PP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

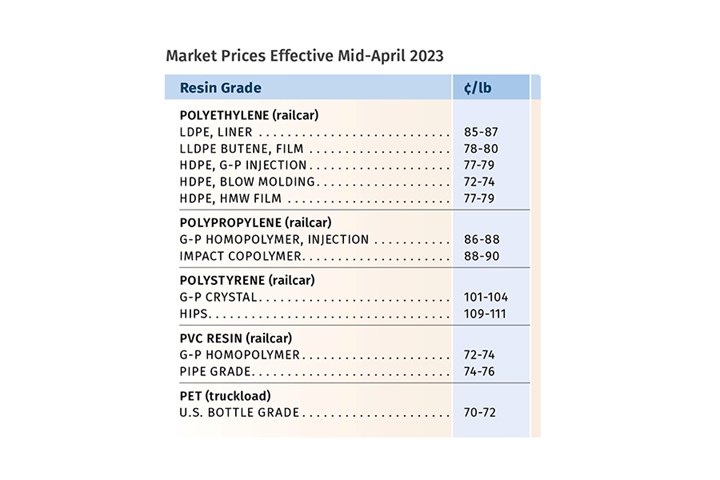

Despite some suppliers aiming to push through increases from month to month, the second-quarter prices of major commodity resins seem to be mainly on a flat trajectory, though a major correction is looming for PP. Other resins with potential for some modest downward movement — at least a give-back of increases gained in the first quarter, include PE, PS, and PVC. Slowed domestic and global demand lead among contributing factors, along with generally static or lower prices of key feedstocks. In some cases, like PE and PET, high inventories across the supply chain are also a factor, as are competitively priced imports of pellets and/or finished goods in the case of PS and PET.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

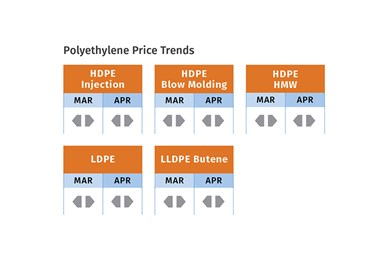

PE Prices Flat to Soft

Polyethylene prices appeared to be flat in February and were generally expected to hold steady in March, despite suppliers aiming to implement a 3¢/lb increase, and in some cases 5¢/lb for HDPE, attributed to force majeure actions. Two suppliers had announced a 5¢ increase for April, but prices for were expected to remain mostly unchanged, according to David Barry, PCW’s associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s Greenberg. “Spot market conditions and pricing do not support implementing the PE increase this month, but stranger things have happened,” reported Greenberg, referring to the March increases.

PCW’s Barry noted that despite unplanned production shutdowns, domestic demand continued to be soft and export activity had slowed, leading suppliers to cut prices. “Supplier inventory levels are close to oversupply, and new supply from SABIC and Shell are having an impact, making an April increase unlikely.” Still, he noted that there were some plant maintenance shutdowns planned in April, as well as reports that Shell was not running at full production due to some problems with its cracker. As for May, he ventured that prices could roll over again, barring a spike in crude oil prices. “If suppliers get an increase in March-April, it will come back off pretty rapidly in May or June.”

RTi’s Chesshier noted that processors are being squeezed and say they cannot pass on any more increases, particularly in the face of competition from lower-priced imported finished goods. “Despite one industry index posting a 3¢/lb increase for March, there should not be any more increases — if anything, prices should drop, based on slowed demand and low feedstock costs.” She advised buyers to push for lower prices in the face of sluggish demand.

Greenberg cited February data released by the American Chemistry Council (ACC), which showed that suppliers had throttled back reactor run rates in February well below capacity and even below January, but still above fourth-quarter levels. “Domestic PE sales in February pulled back from higher January levels and tallied 200+ million lb below the trailing 12 month average. Exports were still strong at 4% above the 12-month average, and all told, there was a small draw from producer PE stockpiles, which entered March about 900 million lb below the July peak.”

PP Prices Poised to Plunge

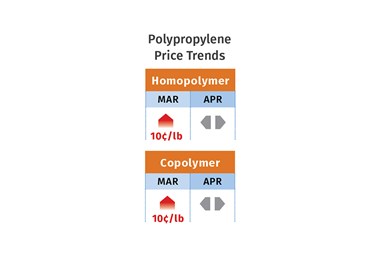

Polypropylene prices were moving up about 10¢/lb in step with March propylene monomer contracts, which were nominated for increases of 10-13¢/lb. Suppliers were still seeking margin increases of 3¢ to 6¢/lb, but were very unlikely to get any of that, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. The latter reported in the last week of March that spot PP homopolymer and copolymer prices had dropped by 3¢/lb as spot propylene monomer prices dropped significantly from the year’s highs.

Both Barry and Newell noted that monomer supply had been squeezed by planned and unplanned production disruptions at PDH units, steam crackers and refineries through much of the first quarter. Said Newell, “It has been a very volatile market, but these supply issues are being resolved, even if the volatility goes into April. However, May will bring a lot of relief for monomer and PP, with double-digit price drops.”

