Large-Scale 3D Printing Venture Competes with Injection Molding

With 160 FDM printers, a Brooklyn startup offers part runs up to 10,000 units—and soon perhaps 100,000—at prices competitive with injection molding.

Up to now, additive manufacturing (commonly called 3D printing) of plastics objects has not appeared to threaten the business of injection molders. With its elimination of tooling and ability to produce “impossible” shapes economically in lots as small as one, additive manufacturing (AM) seemed more likely to be a useful adjunct to injection molding for applications with very low volumes and un-moldable geometries. But if a startup company in Brooklyn, N.Y., has its way, that reassuring assumption may be about to change.

Located on the fourth floor of a loft building in the not-yet-fashionable East Williamsburg industrial district, Voodoo Manufacturing has been fully operational for just a year this month. Its 5000 ft2 facility includes one open room with computer workstations for design, sales, and other administrative functions; plus a second room, which Schwartz calls the “factory.” Measuring about 2000 ft2, it is full of steel racks holding 160 MakerBot 3D printers.

“We aim to compete with injection molding, something no one ever thought was possible before,” states Jonathan Schwartz, a company co-founder. “Our prices compete with injection molding at volumes from one part to 10,000—but we are much faster. No waiting weeks for tool-up. We can get hundreds of units into production in the next 10 minutes.”

Schwartz is not overly concerned about competition with other 3D printing service bureaus, either. “We are faster, cheaper, and more scaleable than anyone else in the business. We’re half as expensive as the next most affordable 3D print service.”

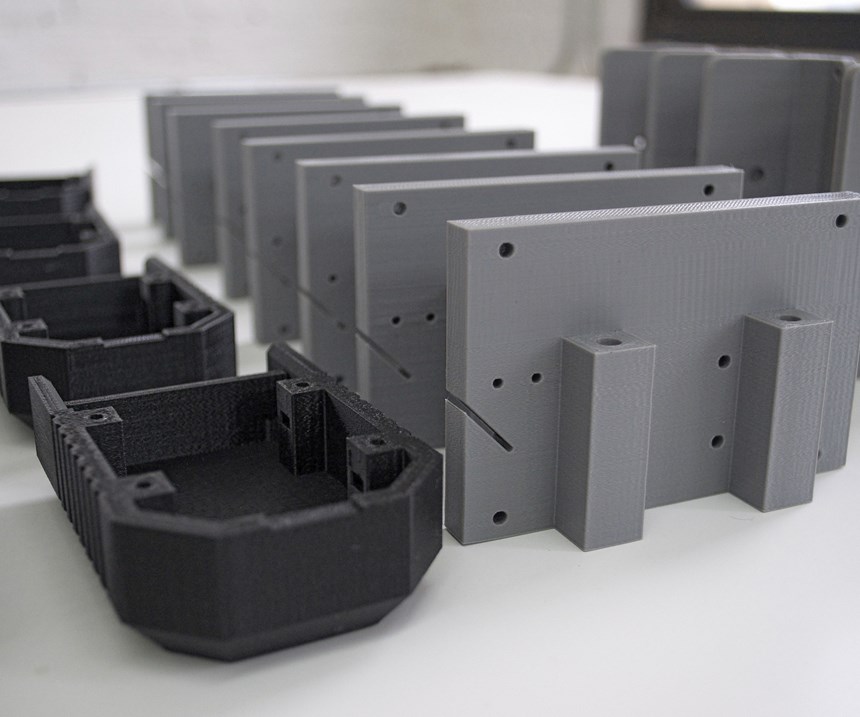

That’s because Voodoo Manufacturing was conceived very differently from its competitors. “Other service bureaus focus on low volumes of high-value parts—aerospace components, for example. We’re the opposite, aimed at high volumes of commodity parts with no high-end requirements for dimensional accuracy. “Our business is built on commodity hardware that we can depreciate in 24 months. But features that used to be available only on $100,000 AM systems now are available on printers that cost only $2000 to $3000. And we modify our printers’ hardware and software to improve yield.”

ITS NOT MAGIC

Despite the company name, there’s no black magic behind Voodoo’s success. Rather, careful planning has been the key. The story starts back in 2012, when three co-founders of Voodoo were engineering and computer science students at Harvey Mudd College in Claremont, Calif. They had an idea for an AM company, “So we quit our internships and went for it.” Called Layer By Layer, their firm developed software that handled e-commerce between 3D printing firms and end users. “We developed software for streaming part designs and built an online marketplace using cloud tools,” says Schwartz.

