Mixed Signals on Resin Prices

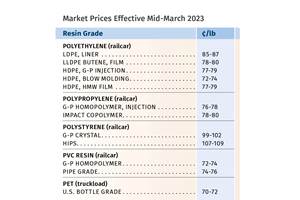

Prices of PE, PVC and PET were flat in March, while PP dropped and PS moved up.

Arrival of the second quarter saw a mixed trajectory for prices of the five major commodity resins, with PE, PVC and PET generally flat, PP dropping, and PS moving up. While the key drivers varied to some degree, there was a general sense that the overall softness in demand through the first quarter was coming to an end in April. Still, barring the surprise occurrence of some serious event, there were no major price surges projected for this quarter. These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW), and CEO Michael Greenberg of The Plastics Exchange.

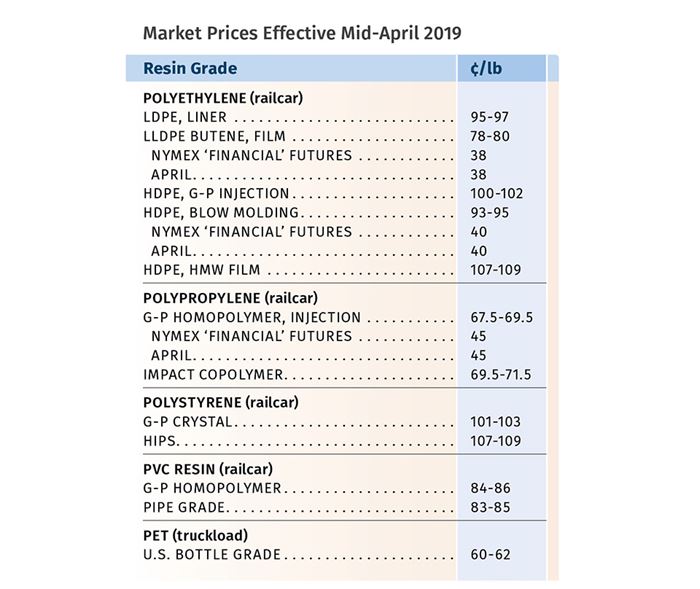

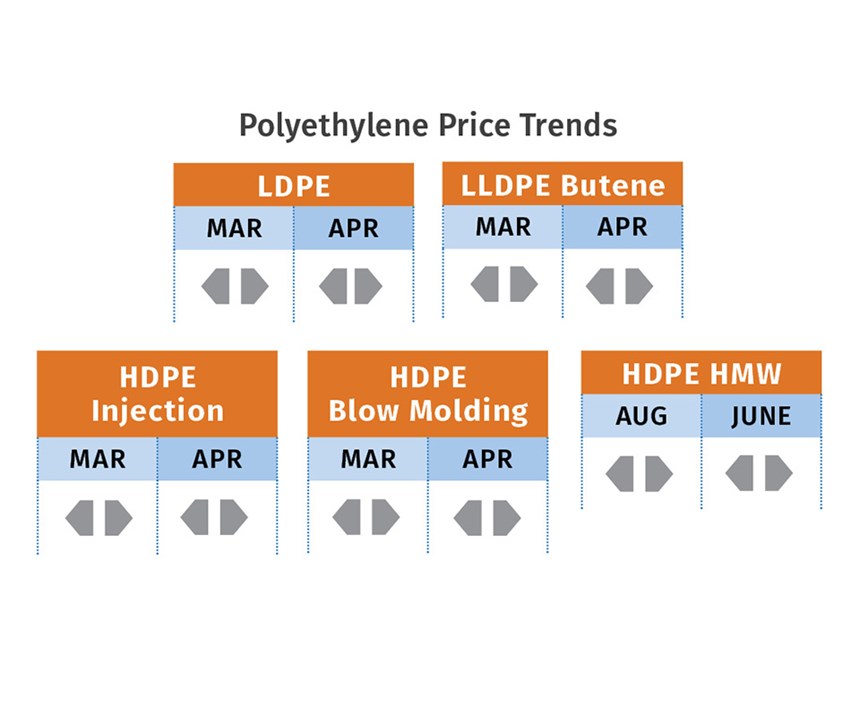

PE PRICES FLAT

Polyethylene prices were flat in March, making this the first time in 10 years that PE pricing did not change in the first quarter, according to Mike Burns, RTi’s v.p. of PE markets. Suppliers generally delayed their 3¢/lb March increases to April. PCW senior editor David Barry reported that both Dow Chemical and ExxonMobil had issued additional 3¢ hikes for April 1.

