Seven years ago, bowing to customer requests and in a bid to better exploit a growing market, Integrity Tool and Mold opened a 20,000-ft2 facility in Mexico. Initially focused on maintenance and engineering changes for existing molds, the operation in Querétaro generated enough business that after just two years it was doubled to 40,000 ft2.

Two years later in 2015, still experiencing tremendous growth, including branching into new tool builds, the company faced a decision. Space-restricted at its location, but still sensing the potential to expand, the Windsor, Ont.,-based moldmaker opted to nearly triple its Mexican operation, electing to construct a new greenfield site in Querétaro.

“We knew we’d already doubled size at the original plant, and we were landlocked at that point,” explains Wayne McLaughlin, plant manager at Integrity Tool and Mold de Mexico. “We saw a lot more opportunity coming, but we were at full capacity. It spawned the idea for this new plant; and at the same time, we were hearing a little bit from customers about better tryout support and the possibility of supporting them with service part runs.”

The company broke ground on the 118,000-ft2 facility in the third quarter of 2016, and by June 2017, it began moving into the new space. When Plastics Technology visited in the fall of 2018, each of the three bays were filled to varying degrees with equipment, while the administrative space, including a cafeteria, neared final completion.

“Our capable capacity in Mexico has tripled,” McLaughlin says. “We’re not to that level yet, but the infrastructure is here to do that.”

AUTOMOTIVE MARKET ACCELERATES

As automotive OEMs and their tier suppliers set up factories in Mexico, the country’s tooling industry is expanding rapidly alongside the burgeoning transportation sector. According to business information source IHS Markit, the 13 OEMs currently making light vehicles in Mexico—including BMW which will open its plant in San Luis Potosi in 2019—will produce just shy of 5 million automobiles in 2021, up 48% from 2015. In terms of part production, IHS Markit forecasts that by that time, Mexico will rank fourth globally, trailing only China, the U.S. and Japan.

Speaking at the Amerimold 2018 conference last June in Novi, Mich. (organized by PT parent Gardner Business Media), Eduardo Medrano, president of Mexico’s tooling association (AMMMT), said that the $3 billion worth of tools and dies imported by Mexico in 2017 made it the second largest market in the world. Only 5% of what the domestic market required was made locally.

Because of the lack of domestic tool makers, Medrano said that Mexico imported an estimated 5000 plastic injection molds in 2017, supplied mainly from China, the U.S., Canada, South Korea and Germany for larger tools. For smaller molds, the top sources were, in order, the U.S., China, Germany, South Korea and Canada.

According to AMMMT, there are currently 265 mold and die shops in Mexico, including 30 with foreign investment or ownership. These generate an estimated $175 million in sales, employing 3400 workers and running 1000 CNC machines to serve 695 local customers.

BUILDING FOR THE FUTURE

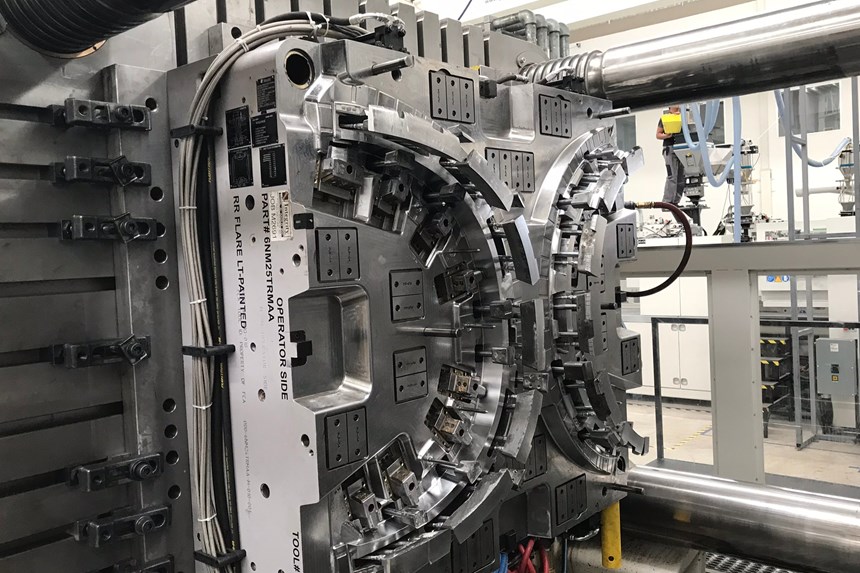

Integrity is banking on continued growth for moldmaking in Mexico, building in specialized capabilities and scale to its new Querétaro site with an eye to future needs. In addition to two 10-ton systems, the facility has a 50-ton overhead crane to take on extra-large tools, including bumper fascia molds. The first bay, adjacent to the administrative offices, features injection molding capabilities, with five KraussMaffei and Haitian presses ranging in clamp force from 320 to 2300 tons. Integrity has two 2300-ton KraussMaffei presses in this bay, including one capable of running up four different materials at a time. Beyond mold trials, Integrity says its molding capabilities are intended to support customers in emergency production situations. At the back of the bay, Integrity has installed a complete material-handling and drying system from Novatec.