Their firm was bought by MakerBot Industries LLC (owned by Stratasys, Inc.) in Brooklyn in early 2014. A year later, they left to form Voodoo Manufacturing, together with the fourth co-founder, Patrick Deem, who was head of mergers & acquisitions at MakerBot. “We had spent lots of time with MakerBot machines,” says Schwartz, “so we knew their capabilities and limitations. And we had the software background to make it work.

“We started out assuming that we would have a consumer focus—which proved to be wrong. And we were not focused on prototypes. We saw potential for AM production parts, something others discounted at the time. But we were not going after high-end aerospace components or highly regulated medical parts.”

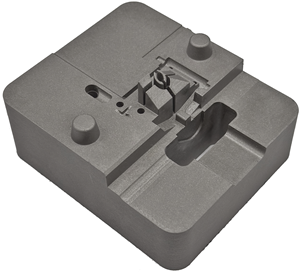

Schwartz is well aware that FDM parts are anisotropic and therefore not equal in all mechanical properties to injection molded parts. But he and his colleagues discovered an unexpected outlet in marketing and promotional products, which Schwartz says is a $20 billion U.S. market. For example, Voodoo made 10,000 coffee-cup stoppers for Dixie, each one unique. Voodoo also serves the toy business (it has done work for Mattel) and industrial hardware—enclosures, fixtures, and internal mechanical components. Thanks to its proximity to the creative community in N.Y.C., Voodoo also makes architectural models, custom clothing mannikins, and movie sets—miniature scale models that are later hand painted and overlaid with computer-generated imagery (CGI). NBC Universal is one of Voodoo’s largest customers, commissioning more than 20 projects in the last year.

Voodoo’s customers range from solo inventors to “marketing professionals who have never manufactured anything before,” says Schwartz. “If you just have an idea, we have a design team to realize it for you.”

The co-founders and principals of Voodoo Manufacturing are Schwartz (now 26), who is chief product officer (CPO); Max Friefeld, 26, CEO; Oliver Ortlieb, 27, CTO; and Deem, 37, CFO. The company employs a total of around 21, including three in sales, a marketing director, two project engineers, five full-time printing technicians, a 3D artist, three software engineers, two mechanical/industrial engineers, a customer support person, and a person in charge of graphic design, branding, and user-interface design for the company website.

Schwartz declines to specify the company’s annual volume more specifically than “under $10 million—hopefully not for long!” In its first year, the firm claims to have served more than 1000 customers, made more than 200,000 parts, and logged more than 500,000 print hours. Its largest order so far was for 18,000 parts—but again, probably not for long.

“We don’t think of ourselves as a 3D printing company,” Schwartz explains. “Rather, we are a digital manufacturing company. That means taking a customer order from a digital file to a physical product.” CEO Friefeld notes that digital manufacturing erases the labor-cost advantages of offshore producers like China.

Voodoo offers two “flavors” of service, as Schwartz puts it. One is direct printing, whereby the customer uploads a digital file, receives a quote, and Voodoo prints and ships up to 20 parts. Orders received before 6:00 pm ship the next day. The other service is volume printing, generally up to 10,000 parts, with a dedicated project manager and customized scheduling. Orders up to 10,000 parts ship in two weeks or less.

Voodoo also offers post-processing such as sanding, spray painting or “chroming,” electroplating (through an outside vendor), and “resin hardening”—dipping in a curable resin for enhanced durability. Schwartz explains that these services are still in “beta” stage and not widely available.

ADDING AUTOMATION

Voodoo Manufacturing uses exclusively Replicator 2 printers from MakerBot. They use FDM technology that deposits a molten filament of thermoplastic in thin layers. Maximum part size is 11.2 × 6 × 6.1 in. and layer resolution is 0.1 to 0.3 mm. Voodoo’s website recommends minimum feature size of 0.1 mm and cautions that part sections <1 mm are very fragile.

Voodoo runs mainly PLA and some TPU (flexible and semi-flexible grades) in 22 colors. In the next six months, Schwartz says the firm plans to add one or two additional materials with higher performance properties.

Schwartz can easily imagine adopting other digital manufacturing techniques in the future—laser cutting, CNC milling, and perhaps other AM technologies—provided the economics are right (he considers some systems to be too expensive for their business). Additive manufacturing with metal powders is not out of the question, either: “It’s a whole different ballgame, but I would love to get there.”

