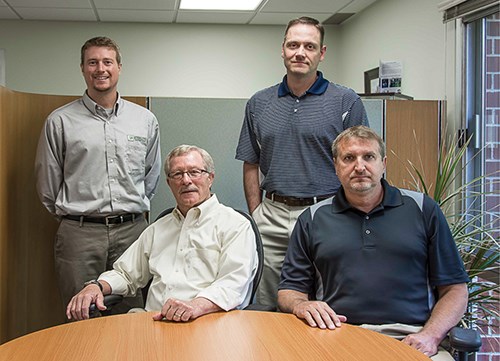

On-Site: A Big Molder’s Technical Engineering Plus a Small Company’s Customer Service

That’s the formula for rapid growth at a new/old firm serving medical, military, and aviation markets.

Sterling Manufacturing likes to think of itself as a company that “always puts the customer first,” in the words of CEO John Gravelle. To his way of thinking, that simple expression can mean a lot of things:

• Investing in technologies like rapid prototyping to add value to a project as close to the initial idea stage as possible.

• Using technology to help customers cut costs.

• Rethinking both part design and processing to make a product perform beyond the customer’s requirements.

• Offering value-added secondary operations that customers were not expecting.

• Achieving quality and on-time performance that most manufacturers would envy.

• Adding capabilities that give customers both the benefits of global sourcing and the convenience and security of domestic production.

Put all that together, and you get an idea of how Sterling aspires to offer—as it says on its website —“the superior technological capabilities and engineering services of a large molder while retaining the flexibility and customer focus of a small manufacturer.”

OLD AND NEW AGAIN

While Sterling has existed in its current form for only a few years, the firm and its leaders have a long pedigree in plastics. Gravelle started out as a design technician for DuPont in the 1960s. In 1972, he signed on with his father-in-law, Leo Lavoie, to be the second employee at his new firm, Mar-Lee Company, in Leominster, Mass. Lavoie had been general manager of Burton Tool & Die in Leominster, and Mar-Lee was a moldmaker until the 1990s, when it got into injection molding as well. Gravelle eventually became the owner of the Mar-Lee Companies until he sold them to a French conglomerate in 2008.

He had planned to retire after that, but three years later, he bought a molding company that had been one of Mar-Lee’s tooling customers, Sterling Manufacturing. That firm had been started in 1968 by Ted Underwood, formerly of Standard Tool & Die in Leominster. It moved from its original location in Sterling, Mass., to its current facility in Lancaster, Mass., in 1983. “It was the most beautiful building in the area,” Gravelle recalls—sunk low into the side of a grassy hill like a split-level home. But after the founder retired and Sterling’s customers moved their manufacturing to Asia and Mexico, sales plunged and the company stagnated.

When the company was purchased in 2011, Sterling still had experienced people and a proud tradition of quality manufacturing, but it had fallen on hard times. Gravelle says, “The plant was dated, and had old machines. So we shut it down for two weeks in the summer, when business was slow anyway, and cleaned and repainted from top to bottom.” Management rearranged the production layout to be more efficient, with utilities buried out of the way in a trench in the plant floor. And they started getting rid of the oldest machines and an accumulation of obsolete molds. Then management began bringing in new equipment and got the plant ISO 9001 certified in four months—“a pretty short time,” he notes.

Former colleagues from Mar-Lee joined the reborn Sterling Manufacturing, including Stan Bowker, Sterling’s president; Gravelle’s son Michael, director of business development; and Bob Clinton, v.p. of engineering. They built up the firm’s production and marketing departments with the additions of Dave Atamian, plant manager, and Scott Zygulski, v.p. of sales and marketing. John Gravelle says they then put their heads together to develop a market focus “based on what we’re good at—medical, healthcare-diagnostics, aviation, and military.” They also chose those markets because they were least susceptible to offshoring.

A little more than three years later, annual sales have doubled to just under $10 million. The 40,000 ft2 plant has almost 50 employees and 26 presses from 28 to 550 tons. Six new Engel presses were purchased in March, while three old machines are being shipped out and more will be retired this year. The plant can fit 40 machines and has room on the site to expand.

Recent plant upgrades include a 5-ton overhead crane, the plant’s first, which will help speed mold changes on the larger presses (300 to 550 tons). And energy efficiency has been improved with a new water system installed in the past year. The building was always quite energy efficient: Built partly underground, it maintains a more uniform temperature year-round. And the former owner was ahead of his time in using “waste heat” from the 75-80 F process water leaving the molds to warm the plant in winter and cool it—via a heat exchanger—in summer. Last winter, says John Gravelle, he used heating oil only on weekends when the plant wasn’t running.

