Mixed Pricing Outlook for Commodity Resins for Q4 2021

Up, down or flat--tabs for different resins head in different directions.

(Photo: BASF)

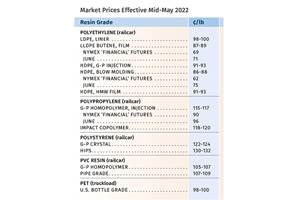

Heading into the fourth quarter, the prognosis for volume resin prices was all over the map, depending on which resin you look at. Downward for PE, PP and PS, all of which have seen record-setting increases. Upward for PVC, PET, ABS, PC and nylon 66 due to factors such as resin, feedstock and/or additives supply constraints and continued high demand. And flat for nylon 6 as the market for this material becomes more balanced.

The impact of Hurricane Ida affected primarily PVC and PS. Louisiana accounts for about 40% of North American PVC production, 25% of PS capacity and 44% of styrene monomer. The storm also affected about 14% of PE capacity and 11% of PP. About 18% of ethylene monomer capacity was also impacted. While there were no major damages to plants reported, a slew of logistical issues followed power outages and flooding.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW); and CEO Michael Greenberg of The Plastics Exchange.

PE Prices May Retreat

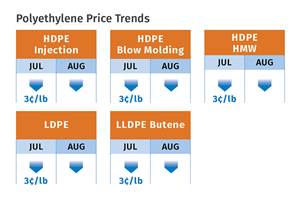

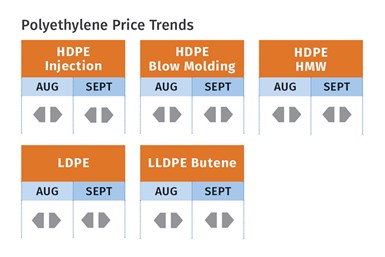

Through July, polyethylene price hikes in 2021 totaled 43¢/lb for L/LLDPE and 41¢/lb for HDPE. But PE prices were flat in August, and though suppliers came out with a 5¢/lb increase for September, signs emerged last month that prices could stay put or even decline. That was the consensus of Mike Burns, RTi’s v.p. of PE markets, PCW senior editor David Barry and The Plastic Exchange’s Greenberg. Hurricane Ida proved to be nearly a “non-event” for PE, according to Burns, with most plants back in full operation within two weeks after brief shutdowns primarily from power outages in Louisiana. Both Burns and Barry said supplier inventories were in pretty good shape. “LDPE and LLDPE capacity is totally recovered and HDPE is close to it,” said Burns. Added Barry, “Barring another disruption, there’s good likelihood for downward pricing starting this month. Suppliers need to export material and those prices have to come down and domestic prices will follow.” These sources say the premium on domestic over export prices has been well over 50¢/lb, vs. a more typical 10¢.

Greenberg reported that spot PE prices were moving lower, while trading picked up to a “more normal pace as availability continued to improve. Although pricing was somewhat better for buyers, it is still close to record highs established earlier this year. Notably, several transactions were completed in HDPE blow molding and LLDPE injection grades, which have both been difficult to obtain.”

PP Prices Heading Toward Correction

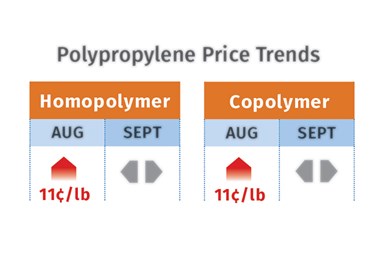

Polypropylene prices moved up 11¢/lb in August, in step with propylene monomer. While September was a “wild card,” awaiting recovery of monomer supply after unplanned shutdowns, potential for a significant price correction—possibly in the double digits—before year’s end was foreseen by Scott Newell, RTi’s v.p. of PP markets, as well as Barry and Greenberg. According to these sources, pushback from buyers blocked PP suppliers from passing through a 5¢/lb non-monomer increase.

Supplier PP inventories are back up to near normal levels, with 32.8 days of supply vs. 20.7 days in February, and production rates are in the low 90s percentage range. Meanwhile, demand has backed off a little for food packaging and some consumer goods, according to both Newell and Barry. Any supply impact from Hurricane Ida was expected to be felt mainly on impact and random copolymers.

Greenberg reported that spot PP prices already dropped a bit in early September as supply continued to improve. “There were plenty of offgrade railcars that continued to pelt the spot market, and some generic prime also appeared, though the market is certainly not awash in resin. Prime truckloads for prompt availability were mostly supplied through imports already here, and more is still on the way.”

