PE, PP, PS Prices Heading Down

There could be significant price corrections for some resins as supply outpaces demand.

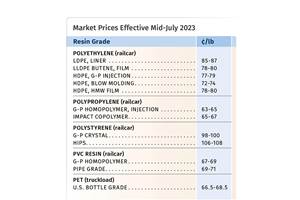

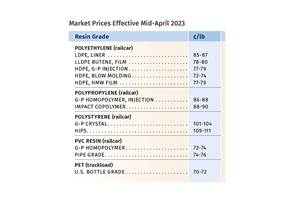

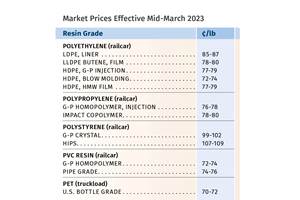

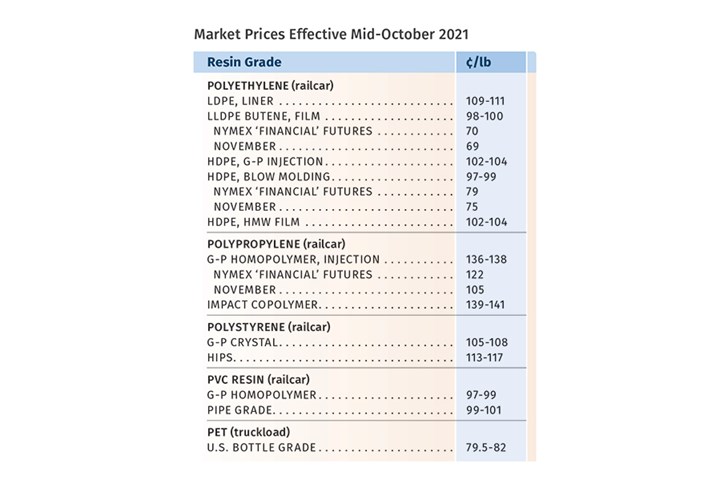

Going into the fourth quarter, prices of PE, PP, and PS were retreating, raising the potential for significant price corrections following a year and a half of substantial price hikes. The key driver is supply outpacing demand along with some reductions in feedstock prices. In contrast, the outlook for PVC tabs was flat to higher, due to a deficit in supply resulting from production outages while demand remained strong. Ditto for PET prices as PET packaging demand was soaring and feedstock and energy costs rising.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from Houston-based PetroChemWire (PCW), and CEO Michael Greenberg of the Plastics Exchange.

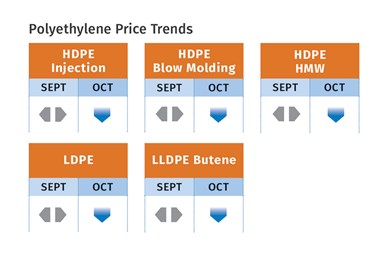

PE Prices Flat, Then Down

Polyethylene prices were flat in September, with suppliers’ announced 5¢/lb increase delayed to October, according to Mike Burns, RTi’s v.p. of PE markets, as well as PCW senior editor David Barry and The Plastic Exchange’s Greenberg. “There’s enough supply, and demand is now steadying, so the increase may not go through,” said Burns. He expected no movement last month with good potential for a 3¢/lb or more price drop this month and possibly next. Barry saw potential for 10-15¢/lb lower prices before year’s end. All three sources anticipate that buyers will have more leverage going into contract negotiations for 2022.

Barry noted that suppliers will need to lower prices into next year as some significant capacity is scheduled to come on stream, including the new SABIC/ExxonMobil and Shell L/LDPE and HDPE plants and Baystar’s new HDPE plant, a good portion of which will be geared to exports.

All sources noted that spot PE prices were dropping and demand was waning. “Although PE pricing was further removed from record highs set earlier in the year, they remain at the highest levels ever for September,” reported Greenberg. Meanwhile, contracts prices increased 41¢ to 43¢/lb since the beginning of this year and a total of 65¢ to 67¢/lb since May 2020.