The new water system includes two cooling towers with pumps and fans using variable-frequency drives (VFDs) instead of fixed-speed motors. Two older pumps of 50 and 25 hp were replaced by two 20-hp models. The net result is that the cooling system uses only one-third as much energy as before, says Gravelle. The new system can handle future expansions to 35-40 presses.

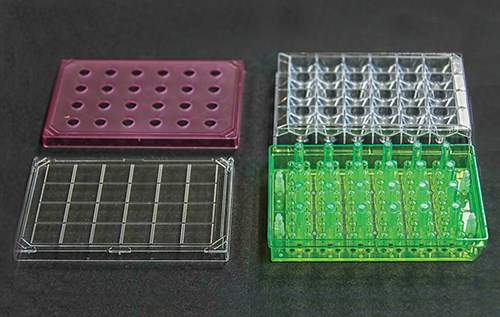

Medical, dental, and healthcare markets—encompassing disposables, implants, and diagnostic supplies and equipment—now constitute half the firm’s business. A 2500 ft2 Class 8 (100,000) clean room was installed in 2012; it holds eight machines that mold PEEK dental and medical implants and PLA resorbable devices, as well as pad printing and assembly operations. Last month, the firm began a project to double the clean room’s size by October. A “gap audit” for the ISO 13485 medical quality standard has been completed, and the company plans to seek certification this year.

Another 35% of Sterling’s business is in aviation and military markets. Examples are a polycarbonate pilot’s helmet liner and communication headsets, and an infantry backpack frame in different sizes, the largest of which is the biggest part Sterling molds. The remainder of Sterling’s business is general industrial products, but this is a shrinking share of the total.

Sterling’s business falls generally into the medium-volume category, but spans a range from prototyping a handful of parts to more than 1 million parts/yr for some jobs. “There are not a lot of jobs out there that would scare us,” states Zygulski.

INVESTING IN TECHNOLOGY

Sterling’s active machine replacement and expansion program is one sign of its commitment to first-class technology. The company is steadily converting the plant to all tiebarless Engel machines, which already account for 75% of its capacity. The six new Engels are Victory Spex models of 30 to 340 tons, all with electric injection units and hydraulic clamps powered by servo-driven variable-speed pumps, which Engel calls Ecodrive. These machines are said to be 40% more energy efficient than standard hydraulic presses and as much as 50-70% more efficient than older presses. In fact, rebates from the local utility for replacing older machines with more energy-saving models paid for Engel Viper robots on all the new presses, according to Michael Gravelle. For these reasons, Sterling’s managers consider the Engel hybrids to be a cost-effective alternative to all-electric machines that are only marginally more efficient.

Why is Sterling going tiebarless? “Why not go tiebarless?” asks John Gravelle. “Nobody has ever given me a reason not to, and I can see several good reasons in their favor.” He bought his first Engel tiebarless machine at Mar-Lee back in 1995, when they were a relatively new phenomenon.

Bowker likes the fact that tiebarless machines offer “lots of flexibility in mold size. We have very complex parts and molds. Medical parts often have lots of core pulls and slide actions but we can use low-tonnage presses with smaller platens.”

Michael Gravelle adds, “Tiebarless machines have greater daylight and available mold space without tiebars interfering. They also give us more flexibility to use side-entry robots.”

Convenience of mold changes without tiebars getting in the way is another reason. “We do three to five mold changes a day,” says Michael Gravelle, “especially now, when we’re validating 19 new tools.”

Sterling takes pride in offering a range of capabilities: “We do a lot of multi-material molding,” says Michael Gravelle, “generally by transferring the initial shot to a second press for overmolding.” The firm also does some micromolding, such as a tiny gear with 0.0015-in. tolerances and a mini PEEK surgical “anchor” for reattaching tendons to finger joints.

Sterling doesn’t hesitate to buy new equipment for special jobs. One complex project involves overmolding tiny polycarbonate lenses onto hollow posts of a cell-culture rack and then overmolding the bottom of the polycarbonate rack with a TPE pad. Sterling purchased a vertical tiebarless machine for the TPE overmolding as a more efficient solution than the previous post-mold assembly operation.

The firm is actively seeking to broaden its skills. “We’re looking at LSR,” says Zygulski, “to see whether it would help our customers. Another technology we have investigated for medical products is external gas molding, which could help us mold even larger parts without needing larger presses. That would save money for our customers. External gas injection can also solve sink problems in parts with thick walls and ribs, like surgical instrument handles and other medical products.”

The firm is also exploring the idea of rapid tooling via laser sintering as a way to build tooling inserts faster and less expensively. “Our roots are in tooling,” Zygulski points out.

Sterling invests its own funds for automation for secondary operations such as assembly or decorating. “We don’t ask the customer to invest in it if it makes us more cost-efficient,” says John Gravelle.

