Hurricane Lifts Resin Prices Across the Board

Length of Hurricane Harvey’s impact on feedstocks and resins is still uncertain.

Even by the second week in September, following the aftermath of Hurricane Harvey, the full impact on availability of key feedstocks and some resins was still a question mark. Play-by-play update reports were available daily from industry analysts like Houston-based PetroChemWire (PCW) and IHS Markit. Significant recovery was taking place in terms of restarting resin plants, less so for feedstocks. Some 54% of ethylene monomer capacity remained offline and 40% for propylene monomer. New ethylene units slated to come on stream in the next six months will likely be delayed by at least a month. Logistical constraints on truck, railroad, and marine transportation complicated the situation, though rail and marine services were recovering faster than trucking capacity, as motor carriers were diverted to hauling relief and construction supplies and faced traffic congestion.

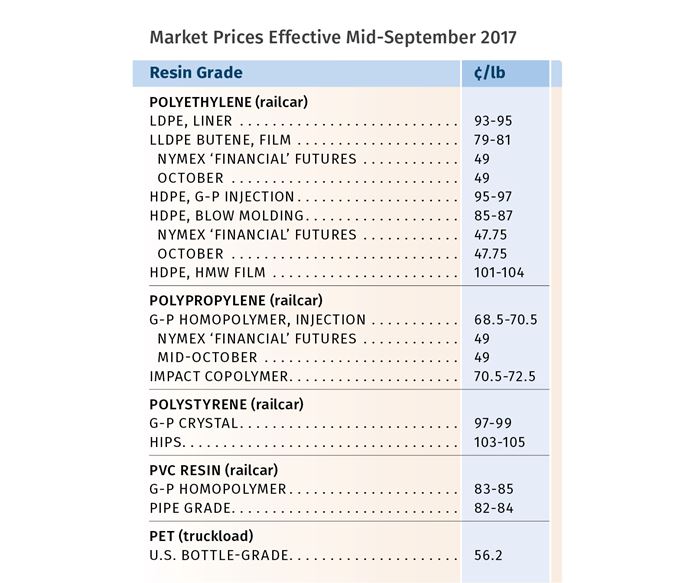

One thing was clear from the outset—the pricing trajectory for pretty much all commodity thermoplastics is upwards, though how much and for how long will vary from resin to resin. These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of Plastics Exchange, The in Chicago; as well as from PCW and IHS Markit reports.

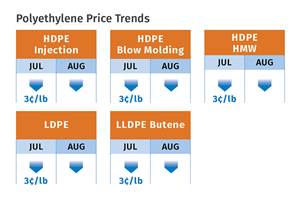

PE PRICES PUSHED UP

Polyethylene prices moved up 3¢/lb in September, and a 4¢/lb increase for mid- September or October was gaining momentum. “Expect firm to higher prices for the remainder of the year, delivery delays, and resin allocations—depending on the speed of recovery,” noted Mike Burns, RTi’s v.p. of client services for PE. IHS Markit added that while PE suppliers typically give their customers 30-day advance notice of a price increase, some were effectively offering less than two weeks.

PCW reported that while the outlook for PE was still unclear—based on unexpected problems that surfaced as suppliers throttled up their plants, it was clear that resin makers would spend September and October refilling their supply lines. Little, if any, incremental resin was expected in the spot market before November, but December could show a dramatically different supply balance, according to PCW. More than 7.7 billion lb of new Gulf Coast PE capacity is slated to come online by year’s end; early indications are that those startups will be delayed by only a few weeks.

Monomer availability did not appear to be a major issue for PE. “While ethylene spot prices have jumped by more than 10¢/lb since last July, ending the week of Sept. 8 at 30.25 ¢/lb, U.S. ethylene prices remain well below international markets, and the recent runup in ethylene prices began before Harvey’s landfall. Construction delays of new ethylene plants appear to be a bigger factor than storm-related problems at existing ones,” PCW reported.