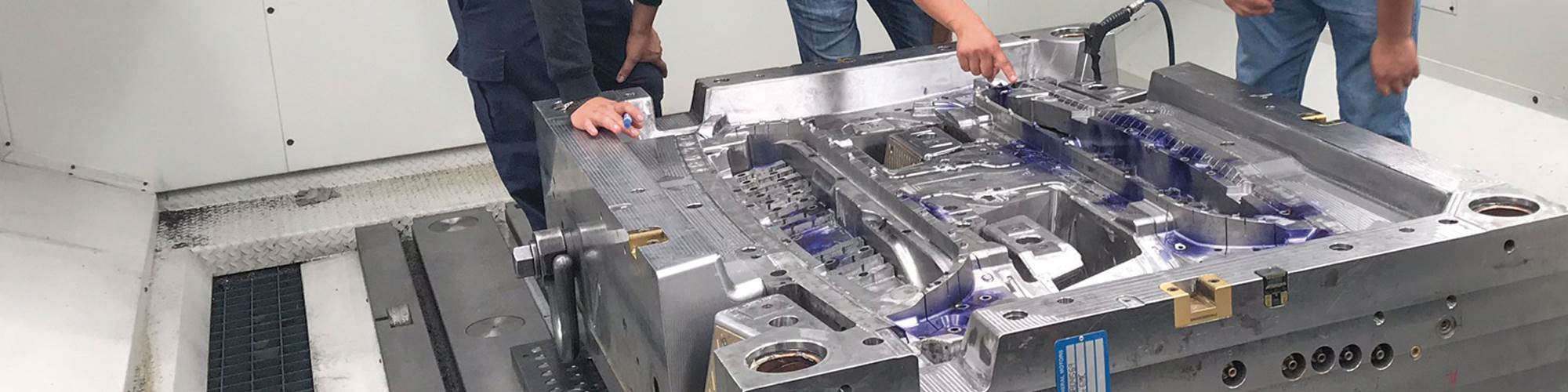

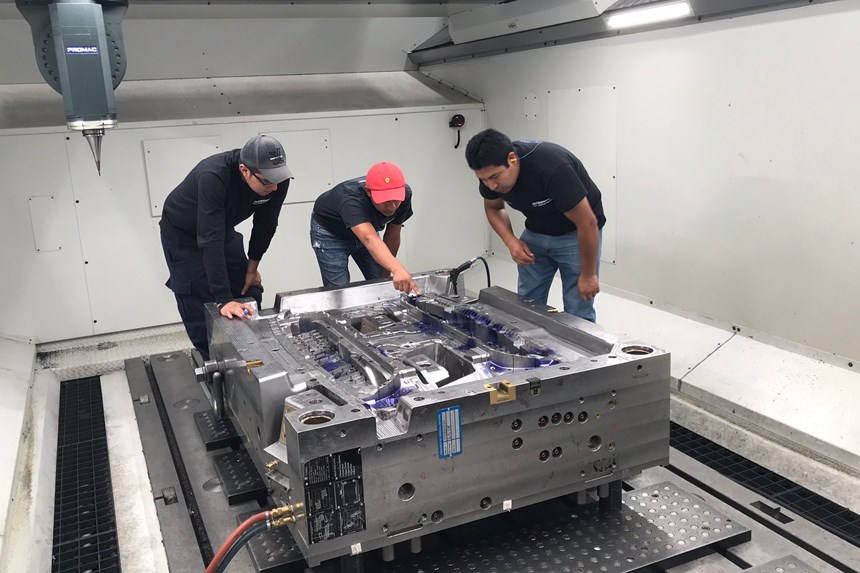

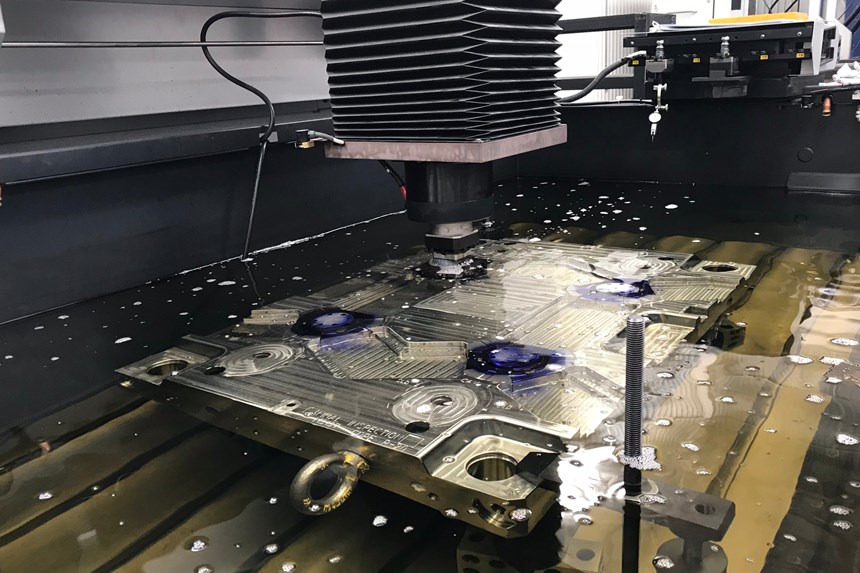

The middle bay houses mold assembly operations, with 22 separate work cells. The final bay is designated for moldmaking, with eight large five-axis CNC machining centers, including Promac and DMG Mori models, as well as EDM machines from Makino. Of the more than 170 full-time employees, between 35 and 40 are moldmakers; and the company is on track to build 130 new tools in 2018.

Compared with Integrity’s other operations globally, McLaughlin notes that the new site in Querétaro is roughly twice the size of its factility in Tennessee and just a little smaller than all of its original Canadian factories put together. The Querétaro location puts it very near the geographic center of Mexico, with Mexico City 135 miles south; San Luis Potosi the same distance north; Guadalajara around 200 miles to the west; and Aguascalientes about 180 miles northwest.

When Integrity first set up operations in Mexico, McLaughlin said the company identified two primary obstacles: “The first challenge was human-resource availability, skilled help. The second was supply base. Supply base has stepped it up really well over time. We don’t even really qualify that as a challenge anymore. Steel suppliers are here; hot-runner systems are here; mold texturing—they’re all right here.” The human-resource issue, however, is still one that Integrity and others must confront constantly, according to McLaughlin.

There is a labor pool to draw from, but its depth, and the skill set of the individuals within it, differ from what Integrity is used to. “We’re hiring some semi-skilled labor that may have come from a machine shop or were in a tool room at a molder,” McLaughlin says, “but they really didn’t have experience with building new tools.”

To address that, Integrity has instituted a comprehensive in-house training program, as well as flying experienced workers from Canada down to Mexico and some Mexican workers up to Windsor. In addition, the company is collaborating with local technical colleges to find new recruits and help those schools build a curriculum that will serve the growing moldmaking industry.

“At least here in Querétaro, there is no specialized training for moldmaking,” McLaughlin says. “So we’re hiring guys that have industrial engineering and mechanical engineering experience. They’ve proven that they have that mindset, and then we’re training them specific to our industry.”