Burns anticipated significant downward pricing pressure last month, but continuation of higher oil prices could help keep prices stable. Similarly, Burns ventured that China tariffs—if lifted or further delayed—could also impact demand and exports. In fact, Burns ventured that through the second quarter, barring any major production disruptions, record-high PE inventories would continue to suppress price increases and could even result in downward movement of about 3¢/lb. Oil price surges would be the only driver that could change this likely scenario.

The Plastic Exchange’s Greenberg reported on a strong spot PE market through the first quarter. Going into April, he reported, “Processors have been drawing down their inventories since November and they are now getting quite low; we expect better buying to return in the months ahead.” All sources expected spot PE prices to increase in April. PCW’s Barry reported spot supply as mostly balanced, with LLDPE grades especially plentiful as the startup of Sasol’s new plant added product to an already flush market.

RTi’s Burns said first-quarter export volume remained at historic high levels, and Greenberg reported that export prices had risen 1-2¢/lb from their cyclic low.

Meanwhile, nearly 10% of ethylene monomer production was expected to be down for plant maintenance in second quarter. Its price remained at 15¢/lb. The cost to produce ethylene remains near 13¢/lb. The cost to make a PE pellet is near 30¢/lb for integrated producers, according to Burns.

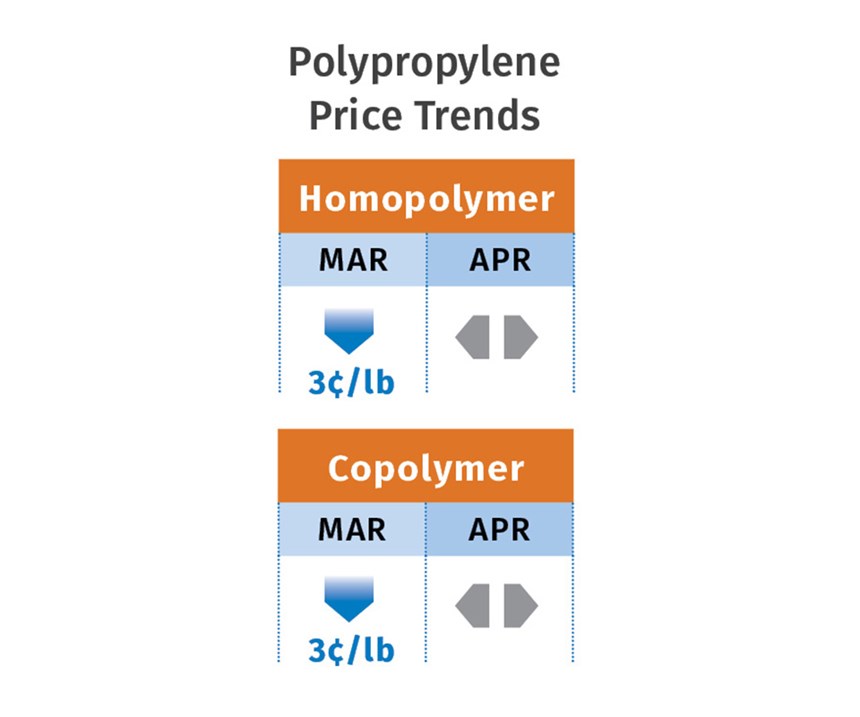

PP PRICES DOWN

Polypropylene prices dropped 3¢/lb in March, in step with propylene monomer March contracts, which settled lower at 35.5¢/lb. The Plastic Exchange’s Greenberg saw the net effect as bringing the first-quarter price down to 6.5¢/lb and “the total decrease since October to a whopping 24.5¢/lb.” Resin prices were expected to continue to track propylene monomer, perhaps bottoming out, according to both PCW’s Barry and Scott Newell, RTi’s v.p. of PP markets. All sources characterize this as a “buyers’ market” and expected a revival of demand in the second quarter. Newell projected flat to slightly higher prices this month, depending on demand.