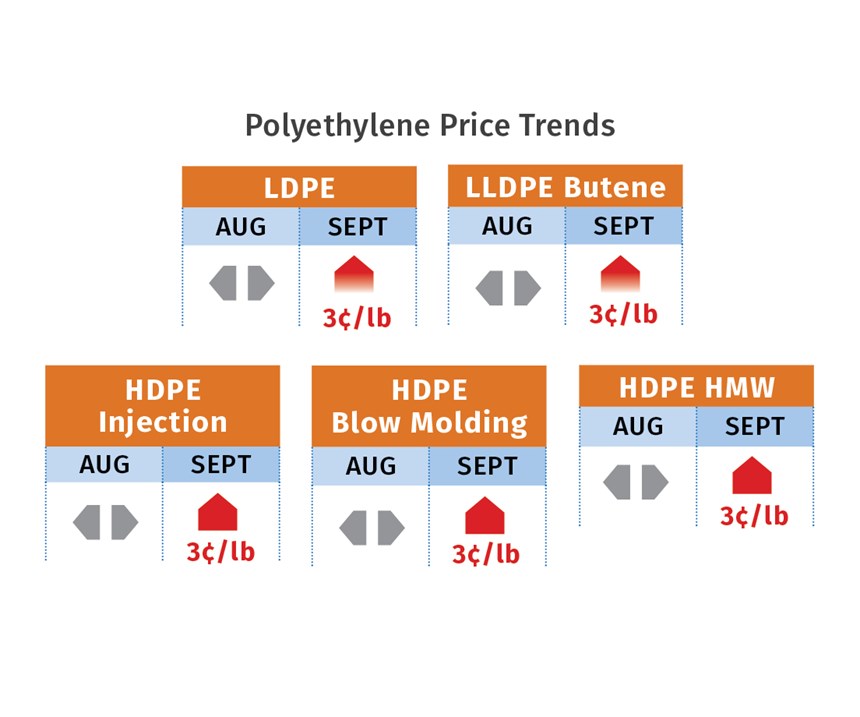

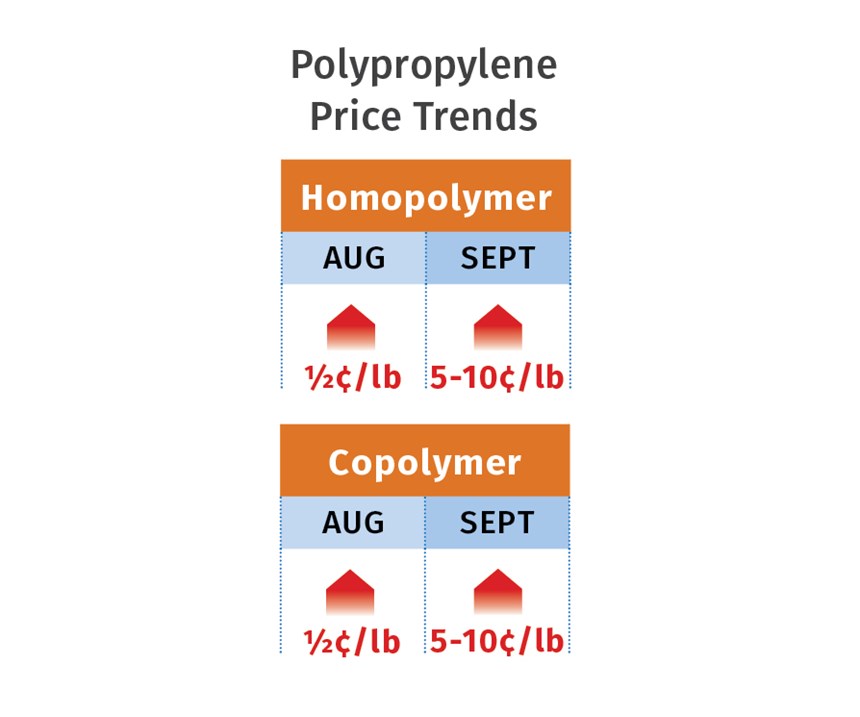

PP PRICES GET A LIFT

Polypropylene prices in August moved up by another 0.5¢/lb in step with August propylene contracts, but processors were facing higher prices in September as suppliers aimed to push through a 3¢/lb profit-margin expansion above where the September monomer contracts might settle, according to Scott Newell, RTi’s v.p. of PP markets. He expected at least a 5¢/lb increase to be implemented.

PCW reported that spot monomer prices had risen by at least 7¢/lb and The Plastics Exchange’s Greenberg added, “Since monomer costs have continued to rise to a level that would already justify a September increase, coupled with the added weather dynamic, PP will likely move higher and bring the elusive margin gain within reach.”

RTi’s Newell characterized PP supplies as on the “tight side of balanced,” except for copolymer, which was already tight. He ventured that PP imports could become attractive. PCW reported industry chatter that the supply impacts of Harvey could linger longer for PP than for PE, as a greater percentage of North American PP capacity was taken offline. “Uncertainty about the restoration of monomer supply was cited as a key concern in the coming weeks.” A couple of PP suppliers had set supply allocations at 70%.

According to IHS Markit’s Sept. 11 update, “We are now assessing that 90% of [PP] nameplate capacity is back up or in startup mode. Unlike monomer units, PP plants are able to start up and reach full rates in a relatively short period of time. [Capacity utilization] is expected to increase to over 90% by early next week and possibly higher. While plants are now running, the next obstacle is logistics and the ability to efficiently move product to customers. We typically estimate near 20 days for most railcar shipments and it is likely we will see extra days added in the near term.”