Part of this effort involves a co-op partnership with local technical colleges. On Integrity’s shop floor, multiple workers sport yellow shirts that designate them as members of the co-op program. Integrity currently has eight co-op students, spending a portion of their school day at the plant for paid hands-on experience. From the last co-op student group, McLaughlin says Integrity hired all eight, giving the company workers experience not just in moldmaking but in how Integrity makes molds.

“The co-op is appealing to us because we’re training them in our processes and techniques and work ethic, which is good,” McLaughlin says. “There’s a benefit to that—you’re investing in a young guy and if he’s treated properly, he’s going to stay here.”

HECHO EN MEXICO (MADE in MEXICO)

As the nascent moldmaking industry grows in Mexico, its OEM and tier supplier customers are increasingly asking for local tool builds and support, instead of using Mexican shops simply for repairs and engineering changes on molds that were brought in from elsewhere. “We’re hearing a lot more about local tooling requests,” McLaughlin says. “It seems like it’s being mandated by the OEMs or the big Tier Ones—they want to build local now, in Mexico.”

When Integrity first came to Mexico, its business was 100% based on repairs, maintenance and engineering changes. Not long after arriving, it moved into building locally, and today, McLaughlin says its business is split 70:30 between new builds and maintenance/repairs. That’s the same ratio as at its headquarters in Canada. “I think OEMs and Tiers are seeing that there’s more ability here,” McLaughlin says. “I’m not bragging, but I think Integrity is helping that. Whatever we can do in Canada, we can do here.”Related Content

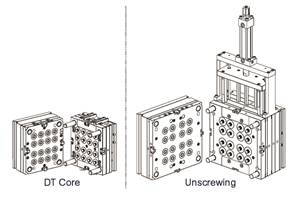

Best Methods of Molding Undercuts

Producing plastics parts with undercuts presents distinct challenges for molders.

Read MorePregis Performance Flexibles: In the ‘Wow’ Business

Pregis went big and bold with investment in a brand-new, state-of-the-art plant and spent big on expanding an existing facility. High-tech lines, well-known leadership and a commitment to sustainability are bringing the “wow” factor to blown film.

Read MoreUS Merchants Makes its Mark in Injection Molding

In less than a decade in injection molding, US Merchants has acquired hundreds of machines spread across facilities in California, Texas, Virginia and Arizona, with even more growth coming.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

.png;maxWidth=300;quality=90)