Said Newell, “April will be an interesting month. We’ve had negative growth rates so far this year. Monomer inventories are high and PP inventories are starting to balance out a bit more, though suppliers are still discounting trying to move material.” Barry said there was a lot of spot PP that was highly discounted from contract prices through March. But going into April, he reported spot PP prices as steady and expected suppliers to “test the market with higher prices.” He also reported that PP supplier inventories were believed to be falling, along with an uptick in export activity and domestic demand.

Greenberg reported that some change appeared to be underway, “Demand has been off so far this year as processors drew down from their on-hand resin inventories; however, with the March decrease intact, some processors are recognizing value at this level and have begun to slowly procure more material than their current usage. It will be interesting to see if this trend gains steam.”

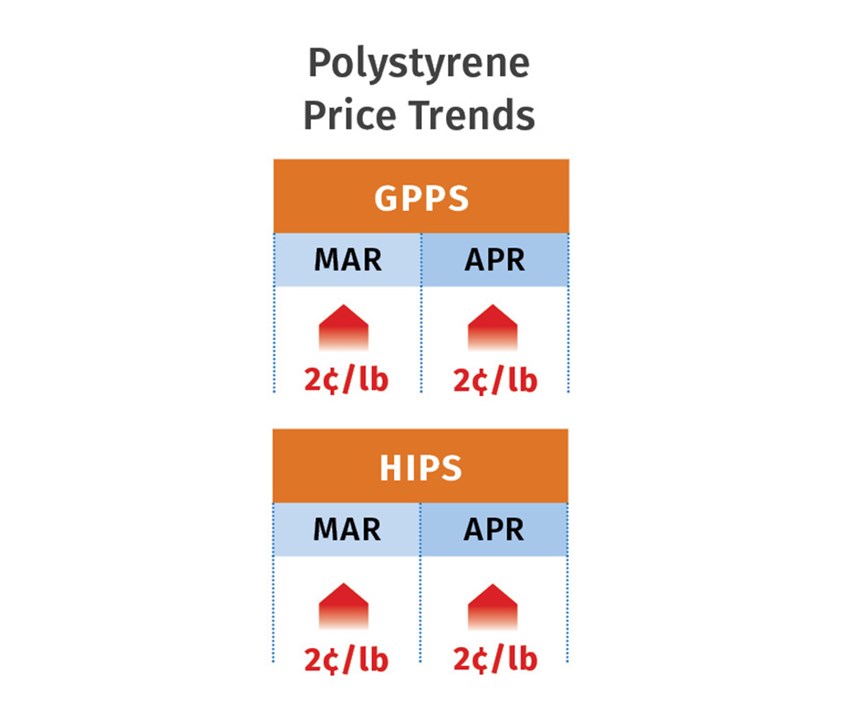

PS PRICES UP

Polystyrene prices moved up 2¢/lb in March, and all suppliers issued increases of 4¢/lb for April 1. The upward movement was driven by rising benzene prices and tight styrene monomer supply, according to PCW’s Barry. He and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, noted that while the hike appeared initially to have a good chance for full implementation, spot benzene prices abruptly dropped and ethylene prices were also down.

Both sources ventured that suppliers could get a 2¢/lb increase through last month. Barry reported that the implied styrene cost based on a 30/70 formula of spot ethylene/benzene was down 2¢/lb to 23.7¢/lb going into April, returning to February levels. These sources concede that feedstock costs vs. demand will continue to drive PS prices. Chesshier noted that plant utilization rates were in the low 70s. Based on predicted pricing curves for benzene, Barry ventured that the remainder of second quarter would see PS prices flat to higher. He noted that feedstock supply disruptions to inland PS plants was a concern, given forecasts of extreme river flooding in parts of the Midwest. Chesshier noted that some suppliers were signaling another price increase.