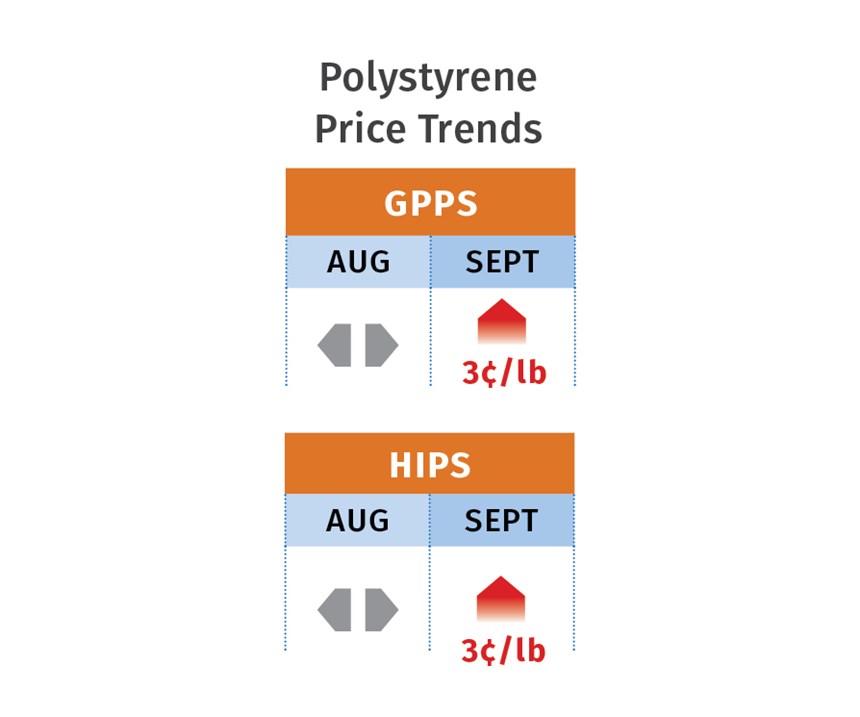

PS PRICES GOING UP

Polystyrene prices remained flat in August as benzene contracts settled flat—this after decreases of 7¢/lb for PS in March/April followed by another 2-6¢/lb drop in July. But going into September, the scenario was changing. Suppliers pushed through a 3¢/lb PS increase in September, according to PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. Although PS production was not affected by the storm, raw materials were on their way up right after the hurricane passed.

September benzene contracts settled at an average of $2.66/ gal, an 18¢ increase. Such a hike would typically put a 2¢/lb cost pressure on PS, noted Kallman. He ventured that PS prices would move up by at least the 3¢ posted for September. What happens to spot benzene and ethylene prices is key.

PCW on Sept. 11 reported that in addition to the minimal overall supply impact on the PS market, styrene monomer availability concerns were fading as plant startups were underway and spot prices were dropping.

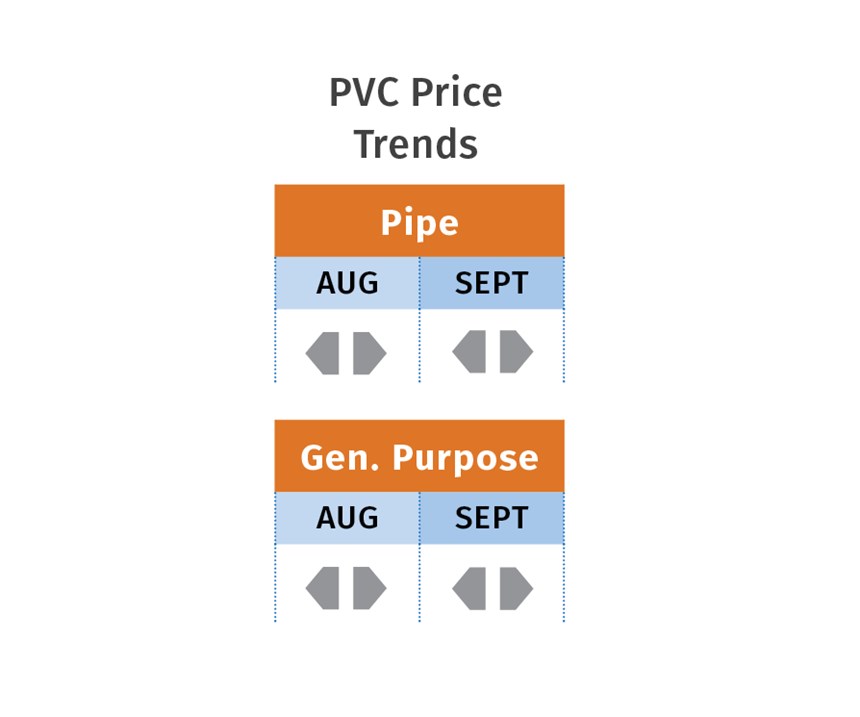

PVC PRICES HIGHER, TOO

PVC prices were flat in August and had potential to remain flat in September, according to Kallman. Two suppliers issued a 5¢/lb increase for Oct. 1. Others were likely to follow. How much prices move up is subject to pressure from ethylene, chlorine, and PVC resin outages, said Kallman. He expected at least the 5¢ hike to go through, with more to follow.

