Polyolefin Prices Drop; Ditto for PET

PE, PP, PET prices head down, PS and PVC flat for now.

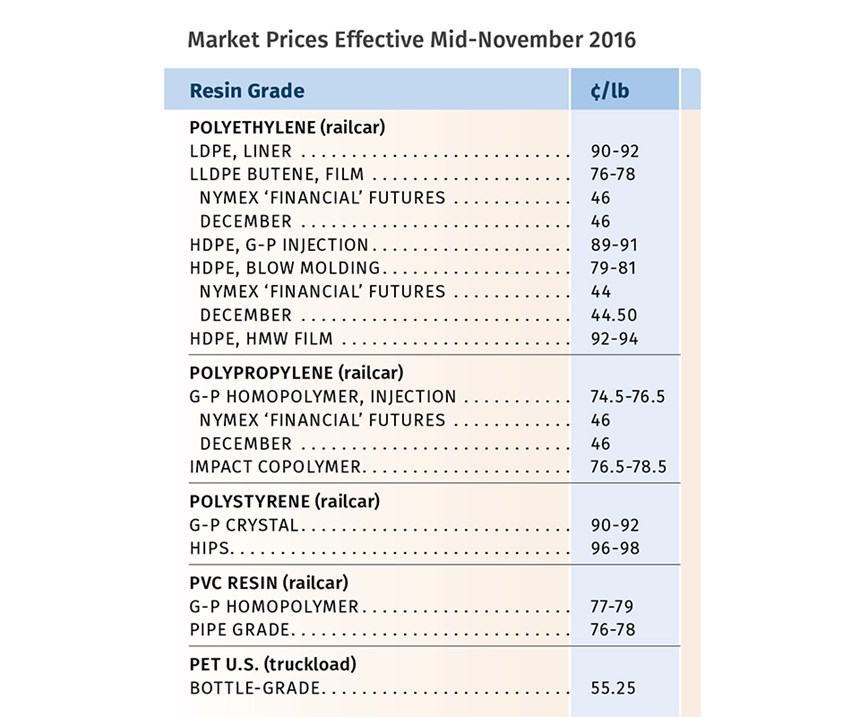

In early November, lower PP, PS, and PET prices were the con- census forecast for the last two months of the year. PE and PVC, however, were generally expected to be flat. But supply/demand fundamentals were changing and, in the case of PE, lower price offers were emerging.

Those are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The, Chicago, and Houston-based PetroChemWire (PCW).

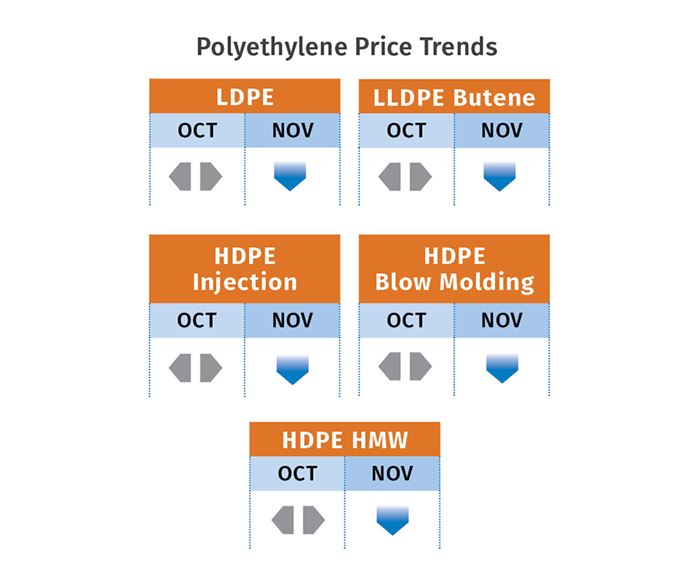

PE PRICES FLAT TO DOWN

Polyethylene prices stayed put in October, following September’s 5¢/lb hike. As expected, an October 4¢/lb price initiative failed to gain industry support. But further change was underway as Nova Chemicals offered customers a 3¢/lb discount, effective Nov. 1.

Suppliers had been expected to hold on firmly to their September 5¢ increase, but industry dynamics were likely to weaken their grip. At October’s end, PCW reported that market chatter was focused on potential price decreases in the last two months of the year, but noted that suppliers were citing firm pricing in the bellwether Chinese market, as well as data showing healthy domestic demand, to counteract expectations of lower prices. The Plastics Exchange’s Greenberg reported availability of deeply discounted, spot prime-resin railcars, with certain PE grades dropping below pre-September levels. The lone standout, he noted, was tightly supplied clarity LDPE.

