Prices of Volume Resins Drop

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Prices of nine volume commodity and engineering resins had either dropped or were heading downwards at the end of August. Flat or declining prices were projected through this quarter, barring any major disruptive event, such as a hurricane. The key factors behind this trend include inflation-driven demand destruction across the supply chain, significant supplier inventory buildup, lower feedstock prices and lower exports due to slowed global demand and relatively high prices for North American resins. Logistical issues continued to be an issue, with extended lead times at ports, as well as rail congestion, which has surged demand for ready-to-go truckloads. Very competitively priced imports are yet another factor for certain resins, including PVC, PC and nylon 6.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. of polyolefins at distributor/compounder Spartan Polymers.

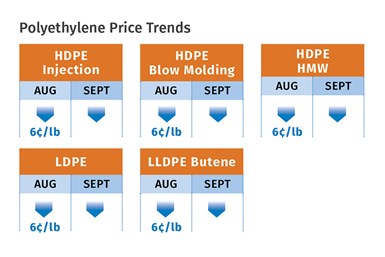

PE Prices Sinking

Polyethylene prices in August were poised to drop by 6¢/lb, with potential for another, more modest drop in September and flat pricing this month, according to David Barry, PCW’s associate director for PE, PP and PS; Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets; and The Plastic Exchange’s CEO Michael Greenberg.

These sources noted a significant buildup in supplier inventories as a slowdown in domestic demand followed the slump in exports. They noted that PE suppliers, which have been consistently running plants at high operating rates (>90%) over the last few years, were planning to throttle back production. Dow, for one, announced that it would cut its operating rates globally by 15% “due to supply-chain issues.” RTi’s Chesshier noted that while other suppliers expected to scale back production rates, some also had opted for earlier planned plant maintenance shutdowns.

PCW’s Barry ventured that demand was likely to improve globally this month but noted that there was concern among some market participants about the impact of new capacity being brought on by PE “newcomer” Shell. At the end of August, Greenberg characterized spot-market activity as “uninspired,” with buyers holding off on large orders in anticipation of lower prices. “Some processors were out seeking prime truckloads for immediate shipment at offgrade railcar pricing, but suppliers seemed more disciplined not to cave to these offers,” he reported, also noting there was plenty of prime PE available for export at deeply discounted prices.

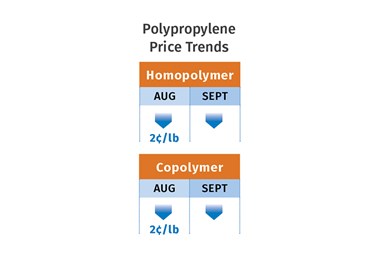

PP Prices & Demand Slipping

Polypropylene prices in July dropped by a total of 7¢/lb – 4¢ of that in step with propylene monomer and 3¢ in lower profit margin for suppliers. August prices were expected to move up 1¢ to 2¢/lb along with monomer, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. However, these sources anticipated further “non-monomer” margin reductions though year’s end.

Spartan Polymers’ Newell ventured that August PP prices were likely to reflect suppliers’ loss of another 3¢/lb of profit margin and noted that PP suppliers will need to drop operating rates drastically — perhaps to somewhere in the 70% range, because supplier inventory buildup was significant and demand was down. Said Newell, “I think monomer will head lower and more of suppliers’ margins will come off by end of year.” He noted that processors were taking actions such as shutting down production lines as demand waned. Similarly, PCW’s Barry noted that buyers were still paying 30¢/lb for PP over the monomer price.

He also noted that new capacity from Heartland Polymers already on stream, and that from ExxonMobil anticipated in this quarter would have further impact on the supply/demand balance. “Domestic demand remained sluggish as producers of consumer goods such as storage bins and toys focused on moving their higher-cost inventory.”

Meanwhile, by end of August, spot PP prices had dropped by 21¢/lb since late April, as as spot monomer dropped by roughly the same amount, according to Greenberg. “Given current market conditions, and PP contracts not having experienced much margin erosion yet, we would expect to see some further deterioration in the coming months, barring a major supply disruption,” he reported.

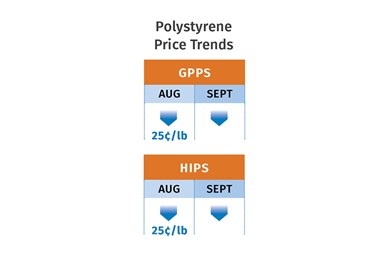

PS Prices Plunge

Polystyrene prices dropped 22¢ to 25¢/lb in August, following increases totaling 47¢/lb since March, according to PCW’s Barry and RTi’s Chesshier. Both sources saw potential for further, more modest decreases in September, if benzene prices continue to move lower. Ditto for fourth-quarter projections. Chesshier noted that suppliers of PS were aiming to curtail inventory buildup and ventured that further PS price reduction would depend on supply/demand along with benzene’s price trajectory.

