Making the Value Connection In Proprietary Molding

“We make components that go into other devices.

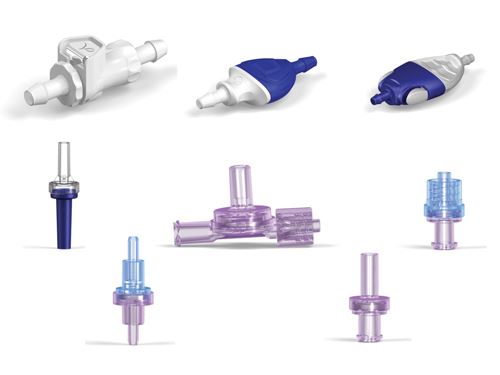

“We make components that go into other devices. If we do it right, no one ever notices our product.” That touch of humility masks the obvious pride that Value Plastics and its operations v.p., John Gibson, take in doing one thing and doing it well. The 45-year-old company has always specialized in plastic fluid connectors, couplings, and fittings. It makes more than 4000 tubing connectors, quick-connect fittings, luer fittings, check valves, sanitary fittings/couplers, and the like.

Most of its products, typically costing under a dollar apiece, go into medical and diagnostic equipment costing tens of thousands of dollars, or into their consumable tube sets. The company’s products are shipped from its plant in Fort Collins, Colo., to Europe, South America, and the Asia/Pacific region. “We are proud to have kept this manufacturing in Colorado,” Gibson says. While not giving out sales figures, he asserts that “our business growth is outpacing that of the markets we serve.”

There’s no exact formula for that kind of success. In the case of Value Plastics, the key terms in the equation are innovative product development, customer service, quality assurance, employee training, automation, and data-driven production management.

HUMBLE BEGINNINGS

Value Plastics was started, literally, in a garage. The original founder had been working for Norgren, a Denver-area specialist in motion and fluid control technologies. He was familiar with brass fittings used in hose connections and had some background in plastics molding. So he believed he could improve on the design and performance using plastics. Typical multi-barbed connectors have a parting line down the middle, which interferes with proper sealing and compromises retention. So, in 1968 Value Plastics was launched to make a better plastic connector.

The firm pioneered the single-barb concept, with the barb created by a mold insert, producing a smooth sealing surface and higher tensile pull capability. This has been the foundation of the company’s tube connector line ever since.

That business is more than 85% healthcare related—medical devices and biotech processing in the pharmaceuticals industry. The rest is light industrial markets, such as inkjet printers and pneumatics.

“One of our big launching pads was in the early 1980s with the need for improved sterility and cleanliness of medical fluid connections and the rise of single-use consumables,” says Riley Phipps, manager of business development and design services. “That created a need for cost-effective medical luer connectors that were disposable, eliminating the need for the critical levels of sterilization that accompanied reuse.” Plastics neatly fitted the bill.

Today, Value Plastics, Inc. has around 100 employees and a 40,000-ft2 plant. The company had 30 injection machines in 2011, a number that has grown since then, which is all Gibson is allowed to say about production capacity. Its machines are mostly under 100 tons, and for the past 17 years, the company has focused on all-electric machines for their repeatability and cleanliness. Energy savings are icing on the cake, Gibson says. The company also has one Engel two-shot machine, which it is using to explore development of products utilizing hard/soft overmolding.

Typical Value Plastics products are small, weighing on average 1-2 grams, though some are much bigger.. The company’s “big three” materials are PP, nylon, and PC, followed by PVDF, ABS, acetal, and acrylic.

In mid-2011, Value Plastics was acquired by Nordson Corp. of Westlake, Ohio, a $1.3-billion global producer of precision dispensing equipment for adhesives, sealants, coatings, and other materials. “Very exciting” is how Gibson sees the resulting opportunities for Value Plastics. “They are strategic owners, not looking at the short term. They have deep roots in the U.S., high-quality products, and high-quality customer service.”

Adds Phipps, “They can help us with international sales and distribution resources, insights, and strategies, as well as expanding into other market areas.”

CUSTOMERS—OR COMPETITORS?

“We are in many regards a niche manufacturer, with a few direct and other indirect competitors,” says Gibson. Some of those indirect competitors are its own customers—or potential customers—the medical device producers, some of which have their own in-house captive molding of plastic fittings and connectors.

Says Phipps, “We have lost business on occasion to our own customers, only to get it back a couple of years later. At times, our customers’ captive operations have bid against us and we still managed to win the business—which says a lot about the value we bring.”

“For many device manufacturers, the fluid connections are often an afterthought,” adds Gibson. “The components look small and simple, but it’s not as easy as it looks. What we offer is 40 years of experience and ready access to design and manufacturing engineers. Choosing whether to make or buy fluid connectors is not always based on the component cost—not when the cost of failure of the OEM product is so high. They don’t want a $10,000 or $100,000 device to fail because of a 20¢ fitting.”

One way to keep customers from becoming competitors is by giving them confidence in the quality of supplied components—“assuring them that we won’t add risk to their product,” as Gibson puts it. “As a component supplier, we’re not FDA regulated but are ISO 9001:2008 certified and have invested heavily in a quality management system that’s modeled on FDA’s GMP [Good Manufacturing Practice]. We are audited regularly by customers—often to ISO 13485 standards,” the international quality standard for medical product manufacturing.

