On-Site: This Currier Delivers

“We love to tell our story.” That’s one way Mike Cartner, CFO of Currier Plastics, defines what separates this family-owned custom processor from its competitors.

“We love to tell our story.” That’s one way Mike Cartner, CFO of Currier Plastics, defines what separates this family-owned custom processor from its competitors. The “story” details how the Auburn, N.Y., molder—a midsize company with 110 employees and annual sales around $18.5 million—has managed to get a leg up on much larger competitors in its core packaging market by combining design, injection molding, and blow molding to offer one-stop shopping—and single-source accountability—to “super-customers” who buy both kinds of parts.

It’s a story of a processor that invests in technology even in the face of poor economic conditions and is committed to automation, quality control, and continuous improvement. It’s the story of a processor that has not lost its grasp of a fundamental but often forgotten business concept: The customer comes first. In fact, Currier launched an internal program it calls V² (Velocity × Value), that guides the way the molder goes about its business.

Currier was founded in 1982 by Raymond J. Currier as a custom injection molder serving a wide variety of OEM customers. Ray Currier worked for now-defunct Auburn Plastics, injection and compression molding parts for Xerox and others. Currier started his business at age 60, with two injection presses and 4000 ft² of converted warehouse space.

Today, the company is owned by sons Jim and John along with a couple of other long-time employees. Jim retired four years ago, but not before the company grew into an agile, multi-functional operation that offers custom solutions—not just parts—from a 65,000-ft² plant on the same piece of land on which the business was launched in ’82.

MULTI-PROCESS, DESIGN EXPERTISE

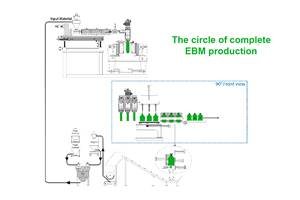

In the last 28 years, Currier developed and nurtured expertise in injection molding, extrusion blow molding, injection-blow molding, and design, enabling it to provide integrated closure and container solutions to a customer base looking to streamline its vendor lists.

“About 70% of our customers buy both injection and blow molded products,” says John Currier, president. “We added extrusion blow molding capacity to our core competency in 1996. From a strategic standpoint, we focus on a target market of companies that require the integration of design expertise, injection molding, and blow molding.”

Although it’s hardly rare today, Currier was a bit ahead of the curve in offering multi-process capabilities. As a result, clients who were set in their buying patterns didn’t recognize the value at first. But it didn’t take all that long. “We could produce a closure exactly to the customer specifications and design,” Currier recalls. “And the blow molder could produce the bottle exactly to the customer’s specifications. But sometimes the fit between the two wasn’t perfect. The customer would complain, the finger-pointing would begin, and neither I—the cap molder—nor the bottle molder would budge because we both had produced the parts to spec. But by controlling both processes, augmented further by our in-house design capabilities, we had taken a huge field of competitors and narrowed it down considerably.”

In packaging, Currier is perhaps best known for canisters and lids for wet-wipes, as well as small bottles and caps for personal care, healthcare, beauty, and cosmetics products, household chemicals, and amenities. It also molds medical and electronics components.

Currier runs 24 injection presses in tonnages ranging from 40 to 500 from Nissei, Sumitomo Plastics Machinery, and Mitsubishi (MHI). It has purchased nine machines over the last two and a half years, gravitating toward all-electric technology. Currier plans on replacing one or two machines a year over the next several years, says Alan Gross, v.p. of operations.

Currier injection molds more than 50 types of materials, primarily polypropylene and acetal, into parts weighing 0.5 g to 30 oz. All its molds have hot runners. The molds are sourced domestically and abroad with up to 48 cavities. Its most unusual closure tool closes the parts in the mold.

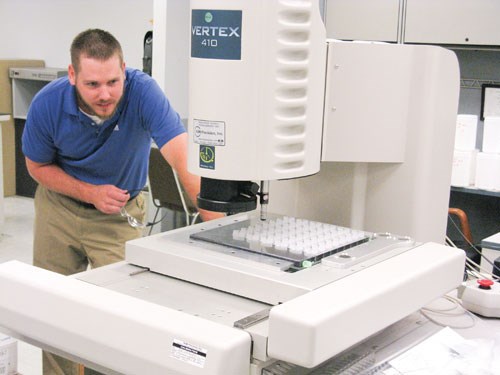

Currier has three quality test stations on the production floor, where products are pulled and checked every 2 to 4 hr. It also has a separate QC lab that houses a fully programmable vision/touch probe measuring system, a tensile/compression tester, a vacuum leak-test chamber, a torque tester for bottles and caps, and a moisture analyzer for resin testing.