Mike Burns, RTi’s v.p. of client services for PE, saw strong likelihood for the September 5¢ hike sloughing off before year’s end. He expected that other suppliers were likely to offer price concessions similar to that of Nova Chemicals. He pointed out that current PE contract prices were 5¢ above what they should have been. At the same time, spot prices were as much as 10¢/lb lower than contract prices, compared with a more typical 5-7¢ differ- ence. Ditto for export prices, which were 15¢ lower than contract prices, vs. a more typical 7-10¢ discount. “Something’s got to give,” he said, adding that suppliers’ inventories were growing while some softness in domestic demand had emerged.

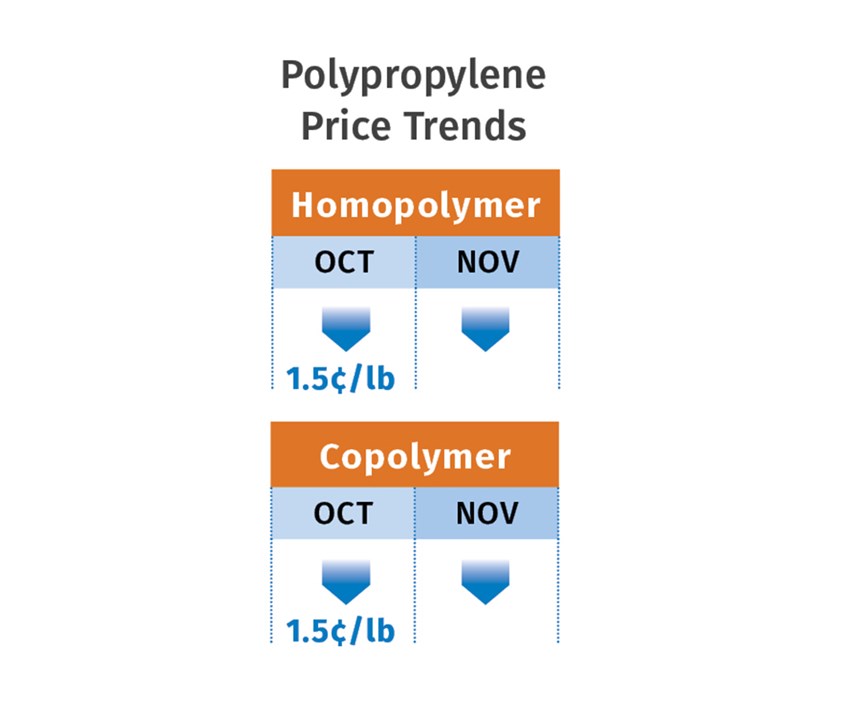

PP PRICES DROP

Polypropylene prices dropped 1.5¢/lb in October, once again in lock-step with propylene monomer. Prices were very likely to drop farther in the last two months of the year. In fact, suppliers’ margins which held at about 11.5¢/lb through October (down from the April high of 25.5¢/lb) were expected to erode much further going into next year. Contracts for 2017 were being renegotiated in a much different environment than the previous year, according to Scott Newell, RTi’s v.p. of PP markets. “Suppliers are showing more flexibility in their negotiations as they are trying to regain the market share they lost to imports,” said Newell.

At October’s end, PCW reported that PP spot prices were flat to lower, yet buying activity was lackluster owing to ample supplies. Both PCW and Newell noted that spot import offers had lost their edge, as domestic spot prices had become much more attractive. Greenberg reported spot PP prices shedding 2¢/lb by late October.

“We are now seeing a large gap develop between contract and spot, as generic prime has slipped back to the low seen during the summer.” Offgrade PP prices dropped much more due to challenges from imports. With planned and unplanned shutdowns of both PP and propylene monomer pretty much over with last month, inventories were on the rise. Suppliers were reported to be throttling back on production due to the significant excess in inventory and demand being a bit soft. According to Newell, if suppliers are successful in their aim to regain lost market share, there is a likely potential for resin to get tight once again next year.