Notes marketing communications manager Will Kiff Stone, “Our Quality Dept. performs internal audits on every department throughout our organization to ensure adherence to our quality process and to identify opportunities for improvement.”

All production and packaging is in an ISO Class 8 cleanroom environment. Materials storage and drying is in a separate room, with automated conveying to the machines, so there are no bins or gaylords in the molding area. All materials used have lot traceability. Value Plastics uses no regrind—it sells its scrap back to the resin manufacturers for distribution to secondary markets.

Gibson also stresses that “we are meticulous about mold maintenance. We will pull down a mold even in mid-run to check that everything is in good shape.” Value Plastics does all its own mold maintenance and repairs and uses only hardened-steel tools. “Some of them have run for as long as 20 million cycles,” says Gibson.

The molds range from one to 32 cavities, and most have moving slides or other actions. Value Plastics maintains tight tolerances, from ±1 mil to 20 mils. “We have very tight standards for gate vestige, flash, etc.—more than most people,” Gibson notes. “We reject standing flash of 2-3 mils, which other people wouldn’t notice.”

Customer service is another key element in the company’s formula for success. “We have a big mix of large and small lots,” Gibson says. “We mold millions of parts a month, but some products sell only hundreds of units per year and some in the millions. We are nimble. We grew up as a service business. We create dozens of new products and product lines every year. We have a 3D printer that we use daily in developing new products. About 10% of our business is custom-designed products to fit a particular customer need.”

As a result, Value Plastics changes molds daily, on average, for every machine, though some jobs do run for several days. The firm uses no specialized quick-mold-change system. Instead, it relies on standardized mold bases and all-electronic documentation of mold setups, maintenance records, and tool configurations—as well as extensive training of its technicians.

Automation is another strategy for quality and efficiency. Value Plastics’ molds are subgated for automatic separation of parts and runners. All the injection machines are outfitted with sprue pickers, and many have robots—often of them 4-axis CNC types that can assist with press-side assembly or packing, or perhaps provide a wrist action for tricky demolding situations.

All machines run unattended 24/7. Value Plastics runs a modified single shift with spread-out hours, so that people cover the plant for 10-11 hours a day. The rest of the time, it’s “lights out.”

DATA-DRIVEN ORGANIZATION

“We have an information-rich environment here,” says Gibson. It starts with Fanuc’s Mold 24i process monitoring on the machines. LCD displays all over the plant indicate machine status at a glance, even from a distance. An ERP system integrates all production monitoring, scheduling, orders, and shipping. “We have a culture of using the ERP resources, which are deployed all over the shop floor. We use handheld devices to scan barcodes for shop orders and packaged products. The barcode follows the product from order to shipping. Nobody ever types in a lot or order number, so there’s never a mistaken identification.”

“We have a completely paperless environment,” says Stone. “Process technicians push carts with laptops. Engineers and setup and assembly personnel all use laptops on the job. And their ERP inputs and updates are shared in real time with the rest of the organization.”

“What’s atypical about us is that we have a very capable and business-centric IT staff in-house,” says Phipps. “They’re always at the table for our discussions, from sales to manufacturing and continuous improvement.”

“We also have a very robust intranet,” adds Gibson. “We’ve defined acceptable ranges for everything, which are distilled down to a color-coded dashboard—green/yellow/red. We use that in every discipline, from scrap levels to on-time deliveries. We get reports, for example, on scrap levels and causes, which tell us whether there is a particular part, process, or material causing problems that is an opportunity for continuous improvement.”

He emphasizes that the firm’s data-driven culture focuses on real-time analysis, “rather than scheduling a meeting to sit down and go over yesterday’s or last week’s numbers.”

Adds Stone, “We have hundreds of position-specific work instructions in our document management system. This helps to make sure every employee is properly trained and empowered to succeed.’

TRAIN, TRAIN, TRAIN

“We’re very employee-centric,” says Stone. “We have a very rigorous training program. We require that every permanent new hire complete this training loop, which consists of sitting with every department manager throughout the company so that the individual gets a beginning-to-end vision of how the company operates and where and how they themselves contribute to the overall success of the business. This also promotes awareness of our focus on efficiency, and we actively encourage employees to offer suggestions of further efficiencies, even if outside their department and role.

“We also have a Department Training Matrix. All departments operate from the same training matrix document, where we have identified over 460 individual training requirements for the various positions here. These range from the macro to micro levels and span on-the-job training, web-based training, and offsite classes. Of these 460, over 50% are on-the-job training requirements, much like formal apprenticeships. Some positions can complete our training requirements within a week, while more technical positions can take as long as a year to become fully trained.”

Related Content

DuPont Buys Medical Product Manufacturer Spectrum Plastics

Purchase price of $1.75 billion for leading supplier of extruded, molded, and 3D printed medical components.

Read MoreSeaway Plastics Acquired

Private equity firm ICG purchased the injection molder and its three facilities located in Florida and California.

Read MoreMedical Manufacturer Innovates with Additive Manufacturing and Extrusion Technology Hubs

Spectrum Plastics Group offers customers two technology hubs — one for extrusion, the other for additive manufacturing — to help bring ground-breaking products to market faster.

Read MorePlastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)