PCW on Sept. 11 said that some VCM production in Texas was still shut down and that PVC plants were running at reduced rates, though no major PVC/VCM plant damages were reported.

PET PRICES COULD TAKE A LEAP

Domestic bottle-grade prime PET prices in August averaged 56.2¢/lb, up 1¢ from July, based on PCW’s Daily PET Report. That price represents a railcar delivered to Chicago. Truckload business is typically 2-5¢/lb higher. The price on Sept. 5 was 60¢/lb, driven by higher feedstock costs and delivery snarls out of Houston due to the hurricane. At least one PET supplier proposed a 7¢/lb increase, for Sept. 1, due to disrupted feedstock deliveries. Others were expected to follow suit.

Imported prime PET, with an IV of 78 dl/g or higher, averaged 53.9¢/lb in August, up 0.4¢ from July. This represented PET on a delivered duty-paid U.S. port basis. The price on September 5 was 57¢/lb, up 1.8¢/lb from July.

ABS PRICES HEADED BACK UP

ABS prices remained flat through July and August, after decreasing 5¢/lb in May—changing the prior trajectory, when prices increased 15-20¢/lb right through April—owing to significant price reduction in key feedstocks. A reversal was well underway in September.

Although ABS resin production was not impacted by the hurri- cane, this was not the case with benzene, styrene, ethylene, buta- diene, and acrylonitrile feedstocks.

Moreover, ABS prices in Asia were higher and ABS imports are a big part of the domestic market, according to Kallman. He saw an increase of 5¢ in ABS prices as likely in the near term.

SUSPENSE OVER PC PRICES

Polycarbonate prices were flat through July and August, having moved up between February and May by a wide range of 10-20¢/lb, owing primarily to a tightly balanced market and strong demand, and despite then fast-falling feedstock costs. But that scenario was already changing in early August, prior to Harvey’s impact, due to a month-long shutdown of SABIC’s Berkfield, Ala., plant, which had further tightened the market, according to RTi’s Kallman.

Add the impact of benzene, propylene, and phenol outages from the storm, and there was ample potential for higher prices. At press time, it was unclear how much Covestro’s Baytown, Texas, facility was affected. There was word that PC production units were operational but possibly not so for feedstocks and intermediaries. Further feedstock price hikes, will lead to PC suppliers seeking a fourth-quarter price hike, said Kallman.

NYLON 6 & 66 STEADY

Nylon 6 prices held firm in July/August, following increases of 2-7¢/ lb in June, which were driven by shortages of caprolactam monomer, according to Kallman. He expected higher prices for nylon 6, driven primarily by benzene prices and continued strong demand from the auto sector.

Nylon 66 prices were largely flat between May and August, having moved up 15-20¢/lb in March/April, according to Kallman. While it appeared that nylon 66 production was not directly affected by the storm, key feedstocks and intermediaries like benzene, propylene, butadiene, and acrylonitrile all were impacted. Ascend Performance, for example, declared force majeure at its Chocolate Bayou facility in Alvin, Texas, and issued a 10¢/lb price increase effective Oct. 1.

Kallman ventured that the price trend for nylon 66 would be similar to PC, as producers of both resins did not pass through significant decreases in feedstock costs through the third quarter. So, if feedstock prices rise farther, a fourth-quarter increase for nylon 66 is likely, since demand has been good and supply is still relatively tight.

Related Content

Prices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

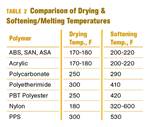

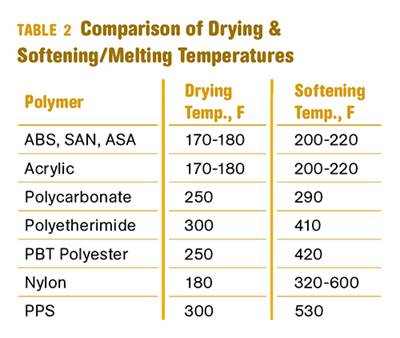

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

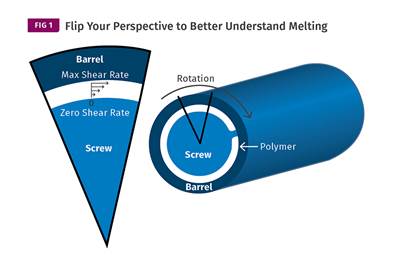

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More