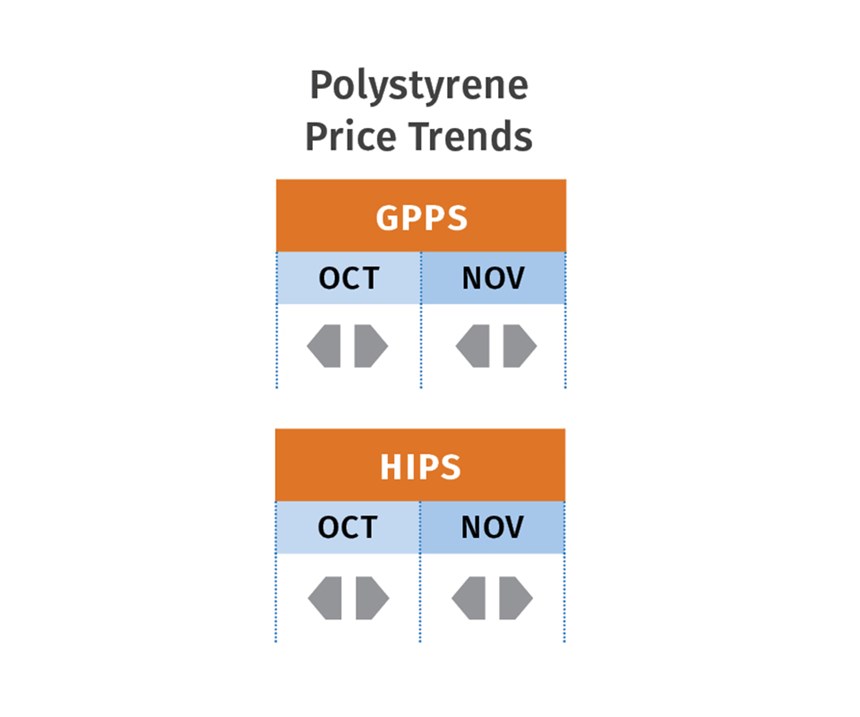

PS PRICES FLAT TO DOWN

Polystyrene prices were flat in October, after having moved up a total of 5¢/lb in the two previous months in step with higher benzene and ethylene prices. But the trajectory for both feed- stocks took a reverse turn. October benzene contract prices dropped nearly 20¢/gal to $2.31, and November contracts were expected to settle around $2.20/gal. Late-settling October ethylene contracts were expected to shave off up to 2¢/lb from the September 2.75¢/ lb increase and possibly more in subsequent months, as all plants were back in operation, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

PCW reported PS spot prices as flat to lower in response to slowed demand and adequate supply. PCW also reported that spot styrene monomer prices were 2.5¢/ lb higher amid active buying—levels not seen since April. According to Kallman, a monomer outage at a Westlake Chemical plant, along with strong demand from Asia due to monomer outages there, were pushing prices upwards. Still, PS prices are more closely tied to benzene and ethylene pricing. At least for GPPS, Kallman expected prices to be flat to 1¢/lb lower in the year’s last two months.

In contrast, the price pressure on HIPS was upwards, as October butadiene contract prices moved up 3¢/lb and November contracts were nominated at 6-8¢/lb higher, driven by the Asian outages.

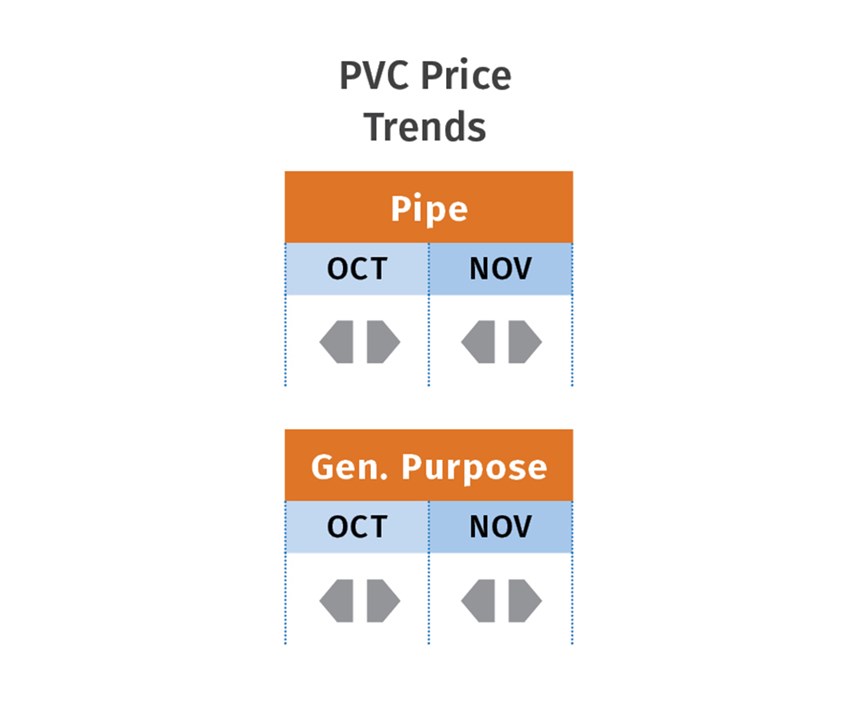

PVC PRICES FLAT TO HIGHER

PVC prices, which had remained flat for the seventh consecutive month through September, were still unsettled for October at press time. RTI’s Kallman ventured that prices could remain flat or perhaps rise by 1.5¢/lb of the 4¢ October hike that suppliers were trying to implement after September’s 2.75¢/lb ethylene contract increase. However, spot ethylene prices were rapidly dropping into November, and lower prices were expected for October and November contracts.