“We do a lot of secondary value-added operations, like hot stamping, pad printing, and sonic welding,” adds Zygulski. “Customers love it— it’s not even in their mindset when they come to us with a molding job. They assume they will have to go elsewhere for the secondary operations.

Sterling’s engineering skills include expertise with “difficult” materials. “We use a lot of fussy engineering resins, like bioabsorbable PLA, PEEK, Radel polyphenylsulfone, and PPS,” says Michael Gravelle. “We even injection mold PVC, which is not so common anymore.”

Dealing with very expensive resins puts a premium on minimizing scrap, which often cannot be reused in medical products. For example, says Gravelle, “We dial in a process using industrial-grade PEEK before we would run the more costly medical grade in production.” He adds that resorbable PLA costs $3000/kg and one job involved insert molding with pure silver electrical contacts, which cost $10 to $12 each. Quite simply, he says, “We can’t afford scrap.”

Michael Gravelle points to what he calls the “total cost of non-quality” for the plant, encompassing process scrap, quality rejects, and customer returns. “Our cost of non-quality is around 1%, while 5% is probably more typical in our industry. A lot of companies work to get their process scrap alone down under 2%.” On top of that, he adds, “Our on-time delivery performance is right around 99%.”

One more important element of good customer service is emphasized by Scott Zygulski: “Decisions in this organization are made right here, not by outside investors who don’t know the A-side from the B-side of a mold. That’s one reason why customers come to us.”

GETTING IN ON THE GROUND FLOOR

Sterling’s engineering services start at the design stage of a project. “We’re always asking ourselves, how do we get closer to the idea stage of a project? How can we add value at the beginning?” says Zygulski. The firm has SolidWorks CAD and Moldflow CAE capabilities, as well as a Stratasys Objet 30 pro 3D printer for prototyping and building jigs and fixtures for internal use.

To pursue this initiative further, “We’re thinking of forming a partnership with a design firm,” states Michael Gravelle. “Most design firms don’t know plastics and molding. But we offer Design for Manufacturing analysis for everything we do,” he says. “When a part comes in, we ask how we can make it better.” He cites the example of the military backpack frame, which came to Sterling as a transfer project. Made of a special Xenoy PC/polyester blend from Sabic Innovative Plastics, the frame experienced some cracking under stress. “The military didn’t consider it a problem, but we fixed it. Our engineering v.p., Bob Clinton, re-examined the design and the processing, and we ended up improving the performance of the part and making it more consistent.” That was not a unique example, Gravelle points out. “We worked with another OEM to make their product better. Now their engineers call us to ask our opinion about design features.”

PROACTIVE, NOT REACTIVE

“One of the great things about this company is that it’s financially secure. A lot of other companies are consumed by scrambling for resources. We’re not,” says Zygulski. “A lot of companies are forced to be reactive, but John and Stan are proactive. They see the big picture.”

Part of the Big Picture is helping customers balance the economic attractions of going global with the convenience and security of buying local. “The last recession forced a lot of customers to look at their true costs of buying overseas,” says Michael Gravelle. “There’s more interest today in buying local to consolidate supply chains and save travel and shipping costs. As a result, we see more opportunity to get jobs in the U.S. today, rather than have them go overseas. It’s not so much about jobs coming back from China, as it is about new programs being more likely to stay domestic.”

On the other side of the coin, Sterling has been working with a handful of Chinese moldmakers to save on tooling costs. Half of Sterling’s molds now come from China, including a 19-tool program for a core customer. “We’ve worked closely with these moldmakers to foster a relationship of trust,” says John Gravelle. “Bob Clinton has visited them. We have a consultant who visits them frequently. We’re quite comfortable with them. Chinese molds have helped us get some of the more capital-sensitive jobs.”

Related Content

How to Select the Right Tool Steel for Mold Cavities

With cavity steel or alloy selection there are many variables that can dictate the best option.

Read MoreHow to Mount an Injection Mold

Five industry pros with more than 200 years of combined molding experience provide step-by-step best practices on mounting a mold in a horizontal injection molding machine.

Read MoreWhere and How to Vent Injection Molds: Part 3

Questioning several “rules of thumb” about venting injection molds.

Read MoreWhat You Need to Know About Leader Pins and Bushings

There’s a lot more to these humble but essential mold components than you might suspect. Following the author’s tips could save much time, money and frustration.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

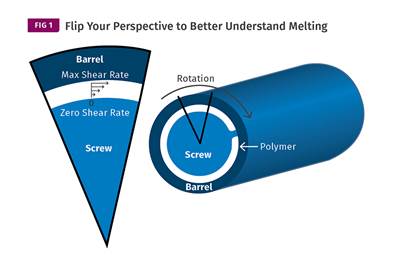

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More