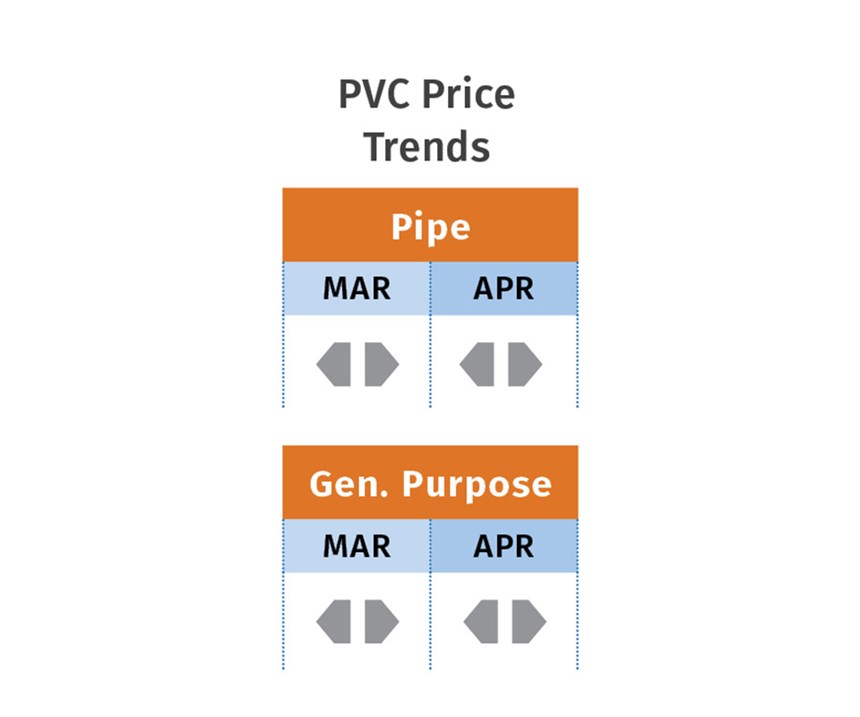

PVC PRICES FLAT TO SLIGHTLY UP

PVC prices appeared to have ended March flat. While suppliers had not rescinded their 2¢/lb hike, at least one industry pundit ventured that barring a major disruptive event, a price reduction of about 1¢/lb was inevitable for April, reported PCW senior editor Donna Todd. Both Todd and Mark Kallman, RTi’s v.p. of PVC and engineering resin markets, noted that spring demand was emerging but it remained to be seen how strongly. Both sources also commented on the flooding in the Midwest that was expected to last through April and was causing shipping delays as railroad tracks were submerged.

Kallman ventured that there would be some upward pricing pressure this month as demand picks up. Still, he noted that domestic and export demand would be the sole driver for upward pricing. “There is no pressure from feedstock costs (e.g., April ethylene contracts were expected to drop) and export prices are not as robust as in 2018.” Moreover, he characterized the market as well supplied, with plant utilization rates still in the low 80s. He expected PVC prices this month to be flat to slightly up.

PET PRICES FLAT TO HIGHER

Prices for domestic bottle-grade PET started April steady in the low 60¢/lb range. According to PCW senior editor Xavier Cronin, business was seen for rail and truck delivery to locations in Chicago, Texas, California and Georgia. Abundant imported PET from around the world, including China Turkey, and Vietnam, continues to compete with PET made in the US.

Demand was expected to rise last month as "bottle season" began to emerge, according to a buyer of PET bottles and packaging for a supplier to consumer brand companies. Cronin noted that market sources were predicting PET prices would move up to the mid-60¢/lb range by April’s end. Cronin noted that prices in May typically rise 1-4 ¢/lb as seasonal demand for PET bottles kicks in. However, he ventured that “chunky import supply” could give buyers pricing leverage with distributors and those representing foreign producers offering resin at a discount to domestic PET for spot delivery. In some cases, PET producers would possibly have to discount prime resing to clear out inventories.

Related Content

VCM in the News Again, Not in a Good Way

Those three letters, V-C-M, stood out from the headlines of the toxic train wreck in Ohio this past week — bringing up echoes of a time that few may remember today, when the vinyl industry was in an uproar over reports of VCM hazards in the workplace and possibly in PVC food packaging.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.png;maxWidth=300;quality=90)