Adding to suppliers’ difficulty in increasing prices was the continued buildup of inventories and seasonal decline in demand. Kallman characterized domestic demand through October as flat, but exports were declining.

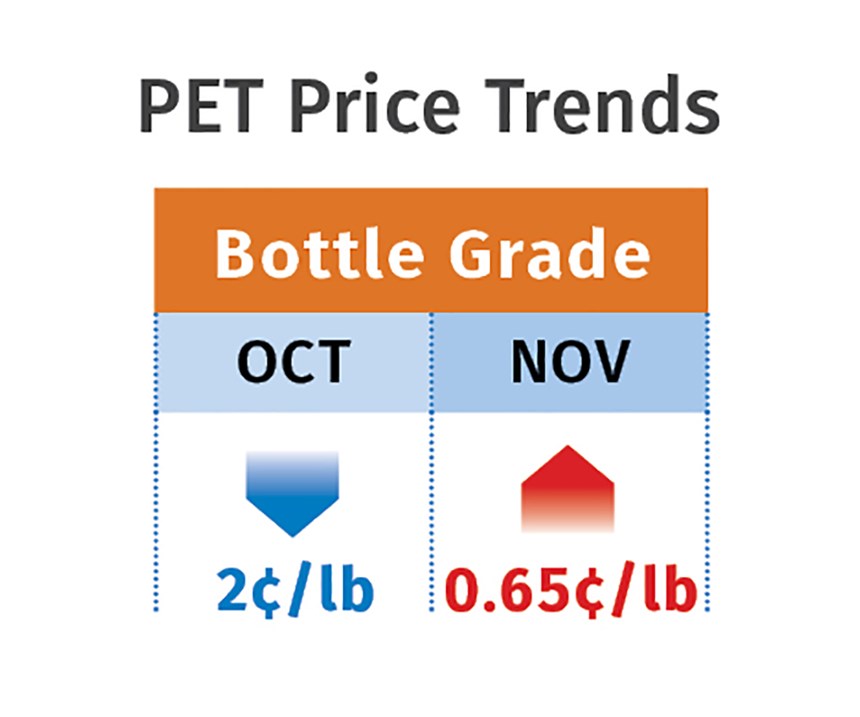

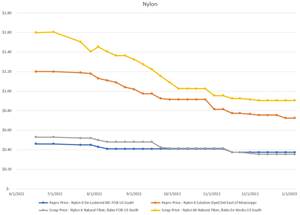

PET PRICES INCH UP, DROP AGAIN

Domestic bottle-grade PET prime resin prices averaged 54.6¢/lb, down 2¢/lb from September, based on PCW’s Daily PET Report. The price represents PET on a delivered Chicago basis. Prices rose in mid-October by 0.65¢/lb, after DAK Americas declared force majeure on PET shipments from its plants in the Carolinas in the aftermath of Hurricane Matthew. By Nov. 3, the force majeure had been lifted as feedstock deliveries returned to normal levels. Domestic PET Price Trends. Meanwhile, U.S. imported PET (packaging grade) averaged 49.7¢⁄lb, up 1.1¢/lb from September (on a delivered duty-paid

U.S. ports basis, in some cases including inland delivery in super sacks). Higher prices for PET from Brazil, which represents about 11% of all imports, was one reason for the higher monthly average price of imports. U.S. imported PET rose 27% year-to-date in August. Imports from Mexico, the largest source, grew by 16% in that month over August 2015, while imports from Taiwan, the second largest source, grew by 98%.

M&G Chemicals’ Project Jumbo, the world’s largest PET plant, under construction in Corpus Christi, Texas, will now come on line during first-quarter 2017. The original end-of-2016 startup was delayed by supply and equipment issues related to the plant’s PTA feedstock section. The latest capacity estimate is for 2.4 billion/lb.

Read the latest on recycled PET prices.

Related Content

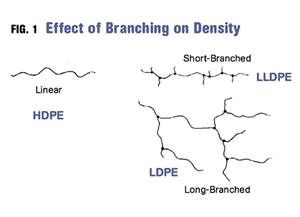

Density & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Resin Prices Mostly Higher

Third quarter ends with upward movement for most resin prices, even for high-volume engineering grades, except for PET.

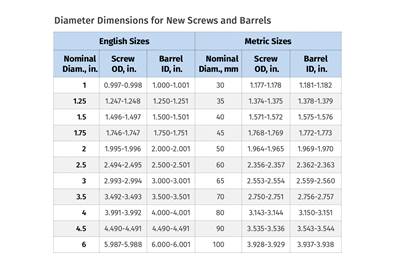

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More