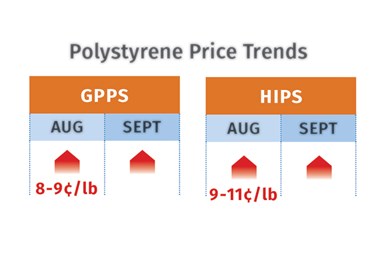

PS Prices Up For Now

Polystyrene prices rose 8-9¢/lb for GP grades and 9-11¢/lb for HIPS in August, due to butadiene supply constraints. Before Hurricane Ida, PS prices were expected to start declining by the fourth quarter, if not sooner. The scenario was reversed in September, though no increases had been announced, according to Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, and PCW’s Barry.

Adding to the fact that more than 40% of U.S. styrene monomer is produced in Louisiana, was the unplanned shutdown of Total’s PS plant in Carville, La., prior to the arrival of Ida, and no restart timetable was immediately available. The plant accounts for approximately 25% of North American PS capacity.

While Chesshier and Barry found it difficult to predict what October PS prices would look like, they agreed that “normal” market drivers would dictate downward pricing, but they cautioned about the impact of logistical issues. Said Chesshier, “We’re at record pricing for PS and there’s demand destruction taking place, so flat to downward pricing is likely for the fourth quarter barring further production disruptions.” Both sources noted that feedstock prices will play a role, though future projections for both benzene and styrene monomer were flat to down.

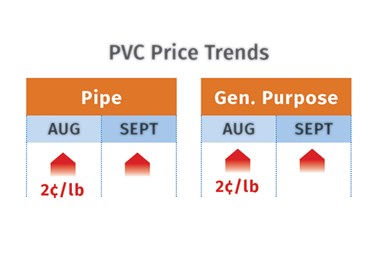

PVC Prices Higher

PVC prices moved up 2¢/lb in August and were expected to rise another 2¢/lb in September, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. She reported that approximately 40% of U.S. PVC production was shut down after the hurricane. Although no major impact for any of the plants were reported, there were difficulties in supplying industrial gases to restart the plants. These sources surmised that if full production resumed in September, PVC prices could hold steady in October.

However, there were real concerns about logistics—rail and road flooding, etc. Kallman characterized the market as tightly balanced, noting that PVC processors did not have large resin reserves before the storm and suppliers had not rebuilt adequate supplies as yet, while demand remained strong.

PET Prices Buoyant

PET prices gained 0.5¢ to 1¢/lb in August and there were some efforts by suppliers to implement surcharges of 2¢ to 3¢/lb in the third quarter, part of which was likely to be in place by that quarter’s end, according to RTi’s Kallman. Supporting these increases was the higher cost of feedstocks owing to supply constraints brought on by planned and unplanned outages. Prices of PET imports were also rising due to logistical issues.

ABS Prices Pushing Upward

ABS prices remained flat through August, after having risen a total of 44¢/lb through June, according to RTi’s Kallman. Some suppliers were seeking an 8¢/lb increase for September, amid supply constraints due to production issues and strong demand from automotive, electronics and construction. ABS imports, which have typically been the lower-cost option, are now closer to domestic resin tabs. Fourth-quarter prices will depend on trends in demand and supply.

PC Prices on the Rise

Polycarbonate prices, having gained on average of 40¢/lb in the first half of 2021, were on an upward trajectory by early September. Suppliers issued price increases from 11¢ to 15¢/lb, which would most likely be implemented by this month, according to RTi’s Kallman. Driving the recent increases is supply/demand imbalance. Demand for PC has been pretty strong, but PC compounders have had difficulty getting additives such as glass fiber, UV stabilizers, and flame retardants—primarily sourced from Asia—due to logistical problems and high freight costs.

Further Hikes Loom for Nylons

Nylon 6 prices remained stable through August, having moved up a total of 60¢/lb in the first half of 2021, but there was potential for another increase in September-October, according to RTi’s Chesshier. She attributed this to seasonal demand, particularly from Asia, with no major pressure from feedstock prices. She saw supply now coming into balance with demand, despite some hiccups.

Nylon 66 prices were flat through August-September, having risen a total of 29-40¢/lb through the year’s first half, but further increases were possible for fourth quarter, according to RTi’s Kallman. He noted that nylon 66 compounders faced the same issues as PC compounders regarding getting supplies of key additives from Asia. “There is potential for a price hike in the fourth quarter if there’s some sort of supply disruption and demand continues to be strong,” he said.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreStill an Up-and-Down Picture for Commodity Resin Prices

Supply/demand imbalances or sharply rising feedstock costs account for the mixed pricing trajectory for the five biggest-volume resins.

Read MoreMixed Pricing Outlook for Commodity Resins for Spring 2022

Prices of PE, PS may have peaked; they were slightly down for PP and PET, up for PVC.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More

.png;maxWidth=300;quality=90)