Barry reported that processors were delaying orders where possible, but many were unable to build inventories due to supply constraints during the second quarter. He also noted that Asian PS imports were coming in 10¢ to 20¢/lb lower than domestic prices. He reported the implied styrene cost based on a 30/70 ratio of spot ethylene/benzene to have dropped to 44.3¢/lb by the last week in August, after peaking around 77¢ in mid-June.

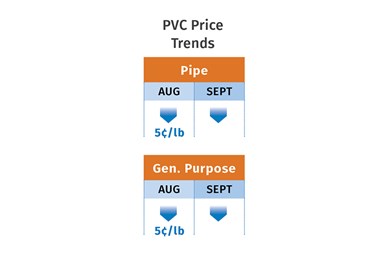

PVC Tabs Facing Long Slide

PVC prices in July dropped 5¢/lb, and there was strong potential for equivalent decreases in both August and September, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. She reported in the last week of August that industry projections were more dramatic, including further reductions of 4¢/lb in October and again in November, followed by 5¢/lb in December, and some projected a price cut of 6¢/lb in first-quarter 2023 — for a total drop of 34¢/lb.

Todd noted that while PVC prices in the first half of 2022 moved up only 1¢/lb, they had increased by a total of 43.5¢/lb between third-quarter 2020 and the end of 2021, owing to major weather-related shutdowns. Factors behind the downward price trend include a slowdown of both domestic and export demand, large supplier inventory buildup, and competitive Asian PVC imports, according to Kallman.

PET Prices Fall Off Their Peak

PET prices dropped substantially in the July-August, on the order of about 20¢/lb, due to feedstock cost reductions, according to RTi’s Kallman. He expected further price erosion, albeit on a lower scale, in September-October. This comes after PET tabs rose a total of 21¢ to 23¢/lb in May-June.

In addition to declining feedstock costs, there were some indications of softer demand, which was expected to continue through the fourth quarter. This now well-supplied market includes continued availability of competitively priced imports.

ABS Prices Take a Dive

ABS prices dropped in the vicinity of 10¢/lb in July, and there was strong potential for decreases for August, September and possibly this month, each within the 5¢ to 10¢/lb range, according to RTi’s Kallman. He characterized the market as very well supplied, with softer demand in key markets such as automotive and electronics, lower feedstock costs, and an increasing volume of lower-priced imports. ABS prices had remained largely flat through the first half of the year.

PC Market & Prices Soft

Polycarbonate prices were poised to drop on the order of 5¢ to 10¢/lb or more in September-October, according to RTi’s Kallman, after remaining largely flat this year, with the exception of a few lower-priced offers in July-August. Kallman noted that this is a very well-supplied market with some very good offers of imported material. Slowed demand in automotive and construction and no major pressure from feedstock prices are further factors pointing to flat-to-lower prices through year’s end.

Lower Nylon Prices Ahead

Nylon 6 prices dropped in August by 20¢ to 22¢/lb as suppliers’ position switched from “Take it or leave it” to “Let’s talk,” according to RTi’s Chesshier. This came after nylon tabs moved up monthly from February to May by a total of 48¢ to 53¢/lb, and another 30¢/lb in June-July. Chesshier ventured that September prices would drop further due to slowed demand in most market segments, even in the food and medical arenas, coupled by processors continuing to buying lower-cost imports. October prices would depend on what happens to benzene feedstock.

Nylon 66 prices were expected to fall through this quarter, perhaps significantly, after moving up a total of 20¢ to 30¢/lb in the first half, with compounds on the higher end due to supply issues with key additives, according to RTi’s Kallman. At the start of September, he characterized the market as very well supplied, both for resins and compounds due to much improved availability of additives. Slowed demand in key automotive and construction markets were also key to the downward movement.

Related Content

Prices of the Five Commodity Resins Largely Flat

While price initiatives for PE and PVC were underway, resin prices had rollover potential for first two months of 2024, perhaps with the exception of PET.

Read MoreVolume Resin Prices Move in Different Directions

PE, PP, PVC, and ABS prices slump, while PS, PET, PC, and nylons 6 and 66 prices rise.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

.png;maxWidth=300;quality=90)