Barry also saw April as the transition month, with prices largely flat to a couple of cents lower. “I don’t see any momentum for a non-monomer increase, based on a high volume of spot material availability, particularly PP homopolymer.” He noted that the industry is pretty much agreed that the May-June timeframe will see a major downtrend in PP prices.

These sources noted that prices need to drop across the propylene chain, as monomer had nearly doubled since December, making the U.S. the highest-priced for propylene and PP. While domestic PP demand rebounded in the first quarter, with an apparent rebalancing of inventories for pellets and finished goods, demand was still below average.

Newell noted that at this level, PP operating rates ought to be in the low-70s rather than mid-70s. Inventory days were at 42, versus a “healthy” normal of 33 to 34 days. Greenberg reported a minimal amount of restocking from the spot market as buyers continued with “wait-and-see” on a potential propylene-monomer/PP correction.

PS Prices Wobbly

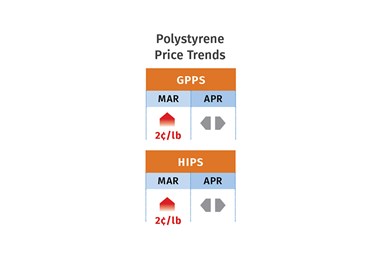

Polystyrene prices in March moved up 2¢/lb for many contract buyers but appeared to have stayed flat elsewhere, according to PCW’s Barry and RTi’s Chesshier, as suppliers were seeking increases of 2¢ to 3¢ for March. April benzene contract prices were expected to move up a bit — around 10¢/gal — though spot prices were dropping.

Said Barry, “In the spot market PS selling prices remained flat at best, along with no availability issues.” He ventured that April prices would be flat to plus-or-minus a couple of cents, but saw the potential for higher prices in May, driven by feedstock costs, primarily benzene. He noted concern that there would not be enough domestic production nor imports moving into May-June. In contrast, Chesshier said, “We’ve been seeing better volume of imports and domestic refineries have switched to higher feeds, which typically results in higher benzene production.” She predicted that prices in April could stay flat with some potential for price reduction in May, if benzene prices drop lower and demand remains slow.

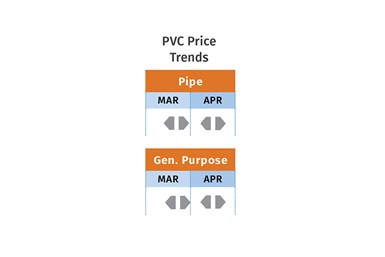

PVC Tabs Up a Bit, Then Flat

PVC prices moved up 1¢/lb in February (mirroring January) and remained flat in March, despite suppliers aiming to implement their announced February increases of 4¢/lb to 5¢/lb, according to Paul Pavlov, RTi’s v.p. of PP and PVC, and PCW senior editor Donna Todd. Pavlov projected generally flat pricing for April-May. He noted that feedstock prices have been stable so far, and while domestic demand has been good, a substantial decrease in global demand has resulted in significantly lower prices.

Todd reported that Formosa, Shintech and Westlake all issued new price hikes of 4¢/lb for March and 4¢ to 5¢/lb for April. On the other hand, OxyVinyls left its February 4¢/lb price hike in place and announced a 5¢/lb increase for May, with nothing further for April.

Todd reported that one industry pundit’s long-range pricing forecast was for flat prices in March-April, followed by a 2¢/lb drop in May and a 1¢/lb increase in June. Going further, he forecasted flat PVC prices in July, up 2¢/lb in August, flat for Sept.-Oct., followed by a 1¢/lb drop each in Nov.-Dec. Todd said processors saw this projection as ignoring the market’s seasonal demand pattern, along with no belief that prices would rise 4¢ to 5¢ anytime soon, barring a major production disruption. She also noted that the impact of export prices (currently dropping) on domestic PVC prices is significantly lower now than it was when suppliers were exporting 30% of their production.

PET Flat to Slightly Lower

PET prices were flat in both February and March and flat to modestly lower was projected for April-May, according to Mark Kallman, RTi’s v.p. of PVC, PET and engineering resins. This was based on flat to lower prices of paraxylene/PTA and MEG feedstock components.

Other key contributing factors are slowed demand and ample domestic supply compounded by ample lower-priced imports on the spot market.

Related Content

How to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MoreUnderstanding the ‘Science’ of Color

And as with all sciences, there are fundamentals that must be considered to do color right. Here’s a helpful start.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreThe Effects of Stress on Polymers

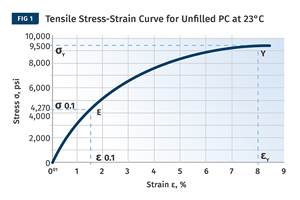

Previously we have discussed the effects of temperature and time on the long-term behavior of polymers. Now let's take a look at stress.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More

.png;maxWidth=300;quality=90)