Voodoo Manufacturing has ambitious goals—one being to reduce costs by 90% in the next two years. “We want to be able to increase run sizes to around 100,000 units or more and still be competitive with injection molding,” states Schwartz. One way to get there will be by reducing material costs—Schwartz hopes that as the company’s production volume increases, its unit costs for FDM filaments will decrease. Increasing the firm’s supplier base could also help toward that goal.

Another part of the cost-reduction effort will to trim machine costs by improving utilization, yield rate, and reliability (uptime). Voodoo is aiming to squeeze more parts per hour out of its machines and to operate closer to 24/7.

The third prong of the strategy is to reduce labor costs through advanced software and automation. Proprietary software is already a big part of the firm’s competitive edge, as Schwartz sees it. “When we got started, other people asked us, ‘How do you get 100+ machines to work reliably? I can’t even get the two 3D printers on my desk to work reliably.’ The answer is a central control system. Our Voodoo Operating System (VOS) manages order control and sending production orders to the printers. We have an extremely parallelized system, so if one printer goes down, another takes its place.”

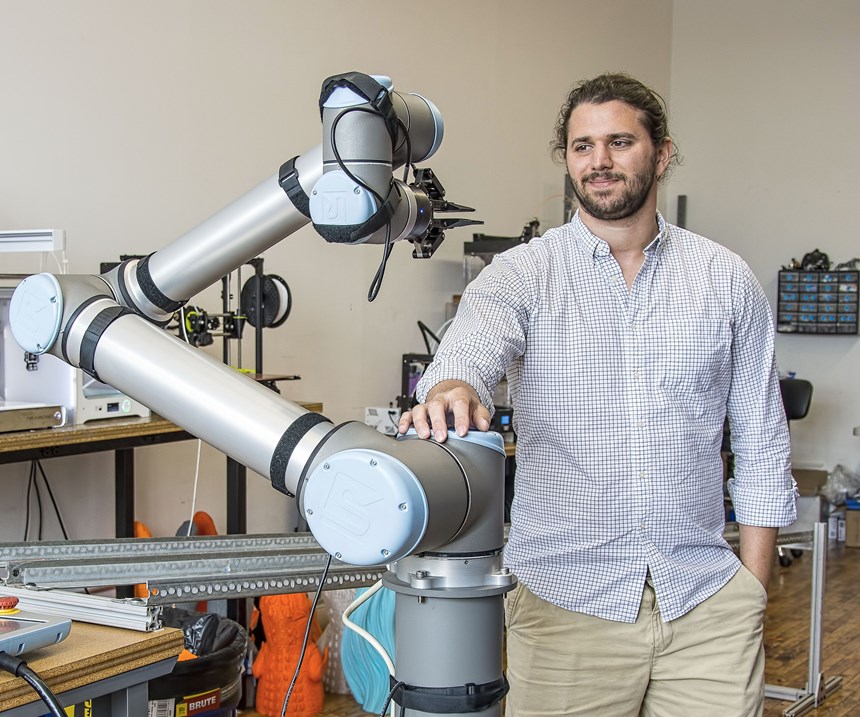

Schwartz also notes that its printers are of relatively simple design and thus easy to repair and maintain. Voodoo has a separate room devoted to a lab for testing new and larger models of 3D printers and also for experimenting with robotics. The firm built its own “Skywalker” robot arm to “harvest” parts from the printers, but is now looking closely at so-called collaborative robots, or “cobots” from Universal Robots USA, Inc., Ann Arbor, Mich. There’s one such machine in the Voodoo lab (see photos) and the firm may purchase another.

Next steps in implementing robotics at Voodoo, Schwartz says, may include adding vision to accommodate slight variations in position of objects to be handled. Adding mobility by mounting robots on a mobile base that follows a track system is another strong possibility. Schwartz believes that a single mobile robot arm could service 100 printers. And besides removing printed parts, changing reels of filament materials is another logical task for automation.

Related Content

Freeform Injection Molding Eases the Path to Medical Device Product Testing

A development and manufacturing service provider is using dissolvable molds to build injection molded silicone prototypes.

Read MoreProduction Tool, Prototype Time

Mantle's metal 3D printing technology targeted toolmaking and injection molders and moldmakers are taking notice.

Read More3D Printing of Injection Molds Flows in a New Direction

Hybrids of additive manufacturing and CNC machining can shorten tooling turnaround times.

Read MoreNew Tool Steel Qualified for Additive Manufactured Molds and Dies

Next Chapter Manufacturing says HTC-45 — an optimized H-13 — will offer superior thermal transfer and longer tool life.

Read MoreRead Next

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More

.png;maxWidth=300;quality=90)