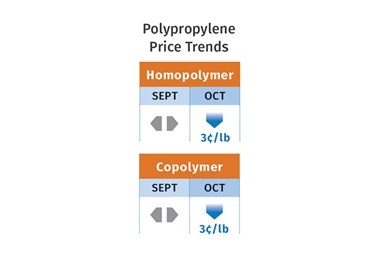

PP Prices Head Down

Polypropylene prices dropped by 3¢/lb in step with propylene monomer, and further price decline was anticipated by Scott Newell, RTi’s v.p. of PP markets, as well as PCW’s Barry and The Plastic Exchange’s Greenberg. Said Newell, “There was no margin expansion attempt and I believe that is the end of them. Instead, expect to see margin erosion.” Both he and Barry saw potential for a big price correction—possibly in the double-digits—before year’s end.

Newell noted that the monomer was still pretty tightly balanced following some unplanned shutdowns and was still vulnerable to any additional outages. Monomer price may moderate some but will not drop by as much as PP, ventured Barry. These sources noted that the PP market is now well supplied with everyone getting 100% allocation, while there is a drop in demand across PP market sectors. Said Newell, “Downstream customers are canceling some orders and so processors are canceling resin orders. Some processors are saying, ‘I don’t need any more material at any price at this point,’ even as their product backlogs are shrinking.” These sources also noted that most processors are throttling down production and predicted that they will throttle back by 10-20%, as will PP resin suppliers.

Greenberg reported that PP prices were dropping amid light demand and continued growth in material availability. “Considering that upstream inventories have returned to robust levels, producers have remained hesitant to release too much material into the market, which could erode expanded margins they earned during the great supply/demand imbalance.”

Barry noted that there were spot-market deals being made at 10-15¢/lb lower than contract prices. “We will continue to see more PP imports, and this factor is likely to give buyers pricing leverage,” he said. Meanwhile, PP contract prices have increased 57¢/lb this year and a total of 88.5 ¢/lb since May 2020.

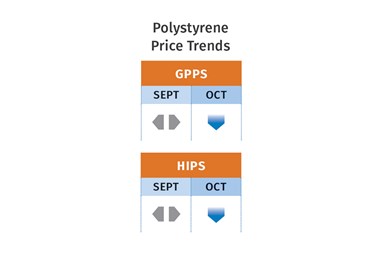

PS Prices Flat to Lower

Polystyrene prices were flat in September, despite a drop of 2¢/lb in key raw materials, with further declines ahead, according to Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, and PCW’s Barry. Chesshier noted lower prices for most PS feedstocks—including benzene, ethylene and butadiene—but not styrene monomer. October benzene contracts settled 32¢/gal lower, which represents a 5¢/lb decrease in PS manufacturing cost, and all other feedstocks were expected to move downward through year’s end.

“We are now trending toward a buyers’ market ,” said Chesshier, noting that monomer and PS exports to Asia, which typically pick up in September, were lackluster owing primarily to extremely high freight rates. Both she and Barry noted that in addition to lower feedstock costs, supply has outpaced demand, and we have entered the typically slow season for PS demand. As such, both sources ventured that a very favorable price concession could arrive this month, barring any major weather or other global disruptive event.

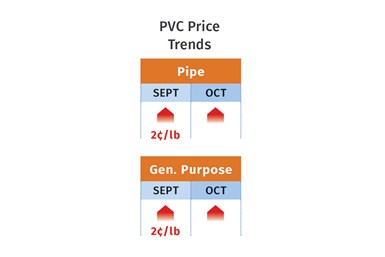

PVC Prices Up

PVC prices rose 2¢/lb in September as a result of Hurricane Ida production disruptions and an unrelated, unplanned PVC production outage, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Moreover, three of the four major suppliers issued hikes of 5¢/lb for October. “Demand is still strong, with a deficit in supply due to production outages,” said Kallman, adding that the pricing outlook for this month would be flat to higher, with the former more likely as production was expected to return to normal.

Todd noted that through August, PVC prices had moved up every month in 2021 except for July, which was flat, for a total increase of 24.5¢/lb. This, following PVC price increases that totaled 16¢/lb in the second quarter of 2020, makes a grand total over that period of 40.5¢/lb.

PET Prices Up

PET prices were generally flat in September, with minor fractional cost adjustments due to feedstock and energy cost increases, according to RTi’s Kallman. “Domestic producers have improved their output as the push for more recycle content continues. There was pressure from higher prices of feedstocks such as MEG due to supply constraints and energy costs.

While seasonal demand for PET bottles was slowing, demand for PET packaging at big box stores once again appeared to be soaring. Kallman said PET prices in October-November would be flat to higher, even if by fractional increases. He noted that PET imports in July were very high, though he thought that month was a peak for imports.

Related Content

PS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More