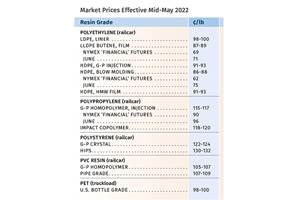

Prices Firm for Polyolefins, PS and PET

PVC prices have the weakest outlook among commodity resins.

Moving toward the end of the first quarter, the pricing trajectory for the five major commodity resins was a mixed bag, with a potential bottoming-out for PP and PE prices, an upward push for PS and PET, and a downturn for PVC tabs. Key drivers included the continued impact of higher feedstock costs and global logistics issues—including higher feedstock costs, a dearth of truck drivers, container availability, and some Gulf Coast warehouses at full capacity, delaying exports.

Those are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at Spartan Polymers.

PE Prices Flat

Polyethylene prices rolled over in January, with suppliers pushing back their 4¢/lb hike to February. However, new price initiative emerged, averaging an additional 4¢/lb for last month, according to Mike Burns, RTi’s v.p. of PE markets, PCW senior editor David Barry, and The Plastic Exchange’s Greenberg.

Burns ventured that PE prices would hold firm in February as suppliers’ price-hike attempts changed the narrative of slumping prices. Still, he forsaw some downward pressure in March and April, noting that supplier inventories are high and new capacity from the SABIC/ExxonMobil joint venture will exacerbate the oversupply that resulted from a drop in exports due to continued logistical problems. Characterizing current domestic demand as “good,” he projected that it will not decline, but will level off from the peaks seen in 2021. “The 2022 PE price is approximately 24¢/lb above the pre-pandemic, January 2020 mark. How much of that increase can be given back given the current status of the economy—COVID, wages, supply issues, trucking, employment issues?”

PCW’s Barry thought that suppliers could get possibly half of their increases implemented within first quarter, noting that while market fundamentals do not support price increases, higher crude-oil and ethylene tabs could have an impact.

Still, all three industry sources see a slowing of the downward trajectory, and pointed to rising spot prices. Greenberg reported toward the end of January, “As the spot market exhibits firmness and the first signs of prices bottoming out, at least for the moment, it brings current price increase initiatives back to the forefront and PE producers do have a 4¢/lb price increases on the table for Jan contracts. When initially nominated during December, it appeared that the increase was pie in the sky, with best hopes to stem the slide in resin prices that eroded 15¢ to 17¢/lb during the fourth quarter. Producers have announced another slew of contract increases for February, which also average 4¢/lb, so there is some additional upward pricing pressure.”

PP Prices Bottomed Out?

Polypropylene prices dropped a few more cents in January—for a total margin give-back from suppliers of 10-13¢/lb since October, despite propylene monomer contract prices rolling over from December, according to Scott Newell at Spartan Polymers, PCW’s Barry, and The Plastic Exchange’s Greenberg. All three sources ventured that PP prices may have bottomed out, after dropping from their peak in August 2021 by a total of about 40-45¢/lb, from a combination of lower monomer prices and non-monomer supplier price concessions.

“I think the February-March timeframe will be flat to higher, depending on how PP demand shapes up, which will put pressure on propylene monomer prices and will also coincide with scheduled monomer plant turnarounds,” said Newell. Barry noted that domestic PP prices are still higher than in the rest of the world, owing to global logistics issues, though PP spot prices have been as much as 10-20¢/lb lower than contracts. He and Newell described the market as balanced to a bit long, despite PP suppliers throttling back production to a low of 70% of capacity in December.

Greenberg noted that spot-market demand for PP in January was the busiest for The Plastics Exchange since early September 2021, due to more balanced fundamentals and higher energy and feedstock costs, lifting spot prices by 2¢/lb. He detected “the early stages in the potential reversal of the pricing trend, ... with much of the burdensome overhang for PP now gone, following six to seven months of reduced production and a decline of more than 120 million lb from producers’ collective resin inventory during December. There have also been six to seven straight months of below-average PP purchases by processors, particularly in the past four months, as they have largely worked down their inventories, expecting even lower prices ahead.”

PS Prices Turning Upward

Polystyrene prices were once again flat in January, but change was underway for February and March, driven solely by rising costs of benzene and ethylene feedstocks. By themselves, supply/demand fundamentals do not support increasess, according to PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets. Said Chesshier, “Today’s PS prices already have the higher feedstock costs built in—aside from future increases—since suppliers never ‘gave back’ any of their margin when feedstock prices dropped. While suppliers will aim to increase prices based on feedstock costs, buyer resistance will ensue.”

Barry said he would be surprised not to see a price hike emerge for February; and, in fact, TotalEnergies Petrochemicals & Refining announced it would increase PS prices by 5¢/lb on Feb. 1. Barry reported at the end of January that the implied styrene cost based on a 30/70 formula of spot ethylene/benzene was at 46.7 ¢/lb, up from 41.5 ¢/lb four weeks earlier. Despite weak supply/demand fundamentals, both sources did not rule out further upward pressure on PS prices in March, which could result from higher crude oil/benzene prices and scheduled benzene plant maintenance.

PVC Prices Flat to Lower

PVC prices in January were most likely flat, though there was industry chatter about some price concessions. Meanwhile, Formosa and Westlake issued price increases of 3¢/lb for Feb. 1 and OxyVinyls for March 1 , according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Missing was Shintech, which was ramping up its new PVC capacity.

Kallman characterized the price initiative as a “defensive move” to stop any price slippage. Barring an unexpected production outage, he predicted flat or lower prices for February and March. Both sources cited high supplier inventories, and PVC export prices fell as much as 24¢/lb, as exports dipped because of global logistics issues. What could offset this scenario, noted Kallman, is the scheduled plant turnarounds for PVC and feedstocks in this timeframe. Over the course of 2021, PVC prices were hiked nine times for a total of 31.5¢/lb.

PET Prices Up

PET prices in January were expected to be 10¢/lb higher, driven by costs of feedstocks PTA and MEG, in combination with new contract terms, according to RTi’s Kallman. He ventured that February and March could see relatively flat pricing.

Meanwhile, imported PET prices also moved up modestly in January—though they continued to be higher than domestic contract prices due to logistical problems. “PET imports will continue to be strong despite the elevated prices, as supply/demand continues to be very tight,” said Kallman.

Related Content

Prices of Volume Resins Drop

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreMixed Pricing Outlook for Commodity Resins for Spring 2022

Prices of PE, PS may have peaked; they were slightly down for PP and PET, up for PVC.

Read MoreStill an Up-and-Down Picture for Commodity Resin Prices

Supply/demand imbalances or sharply rising feedstock costs account for the mixed pricing trajectory for the five biggest-volume resins.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More