Currier also has 15 blow machines, the latest being an Automa 700D extrusion blow molder for HDPE containers. The $850,000 machine offers in-press deflashing and 100% leak testing. Shortly before that investment, Currier spent more than $1 million to add two injection stretch-blow molders from Aoki Technical Laboratory to its arsenal. These are three-stage machines mainly for PET bottles. Overall, Currier produces 70 different container types, mostly from commodity materials, in sizes from 0.5 oz to 1 gal. Currently Currier blow molds in up to 10 cavities but is investigating 12-cavity technology.

Currier is working toward a fully cross-functional workforce, says Gross: Ultimately all process and production personnel will be able to work on any type of machine making any kind of product. This will increase the efficiency of what is already an extremely well-organized operation. For example, on the injection side, there are typically seven people responsible for 24 presses.

In the design department, Currier uses SolidWorks 3D CAD software for transfer of part-design files to its prototyping analysis, and for export of finished files directly to machining of the mold. It also uses Moldflow simulation. Moreover, Currier deploys a gamut of rapid-prototyping technologies, including stereolithography, digital 3D printing, and fused-deposition modeling (FDM). Currier also builds single-cavity molds of aluminum for short runs and other purposes.

“Roughly 80% of the time we are competing against much larger companies, so our ability to wrap ourselves around the customer with all of these services is a critical point of differentiation,” Currier says. “And they not only help us get in the door, they help us maintain business and strengthen the relationship with the client, sometimes by initiating process improvements or design ideas.”

One of Currier’s biggest clients is a leader in supplying pre-moistened towels. A while back, this particular company had ramped up the speed of its filling line, and was finding that the HDPE canisters from Currier were bowing. John Currier recalls: “We went up there, saw the filling line, and saw the problem. We knew that changing the material was not an option. Nor was thickening the walls of the container. So we literally went back to the drawing board and came up with a slight change in the geometry of the container that solved the problem.”

Currier has used its relatively small size and agility to its advantage. “Most of our customers use the service of other molders as well,” Currier says. “And from customers’ first-hand reports we have learned how important it is to be flexible. We can deal with things like delivery date changes, which are problematic for other companies. We had one competitor tell a customer that it will only accept purchase orders during certain times of day. We’ll take them anytime.”

This is where Currier’s V² system comes into play. “Velocity refers to the way we do things at Currier—namely, fast,” Currier says. “Time is the competitive currency of the 21st century. Doing everything in a quality way, faster than others, is one of our key competitive advantages.’

Value, on the other hand, is customized and driven by the client, says Currier. “It has to be individualized because what is valuable to some might not be as valuable to others. So we ask the customer, ‘What is important to your organization?’ We tailor a solution to the answer. Maybe it’s just-in-time delivery. Maybe they want us to carry inventory. Maybe it is offering design solutions and problem-solving ideas. We are prepared to deliver for our core customers in our core markets.”

CONTINUOUS IMPROVEMENT

Currier Plastics considers itself an information-rich company. Continuous improvement, process control, and lean manufacturing are more than buzzwords for this processor. It recently invested in upgrading a real-time production-monitoring software system. Monitors throughout the facility allow for a quick visual check of each machine’s current production status. Technicians and process engineers know immediately if a production order is running at or below projected cycle speed.

“It’s a powerful, yet easy-to-use package that is integrated into our Enterprise Resource Planning (ERP) system to help control scheduling, estimating, job costing, production control, and financials, and is part of our V² initative,” says Gross. “The cost of quality for each job has been reduced because of our ability to react quicker,” he adds.

Currier uses the data it collects to measure itself against benchmarks and launch corrective action if necessary. Each week, department managers meet as part of a cross-sectional team to review the performance of the prior week’s operation. Values such as on-time delivery, cost of quality, and capacity utilization are measured against goals and results from previous weeks. Year-to-date performance is compared with the prior year.

Currier’s objective is to use these and other tools to help increase sales to $30 million in just three years. Currently, some 70% of its sales volume is derived from “super-customers.” While the firm does not “try to be everything to everybody,” as John Currier puts it, he believes a 40% hike in sales is achieveable if the firm can increase its market share among these cap-and-container clients.

As part of that effort, business development v.p. Max Leone notes that Currier has structured a business development team that brings together employees from engineering and sales and marketing under its umbrella.

“The idea of our business development strategy is to present a targeted market focus within a 300-mile radius and present a concurrent engineering/sales model of design, injection molding and blow molding to this market,” Leone states. “With OEMs reducing their supply base, we present a unique selling position of an agile group that can bring packages to market faster with this philosophy.”

Adds John Currier “It is important that we and our customers have a similar view of success and that we have a mutual understanding of the value of what our partnership demands,” he says. “As a result, we have let some customers go, while emphasizing an improved relationship with others.”

Related Content

How to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MoreFoam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

Read MoreGet Color Changes Right In Extrusion Blow Molding

Follow these best practices to minimize loss of time, material and labor during color changes in molding containers from bottles to jerrycans. The authors explore what this means for each step of the process, from raw-material infeed to handling and reprocessing tails and trim.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More

.png;maxWidth=300;quality=90)