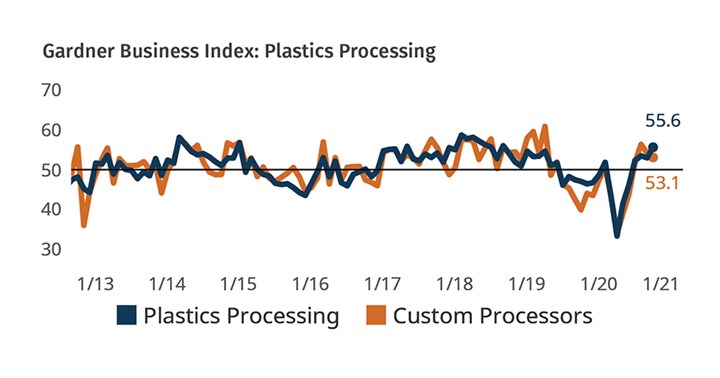

Plastics Processing Index Hits Two-Year High

Five of six business components show expanding October activity as index hits 55.6.

The Gardner Business Index (GBI) for plastics processing closed October with a two-year-high reading of 55.6. Five of the six components of the Index reported expanding conditions (above 50), with only export activity contracting (below 50). The Index, which is calculated based on monthly surveys of Plastics Technology subscribers, moved higher thanks to a fourth consecutive month of expanding new orders and production activity. Strength from these areas likely contributed to the year’s first expansionary backlog reading and a third month of expanding employment activity. As the Index moves into the final months of the year, concerns remain around the ability of shippers to maintain the sufficient flow of goods so as not to stymie production.

Gardner’s Custom Processors Index indicated continued expansion but decelerated slightly to 53.1 due to a greater contraction in export orders and slowing expansion of new orders and production. Custom processors also reported slower supplier deliveries during the month, which may have partially influenced the lower production activity. The disruption of supply chains as the world battles the spread of COVID-19 has been one of the unique challenges for all manufacturers in 2020. COVID’s impact has affected both the demand for goods and the ability of firms to supply those products in particularly high demand.

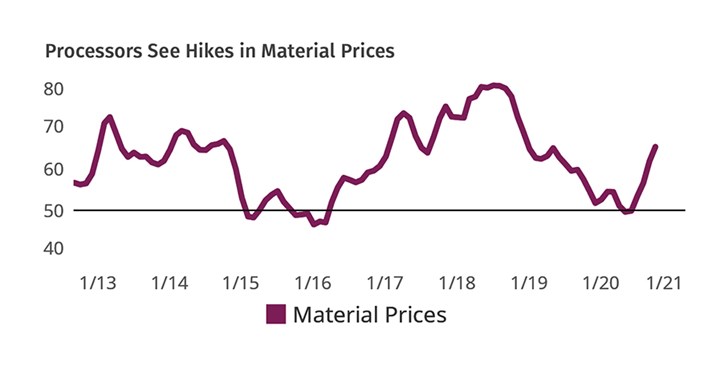

Constraints along the plastics manufacturing supply chain have manifested themselves not only in the form of slowing deliveries but also in rising input prices. Gardner’s tracking of material prices shows that beginning in July a swelling proportion of plastics processors began experiencing rising material prices. The latest plastics prices index was the highest since the end of 2018.

FIG 2 The proportion of plastics processors reporting increasing material prices has grown quickly during the second half of 2020. This may in part be due to the disruption that the coronavirus has caused to supply chains.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

Plastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MorePlastics Processing Contracted Again in March

Processing activity contracted for the ninth straight month, and at a faster rate.

Read MorePlastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)