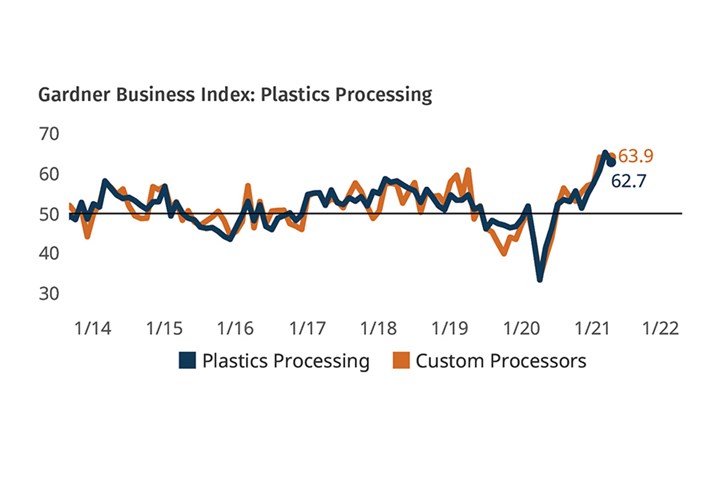

The Gardner Business Index (GBI) for plastics processing fell by more than two points in April, to 62.7, after posting all-time highs in the two preceding months. All activity measures fell from their prior month readings, with the greatest decline observed in new orders and production. While April’s readings were lower than in March, all readings remained above 50, indicating a slowing acceleration in industry activity. (Index values above 50 indicate expansion, while readings below 50 indicate contraction.) Meanwhile, the index for custom processors, at 63.9 in April, was virtually unchanged from March. The Index is based on monthly surveys of subscribers to Plastics Technology magazine.

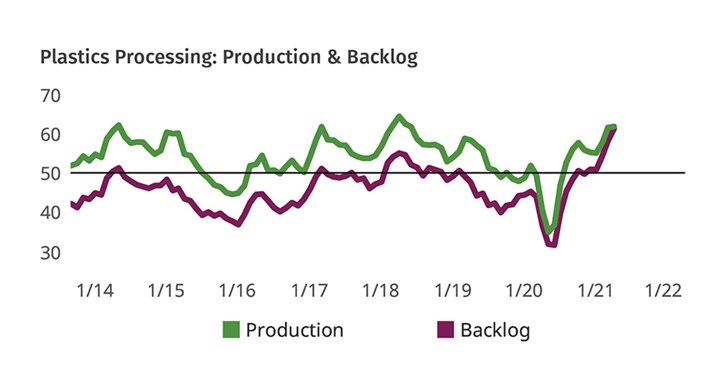

The plastics industry continues to report challenging conditions as processors strive to match surging demand with production that continues to be stymied by disrupted supply chains. The resulting supply/demand imbalance this year has caused an unprecedented shock to backlog activity. Backlog readings have climbed more than 10 points so far in 2021, giving March and April readings the distinction of beating the all-time high reading set in 2012 by over 6 points.

The impact of all of this on pricing has been significant, with nearly all surveyed processors indicating rising material costs. However, unlike other manufacturing disciplines, most plastics respondents indicated that they are passing price increases along to their customers.

FIG 2 Despite a rapid expansion in production activity, backlog activity readings have climbed more steeply this year than at any time since at least 2011.

EDITOR’S NOTE: Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Plastics Processing and Custom Processing Indices serve as a great tool for making data-driven decisions. Thank you to everyone who has previously completed GBI surveys. Your participation helped increased response counts by 15% in 2020, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

ABOUT THE AUTHOR: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Plastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

-

Plastics Processing Contracts Again

October’s reading marks four straight months of contraction.

-

Plastics Processing Contracted Again in March

Processing activity contracted for the ninth straight month, and at a faster rate.

.jpg;width=70;height=70;mode=crop)