Processing Expansion Cools in November

Industry growth slows after quickening expansion over the prior four months.

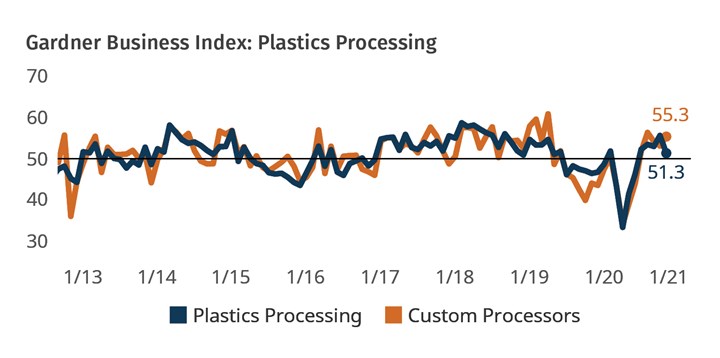

The Gardner Business Index (GBI): Plastics Processing, calculated from monthly survey responses of Plastics Technology subscribers, dipped in November to 51.3. New orders and employment activity fell sharply, with both reporting their first contractionary readings since June. (Values below 50 indicate a contraction in month-over-month activity; the farther away a reading is from 50 indicates how broadly the industry experienced the reported change.) Despite the contraction in new orders, production activity expanded slightly.

Business-activity data provide by custom processors, in particular, told a similar story. New-orders activity indicated a slowing expansion for a second month; this was closely followed by production activity, which showed a similar slowing. Despite these recent changes in new orders and production, backlog activity has been unchanged, with recent readings circling closely around 50 (a neutral reading of “no change”).

FIG 1 The Plastics Processing Index fell by more than 4 points due to a significant slowing of new orders and production activity. The Index reported some of the

most challenging supply-chain conditions in history.

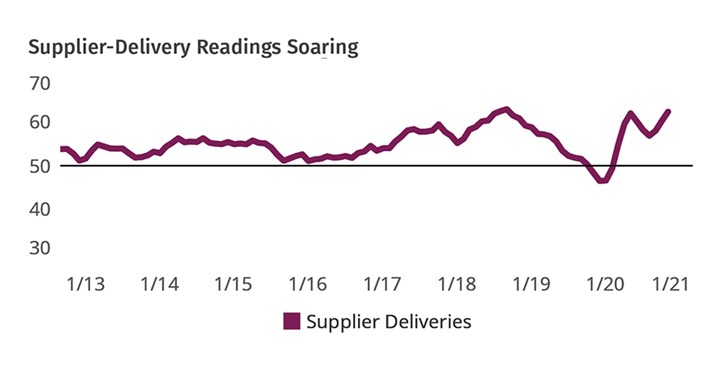

The latest supplier deliveries continue to signal extreme challenges to supply chains and logistics. Supplier deliveries are closely tied to order-to-delivery times, which increase as delivery times lengthen. The October and November readings indicate the industry is facing logistics problems of unprecedented breadth and scale. The fourth quarter will be made worse as seasonal package-delivery demand and vaccine distribution compete for more of the transportation industry’s already diminished capacity.

FIG 2 Supplier-delivery readings during October and November were some of the highest ever recorded in the history of the Index. An influx of seasonal package deliveries and vaccine distribution on already strained carriers during the fourth quarter will only worsen supply-chain conditions, further encumbering production.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Processing Activity Contracts More Slowly in January

Despite contracting again in January, plastics processing activity rebounded a bit from a rather significant drop in December.

-

Processing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

-

Processing Slips as Summer Simmers

Monthly index suggests slower growth in June for plastics processors overall and contraction for custom firms.

.jpg;width=70;height=70;mode=crop)