Multiject in Rochester to supply complete turnkey equipment systems that incorporate licensed tooling know-how and new controls. Multiject has partnered with Digital Technology, a software firm in Toledo, Ohio, to develop methods of controlling mold and molding operations, including robotic handling.

Last year Multiject became the exclusive North American agent of Plasdan, a Portuguese maker of injection units, rotary tables, and tooling. This lets Multiject offer multi-shot systems with hydraulic or electric injection units that are integrated with the press, as well as multi-material molds weighing up to 40,000 lb. Elder developed his own cushion control for the Plasdan injection systems. Multiject will exhibit with Digital Technologies at the NPE show in Chicago this month.

Related Content

Machine Series Debuts for Chen Hsong

Chen Hsong has three injection molding machines in its booth, including 2-platen, hybrid and a next-generation line with improved platen and toggle design.

Read MoreConsistent Shots for Consistent Shots

An integral supplier in the effort to fast-track COVID-19 vaccine deployment, Retractable Technologies turned to Arburg and its PressurePilot technology to help deliver more than 500 million syringes during the pandemic.

Read MoreFakuma 2023: Wittmann Battenfeld Expands All-Electric Line, Direct-Current Capabilities

Wittmann Battenfeld will introduce the new EcoPower B8X injection molding machine line and show direct current as an energy source for a concept machine that will power its own robot.

Read More50 Years of Headlines … Almost

I was lucky to get an early look at many of the past half-century’s exciting developments in plastics. Here’s a selection.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More